Embed presentation

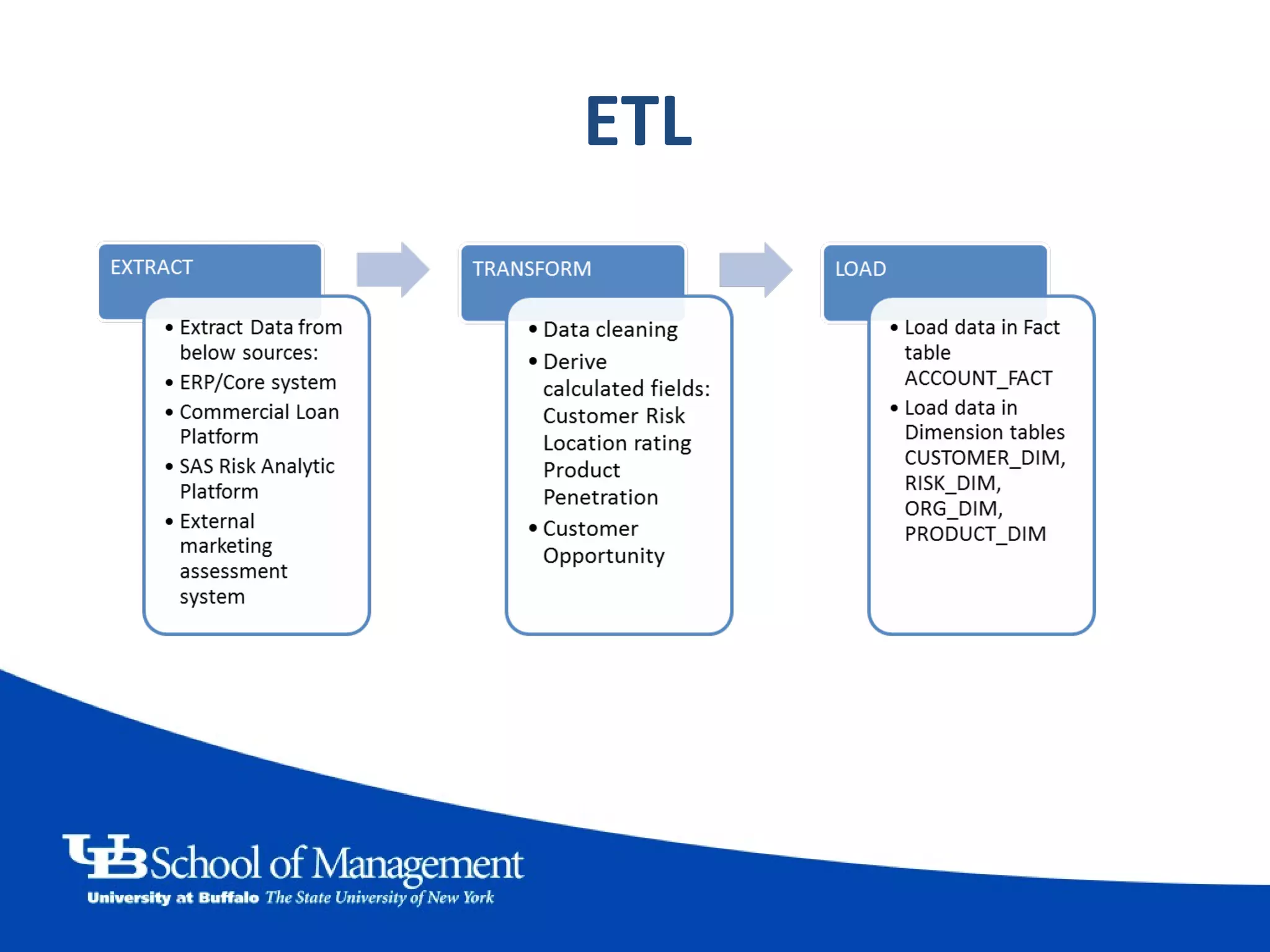

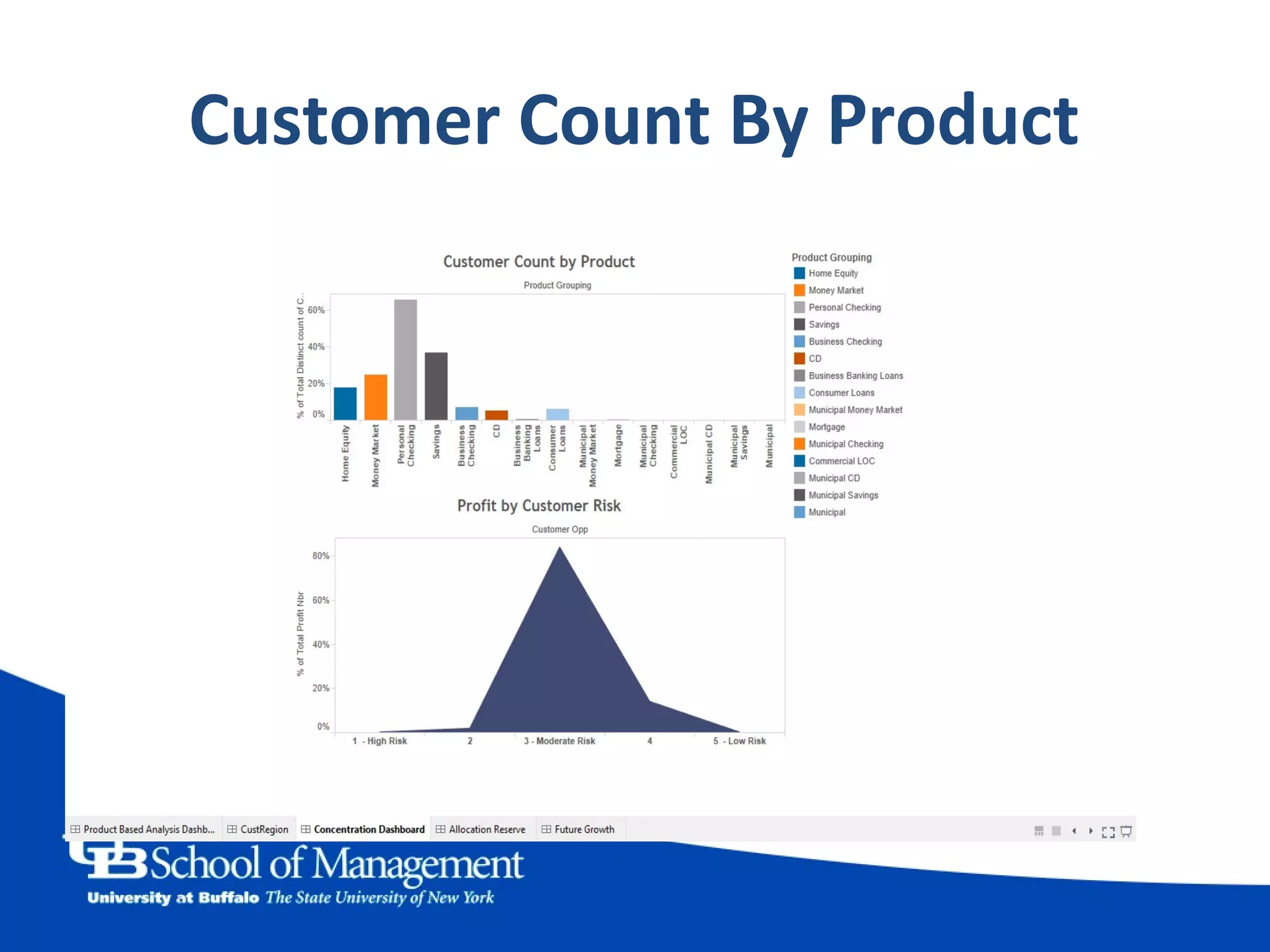

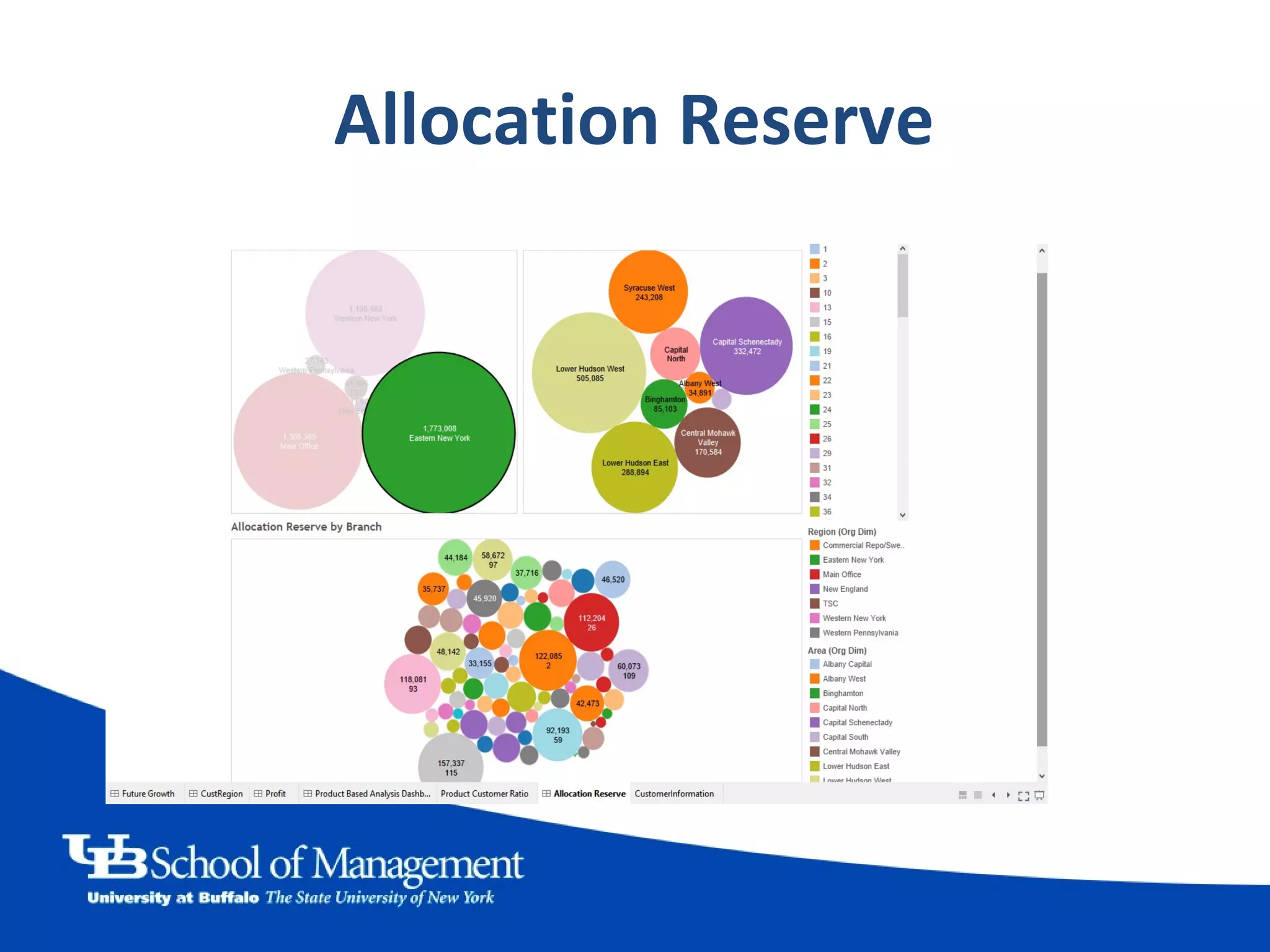

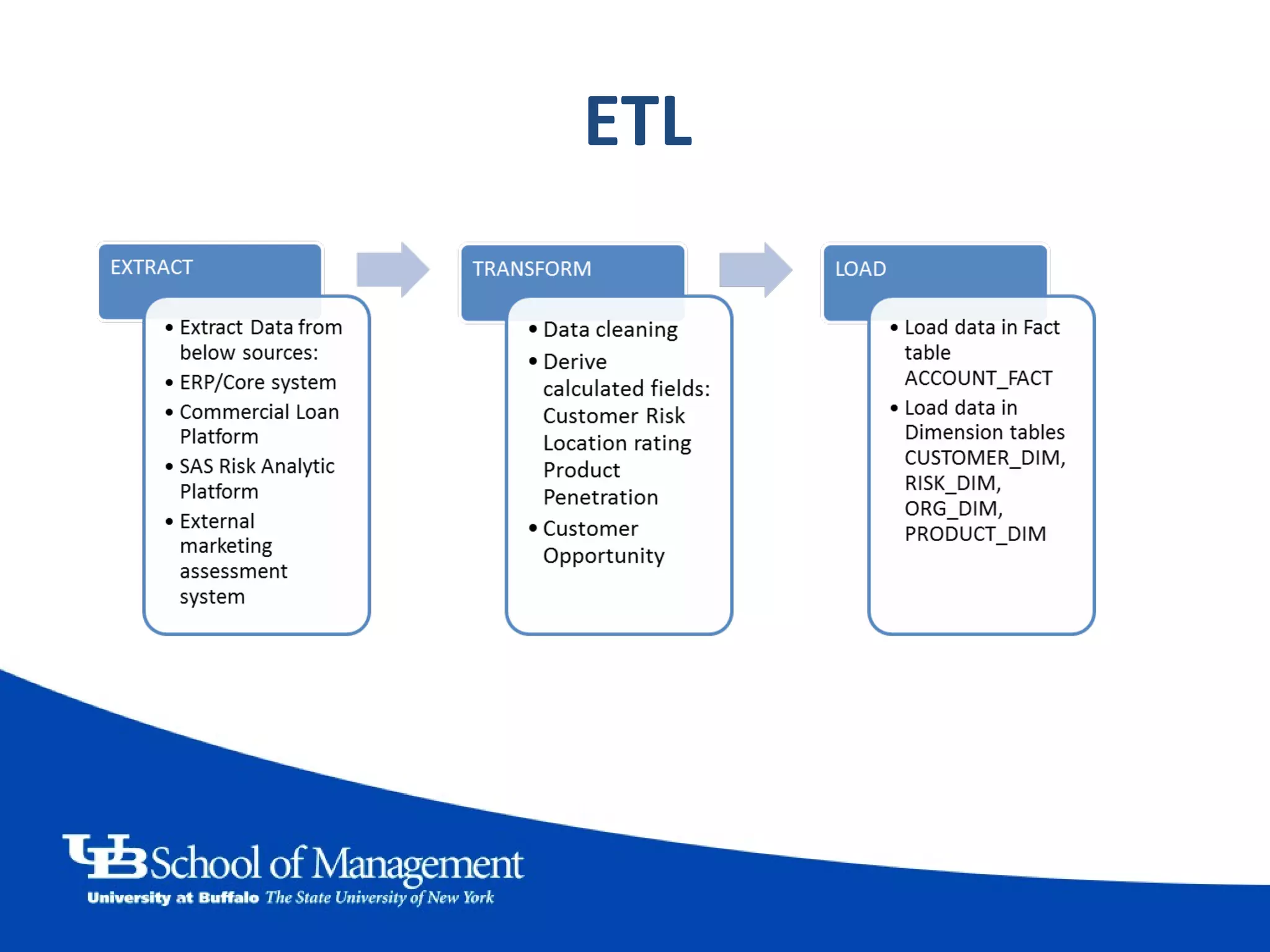

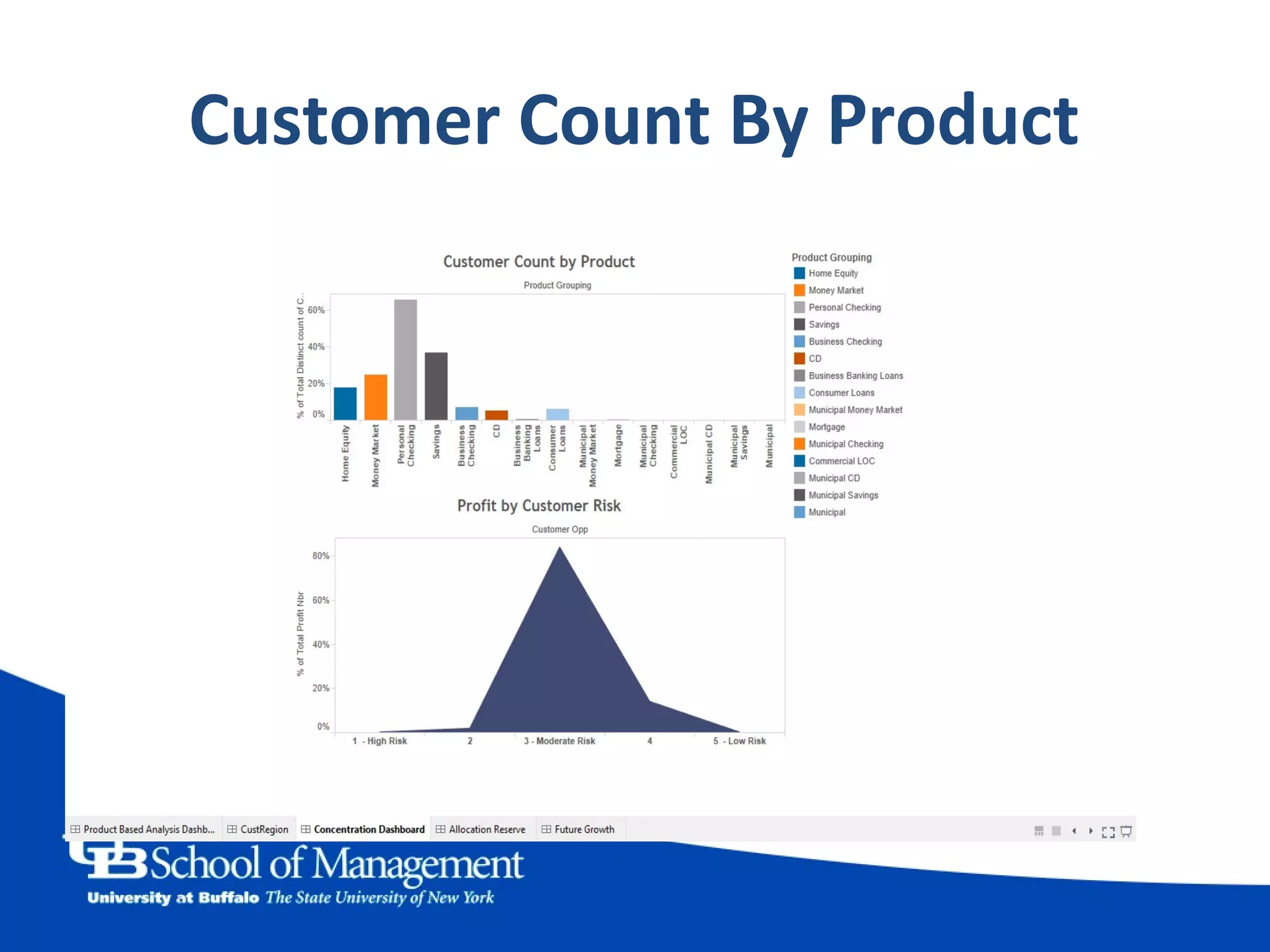

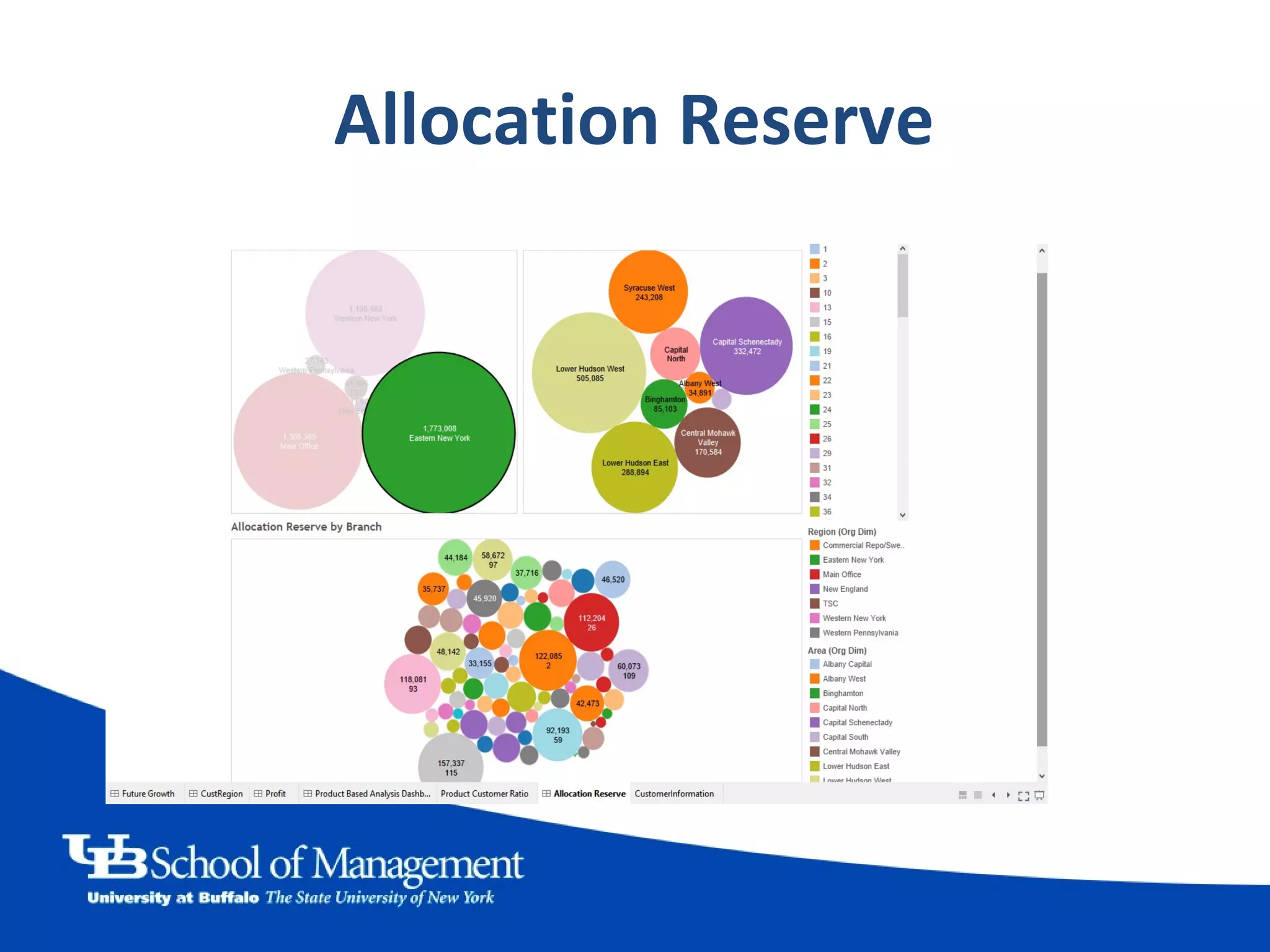

The credit risk management team consists of Sanika Dixit, Shweta Vaidya, Sneha Salian, and Snehal Datta. Their goal is to assess and mitigate credit portfolio risks to reduce financial losses from borrower default. The BI solution enables accurate risk assessment, loss reduction, and faster reporting by analyzing key performance indicators like profit, customer growth, and credit risk at the region, product, and branch level.