HZL Q4 2010 Result Update

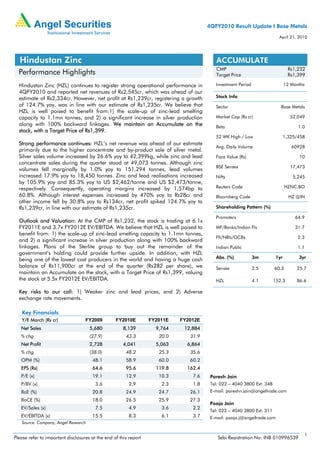

- 1. 4QFY2010 Result Update I Base Metals April 21, 2010 Hindustan Zinc ACCUMULATE CMP Rs1,232 Performance Highlights Target Price Rs1,399 Hindustan Zinc (HZL) continues to register strong operational performance in Investment Period 12 Months 4QFY2010 and reported net revenues of Rs2,545cr, which was ahead of our estimate of Rs2,334cr. However, net profit at Rs1,239cr, registering a growth Stock Info of 124.7% yoy, was in line with our estimate of Rs1,235cr. We believe that Sector Base Metals HZL is well poised to benefit from:1) the scale-up of zinc-lead smelting capacity to 1.1mn tonnes, and 2) a significant increase in silver production Market Cap (Rs cr) 52,049 along with 100% backward linkages. We maintain an Accumulate on the Beta 1.0 stock, with a Target Price of Rs1,399. 52 WK High / Low 1,325/458 Strong performance continues: HZL’s net revenue was ahead of our estimate Avg. Daily Volume 60928 primarily due to the higher concentrate and by-product sale of silver metal. Silver sales volume increased by 26.6% yoy to 42,399kg, while zinc and lead Face Value (Rs) 10 concentrate sales during the quarter stood at 49,073 tonnes. Although zinc BSE Sensex 17,473 volumes fell marginally by 1.0% yoy to 151,294 tonnes, lead volumes increased 17.9% yoy to 18,450 tonnes. Zinc and lead realisations increased Nifty 5,245 by 105.9% yoy and 85.3% yoy to US $2,462/tonne and US $2,473/tonne, respectively. Consequently, operating margins increased by 1,574bp to Reuters Code HZNC.BO 60.8%. Although interest expenses increased by 470% yoy to Rs28cr and Bloomberg Code HZ @IN other income fell by 30.8% yoy to Rs134cr, net profit spiked 124.7% yoy to Rs1,239cr, in line with our estimate of Rs1,235cr. Shareholding Pattern (%) Promoters 64.9 Outlook and Valuation: At the CMP of Rs1,232, the stock is trading at 6.1x FY2011E and 3.7x FY2012E EV/EBITDA. We believe that HZL is well poised to MF/Banks/Indian FIs 31.7 benefit from: 1) the scale-up of zinc-lead smelting capacity to 1.1mn tonnes, FII/NRIs/OCBs 2.3 and 2) a significant increase in silver production along with 100% backward linkages. Plans of the Sterlite group to buy out the remainder of the Indian Public 1.1 government’s holding could provide further upside. In addition, with HZL Abs. (%) 3m 1yr 3yr being one of the lowest cost producers in the world and having a huge cash balance of Rs11,900cr at the end of the quarter (Rs282 per share), we Sensex 2.5 60.3 25.7 maintain an Accumulate on the stock, with a Target Price of Rs1,399, valuing the stock at 5.5x FY2012E EV/EBITDA. HZL 4.1 152.3 86.6 Key risks to our call: 1) Weaker zinc and lead prices, and 2) Adverse exchange rate movements. Key Financials Y/E March (Rs cr) FY2009 FY2010E FY2011E FY2012E Net Sales 5,680 8,139 9,764 12,884 % chg (27.9) 43.3 20.0 31.9 Net Profit 2,728 4,041 5,063 6,864 % chg (38.0) 48.2 25.3 35.6 OPM (%) 48.1 58.9 60.0 60.2 EPS (Rs) 64.6 95.6 119.8 162.4 P/E (x) 19.1 12.9 10.3 7.6 Paresh Jain P/BV (x) 3.6 2.9 2.3 1.8 Tel: 022 – 4040 3800 Ext: 348 RoE (%) 20.8 24.9 24.7 26.1 E-mail: pareshn.jain@angeltrade.com RoCE (%) 18.0 26.5 25.9 27.3 Pooja Jain EV/Sales (x) 7.5 4.9 3.6 2.2 Tel: 022 – 4040 3800 Ext: 311 EV/EBITDA (x) 15.5 8.3 6.1 3.7 E-mail: pooja.j@angeltrade.com Source: Company, Angel Research 1 Please refer to important disclosures at the end of this report Sebi Registration No: INB 010996539

- 2. Hindustan Zinc I 4QFY2010 Result Update Exhibit 1: 4QFY2010 Performance Y/E March (Rs cr) 4QFY10 4QFY09 yoy (%) FY10 FY09 yoy (%) Net Sales 2,545 1,289 97.4 8,139 5,680 43.3 Mining and Manufacturing 566 466 21.4 1,961 1,906 2.9 expenses % of Net sales 22.3 36.2 24.1 33.5 Mining Royalty 191 84 128.0 613 364 68.2 % of Net sales 7.5 6.5 7.5 6.4 Staff Cost 135 87 55.1 457 365 25.3 % of Net sales 5.3 6.8 5.6 6.4 Admin and selling 105 71 48.3 316 311 1.4 % of Net sales 4.1 5.5 3.9 5.5 Total Expenditure 997 708 40.9 3,347 2,946 13.6 % of Net sales 39.2 54.9 41.1 51.9 EBIDTA 1,548 581 166.3 4,792 2,734 75.3 % of Net sales 60.8 45.1 58.9 48.1 Interest 28 5 469.5 44 22 100.7 Depreciation 101 75 34.1 334 285 17.2 Other Income 134 194 (30.8) 600 931 (35.5) Exceptional Items - - - - Profit before Tax 1,554 696 123.4 5,014 3,358 49.3 % of Net sales 61.1 54.0 61.6 59.1 Provision for tax 315 144 118.7 973 631 54.2 % of PBT 20.3 20.7 19.4 18.8 Profit After tax 1,239 551 124.7 4,041 2,728 48.2 % of Net sales 48.7 42.8 49.7 48.0 EPS (Rs) 29.3 13.1 124.8 95.6 64.6 48.2 Source: Company, Angel Research Higher by-product sales led to strong top-line performance HZL’s saleable zinc production was flat at 150,309 tonnes (150,544 tonnes), while saleable lead production increased by 16.9% yoy to 18,345 tonnes (15,691 tonnes). Consequently, zinc volumes declined by 1.0% yoy to 151,294 tonnes (152,796 tonnes), while lead volumes increased by 17.9% yoy to 18,450 tonnes (15,651 tonnes). However, zinc and lead realisations increased by 105.9% yoy to US $2,462/tonne and 85.3% yoy to US $2,473/tonne, respectively. Sales were also supported by higher zinc and lead concentrate sales during the quarter at 49,073 tonnes. Silver production increased by 22.4% yoy to 43,066 tonnes (35,176 tonnes), while sales grew 26.6% yoy to 42,399kg (33,496kg). Average silver realisation surged 41.0% yoy to Rs25,970/kg (Rs 19,978/kg). Thus, net revenues increased by 97.4% to Rs2,545cr, ahead of our estimate of Rs2,334cr. April 21, 2010 2

- 3. Hindustan Zinc I 4QFY2010 Result Update Exhibit 2: Zinc Metal Volumes down 1.0%; Realisations up 105.9% 180,000 4,000 160,000 3,500 140,000 3,000 120,000 2,500 (US $/tonne) (tonnes) 100,000 2,000 80,000 1,500 60,000 40,000 1,000 20,000 500 0 0 Q2 2008 Q4 2008 2QFY09 4QFY09 2QFY10 4QFY10 Volume (LHS) Realisation (RHS) Source: Company, Angel Research Exhibit 3: Lead Metal Volumes up 17.9%; Realisation up 85.3% 25,000 4,000 3,500 20,000 3,000 (US $/tonne) 15,000 2,500 (tonnes) 2,000 10,000 1,500 1,000 5,000 500 0 0 Q2 2008 Q4 2008 2QFY09 4QFY09 2QFY10 4QFY10 Volume (LHS) Realisation (RHS) Source: Company, Angel Research EBITDA margins expand by 1,574bp to 60.8% During the quarter, royalty costs increased by 128.0% yoy to Rs191cr and salary costs were up by 55.1% yoy to Rs135cr. However, higher by-product sales resulted in operating margins expanding by 1,574bp to 60.8%, marginally lower than our estimate. Net profit up 124.7% in line with our estimate In 4QFY2010, though interest expenses increased by 470% yoy to Rs28cr and other income fell by 30.8% yoy to Rs134cr, net profit moved up 124.7% yoy to Rs1,239cr on the back of strong operating performance. Status on Expansion projects • At the end of the quarter, the 210,000 tonne zinc smelter at Dariba and 1mtpa zinc concentrator at Rampura Agucha was successfully commissioned around three months ahead of schedule. • The 100,000 tonne lead smelter is expected to be commissioned in 2QFY2011E. • Mining projects at Sindesar Khurd is also on schedule for commissioning by 1QFY2011E. April 21, 2010 3

- 4. Hindustan Zinc I 4QFY2010 Result Update Outlook Zinc Metal surplus to decline by 40.3% in CY2010E As per ILZSG, in CY2010E, global zinc usage is expected to grow by 11.9% to 12.04mn tones, whereas refined zinc production is expected to increase by 10.1% to 12.26mn tonnes. Hence, global zinc metal supply is likely to remain in surplus by 227,000 tonnes in CY2010E, a decline of 40.3% from a surplus of 380,000 tonnes in CY2009E. Lead Metal surplus to increase by 25% in CY2010E As per ILZSG, lead metal is expected to remain in surplus by 100,000 tonnes (80,000 tonnes) in CY2010E. Global lead usage is expected to grow by 7.5% yoy to 9.6mn tonnes. ILZSG expects demand to recover in Europe and US by 8.8% and 2.9% respectively, while China’s lead demand is expected to grow by 7.8% in CY2010E. Lead metal production is likely to increase by 7.4% to 9.7mn tonnes, primarily driven by the commissioning of new plants in Brazil and India. Valuation At the CMP of Rs1,232, the stock is trading at 6.1x FY2011E and 3.7x FY2012E EV/EBITDA. We believe that HZL is well poised to benefit from: 1) the scale-up of zinc-lead smelting capacity to 1.1mn tonnes, and 2) a significant increase in silver production along with 100% backward linkages. Plans of the Sterlite group to buy out the remainder of the government’s holding could provide further upside. Moreover, with HZL being one of the lowest cost producers in the world and having a substantial cash balance of Rs11,900cr at the end of the quarter (Rs282 per share), we maintain an Accumulate on the stock, with a Target Price of Rs1,399, valuing the stock at 5.5x FY2012E EV/EBITDA. Key risks to our call: 1) Weaker zinc and lead prices, and 2) Adverse exchange rate movements. Exhibit 4: 1-year forward EV/EBITDA (Rs mn) 700,000 600,000 9x 500,000 400,000 7x 300,000 5x 200,000 3x 100,000 1x 0 (100,000) Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Source: Bloomberg, Angel Research April 21, 2010 4

- 5. Hindustan Zinc I 4QFY2010 Result Update Exhibit 5: 1-year forward P/E (Rs) 1,800 14x 1,600 1,400 1,200 10x 1,000 800 6x 600 400 2x 200 0 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Source: Bloomberg, Angel Research Exhibit 6: 1-year forward P/BV (Rs) 3,000 5x 2,500 2,000 3.5x 1,500 1,000 2x 500 0.5x 0 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Source: Bloomberg, Angel Research April 21, 2010 5

- 6. Hindustan Zinc I 4QFY2010 Result Update Profit & Loss Statement Rs crore Y/E March FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E Gross sales 9,220 8,737 6,141 8,847 10,278 13,562 Less: Excise duty 660 859 461 708 514 678 Net Sales 8,560 7,878 5,680 8,139 9,764 12,884 Other operating income - - - - - - Total operating income 8,560 7,878 5,680 8,139 9,764 12,884 % chg 120.8 (8.0) (27.9) 43.3 20.0 31.9 Total Expenditure 2,153 2,499 2,946 3,347 3,903 5,129 Net Raw Materials 984 1,352 1,906 1,961 2,465 3,317 Other Mfg costs 644 511 364 613 683 902 Personnel 260 308 365 457 419 516 Other 266 328 311 316 335 395 EBITDA 6,407 5,378 2,734 4,792 5,861 7,754 % chg 178.6 (16.1) (49.2) 75.3 22.3 32.3 (% of Net Sales) 74.8 68.3 48.1 58.9 60.0 60.2 Depreciation 156 221 285 334 382 423 EBIT 6,251 5,158 2,449 4,458 5,479 7,331 % chg 189.2 (17.5) (52.5) 82.0 22.9 33.8 (% of Net Sales) 73.0 65.5 43.1 54.8 56.1 56.9 Interest & other Charges 28 24 22 44 24 26 Other Income 231 852 931 600 874 1,275 (% of PBT) 3.6 14.2 27.7 12.0 13.8 14.9 Share in profit of Asso. - - - - - - Recurring PBT 6,454 5,985 3,358 5,014 6,329 8,580 % chg 189.5 (7.3) (43.9) 49.3 26.2 35.6 Extraordinary Inc/(Exp.) - - - - - - PBT (reported) 6,454 5,985 3,358 5,014 6,329 8,580 Tax 2,012 1,589 631 973 1,266 1,716 (% of PBT) 31.2 26.6 18.8 19.4 20.0 20.0 PAT (reported) 4,442 4,396 2,728 4,041 5,063 6,864 Add: Share of associates - - - - - - Less: Minority interest (MI) - - - - - - Extraordinary Exp./(Inc.) - - - - - - PAT after MI (reported) 4,442 4,396 2,728 4,041 5,063 6,864 ADJ. PAT 4,442 4,396 2,728 4,041 5,063 6,864 % chg 201.7 (1.0) (38.0) 48.2 25.3 35.6 (% of Net Sales) 51.9 55.8 48.0 49.7 51.9 53.3 Basic EPS (Rs) 105.1 104.0 64.6 95.6 119.8 162.4 Fully Diluted EPS (Rs) 105.1 104.0 64.6 95.6 119.8 162.4 % chg 201.7 (1.0) (38.0) 48.2 25.3 35.6 April 21, 2010 6

- 7. Hindustan Zinc I 4QFY2010 Result Update Balance Sheet Rs crore Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E SOURCES OF FUNDS Equity Share Capital 423 423 423 423 423 423 Reserves& Surplus 7,205 11,426 13,935 17,680 22,545 29,211 Shareholders Funds 7,627 11,848 14,358 18,102 22,968 29,634 Share Warrants - - - - - - Minority Interest - - - - - - Total Loans 0.4 0.4 9 9 9 9 Deferred Tax Liability 301 460 559 559 585 597 Total Liabilities 7,928 12,308 14,925 18,670 23,562 30,239 APPLICATION OF FUNDS Gross Block 3,500 5,182 5,856 6,983 8,110 9,037 Less: Acc. Depreciation 1,264 1,485 1,751 2,085 2,467 2,890 Net Block 2,236 3,697 4,105 4,898 5,643 6,147 Capital Work-in-Progress 635 465 1,108 1,308 1,108 408 Goodwill - - - - - - Investments 4,403 6,332 6,929 6,929 6,929 6,929 Current Assets 1,481 2,712 3,784 6,800 11,115 18,186 Cash 120 1,363 2,719 5,580 9,526 16,217 Loans & Advances 305 384 313 313 345 345 Other 1,057 965 751 906 1,244 1,624 Current liabilities 827 898 1,001 1,265 1,233 1,431 Net Current Assets 654 1,813 2,783 5,535 9,881 16,755 Mis. Exp. not written off - - - - - - Total Assets 7,928 12,308 14,925 18,670 23,562 30,239 Cash Flow Statement Rs crore Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E Profit before tax 6,454 5,985 3,358 5,014 6,329 8,580 Depreciation 157 222 286 334 382 423 Change in Working Capital 238 376 296 (87) (297) (229) Less: Other income (144) (767) (777) - - - Direct taxes paid 1,958 1,529 521 876 1,213 1,658 Cash Flow from Operations 4,747 4,288 2,642 4,386 5,201 7,116 Inc./ (Dec.) in Fixed Assets 1,110 1,513 1,374 1,327 927 227 Inc./ (Dec.) in Investments 2,798 1,407 443 - - - Inc./ (Dec.) in loans and advances 142 80 (71) - 31.3 - Other income 178 226 (1,602) - - - Cash Flow from Investing 3,872 2,774 3,348 1,327 958 227 Issue of Equity - - - - - - Inc./(Dec.) in loans (558) - 8 - - - Dividend Paid (Incl. Tax) 240 247 124 198 297 198 Others 31 24 22 - - - Cash Flow from Financing (829) (271) (137) (198) (297) (198) Inc./(Dec.) in Cash 46 1,243 (844) 2,861 3,946 6,691 Opening Cash balances 74 120 3,563 2,719 5,580 9,526 Closing Cash balances 120 1,363 2,719 5,580 9,526 16,217 April 21, 2010 7

- 8. Hindustan Zinc I 4QFY2010 Result Update Key Ratios Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E Valuation Ratio (x) P/E (on FDEPS) 11.7 11.8 19.1 12.9 10.3 7.6 P/CEPS 11.3 11.3 17.3 11.9 9.6 7.1 P/BV 6.8 4.4 3.6 2.9 2.3 1.8 Dividend yield (%) 0.4 0.4 0.3 0.5 0.3 0.3 EV/Sales 5.6 5.6 7.5 4.9 3.6 2.2 EV/EBITDA 7.4 8.2 15.5 8.3 6.1 3.7 EV / Total Assets 6.0 3.6 2.8 2.1 1.5 1.0 Per Share Data (Rs) EPS (Basic) 105.1 104.0 64.6 95.6 119.8 162.4 EPS (fully diluted) 105.1 104.0 64.6 95.6 119.8 162.4 Cash EPS 108.8 109.3 71.3 103.6 28.9 172.5 DPS 5.0 5.0 4.0 6.0 4.0 4.0 Book Value 180.5 280.4 339.8 428.4 543.6 701.3 Dupont Analysis EBIT margin 73.0 65.5 43.1 54.8 56.1 56.9 Tax retention ratio (%) 68.8 73.4 81.2 80.6 80.0 80.0 Asset turnover (x) 2.5 1.7 1.1 1.3 1.4 1.8 ROIC (Post-tax) 126.3 82.1 37.7 58.3 61.7 82.7 Cost of Debt (Post Tax) - - - - - - Leverage (x) (0.6) (0.6) (0.7) (0.7) (0.7) (0.8) Operating ROE 51.4 28.8 12.4 18.0 17.5 18.1 Returns (%) ROCE (Pre-tax) 102.8 51.0 18.0 26.5 25.9 27.3 Angel ROIC (Pre-tax) 209.9 128.6 49.5 77.9 82.6 103.2 ROE 80.3 45.1 20.8 24.9 24.7 26.1 Turnover ratios (x) Asset Turnover (Gross Block) 2.6 1.8 1.0 1.3 1.3 1.5 Inventory / Sales (days) 84.6 75.7 67.6 67.6 75.0 75.0 Receivables (days) 23.7 20.6 10.6 11.0 15.0 15.0 Payables (days) 35.0 51.8 46.1 48.0 45.0 45.0 WC cycle (ex-cash) (days) 37.1 33.7 30.4 17.1 21.4 23.7 Solvency ratios (x) Net debt to equity (0.6) (0.6) (0.7) (0.7) (0.7) (0.8) Net debt to EBITDA (0.7) (1.4) (3.5) (2.6) (2.8) (3.0) Interest Coverage 219.8 213.4 111.9 101.5 225.6 278.8 April 21, 2010 8

- 9. Hindustan Zinc I 4QFY2010 Result Update Research Team Tel: 4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Securities Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, and is for general guidance only. Angel Securities Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Securities Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Securities Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Securities Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Disclosure of Interest Statement Hindustan Zinc 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies’ Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below Rs 1 lakh for Angel and its Group companies. Address: Acme Plaza, ‘A’ Wing, 3rd Floor, M.V. Road, Opp. Sangam Cinema, Andheri (E), Mumbai - 400 059. Tel: (022) 3952 4568 / 4040 3800 Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 April 21, 2010 9