The document provides an overview of credit scoring and scorecard development. It discusses:

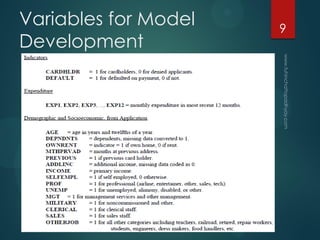

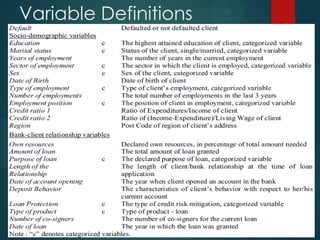

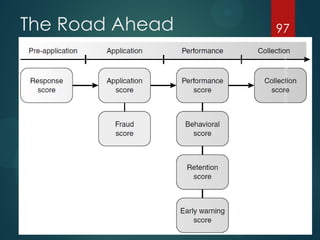

- The objectives of credit scoring in assessing credit risk and forecasting good/bad applicants.

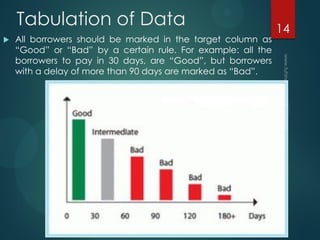

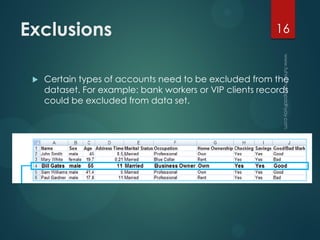

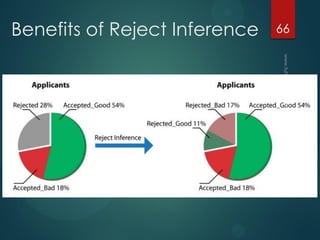

- The types of clients that are categorized for scoring, including good, bad, indeterminate, insufficient, excluded, and rejected.

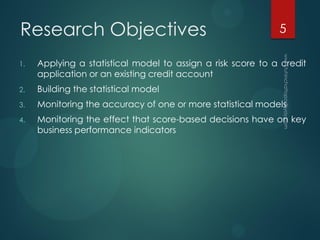

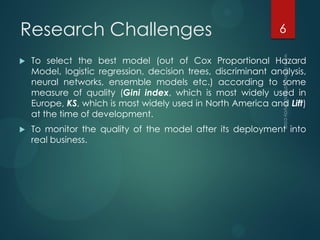

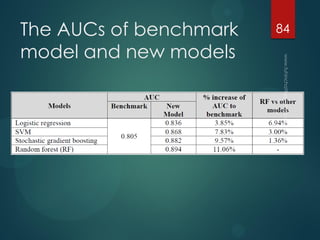

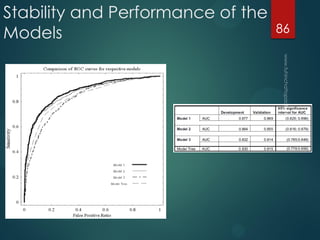

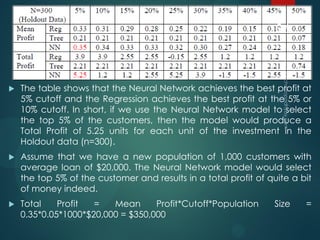

- The research objectives and challenges in building statistical models to assign risk scores and monitor model performance.

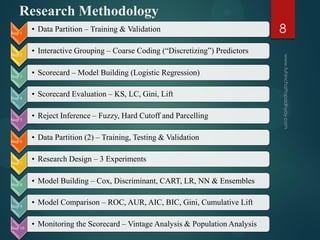

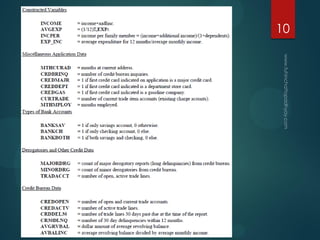

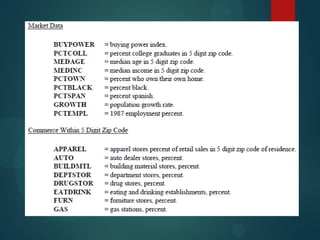

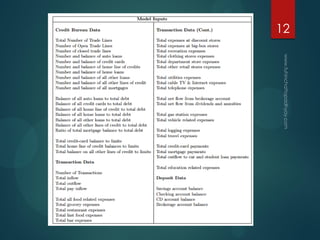

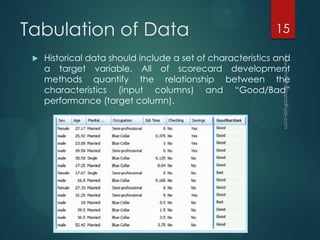

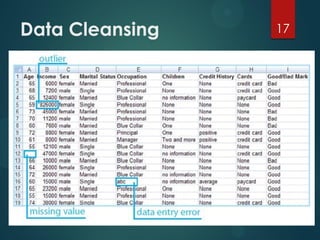

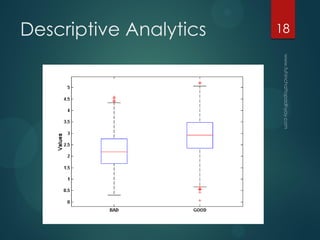

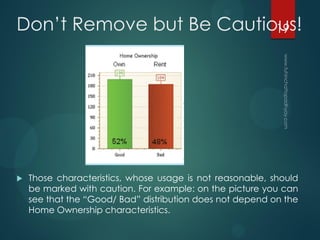

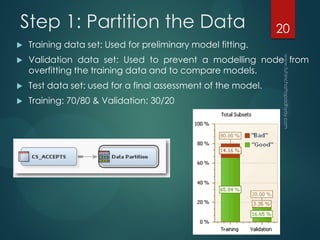

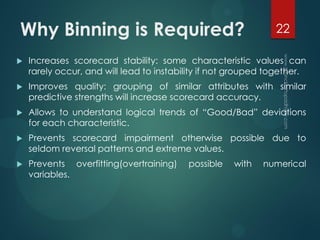

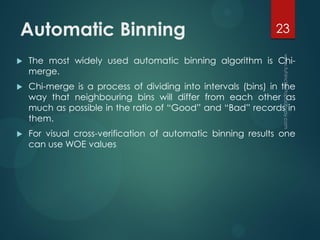

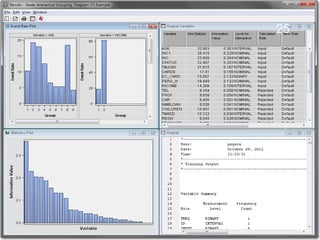

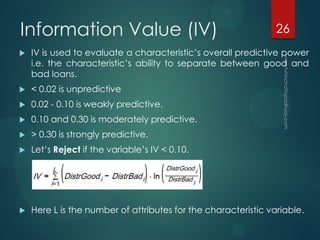

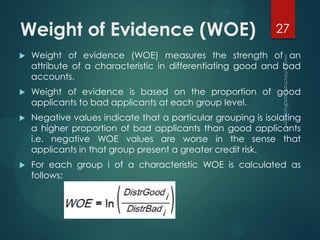

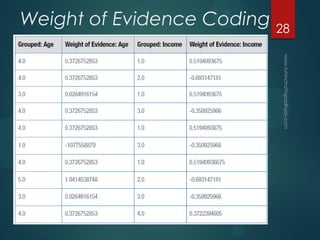

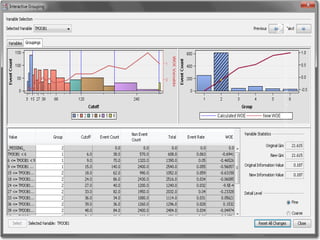

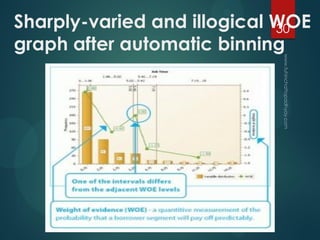

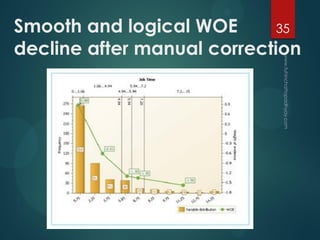

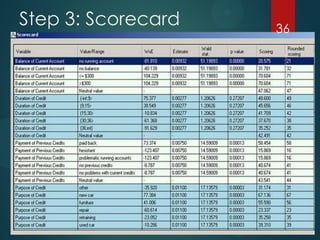

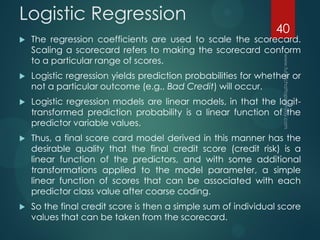

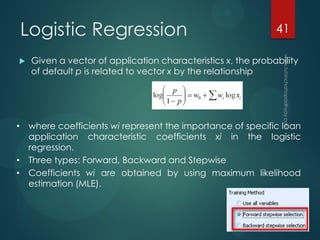

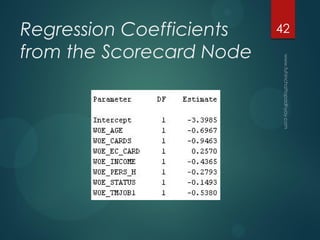

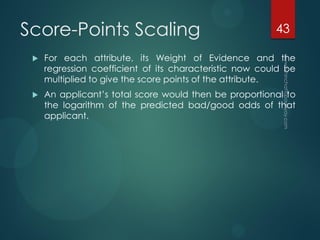

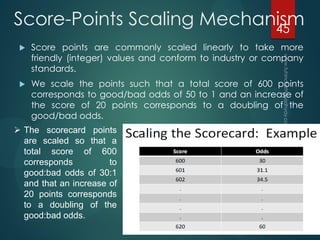

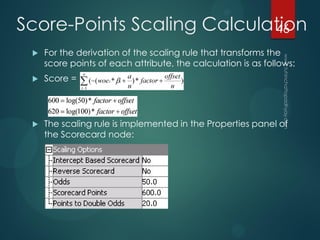

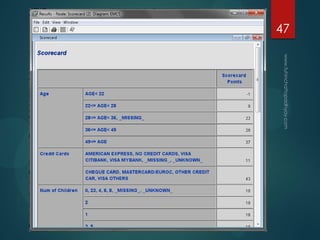

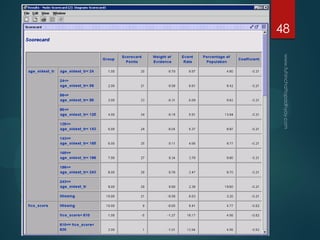

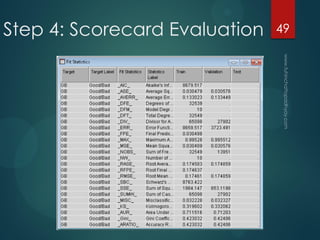

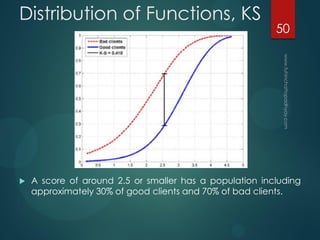

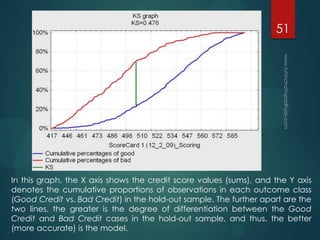

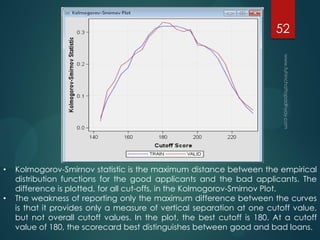

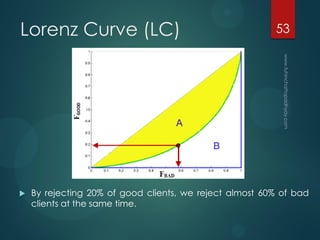

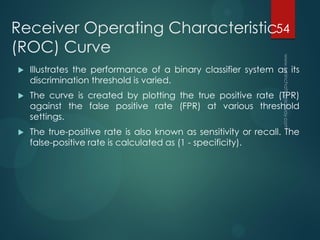

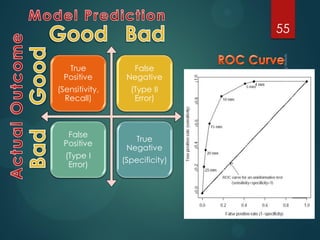

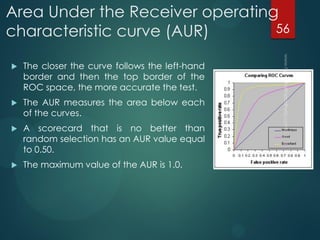

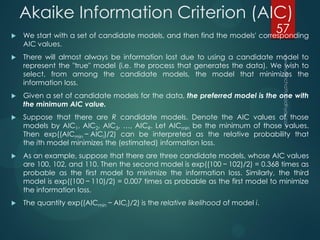

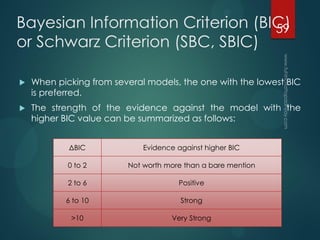

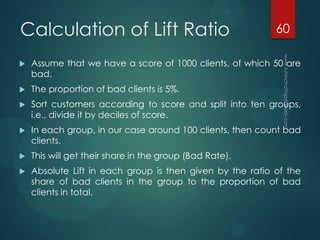

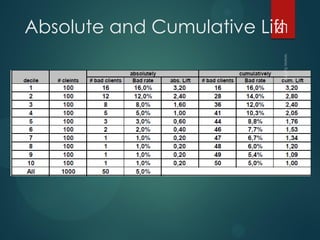

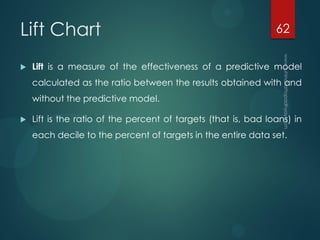

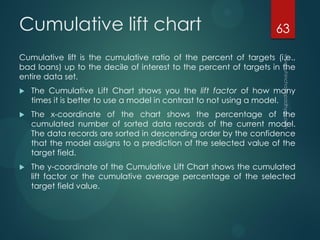

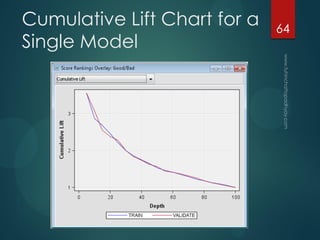

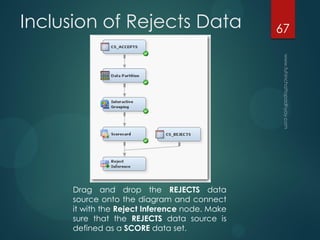

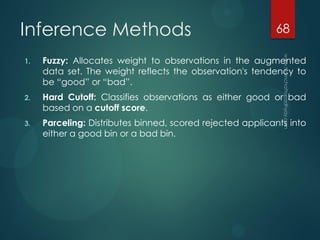

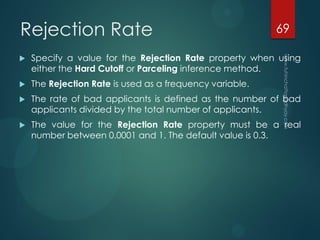

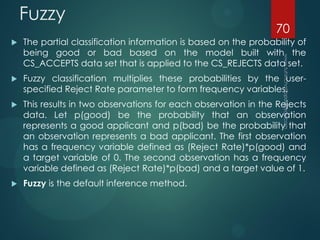

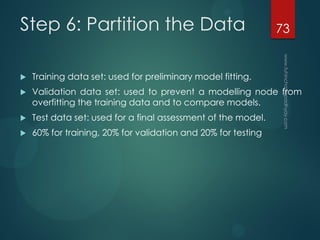

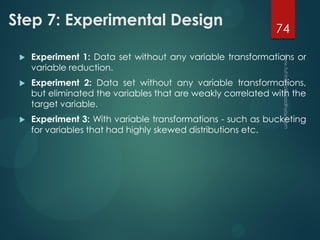

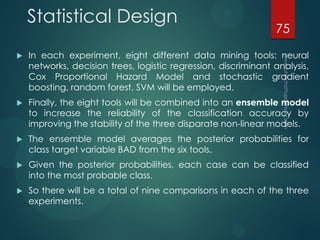

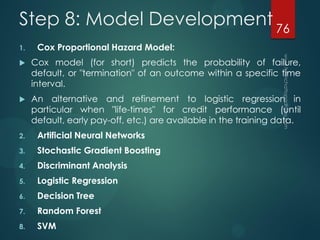

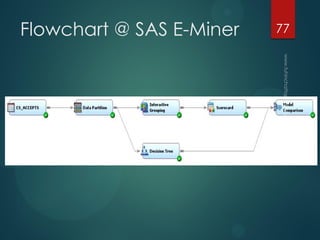

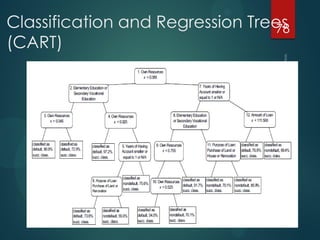

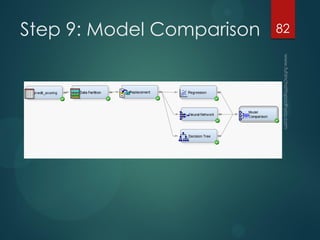

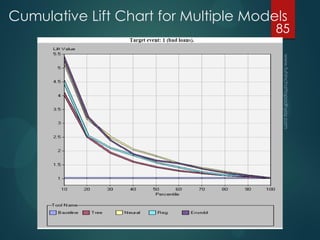

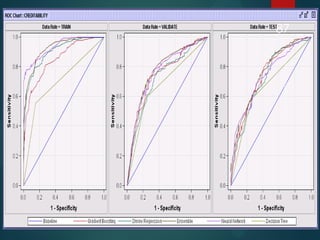

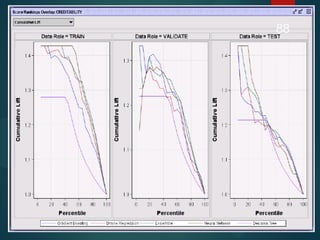

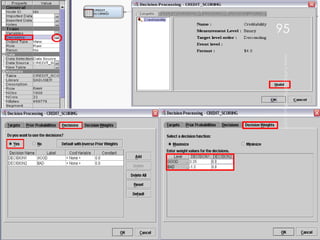

- The research methodology involving data partitioning, variable binning, scorecard modeling using logistic regression, and scorecard evaluation metrics like KS, Gini, and lift.