SBI Beats 1QFY2011 Estimates on Strong NII, Lower Costs

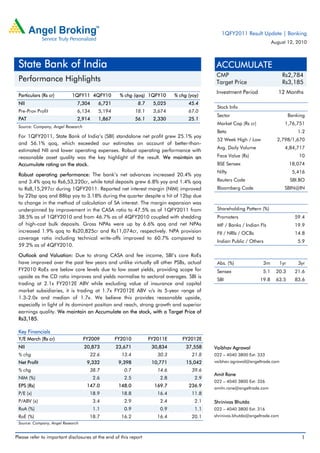

- 1. 1QFY2011 Result Update | Banking August 12, 2010 State Bank of India ACCUMULATE CMP Rs2,784 Performance Highlights Target Price Rs3,185 Investment Period 12 Months Particulars (Rs cr) 1QFY11 4QFY10 % chg (qoq) 1QFY10 % chg (yoy) NII 7,304 6,721 8.7 5,025 45.4 Stock Info Pre-Prov Profit 6,134 5,194 18.1 3,674 67.0 Sector Banking PAT 2,914 1,867 56.1 2,330 25.1 Market Cap (Rs cr) 1,76,751 Source: Company, Angel Research Beta 1.2 For 1QFY2011, State Bank of India’s (SBI) standalone net profit grew 25.1% yoy 52 Week High / Low 2,798/1,670 and 56.1% qoq, which exceeded our estimates on account of better-than- Avg. Daily Volume 4,84,717 estimated NII and lower operating expenses. Robust operating performance with reasonable asset quality was the key highlight of the result. We maintain an Face Value (Rs) 10 Accumulate rating on the stock. BSE Sensex 18,074 Nifty 5,416 Robust operating performance: The bank’s net advances increased 20.4% yoy and 3.4% qoq to Rs6,53,220cr, while total deposits grew 6.8% yoy and 1.4% qoq Reuters Code SBI.BO to Rs8,15,297cr during 1QFY2011. Reported net interest margin (NIM) improved Bloomberg Code SBIN@IN by 22bp qoq and 88bp yoy to 3.18% during the quarter despite a hit of 12bp due to change in the method of calculation of SA interest. The margin expansion was underpinned by improvement in the CASA ratio to 47.5% as of 1QFY2011 from Shareholding Pattern (%) 38.5% as of 1QFY2010 and from 46.7% as of 4QFY2010 coupled with shedding Promoters 59.4 of high-cost bulk deposits. Gross NPAs were up by 6.6% qoq and net NPAs MF / Banks / Indian Fls 19.9 increased 1.9% qoq to Rs20,825cr and Rs11,074cr, respectively. NPA provision FII / NRIs / OCBs 14.8 coverage ratio including technical write-offs improved to 60.7% compared to Indian Public / Others 5.9 59.2% as of 4QFY2010. Outlook and Valuation: Due to strong CASA and fee income, SBI’s core RoEs have improved over the past few years and unlike virtually all other PSBs, actual Abs. (%) 3m 1yr 3yr FY2010 RoEs are below core levels due to low asset yields, providing scope for Sensex 5.1 20.3 21.6 upside as the CD ratio improves and yields normalise to sectoral averages. SBI is SBI 19.8 63.5 83.6 trading at 2.1x FY2012E ABV while excluding value of insurance and capital market subsidiaries, it is trading at 1.7x FY2012E ABV v/s its 5-year range of 1.3-2.0x and median of 1.7x. We believe this provides reasonable upside, especially in light of its dominant position and reach, strong growth and superior earnings quality. We maintain an Accumulate on the stock, with a Target Price of Rs3,185. Key Financials Y/E March (Rs cr) FY2009 FY2010 FY2011E FY2012E NII 20,873 23,671 30,834 37,558 Vaibhav Agrawal % chg 22.6 13.4 30.3 21.8 022 – 4040 3800 Ext: 333 Net Profit 9,332 9,398 10,771 15,042 vaibhav.agrawal@angeltrade.com % chg 38.7 0.7 14.6 39.6 Amit Rane NIM (%) 2.6 2.5 2.8 2.9 022 – 4040 3800 Ext: 326 EPS (Rs) 147.0 148.0 169.7 236.9 amitn.rane@angeltrade.com P/E (x) 18.9 18.8 16.4 11.8 P/ABV (x) 3.4 2.9 2.4 2.1 Shrinivas Bhutda RoA (%) 1.1 0.9 0.9 1.1 022 – 4040 3800 Ext: 316 RoE (%) 18.7 16.2 16.4 20.1 shrinivas.bhutda@angeltrade.com Source: Company, Angel Research Please refer to important disclosures at the end of this report 1

- 2. State Bank of India | 1QFY2011 Result Update Exhibit 1: 1QFY2011 performance Particulars (Rs cr) 1QFY11 4QFY10 % chg (qoq) 1QFY10 % chg (yoy) Interest earned 18,452 17,966 2.7 17,473 5.6 Interest expenses 11,148 11,244 (0.9) 12,448 (10.4) Net interest income 7,304 6,721 8.7 5,025 45.4 Non-interest income 3,690 4,509 (18.2) 3,569 3.4 Total income 10,994 11,230 (2.1) 8,594 27.9 Operating expenses 4,859 6,036 (19.5) 4,920 (1.2) Pre-prov. profit 6,134 5,194 18.1 3,674 67.0 Provisions & cont. 1,551 2,349 (34.0) 173 798.1 PBT 4,583 2,844 61.1 3,501 30.9 Prov. for taxes 1,669 978 70.7 1,171 42.5 PAT 2,914 1,867 56.1 2,330 25.1 EPS (Rs) 45.9 29.4 56.1 36.7 25.1 Cost-to-income ratio (%) 44.2 53.7 57.2 Effective tax rate (%) 36.4 34.4 33.4 Net NPA (%) 1.7 1.7 1.6 Source: Company, Angel Research Exhibit 2: 1QFY2011 Actual vs. Estimates Particulars (Rs cr) Actual Estimates Var (%) Net interest income 7,304 6,404 14.0 Non-interest income 3,690 3,848 (4.1) Total income 10,994 10,252 7.2 Operating expenses 4,859 5,374 (9.6) Pre-prov. profit 6,134 4,878 25.8 Provisions & cont. 1,551 1,372 13.1 PBT 4,583 3,506 30.7 Prov. for taxes 1,669 1,192 40.0 PAT 2,914 2,314 26.0 Source: Company, Angel Research August 12, 2010 2

- 3. State Bank of India | 1QFY2011 Result Update Advances grow in line with industry, deposits growth lags During the quarter, net advances of the bank increased 20.4% yoy and 3.4% qoq to Rs6,53,220cr, underpinned by strong growth in large corporate advances of 34.7% yoy and growth in home loans of 29.8% yoy. Loan book of the bank continues to be well diversified with no segment accounting for more than 21% of the total loan book. The growth in advances was driven by the telecom related lending (Rs7,000cr) and upturn in textiles, iron and steel, auto, infrastructure and gems & jewellery industry. Going forward, the credit demand from the large and mid corporate segments is expected to be strong, with sanctions in pipeline of Rs14,798cr and Rs7,791cr, respectively. Exhibit 3: Segment-wise advances yoy growth rates Segment % Large Corporate 34.7 Mid-Corporate 14.3 SME 14.7 Agricultural 16.0 International 22.1 Home 29.8 Auto 48.1 Education 30.8 Overall Advances 20.4 Source: Company, Angel Research Deposits of the bank went up from Rs7,63,563cr in 1QFY2010 to Rs8,15,297cr in 1QFY2011 recording a yoy growth of 6.8%, driven by CASA growth of 28.9% and retail term deposits growth of 10.2%, despite shedding of high-cost bulk deposits by 51.4%. Current deposits increased 12.5% yoy, while savings deposits rose 33.9% yoy. Savings bank deposits grew at an average of Rs9,232cr per month during the quarter to Rs71,806cr as of 1QFY2011 leading to an improvement in CASA ratio from 38.5% as of 1QFY2010 to 47.5% as of 1QFY2011 (46.7% in 4QFY2010). As a result, NII increased by 45.4% yoy and 8.7% qoq to Rs7,304cr in 1QFY2011. Exhibit 4: Business growth trend Advances YoY Growth Deposits YoY Growth Credit-Deposit Ratio (RHS) (%) (%) 40.0 84 80 30.0 76 20.0 72 10.0 68 - 64 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 Source: Company, Angel Research August 12, 2010 3

- 4. State Bank of India | 1QFY2011 Result Update Exhibit 5: Well-diversified loan book - 1QFY2011 Others International 3% 16% Retail 21% Mid-Corporate Agricultural 20% 9% Large Corporate SME 14% 17% Source: Company, Angel Research NIM continues its ride on growth path The bank’s reported NIM has been in an upward trend since hitting a low of 2.30% in 1QFY2010 from which it has improved by 88bp to 3.18% in 1QFY2011. Even on a sequential basis, NIM has expanded by 22bp despite the 12bp hit due to the switch in calculation method of savings deposits interest. The improvement in NIMs was driven by increase in the CD ratio to 80.1% (from 78.6% in 4QFY2010), shedding of bulk deposits and increase in CASA ratio. Exhibit 6: Trend in spreads and NIMs (%) Yield on Advances Cost of Deposits Reported NIM 12.00 10.01 10.24 10.42 10.15 10.01 9.95 9.79 9.66 9.30 9.00 6.16 5.94 5.95 6.30 6.16 6.06 5.92 5.80 5.27 6.00 3.03 3.16 3.10 2.82 2.96 3.18 2.39 2.30 2.55 3.00 0.00 1QFY09 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 Source: Company, Angel Research Reasonable asset quality SBI’s asset quality suffered slightly during the quarter as gross NPAs rose 6.6% qoq to Rs20,825cr, while net NPAs increased 1.9% qoq to Rs11,074cr partly due to the net increase in gross NPAs from agricultural advances of Rs683cr, which included Rs354cr towards the Agri Debt Waiver scheme. The gross and net NPA ratio remained steady sequentially at 3.1% and 1.7%, respectively. The gross slippages during the quarter were Rs4,081cr, which came primarily from the agri, retail and SME portfolios. The annualised slippage ratio stood at 2.6% compared to 2.2% in FY2010. The bank’s corporate and SME portfolio accounted for more than 56.0% of the total gross NPAs of Rs20,825cr. The provision August 12, 2010 4

- 5. State Bank of India | 1QFY2011 Result Update coverage ratio including technical write-offs improved from 59.2% as of 4QFY2010 to 60.7% as of 1QFY2011. Out of the cumulative standard restructured assets under the RBI Special Dispensation Scheme which stood at Rs16,796cr as of 4QFY2010, Rs158cr turned into NPAs during the quarter taking the cumulative slippages from restructured book to Rs1,774cr (10.6% of the restructured loan book). The bank’s restructured loans outside the RBI scheme stood at Rs12,900cr, indicating cumulative restructuring/net worth of 43.1% compared to sector average of 68.3%. Exhibit 7: Trend in asset quality Gross NPAs Net NPAs Provision coverage (RHS) (Rs cr) (%) 25,000 70.0 20,000 60.0 15,000 50.0 10,000 40.0 5,000 - 30.0 1QFY09 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 Source: Company, Angel Research, Note: NPA coverage excluding technical write-offs till 3QFY2009 Provisioning expenses rose substantially on a yoy basis to Rs1,551cr in 1QFY2011, on the back of higher NPA provisions (Rs1,733cr) and lower write-back of investment provisions (Rs298cr). Exhibit 8: Breakup of provisioning expenses (Rs cr) 1QFY11 4QFY10 % chg (qoq) 1QFY10 % chg (yoy) NPA 1,733 2,187 (20.7) 1,344 29.0 Standard Assets 106 72 46.2 14 656.6 Investments (298) 36 - (1,201) (75.2) Others 10 55 (81.0) 15 (31.4) Total 1,551 2,349 (34.0) 173 798.1 Source: Company, Angel Research Operating expenses under control Operating expenses declined 19.5% qoq and 1.2% yoy to Rs4,859cr driven by a 14.4% qoq and 9.9% yoy fall in staff expenses. Decrease in operating expenses coupled with robust operating performance improved the cost-to-income ratio to 44.2% compared to 53.7% in 4QFY2010 and 57.2% in 1QFY2010. There was a write-back of Rs845cr from excess provision on wage revision during the quarter. The bank made a provision of Rs1,100cr for gratuity during 1QFY2011 against the estimated liability of Rs2,200cr for FY2011E for the increase in gratuity ceiling. August 12, 2010 5

- 6. State Bank of India | 1QFY2011 Result Update Exhibit 9: Breakup of operating expenses (Rs cr) 1QFY11 4QFY10 % chg (qoq) 1QFY10 % chg (yoy) Staff expenses 3,074 3,592 (14.4) 3,411 (9.9) Overhead expenses 1,785 2,444 (27.0) 1,508 18.4 Total 4,859 6,036 (19.5) 4,920 (1.2) Source: Company, Angel Research Exhibit 10: Trend in productivity Employee Expenses Other Expenses Cost-to-income ratio (RHS) (Rs cr) (%) 7,500 57 60 6,000 54 52 55 4,500 50 47 50 3,000 46 45 45 44 1,500 45 - 40 1QFY09 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 Source: Company, Angel Research Comfortable capital adequacy The bank has continued to maintain comfortable capital adequacy ratio of above 13.5%. As of 1QFY2011, the overall capital adequacy stood at 13.54% with tier I forming more than 72.3% of the total CAR. The bank is likely to come out with a rights issue by the end of FY2011 to sustain the CAR at comfortable levels. The government has already approved diluting its stake to 51% from the existing stipulated dilution level of 55%. This provides significant headroom for dilution with the existing government holding at 59.4%. Exhibit 11: Comfortable capital adequacy (%) Tier I Tier II 16.0 12.0 4.9 4.4 4.3 4.1 3.9 3.8 8.0 9.4 9.7 9.8 9.7 9.5 9.8 4.0 - 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 Source: Company, Angel Research August 12, 2010 6

- 7. State Bank of India | 1QFY2011 Result Update Muted non-interest income, supported strongly by fee income Total non-interest income growth was muted at 3.4% yoy on account of 75.5% yoy decline in profit on sale of investments. Non-interest income excluding profit on sale of investments was up by 23.0% yoy. Fee income went up 29.4% yoy, driven by robust growth in loan processing charges, non-fund based business, government business and cross-selling. Forex income increased 6.8% yoy to Rs503cr. Growth in other non-interest income was driven by the 42.0% growth in recoveries from written-off accounts. Exhibit 12: Breakup of non-interest income (Rs cr) 1QFY11 4QFY10 % chg (qoq) 1QFY10 % chg (yoy) CEB 2,410 3,486 (30.9) 1,862 29.4 Treasury 173 426 (59.3) 709 (75.5) Forex 503 185 172.1 470 6.8 Dividend 377 47 700.7 358 5.3 Others 227 365 (37.8) 169 34.2 Total 3,690 4,509 (18.2) 3,569 3.4 Source: Company, Angel Research Performance of Associates and Subsidiaries Advances and deposits of associate banks recorded yoy growth of 18.4% and 16.0%, respectively. Gross and net NPAs of the associate banks stood at 2.1% and 1.0%, respectively. Operating profit of associate banks increased 47.4% yoy to Rs1,881cr (Rs1,276cr). However, net profit of the associate banks declined marginally by 0.5% yoy mainly on account of higher provisioning for NPAs taking the provision coverage ratio to a healthy 66%. SBI Life earned PAT of Rs114cr (Rs39cr), registering yoy growth of 192.3%. AuM of the company increased by 64.0% yoy to reach Rs30,082cr. The company was ranked second amongst the private insurance companies under New Business Premium, as on June, 2010. SBI Capital Markets posted PAT of Rs157cr for 1QFY2011, registering a yoy growth of 93% after excluding provision of Rs64cr towards syndication fee sharing payable to SBI. SBI Funds Management posted PAT of Rs15cr in 1QFY2011 as against Rs14cr for 1QFY2010. SBI Cards and Payment Services turned-around in 1QFY2011 with net profit of Rs3cr compared to loss of Rs24cr in 1QFY2010. The overall SBI Group recorded net profit growth of 22.0% yoy to Rs3,365cr (Rs2,759cr) for 1QFY2011. August 12, 2010 7

- 8. State Bank of India | 1QFY2011 Result Update Exhibit 13: Yoy growth rates for associate banks (%) Deposits Advances Operating Profit Net Profit State Bank of Bikaner & Jaipur 23.8 21.7 34.9 (30.0) State Bank of Hyderabad 24.6 27.4 53.9 82.6 State Bank of Indore 2.3 9.6 30.5 (76.6) State Bank of Mysore 17.7 16.9 55.2 35.5 State Bank of Patiala 5.2 12.4 98.6 10.3 State Bank of Travancore 19.6 18.4 12.8 (16.6) Total 16.0 18.4 47.4 (0.5) Source: Company, Angel Research August 12, 2010 8

- 9. State Bank of India | 1QFY2011 Result Update Investment Arguments Improving savings market share Up to FY2007, the bank witnessed a significant decline in CASA market share with private sector banks pursuing aggressive branch expansion. However, the bank’s market share of savings deposits expanded by a substantial 270bp to 23.2% during FY2007-10 (one of the few PSBs to do so) driven by relatively faster branch expansion (9.5% CAGR v/s 2-5% for most PSBs) leveraging its tremendous trust factor in the country. Strongest fee income among PSU banks SBI has a relatively strong share of fee income owing to its strong corporate and government business relationships. During FY2010, the bank continued its dominance with non-interest income/assets at 1.3% (highest among PSU banks). Asset quality concerns receding SBI has a gross NPA ratio of 3.1% and net NPA ratio of 1.7%, leading to a low provision coverage ratio of 60.7% (including technical write-offs) and restructured loans of around Rs30,000cr, constituting 43% of its net worth, which is lower than the peer average. We have factored in a slippage ratio of 2.2% for FY2011E (equal to slippage ratio in FY2010) on a conservative basis. This provides sufficient margin of safety to our provisions estimates. Outlook and Valuation Due to strong CASA and fee income, SBI’s core RoEs have improved over the past few years and unlike virtually all other PSBs, FY2010 RoEs are below core levels due to low asset yields, providing scope for upside as the CD ratio improves and yields normalise to sectoral averages. At CMP, SBI is trading at 2.1x FY2012E ABV while excluding value of insurance and capital market subsidiaries, it is trading at 1.7x FY2012E ABV v/s its 5-year range of 1.3-2.0x and median of 1.7x. We believe this provides reasonable upside, especially in light of its dominant position and reach, strong growth and superior earnings quality. We maintain an Accumulate on the stock, with a Target Price of Rs3,185. August 12, 2010 9

- 10. State Bank of India | 1QFY2011 Result Update Exhibit 14: SOTP valuation summary Company (Rs) Value per share SBI & Associates 2,956 Life 190 AMC 12 Others (Cap Mkt, Cards, Factors) 28 SOTP value 3,185 Source: Angel Research Exhibit 15: Key Assumptions Earlier Estimates Revised Estimates Particulars (%) FY2011E FY2012E FY2011E FY2012E Credit growth 21.0 20.0 21.0 20.0 Deposit growth 21.0 20.0 17.0 20.0 CASA ratio 46.9 46.5 48.5 48.5 NIMs 2.7 2.7 2.8 2.9 Other income growth 5.4 17.3 5.1 17.2 Growth in staff expenses 15.0 19.0 7.0 20.0 Growth in other expenses 15.0 19.0 7.0 20.0 Slippages 2.0 1.7 2.2 1.9 Coverage ratio 70.5 72.7 72.2 73.6 Treasury gain/(loss) (% of investments) 0.3 0.3 0.2 0.2 Source: Company, Angel Research Exhibit 16: Change in estimates FY2011E FY2012E Particulars (Rs cr) Earlier Revised Earlier Revised % chg % chg estimates estimates estimates estimates NII 29,289 30,834 5.3 35,599 37,558 5.5 Non-interest income 16,033 15,980 (0.3) 18,784 18,731 (0.3) Total income 45,322 46,815 3.3 54,383 56,290 3.5 Operating expenses 23,366 21,741 (7.0) 27,806 26,089 (6.2) Pre-prov. profit 21,956 25,074 14.2 26,577 30,201 13.6 Provisions & cont. 6,860 8,885 29.5 5,569 7,554 35.6 PBT 15,096 16,189 7.2 21,008 22,646 7.8 Prov. for taxes 5,046 5,417 7.4 7,047 7,604 7.9 PAT 10,050 10,771 7.2 13,961 15,042 7.7 Source: Company, Angel Research August 12, 2010 10

- 11. State Bank of India | 1QFY2011 Result Update Exhibit 17: P/ABV band Price 1.0x 1.5x 2.0x 2.5x 3.0x (Rs) 4500 4000 3500 3000 2500 2000 1500 1000 500 0 Dec-03 Dec-06 Apr-09 Jul-04 Jul-07 Mar-02 Oct-02 Mar-05 Oct-05 Feb-08 Sep-08 Nov-09 May-03 May-06 Jun-10 Jan-11 Source: Company, Angel Research Exhibit 18: State Bank of India - P/E Band Price 5x 10x 15x 20x 3,600 3,000 2,400 1,800 1,200 600 0 Apr-01 Dec-01 Apr-03 Dec-03 Apr-05 Dec-05 Apr-07 Dec-07 Apr-09 Dec-09 Aug-02 Aug-04 Aug-06 Aug-08 Aug-10 Source: Company, Angel Research Exhibit 19: Discount to Sensex - State Bank of India Discount to Sensex Avg. Historical Discount 0 (10) (20) (30) (40) (50) (60) (70) Aug-07 Aug-08 Aug-09 Aug-10 Jul-06 Dec-06 Dec-07 Dec-08 Dec-09 Apr-07 Apr-08 Apr-09 Apr-10 Mar-06 Source: Company, Angel Research August 12, 2010 11

- 12. State Bank of India | 1QFY2011 Result Update Exhibit 20: Angel EPS forecast v/s consensus Year Angel Forecast Bloomberg Consensus Var.(%) FY2011E 169.7 172.0 (1.4) FY2012E 236.9 216.3 9.5 Source: Company, Angel Research, Bloomberg Exhibit 21: Recommendation summary CMP Tgt. Price Upside FY2012E FY2012E FY2012E FY10-12E FY2012E FY2012E Company Reco (Rs) (Rs) (%) P/ABV (x) Tgt P/ABV (x) P/E (x) CAGR in EPS (%) RoA (%) RoE (%) AxisBk Buy 1,317 1,688 28.2 2.5 3.2 13.1 27.4 1.6 20.5 FedBk Buy 324 409 26.3 0.9 1.2 7.0 30.7 1.4 14.4 HDFCBk Buy 2,075 2,514 21.2 3.3 4.0 17.3 36.5 1.7 20.6 ICICIBk Buy 964 1,211 25.6 1.9 2.5 15.6 31.0 1.4 15.5 SIB Neutral 200 - - 1.2 - 7.0 17.1 1.0 17.8 YesBk Neutral 306 - - 2.5 - 15.4 18.7 1.3 17.1 BOI Neutral 462 - - 1.4 - 7.3 38.0 0.9 20.5 CorpBk Neutral 594 - - 1.1 - 5.7 13.4 1.0 20.5 DenaBk Accumulate 101 109 7.8 0.9 1.0 4.8 7.3 0.8 19.2 IndBk Accumulate 230 256 11.1 1.1 1.2 5.7 7.6 1.3 21.0 IOB Buy 127 147 15.6 0.9 1.1 6.3 25.1 0.7 14.9 OBC Neutral 403 - - 1.0 - 6.0 21.6 0.9 18.3 PNB Neutral 1,132 - - 1.6 - 7.6 9.3 1.2 21.9 SBI Accumulate 2,784 3,185 14.4 1.7 2.0 11.8 26.5 1.1 20.1 UcoBk Accumulate 102 111 9.4 0.9 1.0 4.2 15.1 0.8 25.5 UnionBk Accumulate 329 355 7.8 1.3 1.4 5.8 17.1 1.1 24.1 Source: Company, Angel Research; Note: P/ABVs of the core banks. August 12, 2010 12

- 13. State Bank of India | 1QFY2011 Result Update Income statement Y/E March (Rs cr) FY06 FY07 FY08 FY09 FY10 FY11E FY12E Net Interest Income 15,636 15,058 17,021 20,873 23,671 30,834 37,558 - YoY Growth (%) 12.1 (3.7) 13.0 22.6 13.4 30.3 21.8 Other Income 7,447 7,406 9,398 12,902 15,200 15,980 18,731 - YoY Growth (%) 4.6 (0.6) 26.9 37.3 17.8 5.1 17.2 Operating Income 23,083 22,464 26,420 33,775 38,872 46,815 56,290 - YoY Growth (%) 9.6 (2.7) 17.6 27.8 15.1 20.4 20.2 Operating Expenses 11,725 11,824 12,609 15,649 20,319 21,741 26,089 - YoY Growth (%) 16.4 0.8 6.6 24.1 29.8 7.0 20.0 Pre - Provision Profit 11,358 10,641 13,811 18,127 18,553 25,074 30,201 - YoY Growth (%) 3.3 (6.3) 29.8 31.2 2.4 35.1 20.4 Prov. & Cont. 4,452 3,016 3,373 3,736 4,396 8,885 7,554 - YoY Growth (%) (0.4) (32.3) 11.8 10.8 17.7 102.1 (15.0) Profit Before Tax 6,905 7,625 10,438 14,391 14,157 16,189 22,646 - YoY Growth (%) 5.9 10.4 36.9 37.9 (1.6) 14.4 39.9 Prov. for Taxation 2,499 3,083 3,709 5,058 4,759 5,417 7,604 - as a % of PBT 36.2 40.4 35.5 35.2 33.6 33.5 33.6 PAT 4,407 4,541 6,729 9,332 9,398 10,771 15,042 - YoY Growth (%) 2.4 3.1 48.2 38.7 0.7 14.6 39.6 Balance sheet Y/E March (Rs cr) FY06 FY07 FY08 FY09 FY10 FY11E FY12E Share Capital 526 526 631 635 635 635 635 Reserves & Surplus 27,118 30,772 48,401 57,313 65,314 73,618 85,238 Deposits 380,046 435,521 537,404 742,073 804,116 940,816 1,128,979 - Growth (%) 3.5 14.6 23.4 38.1 8.4 17.0 20.0 Borrowings 30,641 39,703 51,727 53,714 71,031 83,107 99,728 Tier 2 Capital 4,986 16,169 21,289 30,344 31,980 38,696 46,435 Other Liab & Prov. 50,552 43,389 62,073 80,353 80,337 95,224 116,873 Total Liabilities 493,870 566,082 721,526 964,432 1,053,414 1,232,096 1,477,889 Cash balances 21,653 29,076 51,535 55,546 61,291 65,857 79,029 Bank balances 22,907 22,892 15,932 48,858 34,893 40,825 48,990 Investments 162,534 149,149 189,501 275,954 285,790 314,708 377,204 Advances 261,642 337,336 416,768 542,503 631,914 764,616 917,539 - Growth (%) 29.3 28.9 23.5 30.2 16.5 21.0 20.0 Fixed Assets 2,753 2,819 3,373 3,838 4,413 5,008 5,830 Other Assets 22,381 24,809 44,417 37,733 35,113 41,082 49,298 Total Assets 493,870 566,082 721,526 964,432 1,053,414 1,232,096 1,477,889 - Growth (%) 7.3 14.7 27.3 33.8 9.2 17.0 20.0 August 12, 2010 13

- 14. State Bank of India | 1QFY2011 Result Update Ratio analysis Particulars FY06 FY07 FY08 FY09 FY10 FY11E FY12E Profitability ratios (%) NIMs 3.5 3.0 2.8 2.6 2.5 2.8 2.9 Cost to Income Ratio 50.8 52.6 47.7 46.3 52.3 46.4 46.3 RoA 0.9 0.8 1.0 1.1 0.9 0.9 1.1 RoE 17.7 15.7 18.1 18.7 16.2 16.4 20.1 B/S ratios (%) CASA Ratio 47.6 48.5 47.0 41.6 47.3 48.5 48.5 Credit/Deposit Ratio 68.8 77.5 77.6 73.1 78.6 81.3 81.3 CAR 11.9 12.3 13.5 13.2 12.3 10.7 10.6 - Tier I 9.4 8.0 9.1 8.7 8.7 7.3 7.0 Asset Quality (%) Gross NPAs 3.6 2.9 3.0 2.9 3.0 2.5 2.1 Net NPAs 1.9 1.6 1.8 1.8 1.7 0.7 0.6 Slippages 2.1 1.9 2.3 2.6 2.2 2.2 1.9 Loan Loss Prov./Avg. Assets 0.0 0.3 0.3 0.3 0.5 0.7 0.5 Provision Coverage 49.0 47.4 42.2 39.2 44.4 72.2 73.6 Per Share Data (Rs) EPS 83.7 86.3 106.6 147.0 148.0 169.7 236.9 ABVPS 477.8 542.3 709.7 824.2 944.5 1,160.8 1,348.2 DPS 14.0 14.0 21.5 29.0 30.0 31.0 44.0 Valuation Ratios PER (x) 33.3 32.3 26.1 18.9 18.8 16.4 11.8 P/ABVPS (x) 5.8 5.1 3.9 3.4 2.9 2.4 2.1 Dividend Yield 0.5 0.5 0.8 1.0 1.1 1.1 1.6 DuPont Analysis (%) NII 3.3 2.9 2.7 2.5 2.4 2.7 2.8 (-) Prov. Exp. 0.9 0.6 0.5 0.4 0.4 0.8 0.6 Adj. NII 2.4 2.3 2.1 2.0 1.9 1.9 2.2 Treasury 0.1 0.1 0.3 0.3 0.2 0.1 0.0 Int. Sens. Inc. 2.5 2.4 2.4 2.4 2.1 2.0 2.3 Other Inc. 1.4 1.2 1.2 1.2 1.3 1.3 1.3 Op. Inc. 3.9 3.6 3.6 3.6 3.4 3.3 3.6 Opex 2.5 2.2 2.0 1.9 2.0 1.9 1.9 PBT 1.4 1.4 1.6 1.7 1.4 1.4 1.7 Taxes 0.5 0.6 0.6 0.6 0.5 0.5 0.6 RoA 0.9 0.8 1.0 1.1 0.9 0.9 1.1 Leverage (x) 20.0 19.5 17.5 17.2 17.7 17.7 18.3 RoE 17.7 15.7 18.1 18.7 16.2 16.4 20.1 August 12, 2010 14

- 15. State Bank of India | 1QFY2011 Result Update Research Team Tel: 022 - 4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement State Bank of India 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock Yes 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below Rs 1 lakh for Angel, its Group companies and Directors. Ratings (Returns): Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%) Reduce (-5% to 15%) Sell (< -15%) August 12, 2010 15