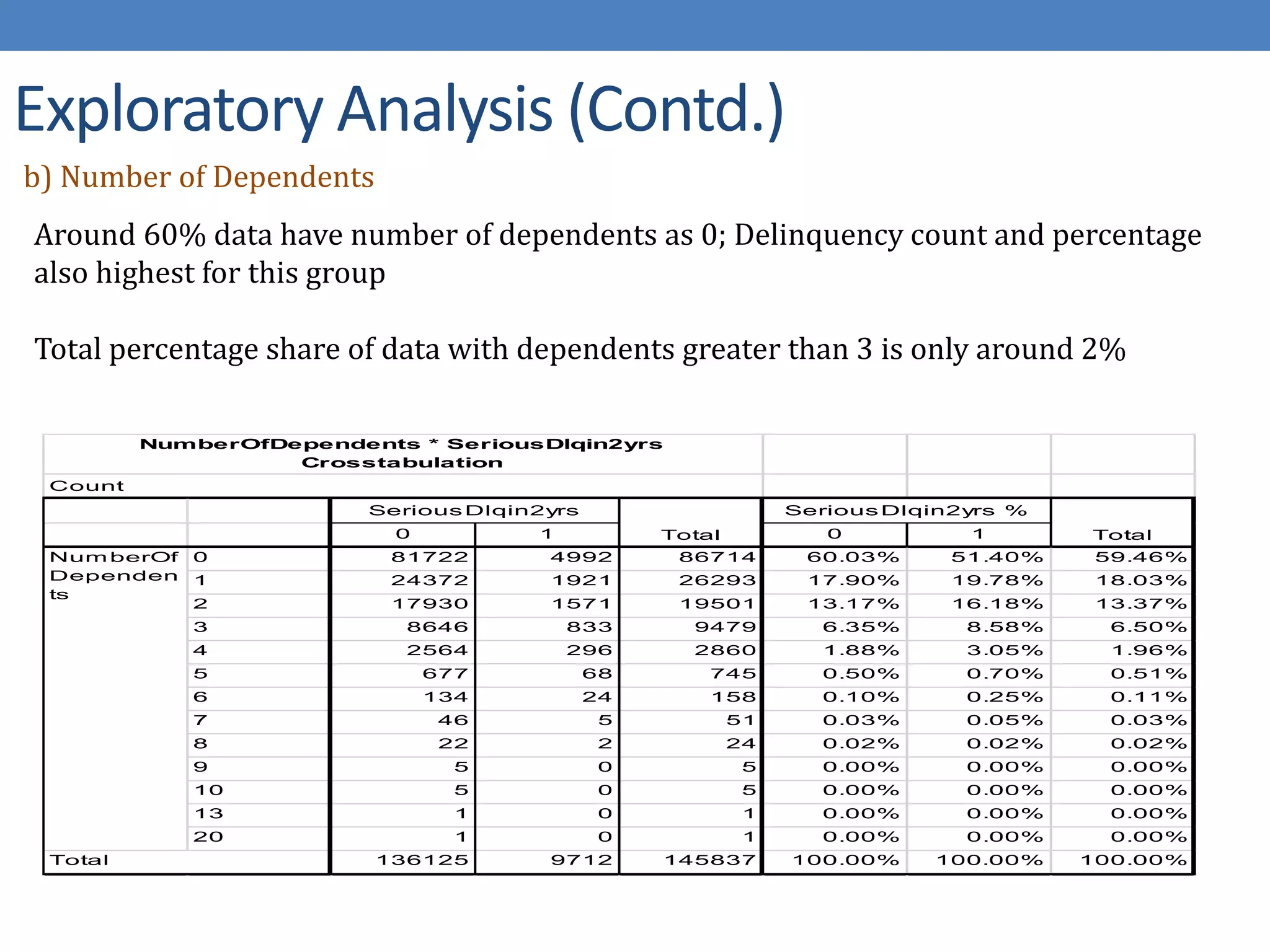

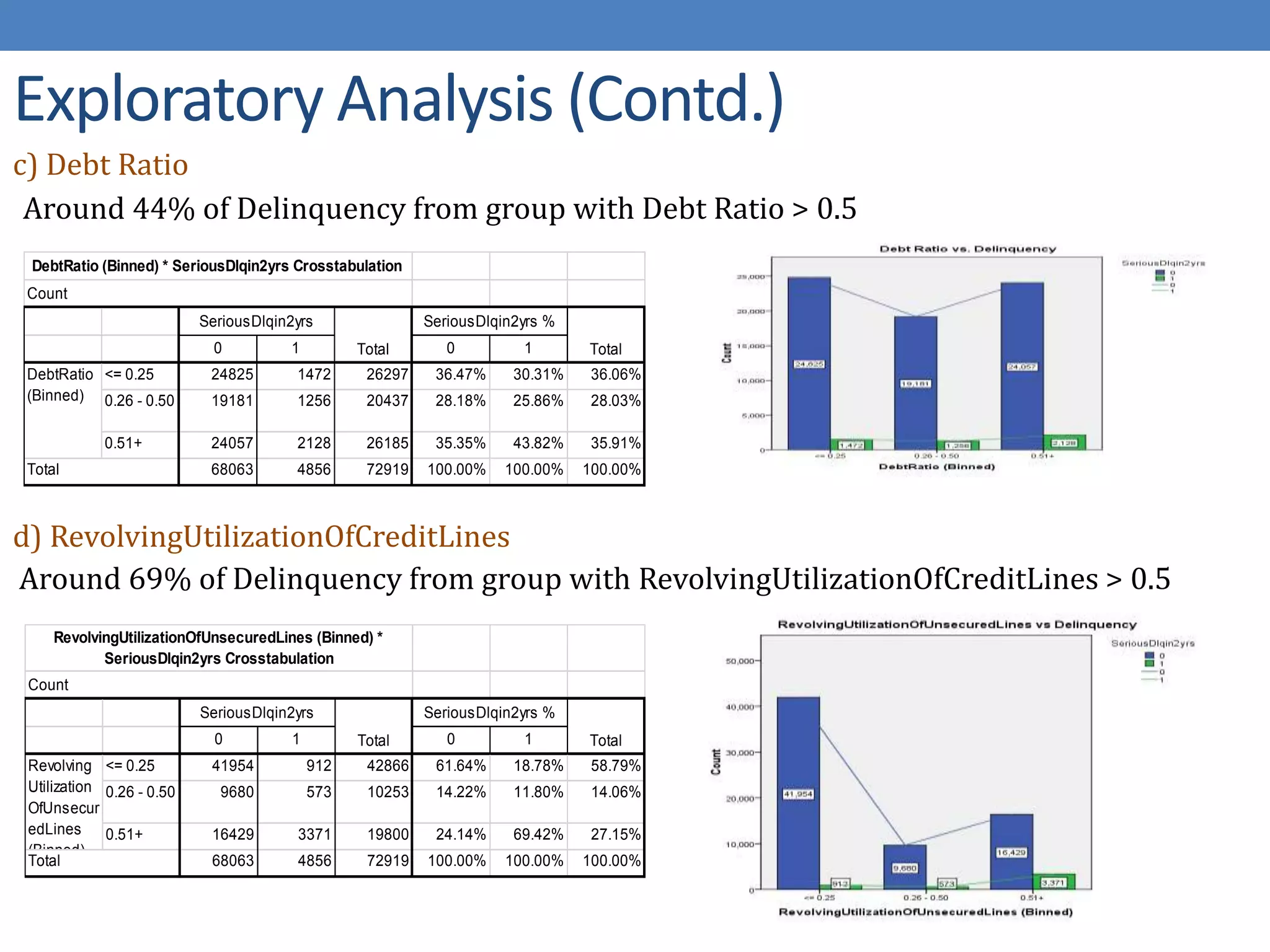

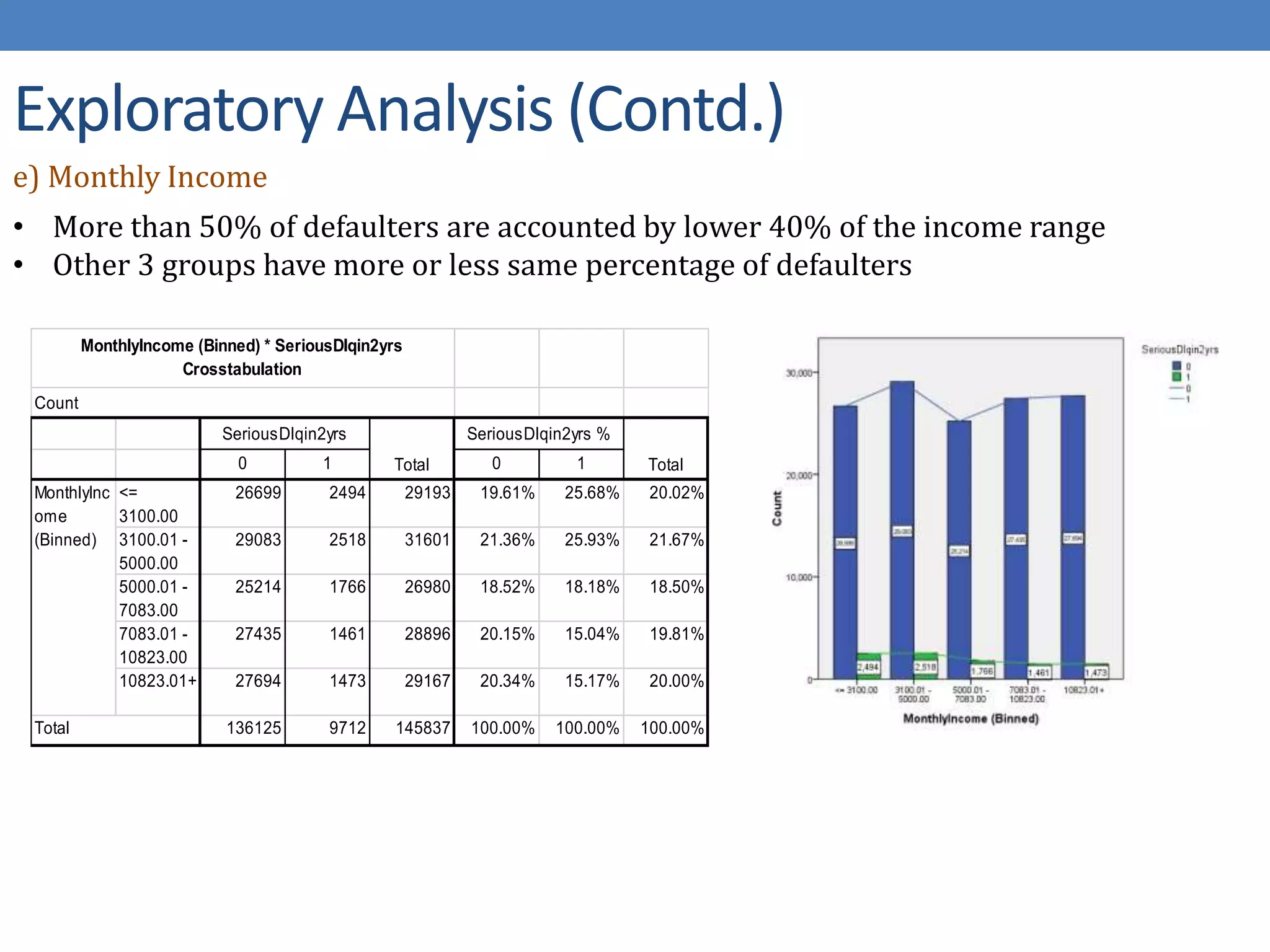

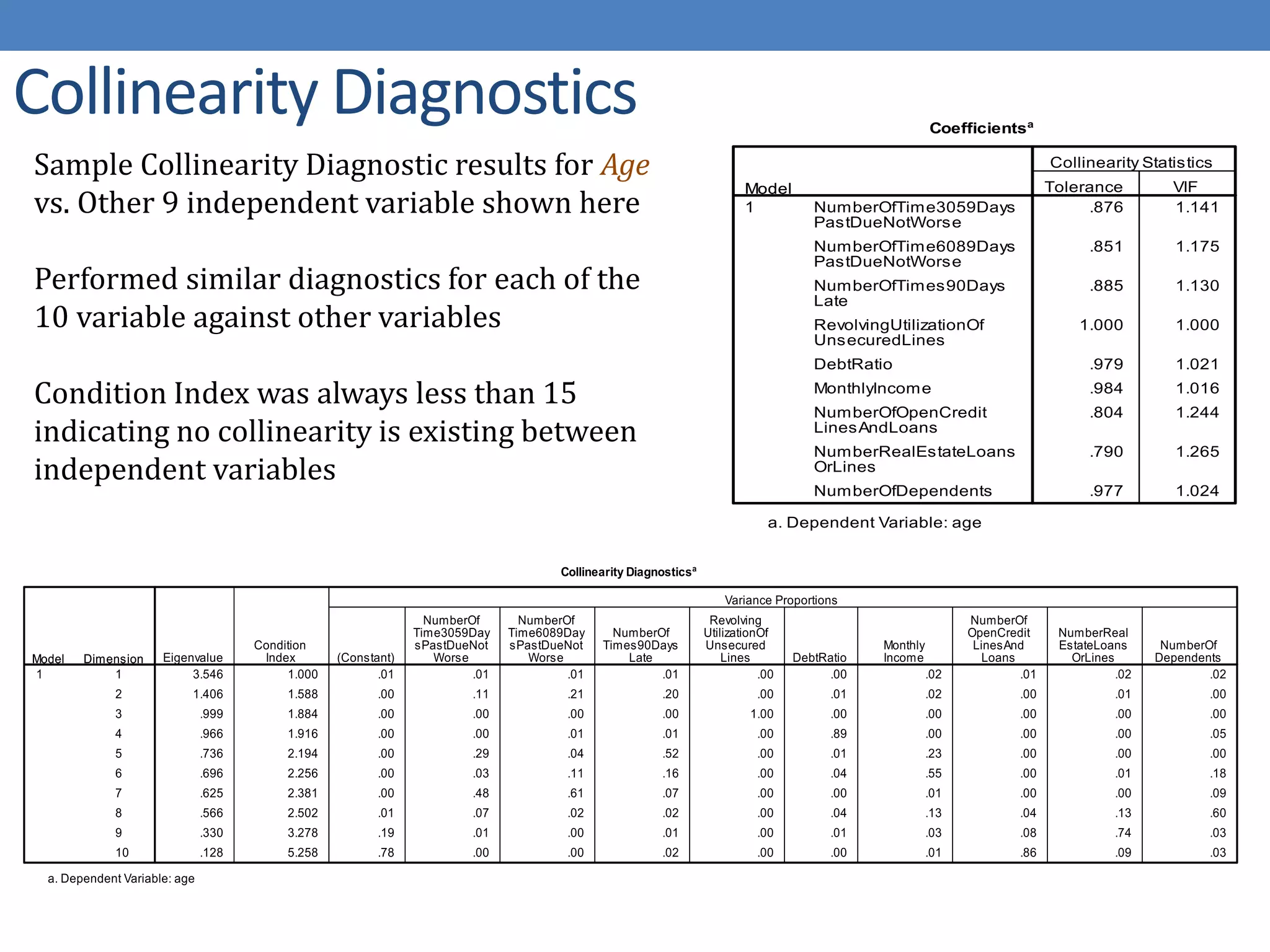

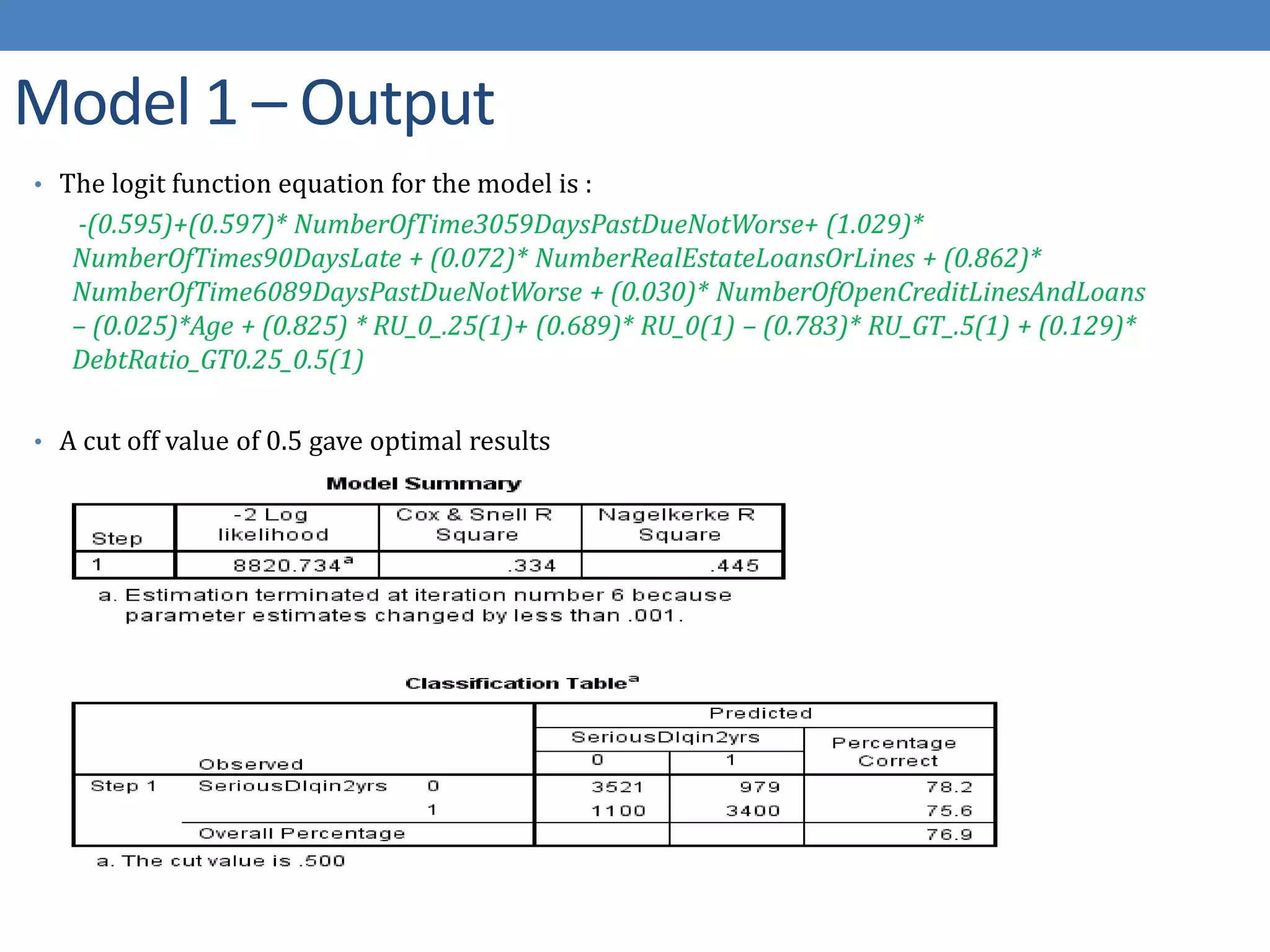

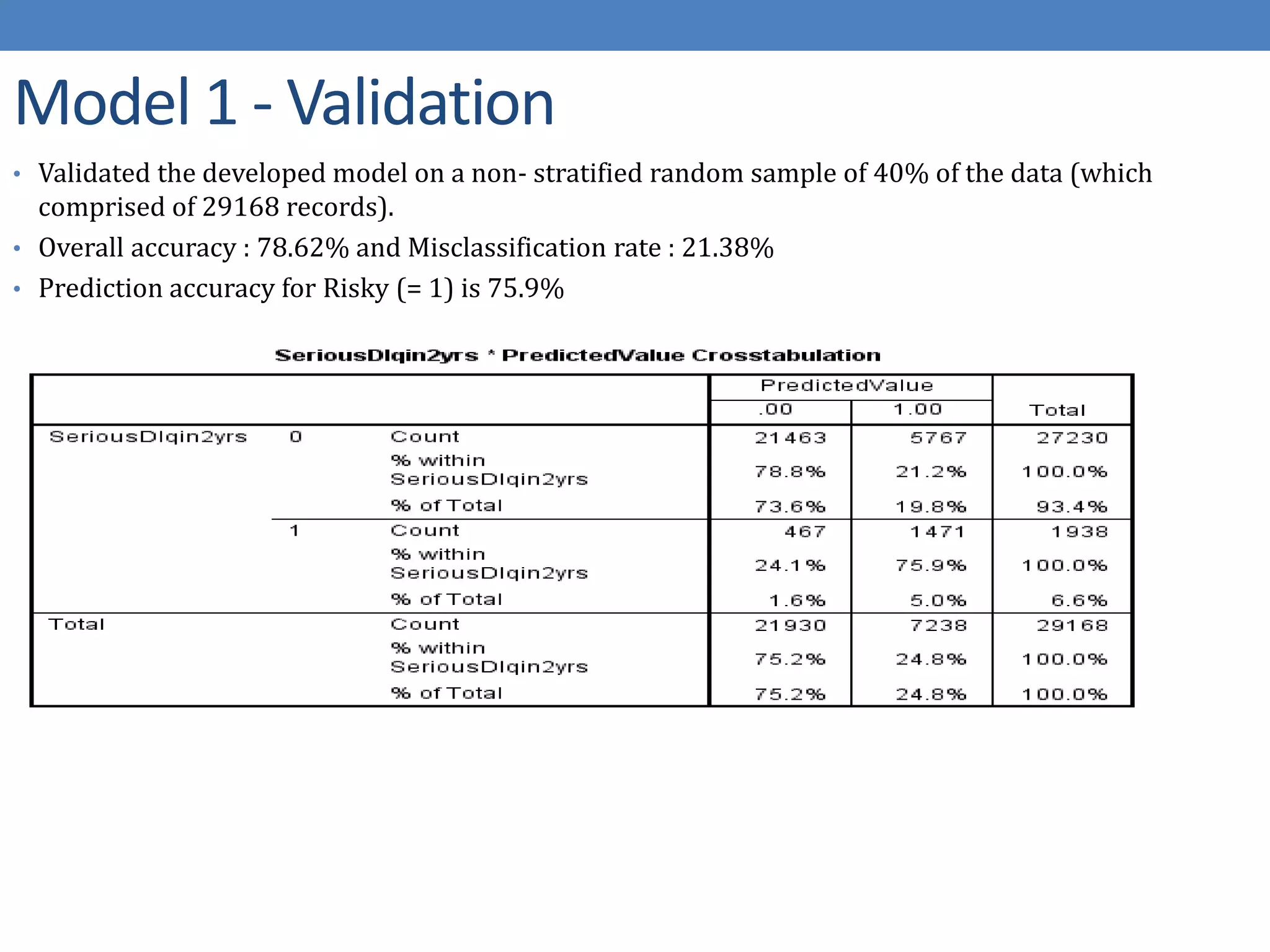

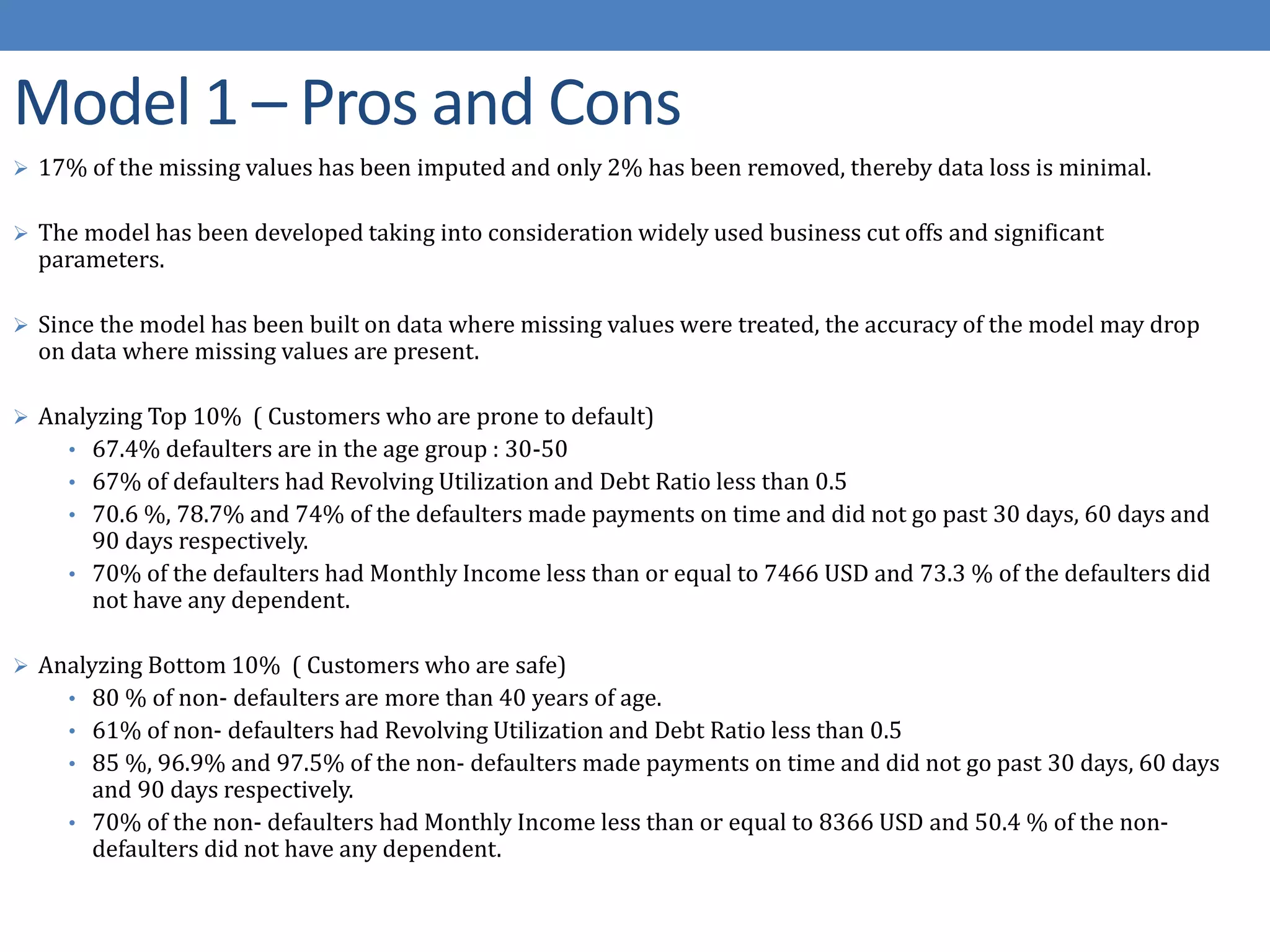

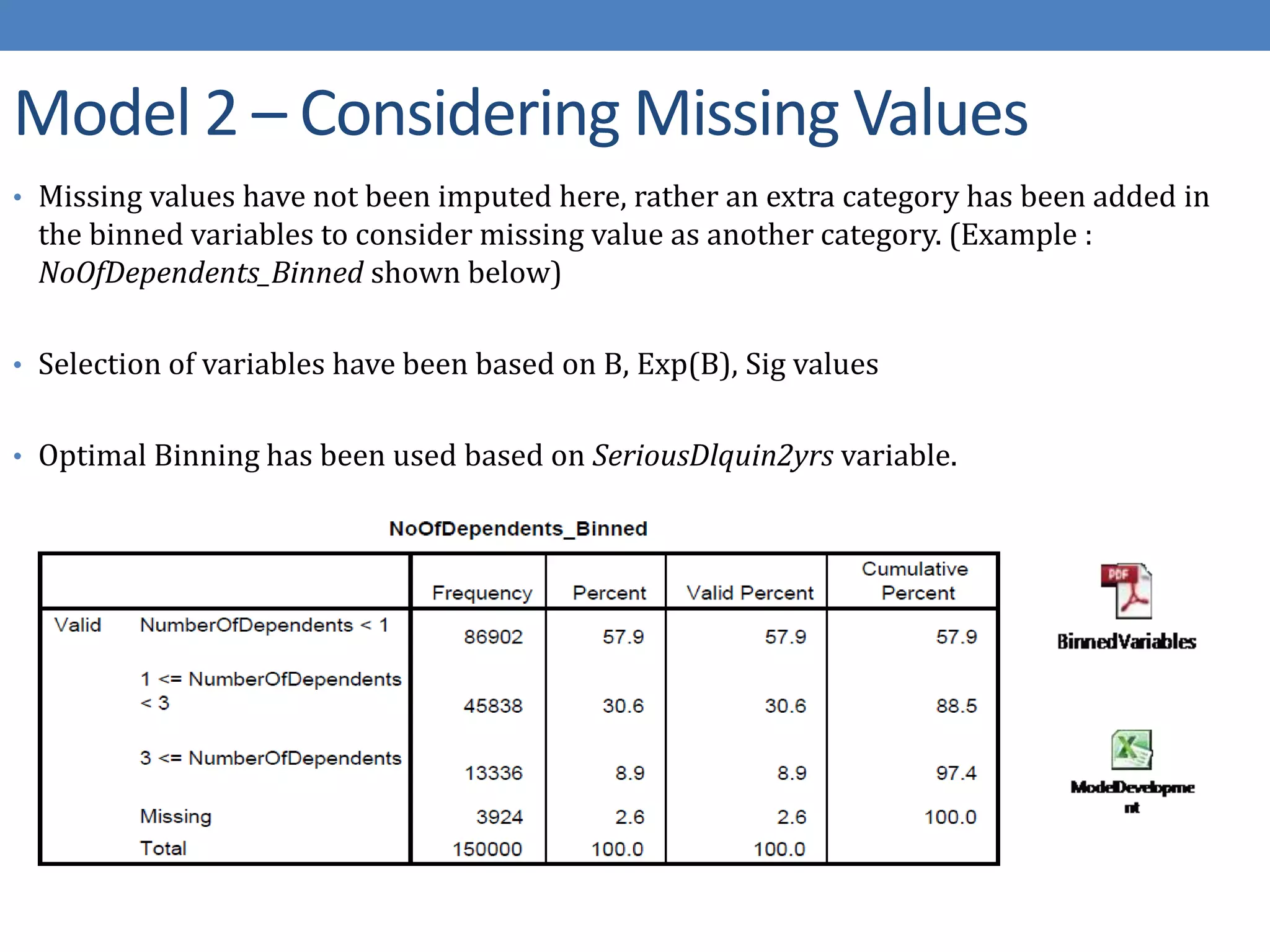

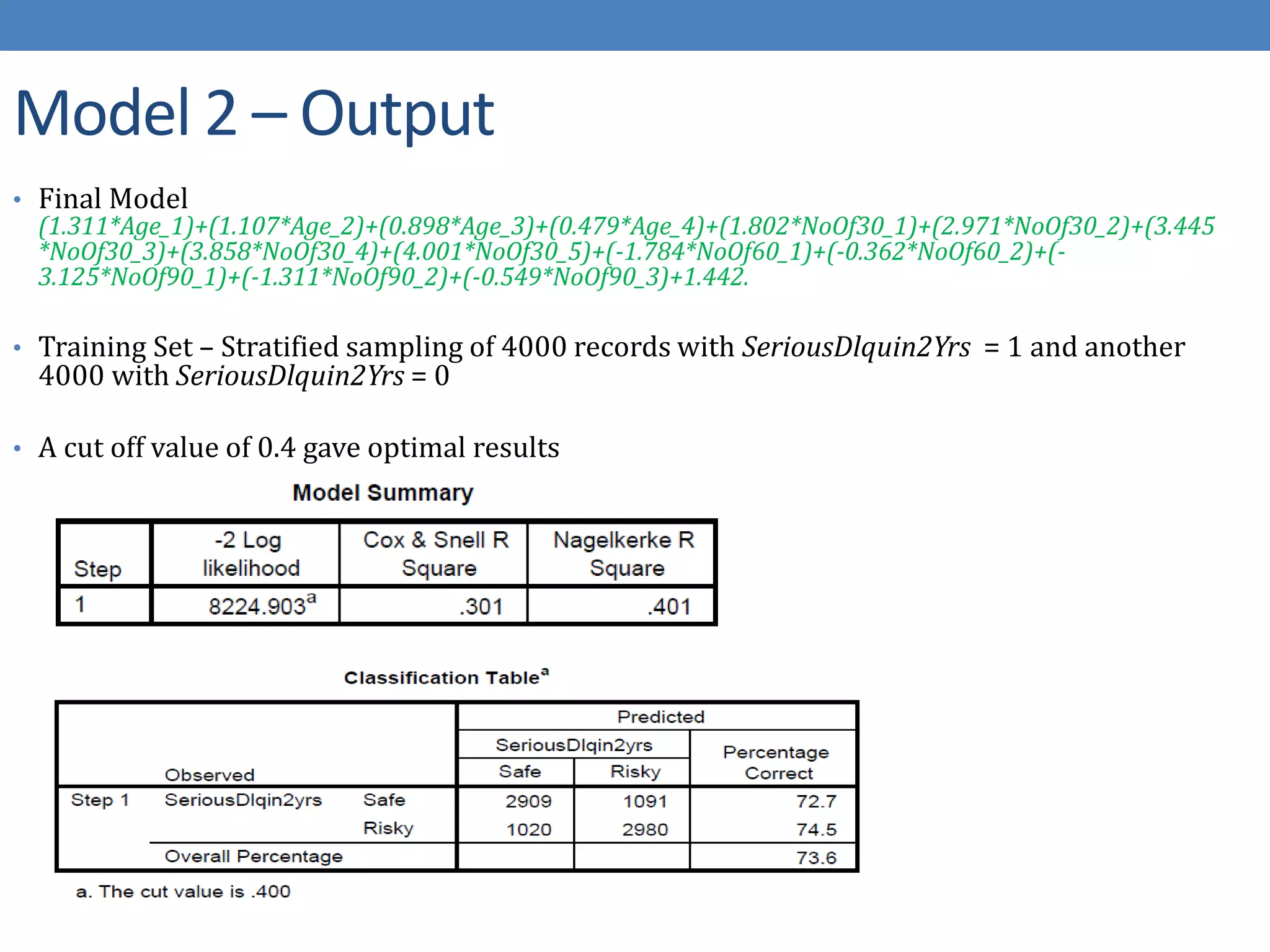

The document describes developing a logistic regression model to predict credit risk. It outlines preprocessing steps like binning variables, handling missing data, and sampling training data. Three models are developed: Model 1 uses binned variables and imputed missing data, Model 2 is similar but bins missing data, and Model 3 uses original variables. Model 1 outputs the logit function and identifies key predictor variables as number of late payments, open accounts, and binned age, debt ratio, and credit utilization variables.