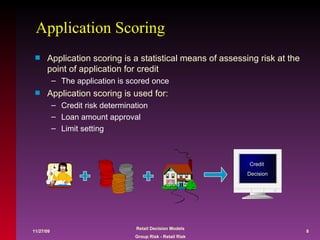

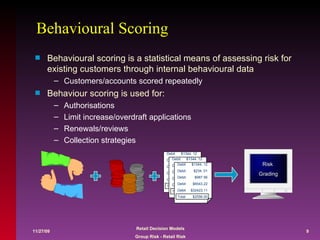

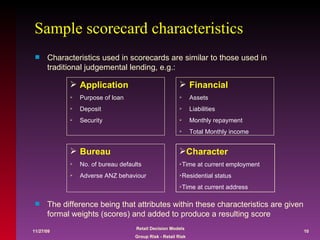

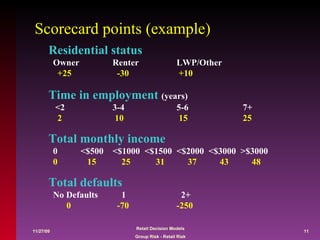

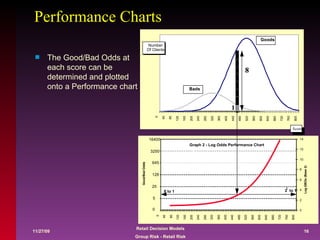

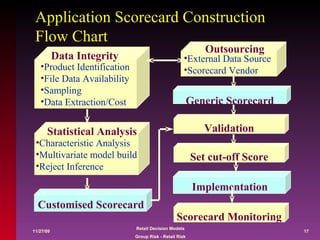

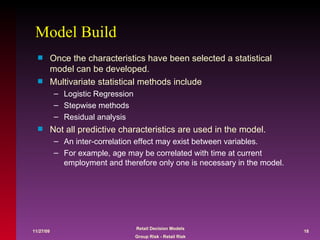

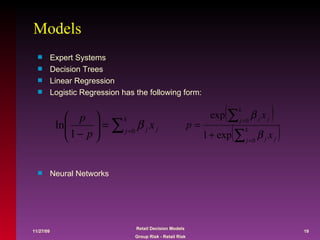

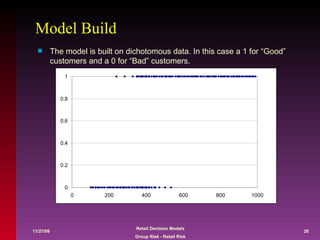

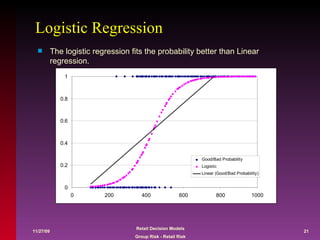

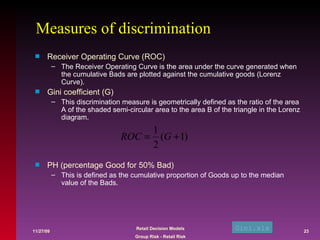

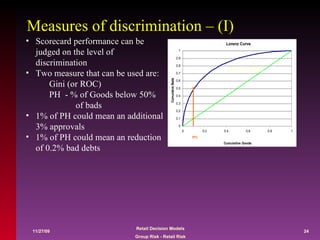

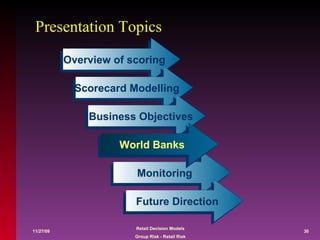

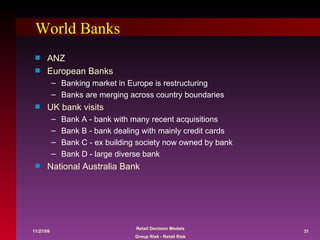

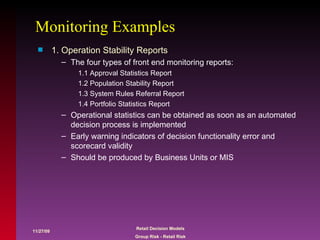

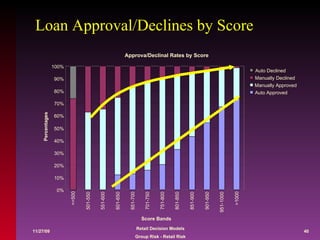

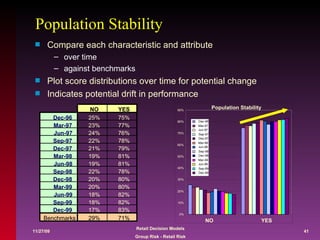

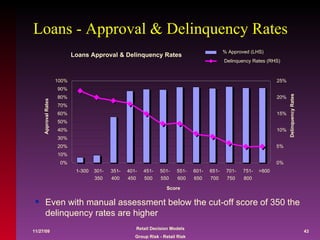

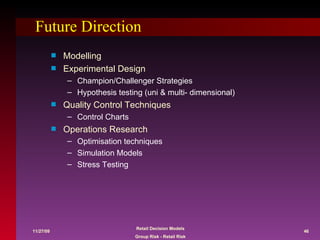

The document discusses credit scoring methods and model development. It provides an overview of different types of scoring models, including application and behavioral scoring. It also describes the model building process, including variable selection, statistical techniques like logistic regression, model validation, and performance measures. Monitoring of models after implementation is discussed through examples like approval rate reports and scorecard performance analysis. Future directions for scoring are mentioned, like adaptive control and profitability modeling.

![BASEL - The New Accord The New Accord will give banks with sophisticated risk management capabilities increased flexibility More emphasis on bank’s internal measures of risk, supervisory review and market discipline Decision support technology has an important role to play Incentivise better risk management Data warehouses are fundamental to addressing many of the requirements SMB sector will be key More risk sensitive Competitive equality Paul%20Russell%2013a[1] The New Basel Capital Accord Pillar 1 : Minimum capital requirement Pillar 2 : Supervisory review process Pillar 3 : Market discipline](https://image.slidesharecdn.com/creditscore-1228076303805700-9/85/Creditscore-35-320.jpg)

![Three Portfolio Dimensions: Volume, Loss, and Profit low high high E [ Profit ] E [ Volume ] E [ Losses ] Low cutoffs High cutoffs](https://image.slidesharecdn.com/creditscore-1228076303805700-9/85/Creditscore-48-320.jpg)

![Efficient Frontiers in two dimensions OP High Cutoffs E[Volume] E[Loss] Low Cutoffs 0.6 0.0 0.2 Low Cutoffs High Cutoffs E[Profit] E[Loss] OP 0.9 0.6 0.0 0.2 0.6 High Cutoffs Low Cutoffs OP E[Volume] E[Profit] 0.6 0.2 0.2 0.9 Efficient Frontier](https://image.slidesharecdn.com/creditscore-1228076303805700-9/85/Creditscore-49-320.jpg)

![Improved portfolio performance OP High Cutoffs E[Volume] E[Loss] Low Cutoffs 0.6 0.0 0.2 Low Cutoffs High Cutoffs E[Profit] E[Loss] OP 0.9 0.6 0.0 0.2 0.6 High Cutoffs Low Cutoffs OP E[Volume] E[Profit] 0.6 0.2 0.2 0.9 Single Score Combined Scores Single Score Combined Scores Single Score Combined Scores Efficient Frontier](https://image.slidesharecdn.com/creditscore-1228076303805700-9/85/Creditscore-50-320.jpg)