Nmdc ru4 qfy2010-210510

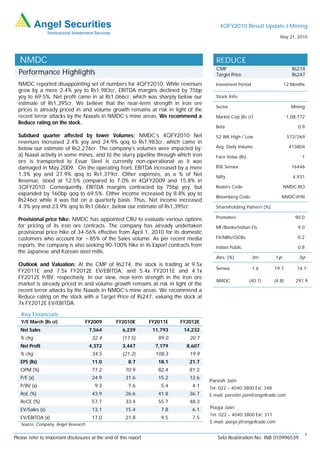

- 1. 4QFY2010 Result Update I Mining May 21, 2010 NMDC REDUCE CMP Rs274 Performance Highlights Target Price Rs247 NMDC reported disappointing set of numbers for 4QFY2010. While revenues Investment Period 12 Months grew by a mere 2.4% yoy to Rs1,983cr, EBITDA margins declined by 75bp yoy to 69.5%. Net profit came in at Rs1,066cr, which was sharply below our Stock Info estimate of Rs1,395cr. We believe that the near-term strength in iron ore Sector Mining prices is already priced in and volume growth remains at risk in light of the recent terror attacks by the Naxals in NMDC’s mine areas. We recommend a Market Cap (Rs cr) 1,08,772 Reduce rating on the stock. Beta 0.9 Subdued quarter affected by lower Volumes: NMDC’s 4QFY2010 Net 52 WK High / Low 572/269 revenues increased 2.4% yoy and 24.9% qoq to Rs1,983cr, which came in below our estimate of Rs2,276cr. The company’s volumes were impacted by: Avg. Daily Volume 413804 a) Naxal activity in some mines, and b) the slurry pipeline through which iron Face Value (Rs) 1 ore is transported to Essar Steel is currently non-operational as it was damaged in May 2009. On the operating front, EBITDA increased by a mere BSE Sensex 16446 1.3% yoy and 27.9% qoq to Rs1,379cr. Other expenses, as a % of Net Nifty 4,931 Revenue, stood at 12.5% compared to 7.0% in 4QFY2009 and 15.8% in 3QFY2010. Consequently, EBITDA margins contracted by 75bp yoy, but Reuters Code NMDC.BO expanded by 160bp qoq to 69.5%. Other income increased by 8.8% yoy to Bloomberg Code NMDC@IN Rs246cr while it was flat on a quarterly basis. Thus, Net income increased 4.3% yoy and 23.9% qoq to Rs1,066cr, below our estimate of Rs1,395cr. Shareholding Pattern (%) Provisional price hike: NMDC has appointed CRU to evaluate various options Promoters 90.0 for pricing of its iron ore contracts. The company has already undertaken MF/Banks/Indian FIs 9.0 provisional price hike of 34-56% effective from April 1, 2010 for its domestic customers who account for ~85% of the Sales volume. As per recent media FII/NRIs/OCBs 0.2 reports, the company is also seeking 90-100% hike in its Export contracts from Indian Public 0.8 the Japanese and Korean steel mills. Abs. (%) 3m 1yr 3yr Outlook and Valuation: At the CMP of Rs274, the stock is trading at 9.5x Sensex 1.6 19.7 14.1 FY2011E and 7.5x FY2012E EV/EBITDA, and 5.4x FY2011E and 4.1x FY2012E P/BV, respectively. In our view, near-term strength in the iron ore NMDC (40.1) (4.8) 291.9 market is already priced in and volume growth remains at risk in light of the recent terror attacks by the Naxals in NMDC’s mine areas. We recommend a Reduce rating on the stock with a Target Price of Rs247, valuing the stock at 7x FY2012E EV/EBITDA. Key Financials Y/E March (Rs cr) FY2009 FY2010E FY2011E FY2012E Net Sales 7,564 6,239 11,793 14,232 % chg 32.4 (17.5) 89.0 20.7 Net Profit 4,372 3,447 7,179 8,607 % chg 34.5 (21.2) 108.3 19.9 EPS (Rs) 11.0 8.7 18.1 21.7 OPM (%) 77.2 70.9 82.4 81.2 P/E (x) 24.9 31.6 15.2 12.6 Paresh Jain P/BV (x) 9.3 7.6 5.4 4.1 Tel: 022 – 4040 3800 Ext: 348 RoE (%) 43.9 26.6 41.8 36.7 E-mail: pareshn.jain@angeltrade.com RoCE (%) 57.7 33.4 55.7 48.3 EV/Sales (x) 13.1 15.4 7.8 6.1 Pooja Jain Tel: 022 – 4040 3800 Ext: 311 EV/EBITDA (x) 17.0 21.8 9.5 7.5 E-mail: pooja.j@angeltrade.com Source: Company, Angel Research 1 Please refer to important disclosures at the end of this report Sebi Registration No: INB 010996539

- 2. NMDC I 4QFY2010 Result Update Exhibit 1: 4QFY2010 Performance (All values in Rs cr) 4QFY10 4QFY09 yoy% FY2010 FY2009 yoy% Net Sales 1,983 1,936 2.4 6,239 7,564 (17.5) Raw Material 12 (46) - 2 (127) - % of Net sales 0.6 - 0.0 - Consumption of Stores & Spares 71 78 (9.1) 209 214 (1.9) % of Net sales 3.6 4.0 3.4 2.8 Staff Cost 149 143 3.9 420 421 (0.4) % of Net sales 7.5 7.4 6.7 5.6 Selling Expenses 124 265 (53.2) 469 854 (45.1) % of Net sales 6.3 13.7 7.5 11.3 Other Expenses 248 136 82.8 717 365 96.5 % of Net sales 12.5 7.0 11.5 4.8 Total Expenditure 604 575 5.0 1,817 1,726 5.2 % of Net sales 30.5 29.7 29.1 22.8 Operating Income - - - - - - EBIDTA 1,379 1,361 1.3 4,422 5,838 (24.2) % of Net sales 69.5 70.3 70.9 77.2 Interest 0 0 - 0 0 - Depreciation 25 24 4.3 77 74 4.2 Other Income 246 226 8.8 862 884 (2.5) Exceptional Items 0 0 0 0 Profit before Tax 1,599 1,562 2.4 5,207 6,648 (21.7) % of Net sales 80.6 80.7 83.5 87.9 Provision for tax 534 541 (1.3) 1,760 2,276 (22.7) % of PBT 33.4 34.6 33.8 34.2 Profit After Tax 1,066 1,021 4.3 3,447 4,372 (21.2) % of Net sales 53.7 52.7 55.3 57.8 Diluted EPS (Rs) 2.7 2.6 4.3 8.7 11.0 (21.2) Source: Company, Angel Research Outlook and Valuation At the CMP of Rs274, the stock is trading at 9.5x FY2011E and 7.5x FY2012E EV/EBITDA, and 5.4x FY2011E and 4.1x FY2012E P/BV, respectively. 4QFY2010 saw a structural shift in the benchmark contract system with global miners reportedly signing contracts on a quarterly basis. We believe the new pricing mechanism is likely to help miners in fetching better realisations. However, in our view, the near- term strength in the iron ore market is already priced in, and volume growth remains at risk in light of the recent terror attacks by the Naxals in NMDC’s mine areas. We recommend a Reduce rating on the stock, with a Target Price of Rs247, valuing the stock at 7x FY2012E EV/EBITDA. Risks to our call: 1) Stronger-than-expected benchmark iron ore pricing, 2) Faster ramp up in iron ore volumes, and 3) Rupee depreciation could have a material impact on our rating. May 21, 2010 2

- 3. NMDC I 4QFY2010 Result Update Exhibit 2: 1-year forward EV/EBITDA band (Rs cr) 300,000 250,000 25x 200,000 20x 150,000 15x 100,000 10x 50,000 5x 0 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Source: Bloomberg, Angel Research Exhibit 3: 1-year forward P/E band (Rs) 600 28x 500 400 21x 300 14x 200 7x 100 0 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Source: Bloomberg, Angel Research Exhibit 4: 1-year forward P/BV band (Rs) 600 500 9x 400 7x 300 5x 200 3x 100 0 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Source: Bloomberg, Angel Research May 21, 2010 3

- 4. NMDC I 4QFY2010 Result Update Exhibit 5: Spot Iron Ore prices 200 180 160 (US $/tonne) 140 120 100 80 60 Jan-09 Mar-09 May-09 Jul-09 Sep-09 Nov-09 Jan-10 Mar-10 May-10 Spot prices (63% Fe CFR China) Source: Bloomberg, Angel Research May 21, 2010 4

- 5. NMDC I 4QFY2010 Result Update Profit & Loss Statement (Rs cr) Y/E March FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E Net Sales 4,186 5,711 7,564 6,239 11,793 14,232 Other operating income - - - - - - Total operating income 4,186 5,711 7,564 6,239 11,793 14,232 % chg 12.8 36.4 32.4 (17.5) 89.0 20.7 Total Expenditure 962 1,374 1,726 1,817 2,071 2,683 Net Raw Materials 6 (30) (127) 2 0 0 Other Mfg costs 157 175 214 209 261 362 Personnel 198 356 421 420 435 578 Other 600 874 1,219 1,186 1,375 1,743 EBITDA 3,224 4,337 5,838 4,422 9,721 11,550 % chg 20.1 34.5 34.6 (24.2) 119.8 18.8 (% of Net Sales) 77.0 75.9 77.2 70.9 82.4 81.2 Depreciation 80 60 74 77 121 193 EBIT 3,144 4,277 5,764 4,346 9,600 11,357 % chg 22.3 36.1 34.8 (24.6) 120.9 18.3 (% of Net Sales) 75.1 74.9 76.2 69.7 81.4 79.8 Interest Charges - - - - - - Other Income 355 671 884 862 1,115 1,490 (% of PBT) 10.1 13.6 13.3 16.5 10.4 11.6 Recurring PBT 3,498 4,947 6,648 5,207 10,715 12,847 % chg 26.3 41.4 34.4 (21.7) 105.8 19.9 Extraordinary Inc/(Expense) - - - - - - PBT (reported) 3,498 4,947 6,648 5,207 10,715 12,847 Tax 1,178 1,696 2,276 1,760 3,536 4,239 (% of PBT) 33.7 34.3 34.2 33.8 33.0 33.0 PAT (reported) 2,320 3,251 4,372 3,447 7,179 8,607 Share of earnings of associate - - - - - - Less: Minority interest (MI) - - - - - - Extraordinary Expense/(Inc.) - - - - - - PAT after MI (reported) 2,320 3,251 4,372 3,447 7,179 8,607 ADJ. PAT 2,320 3,251 4,372 3,447 7,179 8,607 % chg 26.9 40.1 34.5 (21.2) 108.3 19.9 (% of Net Sales) 55.4 56.9 57.8 55.3 60.9 60.5 Basic EPS (Rs) 5.9 8.2 11.0 8.7 18.1 21.7 Fully Diluted EPS (Rs) 5.9 8.2 11.0 8.7 18.1 21.7 % chg 26.9 40.1 34.5 (21.2) 108.3 19.9 May 21, 2010 5

- 6. NMDC I 4QFY2010 Result Update Balance Sheet (Rs cr) Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E SOURCES OF FUNDS Equity Share Capital 132 132 396 396 396 396 Reserves& Surplus 5,669 8,157 11,240 13,876 19,663 26,415 Shareholders Funds 5,801 8,290 11,637 14,272 20,060 26,812 Share Warrants - - - - - - Minority Interest - - - - - - Total Loans - - - - - - Deferred Tax Liability 27 6 58 58 58 58 Total Liabilities 5,828 8,296 11,695 14,330 20,118 26,870 APPLICATION OF FUNDS Gross Block 1,304 1,421 1,669 1,919 2,919 3,919 Less: Acc. Depreciation 799 853 923 999 1,120 1,313 Net Block 505 568 747 920 1,799 2,606 Capital Work-in-Progress 113 112 248 248 248 248 Goodwill - - - - - - Investments 74 83 72 72 72 72 Current Assets 5,526 8,283 11,771 14,253 19,218 25,298 Cash 4,849 7,199 9,740 12,386 16,552 22,194 Loans & Advances 182 244 403 403 403 403 Other 494 840 1,628 1,464 2,263 2,701 Current liabilities 417 775 1,165 1,185 1,241 1,377 Net Current Assets 5,108 7,508 10,606 13,068 17,977 23,921 Mis. Exp. not written off 27 25 22 22 22 22 Total Assets 5,828 8,296 11,695 14,330 20,118 26,870 Cash Flow Statement (Rs cr) Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E Profit before tax 3,498 4,947 6,648 5,207 10,715 12,847 Depreciation 80 60 74 77 121 193 Change in Working Capital (190) (661) (785) 184 (742) (303) Others (101) (105) (866) 0 0 0 Direct taxes paid (1,236) (1,765) (2,292) (1,760) (3,536) (4,239) Cash Flow from Operations 2,052 2,476 2,778 3,708 6,558 8,497 (Inc.)/ Dec. in Fixed Assets (113) (123) (389) (250) (1,000) (1,000) (Inc.)/ Dec. in Investments - - - - - - (Inc.)/ Dec. in loans & adv. - - - - - - Other income 330 640 880 - - - Cash Flow from Investing 217 517 491 (250) (1,000) (1,000) Issue of Equity - - - - - - Inc./(Dec.) in loans - - - - - - Dividend Paid (Incl. Tax) (529) (643) (728) (812) (1,392) (1,855) Others (0.2) - - - - - Cash Flow from Financing (530) (643) (728) (812) (1,392) (1,855) Inc./(Dec.) in Cash 1,740 2,350 2,541 2,646 4,166 5,642 Opening Cash balances 3,109 4,849 7,199 9,740 12,386 16,552 Closing Cash balances 4,849 7,199 9,740 12,386 16,552 22,194 May 21, 2010 6

- 7. NMDC I 4QFY2010 Result Update Key Ratios Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E Valuation Ratio (x) P/E (on FDEPS) 46.9 33.5 24.9 31.6 15.2 12.6 P/CEPS 45.3 32.9 24.5 30.9 14.9 12.4 P/BV 18.8 13.1 9.3 7.6 5.4 4.1 Dividend yield (%) 1.3 1.8 0.8 0.6 1.1 1.5 EV/Sales 24.8 17.8 13.1 15.4 7.8 6.1 EV/EBITDA 32.2 23.4 17.0 21.8 9.5 7.5 EV/Total Assets 17.8 12.2 8.5 6.7 4.6 3.2 Per Share Data (Rs) EPS (Basic) 5.9 8.2 11.0 8.7 18.1 21.7 EPS (fully diluted) 5.9 8.2 11.0 8.7 18.1 21.7 Cash EPS 6.1 8.4 11.2 8.9 18.4 22.2 DPS 3.5 4.9 2.2 1.8 3.0 4.0 Book Value 14.6 20.9 29.4 36.0 50.6 67.6 Dupont Analysis EBIT margin 75.1 74.9 76.2 69.7 81.4 79.8 Tax retention ratio (%) 66.3 65.7 65.8 66.2 67.0 67.0 Asset turnover (x) 4.8 6.2 5.6 3.7 4.7 3.7 ROIC (Post-tax) 240.6 303.8 281.6 169.1 256.6 196.5 Cost of Debt (Post Tax) - - - - - - Leverage (x) - - - - - - Operating ROE 240.6 303.8 281.6 169.1 256.6 196.5 Returns (%) ROCE (Pre-tax) 63.8 60.6 57.7 33.4 55.7 48.3 Angel ROIC (Pre-tax) 402.1 526.2 494.4 299.0 425.1 313.4 ROE 47.3 46.1 43.9 26.6 41.8 36.7 Turnover ratios (x) Asset Turnover (Gross Block) 3.3 4.2 4.9 3.5 4.9 4.2 Inventory (days) 48 44 64 64 64 64 Receivables (days) 25 31 50 50 50 50 Payables (days) 49 61 81 81 81 81 Working capital cycle (days) 26 23 33 50 35 42 Solvency ratios (x) Net debt to equity (0.8) (0.9) (0.8) (0.9) (0.8) (0.8) Net debt to EBITDA (1.5) (1.7) (1.7) (2.8) (1.7) (1.9) Interest Coverage - - - - - - May 21, 2010 7

- 8. NMDC I 4QFY2010 Result Update Research Team Tel: 022 - 4040 3800 E-mail: research@angeltrade.com Website: ww.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Securities Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, and is for general guidance only. Angel Securities Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Securities Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Securities Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Securities Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Disclosure of Interest Statement NMDC 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies’ Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below Rs 1 lakh for Angel and its Group companies Address: Acme Plaza, ‘A’ Wing, 3rd Floor, M.V. Road, Opp. Sangam Cinema, Andheri (E), Mumbai - 400 059. Tel: (022) 3952 4568 / 4040 3800 Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 May 21, 2010 8