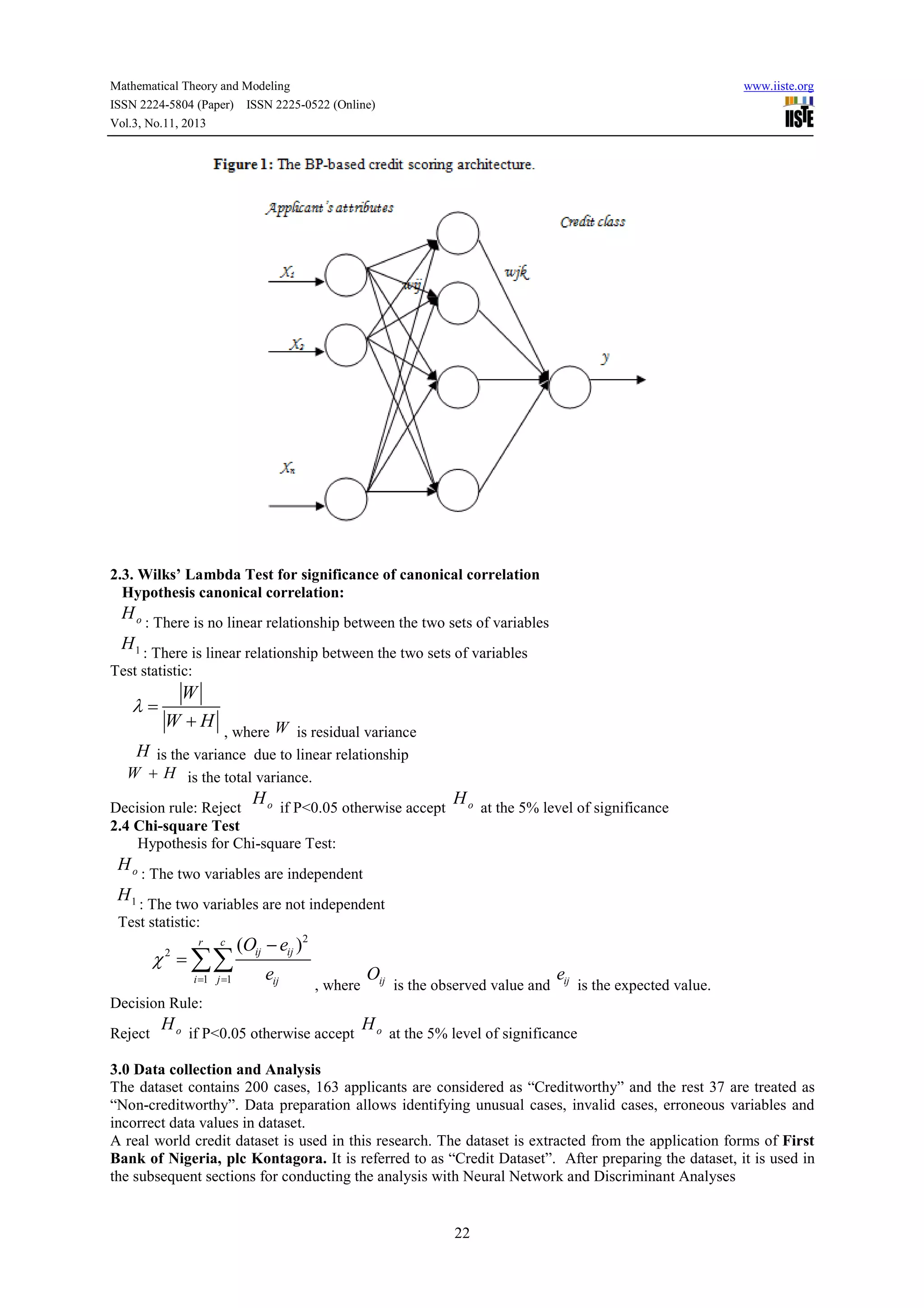

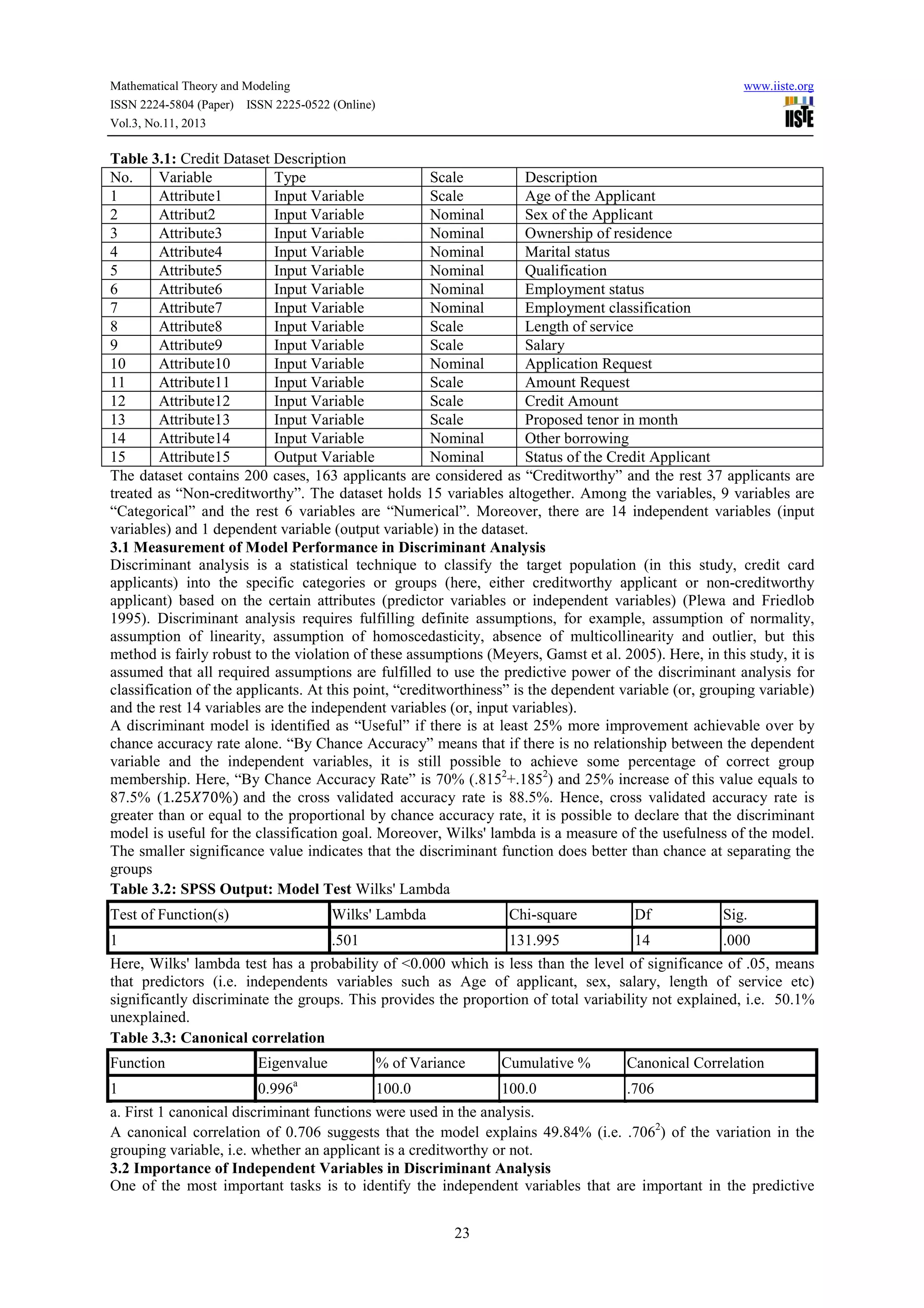

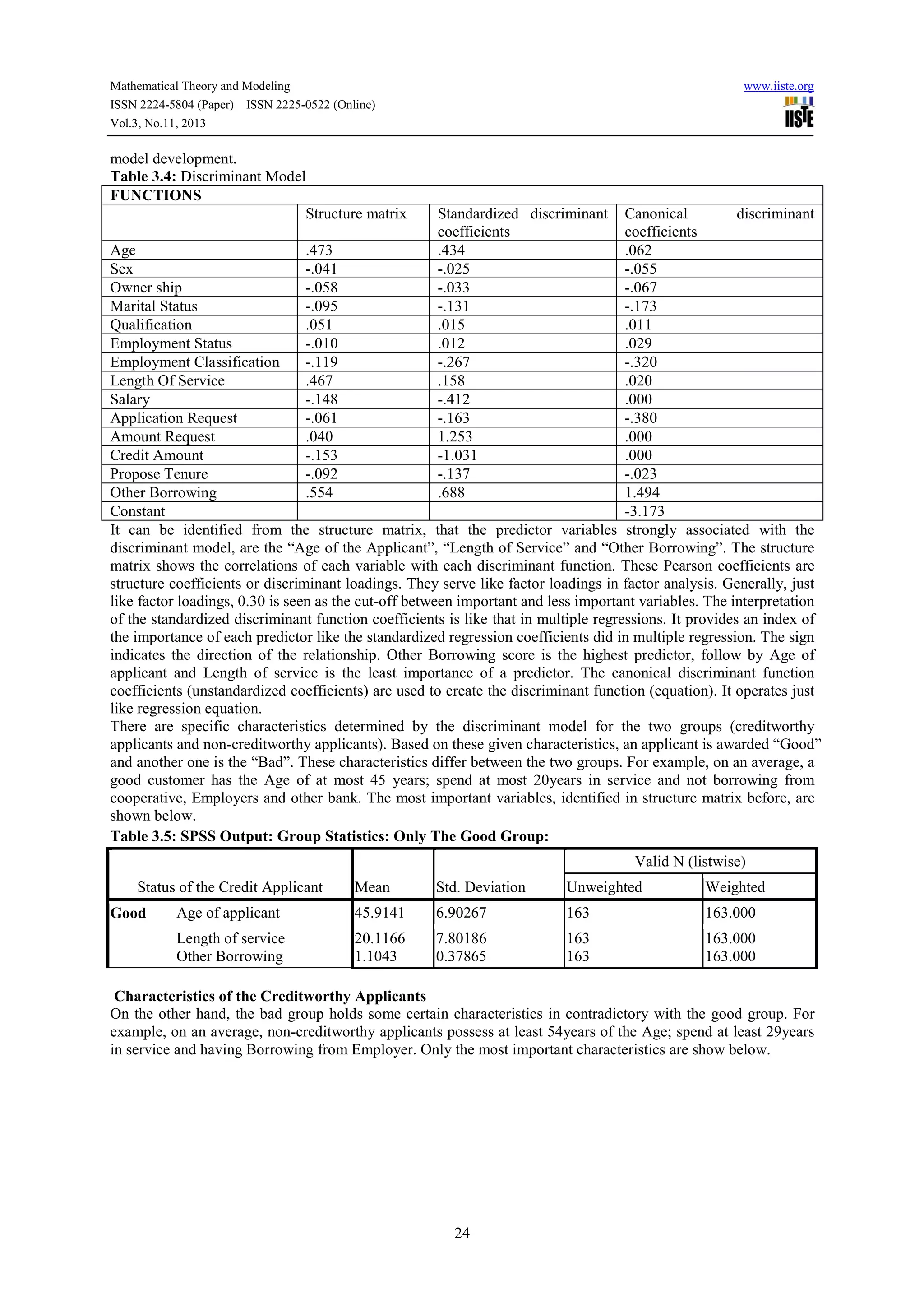

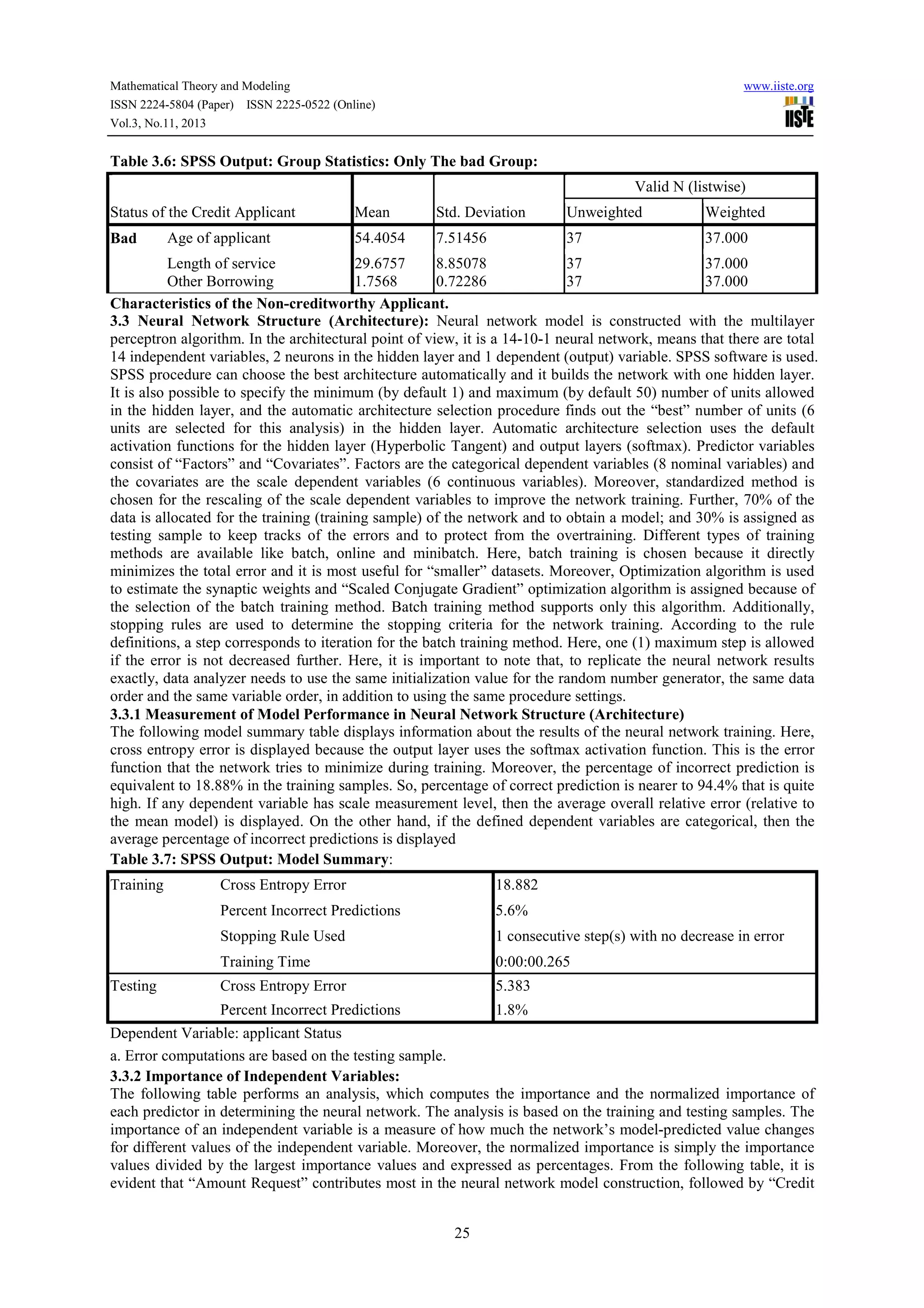

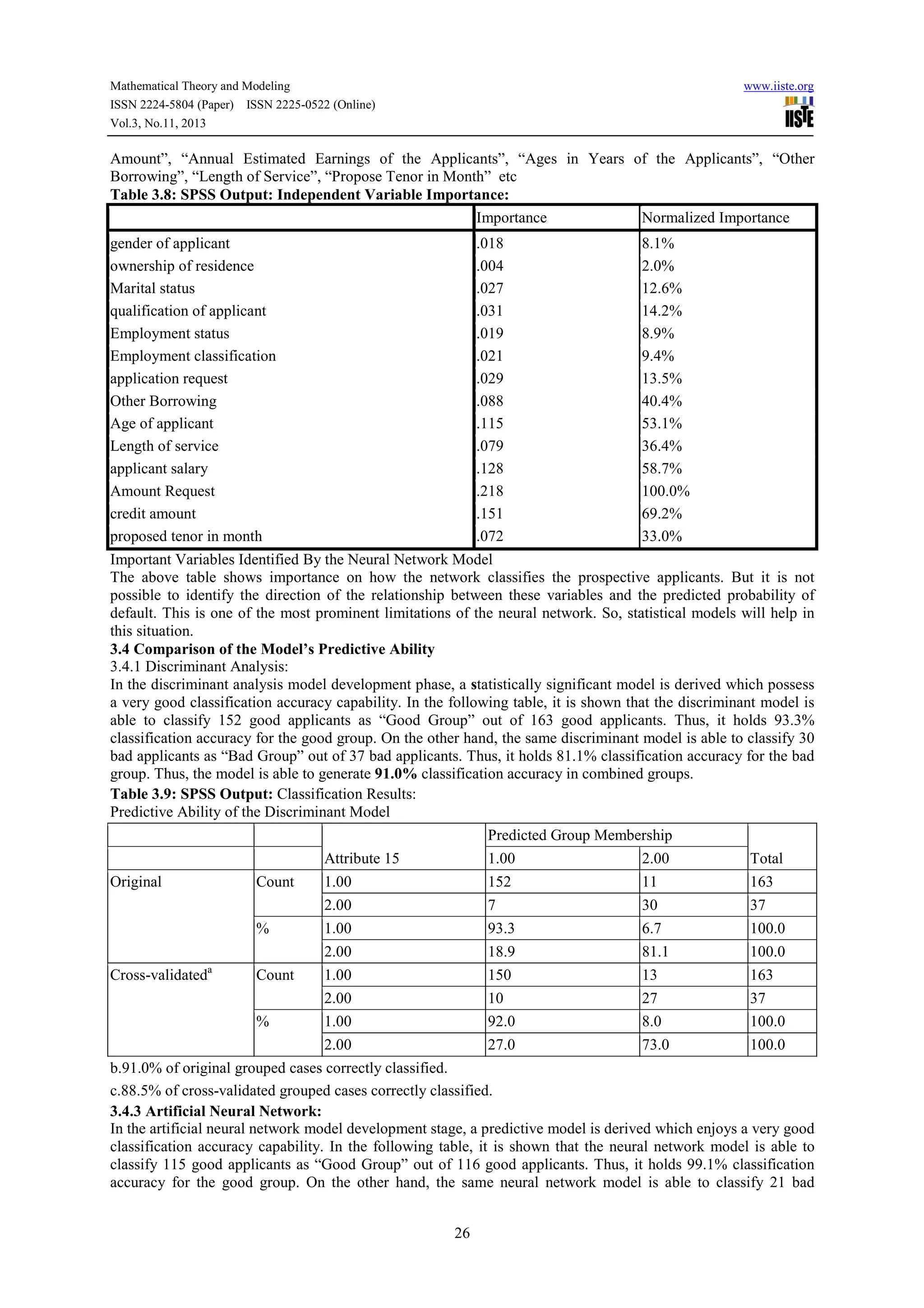

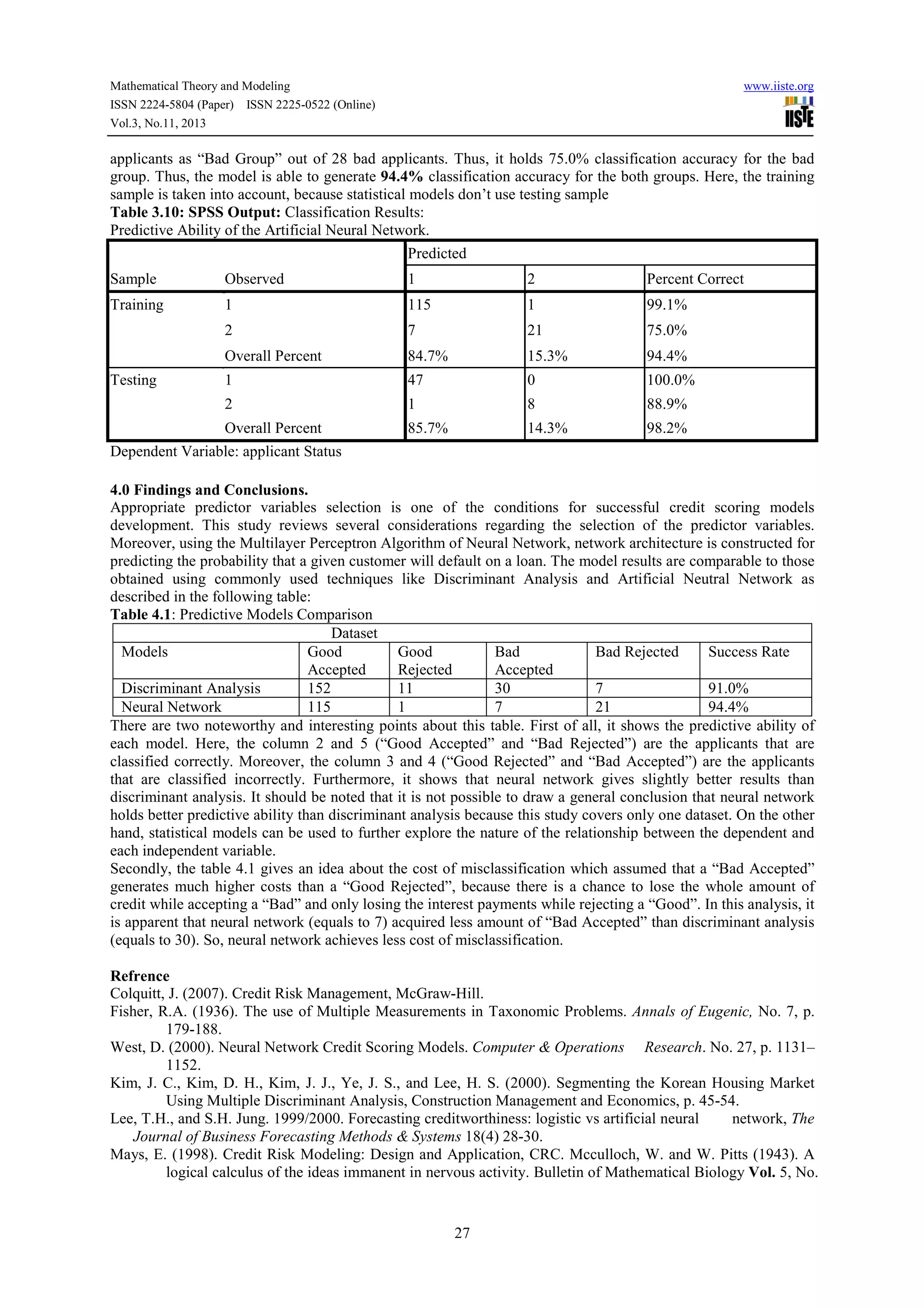

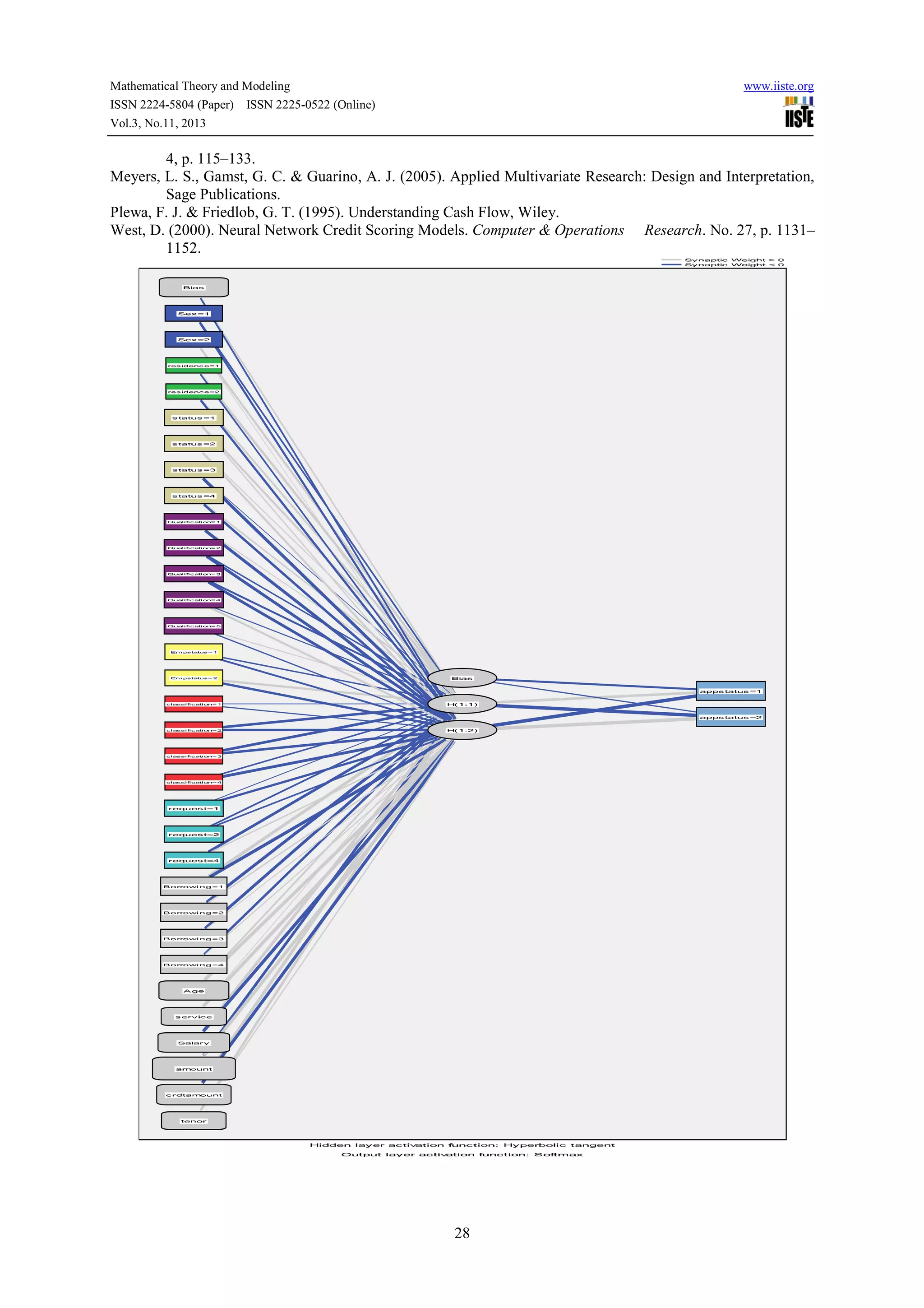

This document presents a study that compares the predictive abilities of artificial neural networks and linear discriminant analysis for credit scoring. A credit dataset from a Nigerian bank with 200 applicants and 15 variables is used to build both neural network and linear discriminant models. The models are evaluated based on measures like accuracy, Wilks' lambda, and canonical correlation. Key findings are that the neural network model performs slightly better with less misclassification cost. However, variable selection is important for both models' success. Age, length of service, and other borrowing are found to be the most important predictor variables.