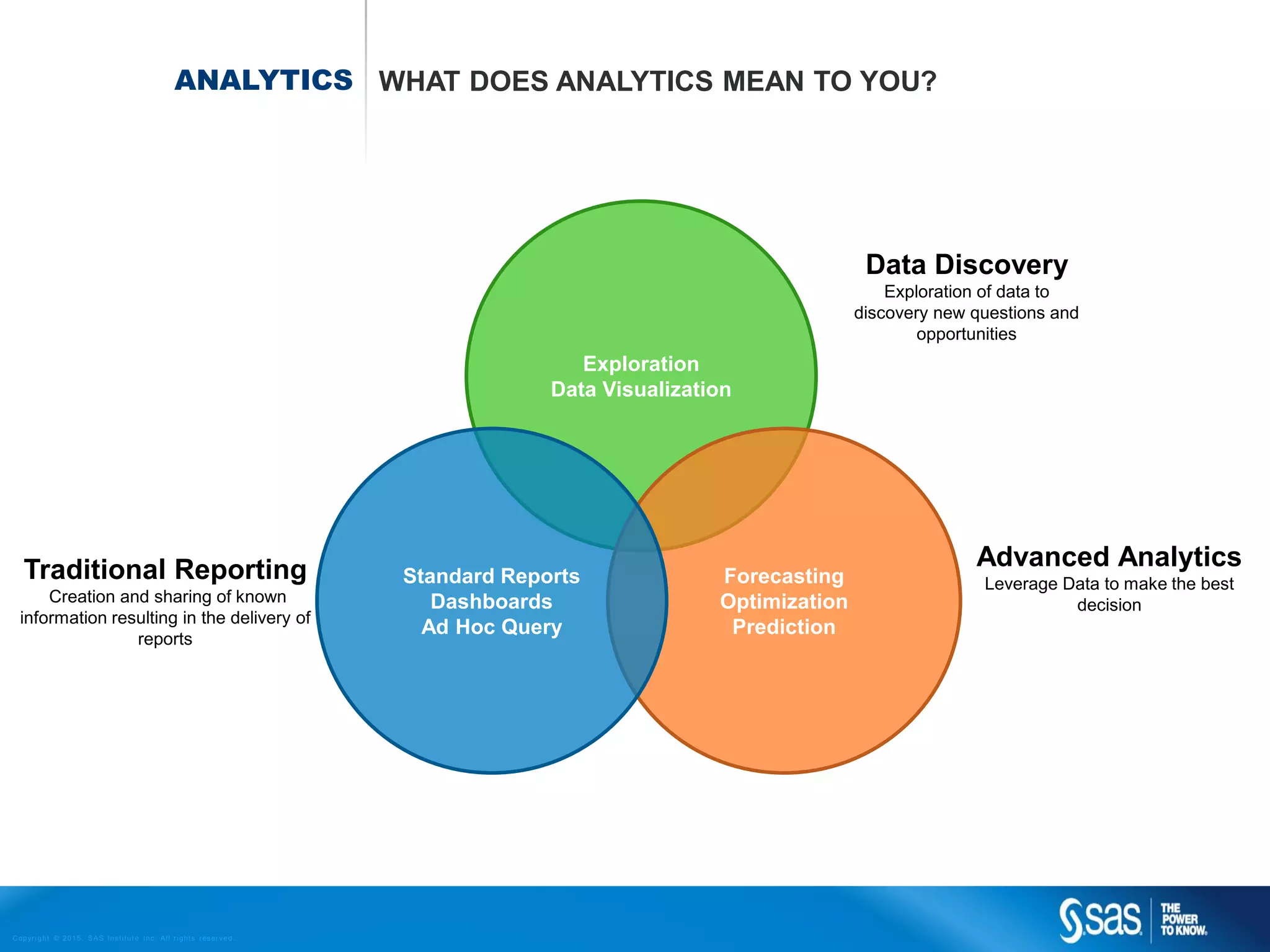

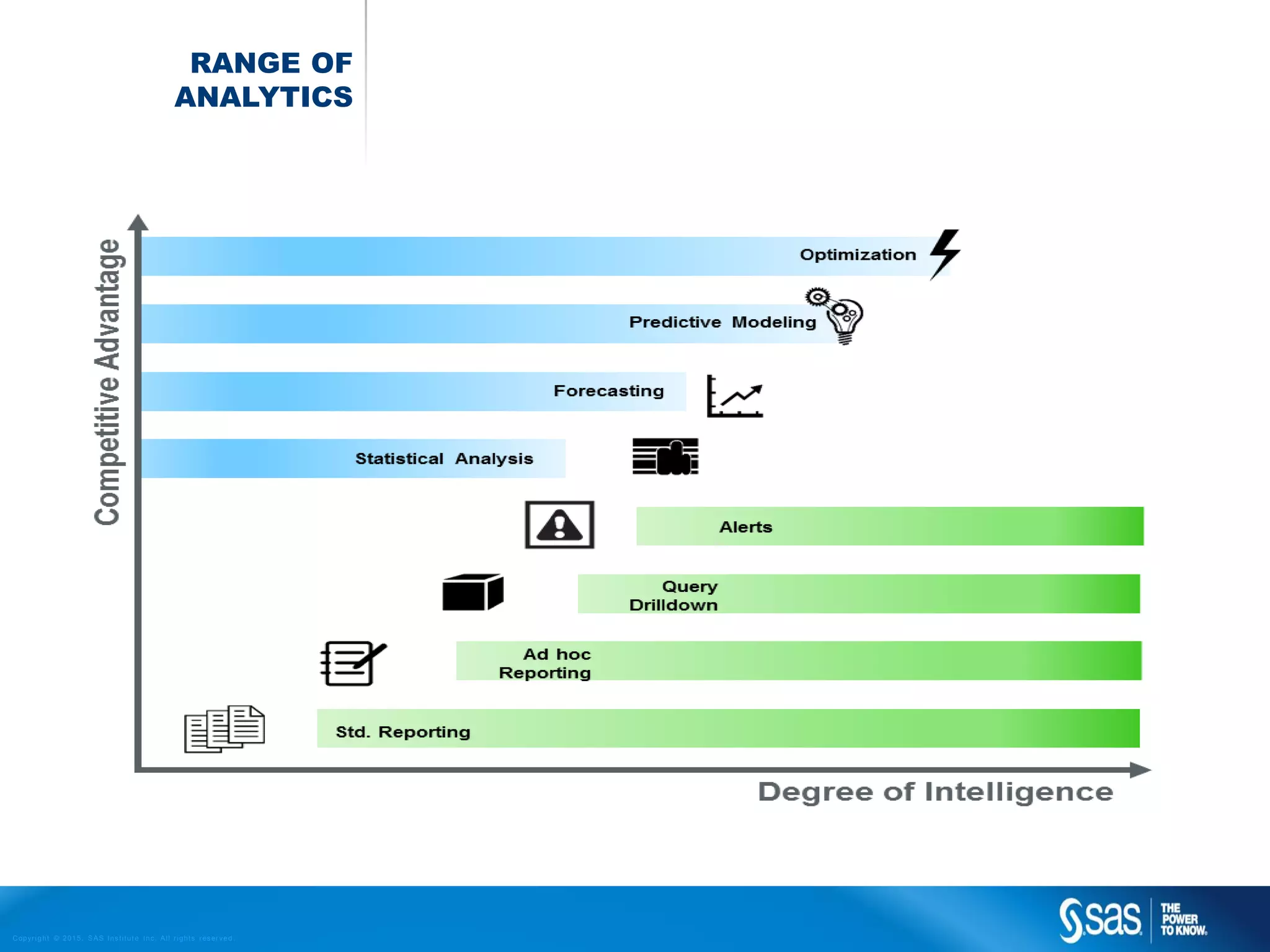

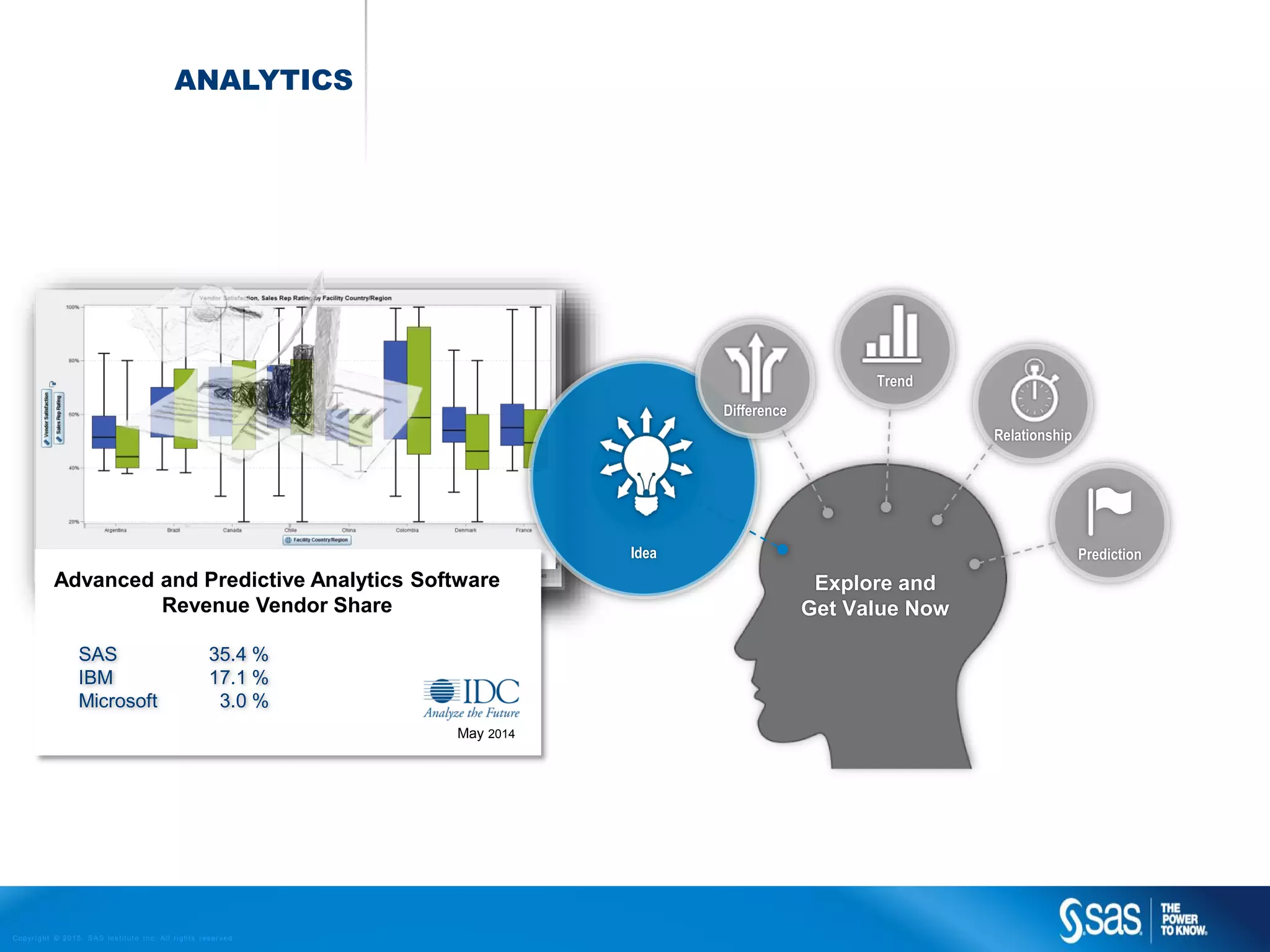

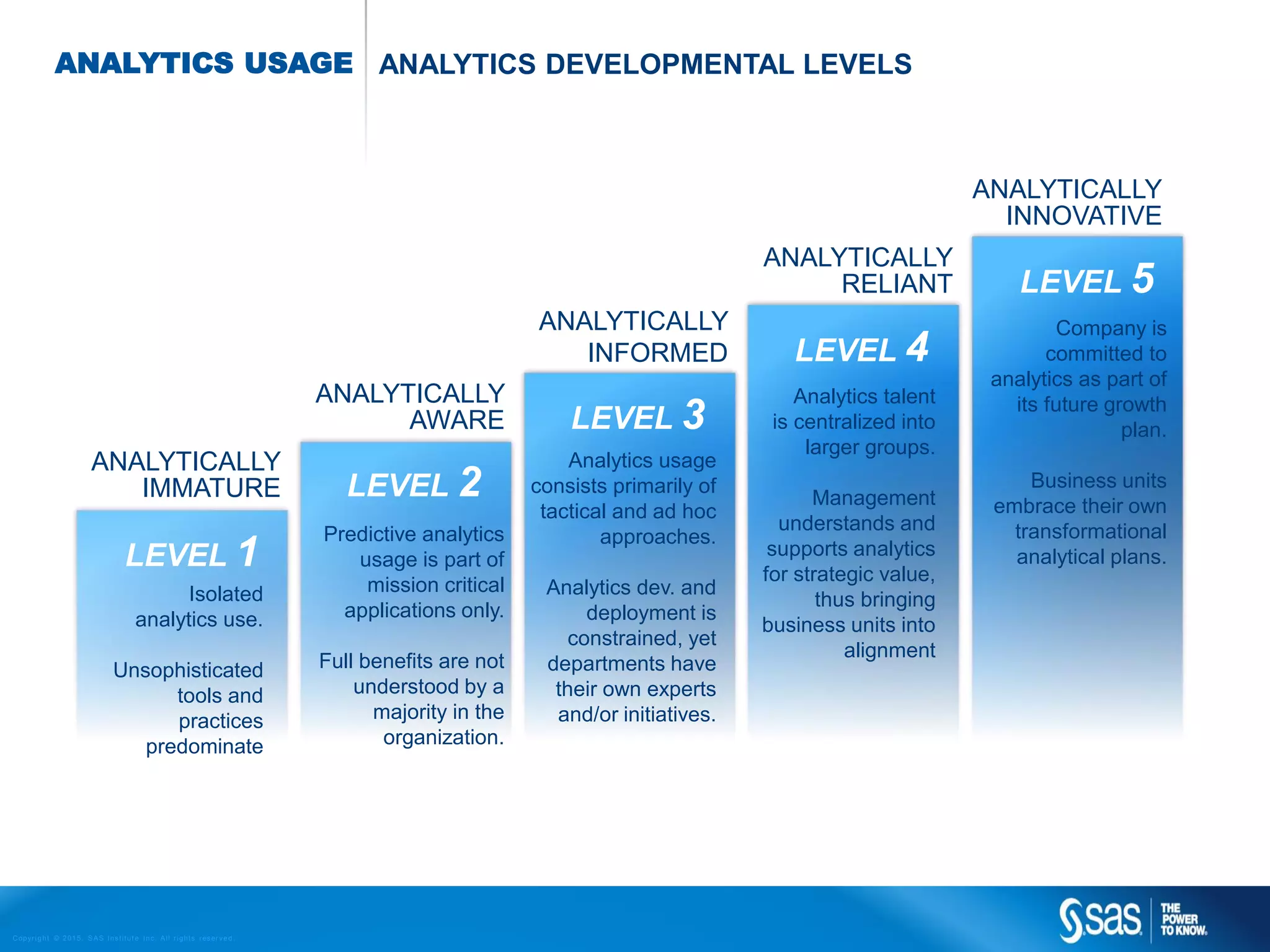

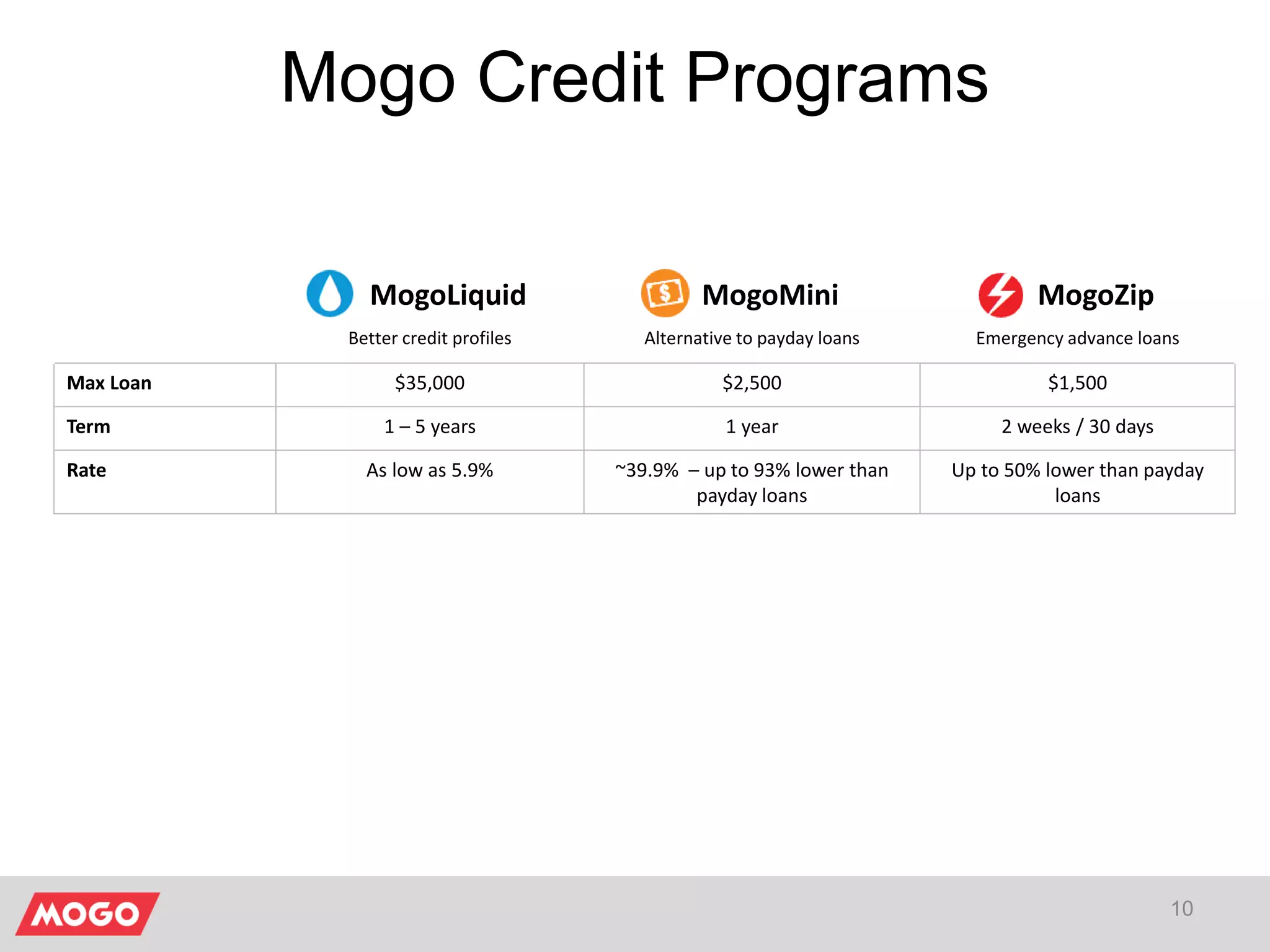

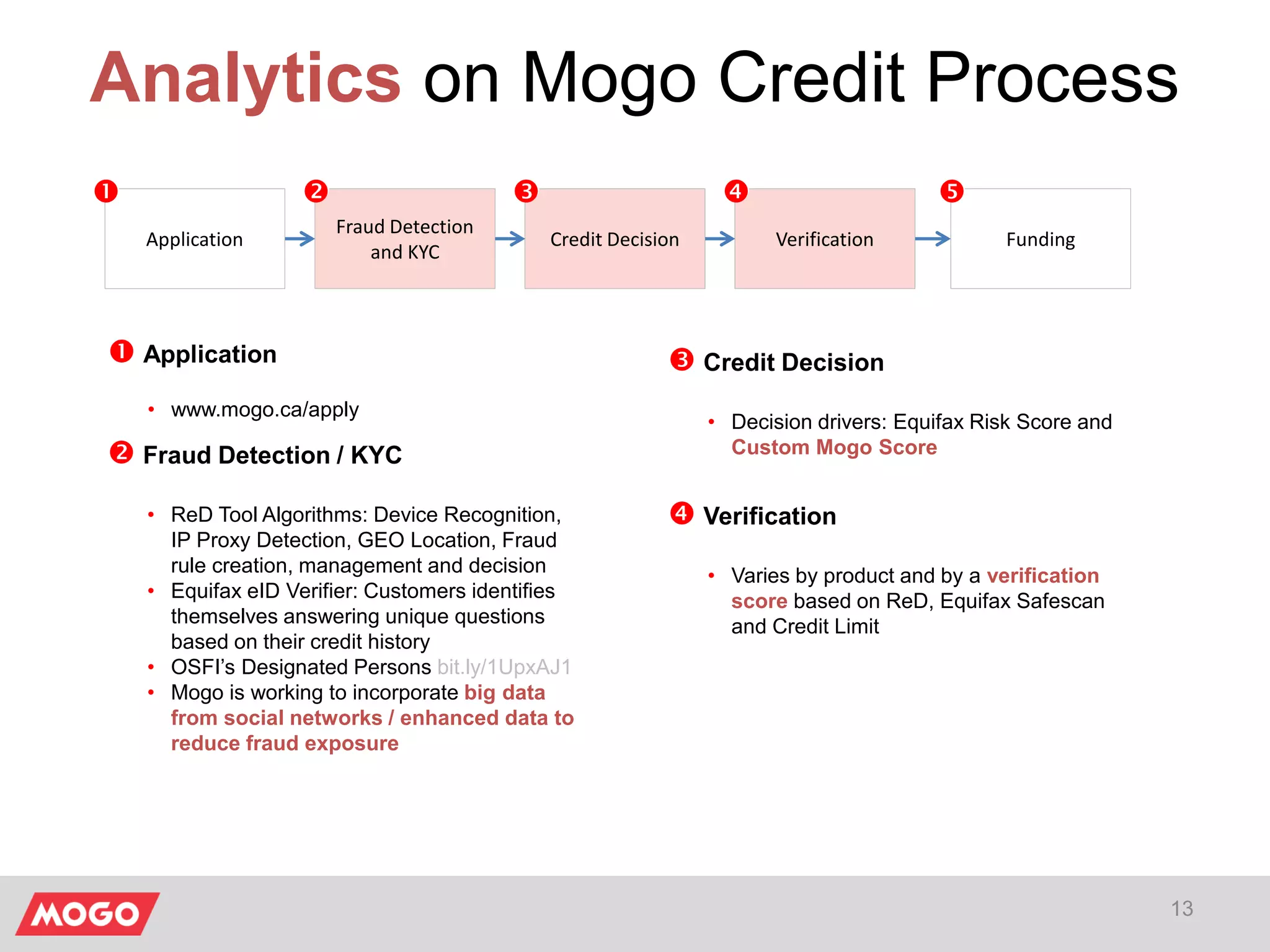

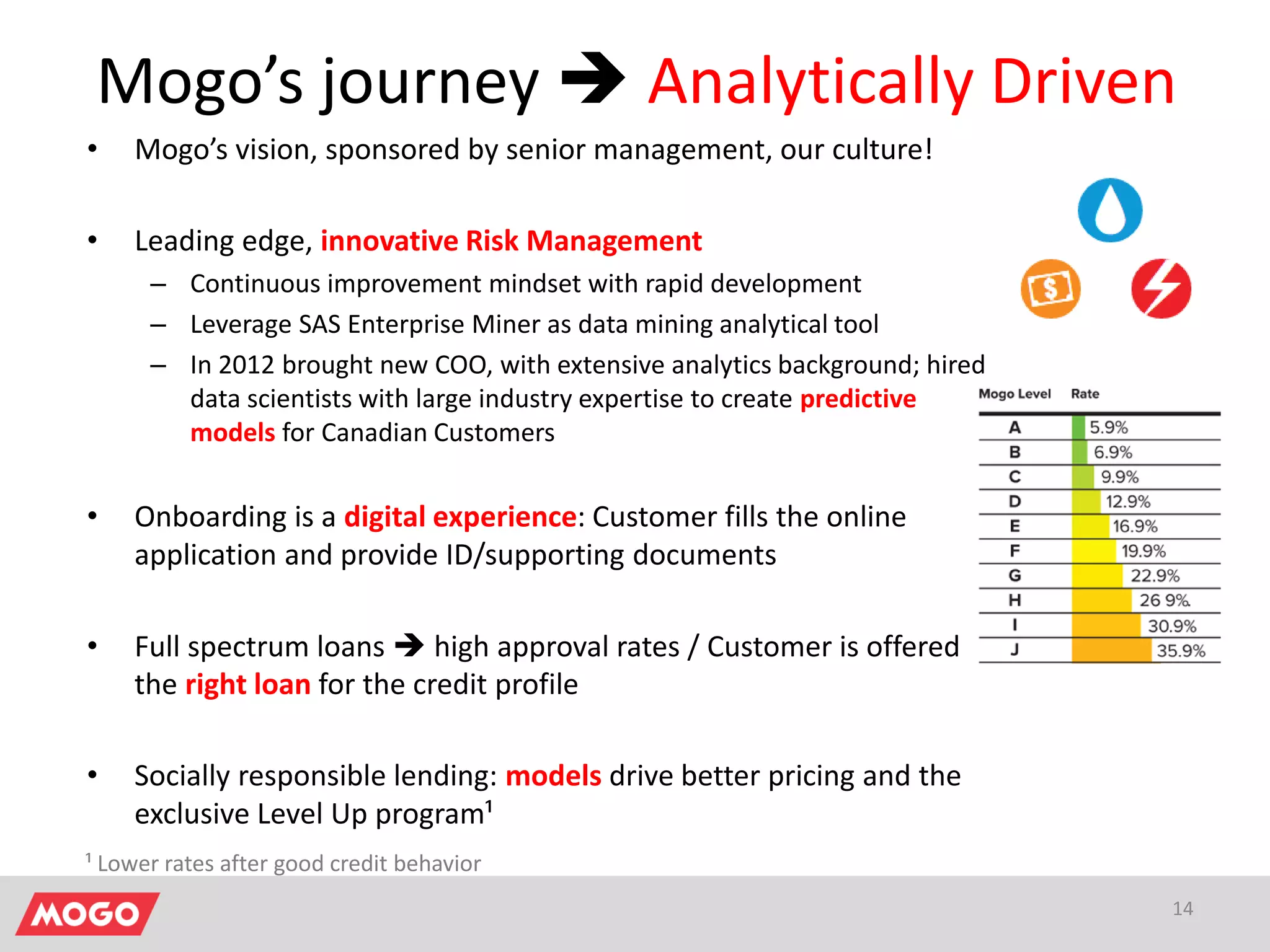

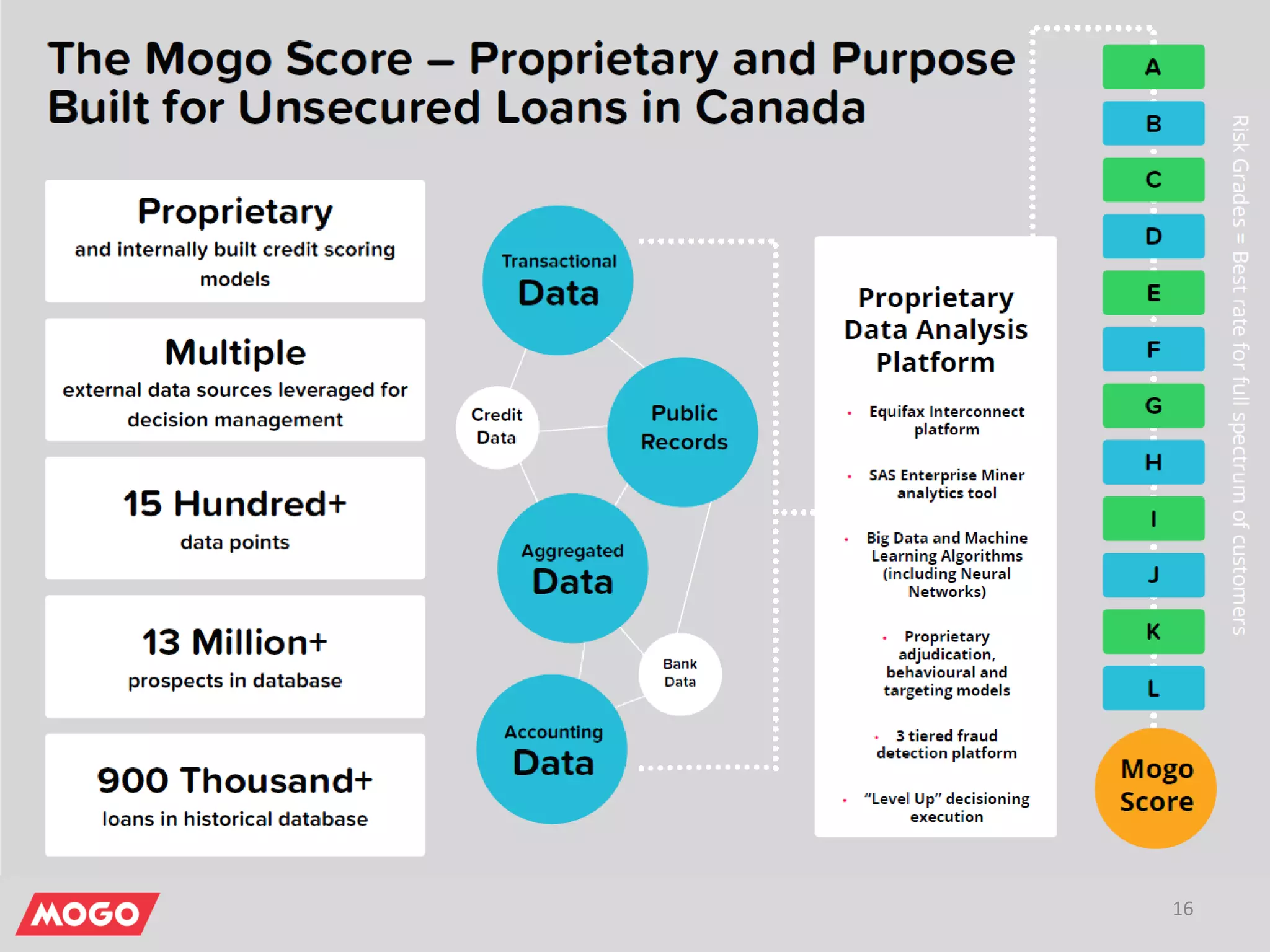

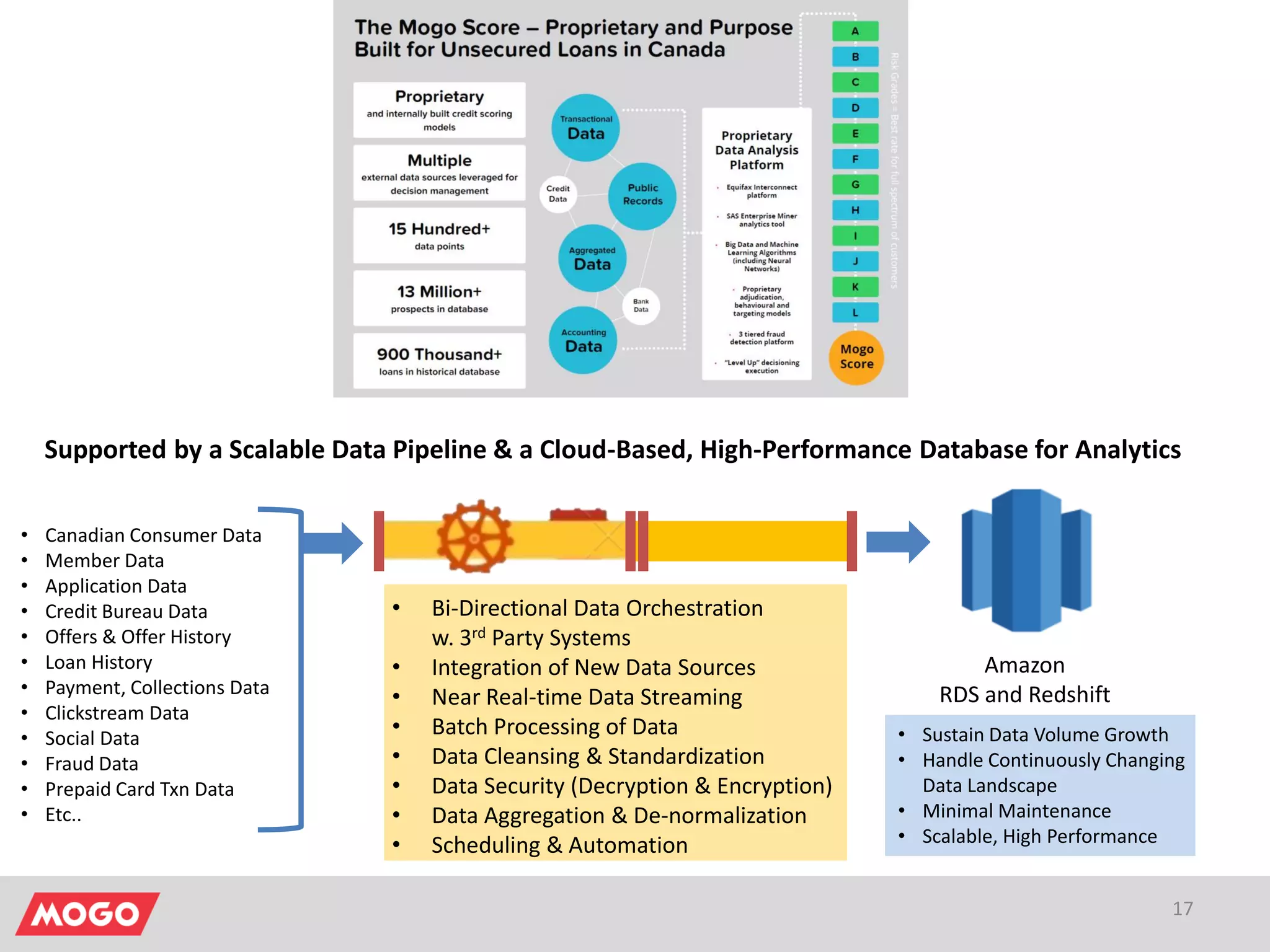

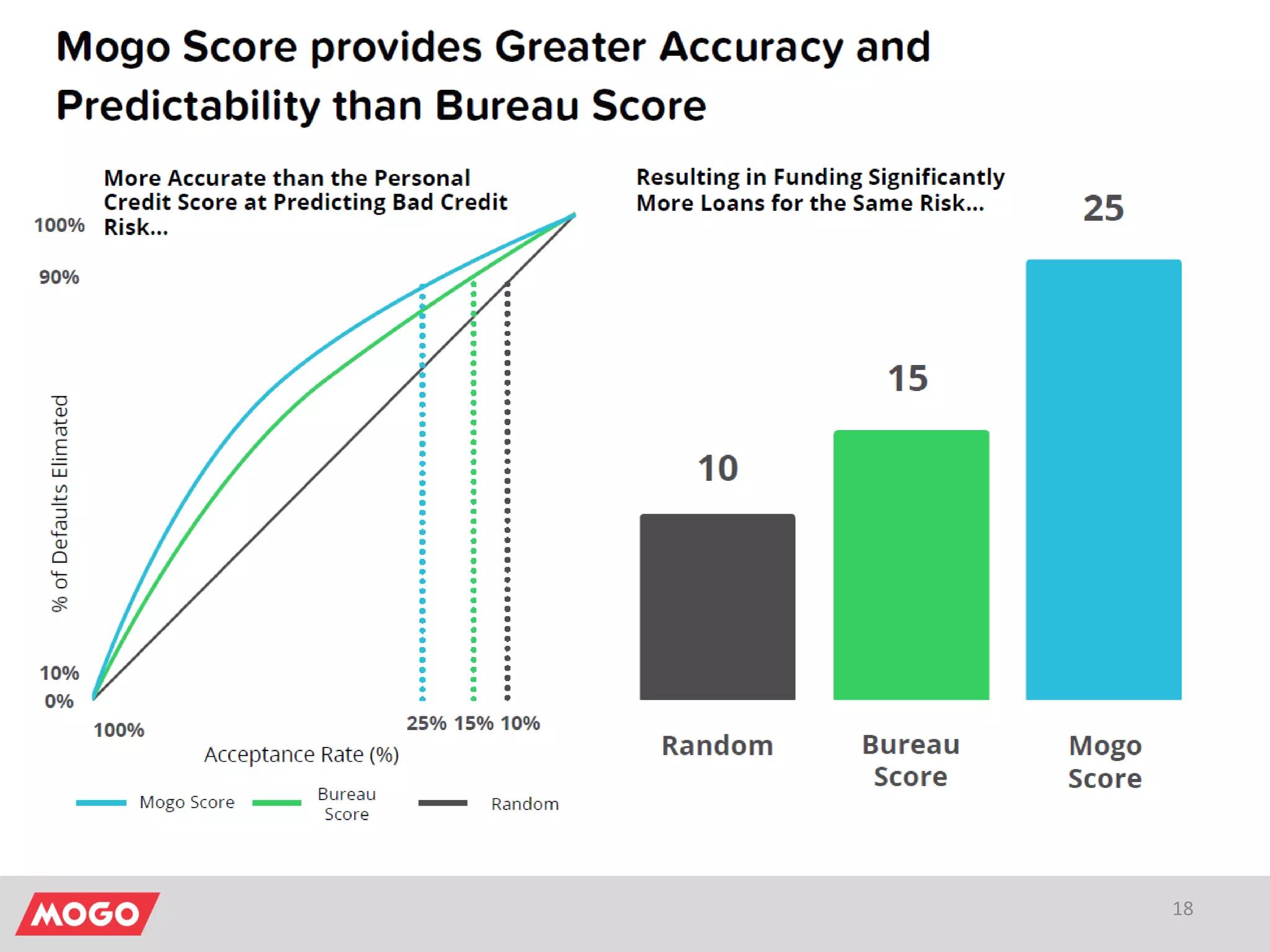

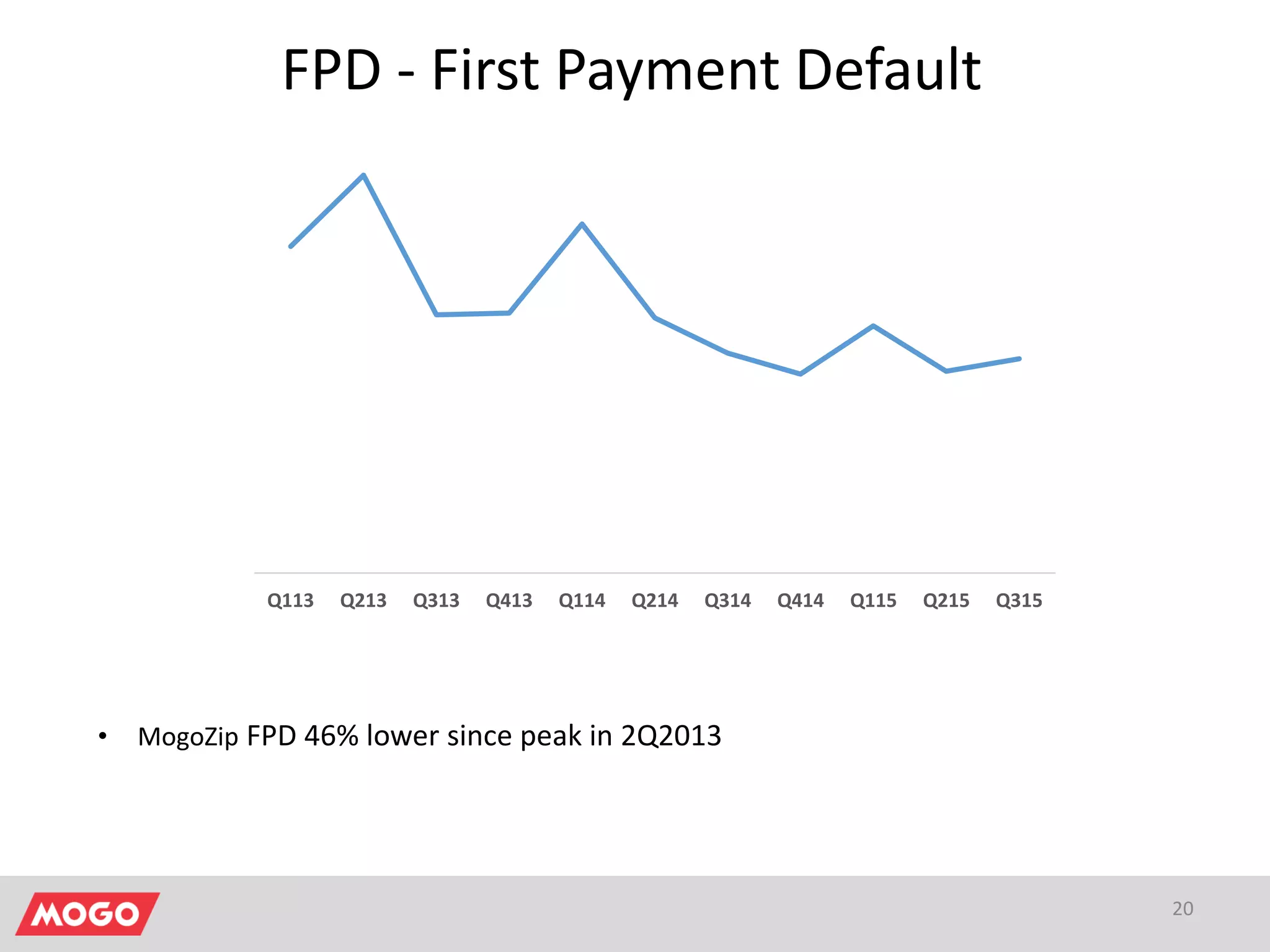

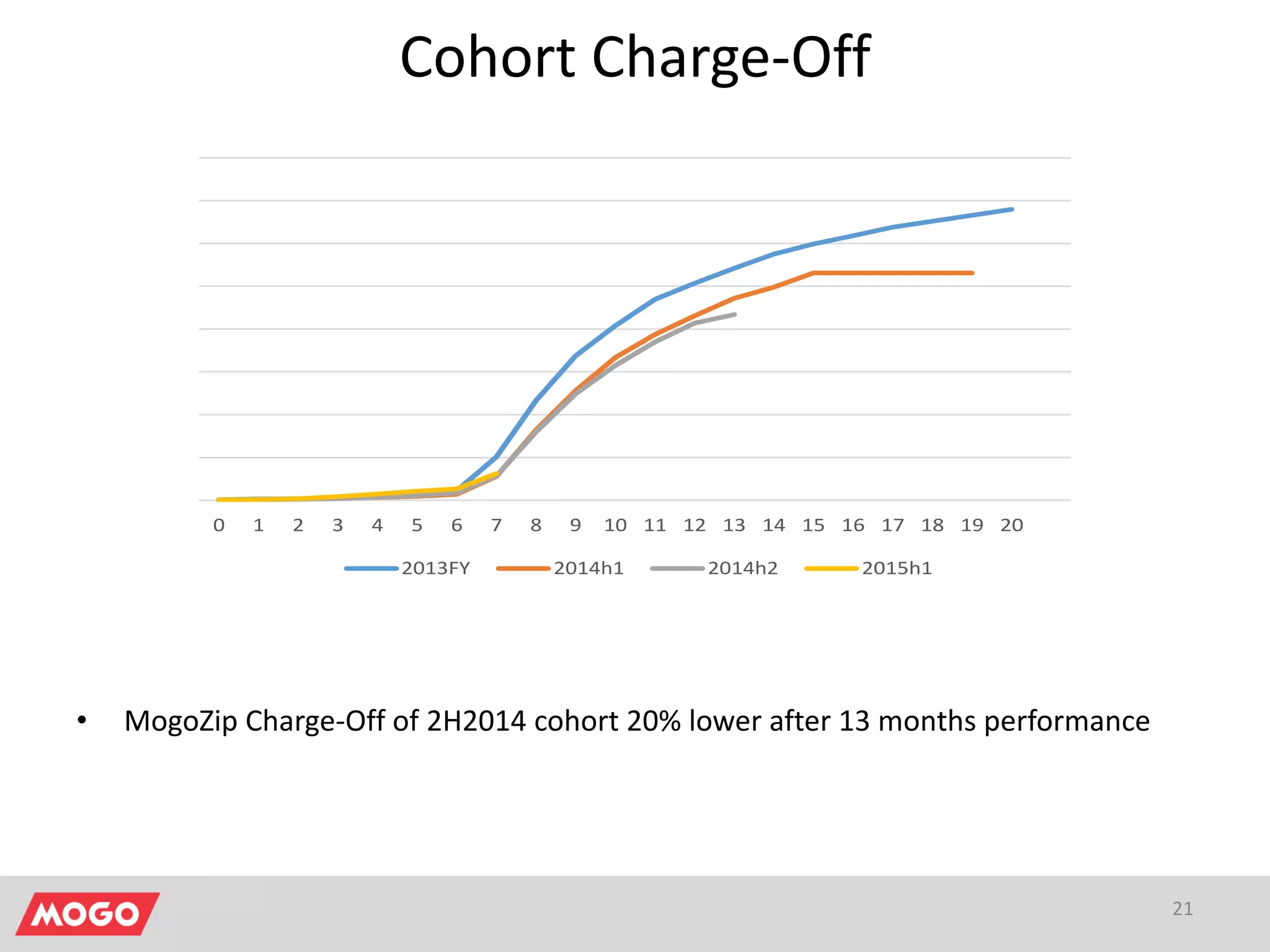

The document discusses the concept of analytics, emphasizing its role in discovering patterns in data and solving business problems through various analytical approaches, including predictive analytics. It highlights the progression of organizations from isolated analytics to being analytically innovative, supported by effective management and a commitment to data-driven growth. Additionally, the document showcases Mogo's use of analytics in online lending, demonstrating how predictive risk analytics enhances credit decision processes and promotes socially responsible lending practices.