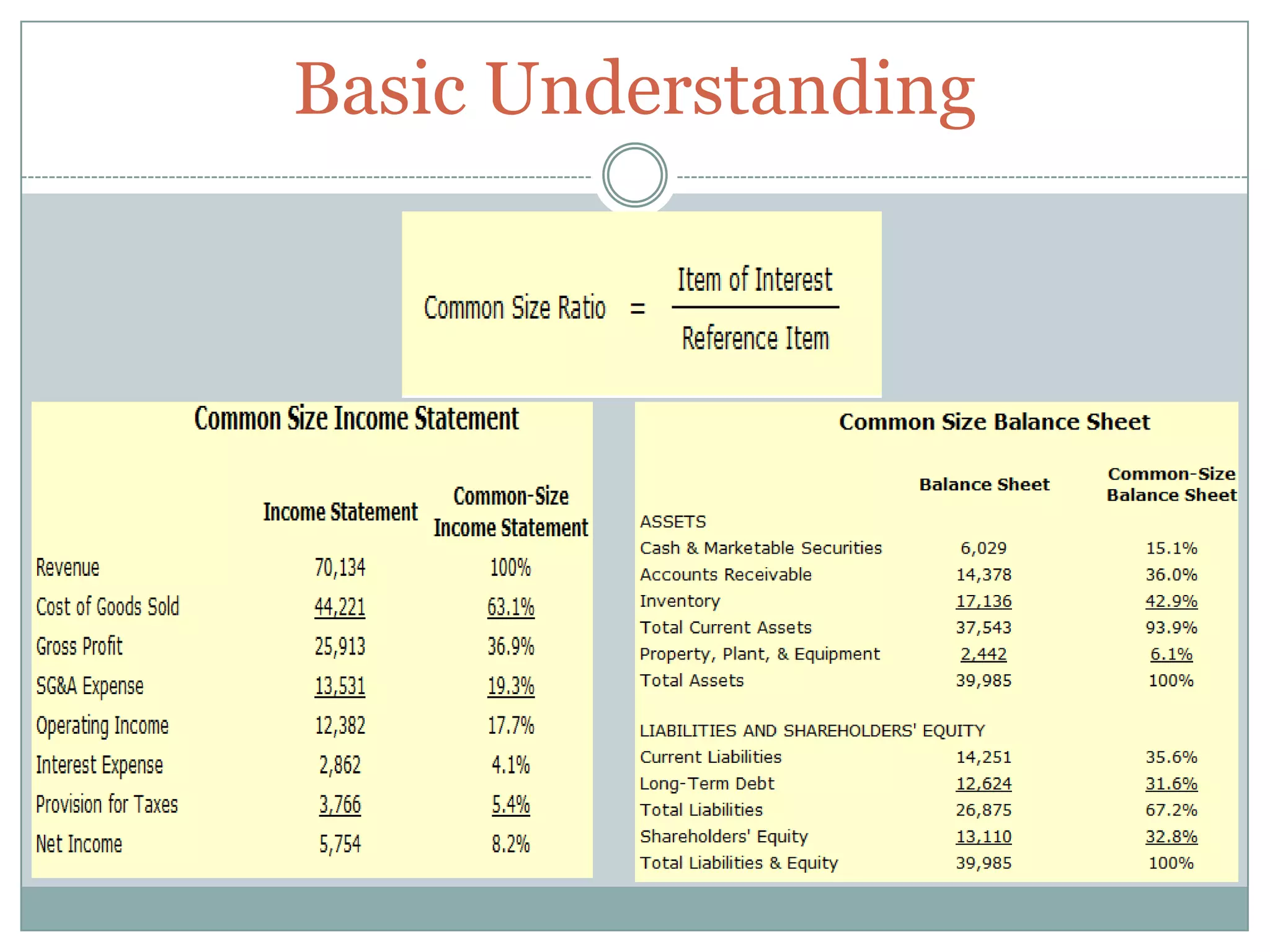

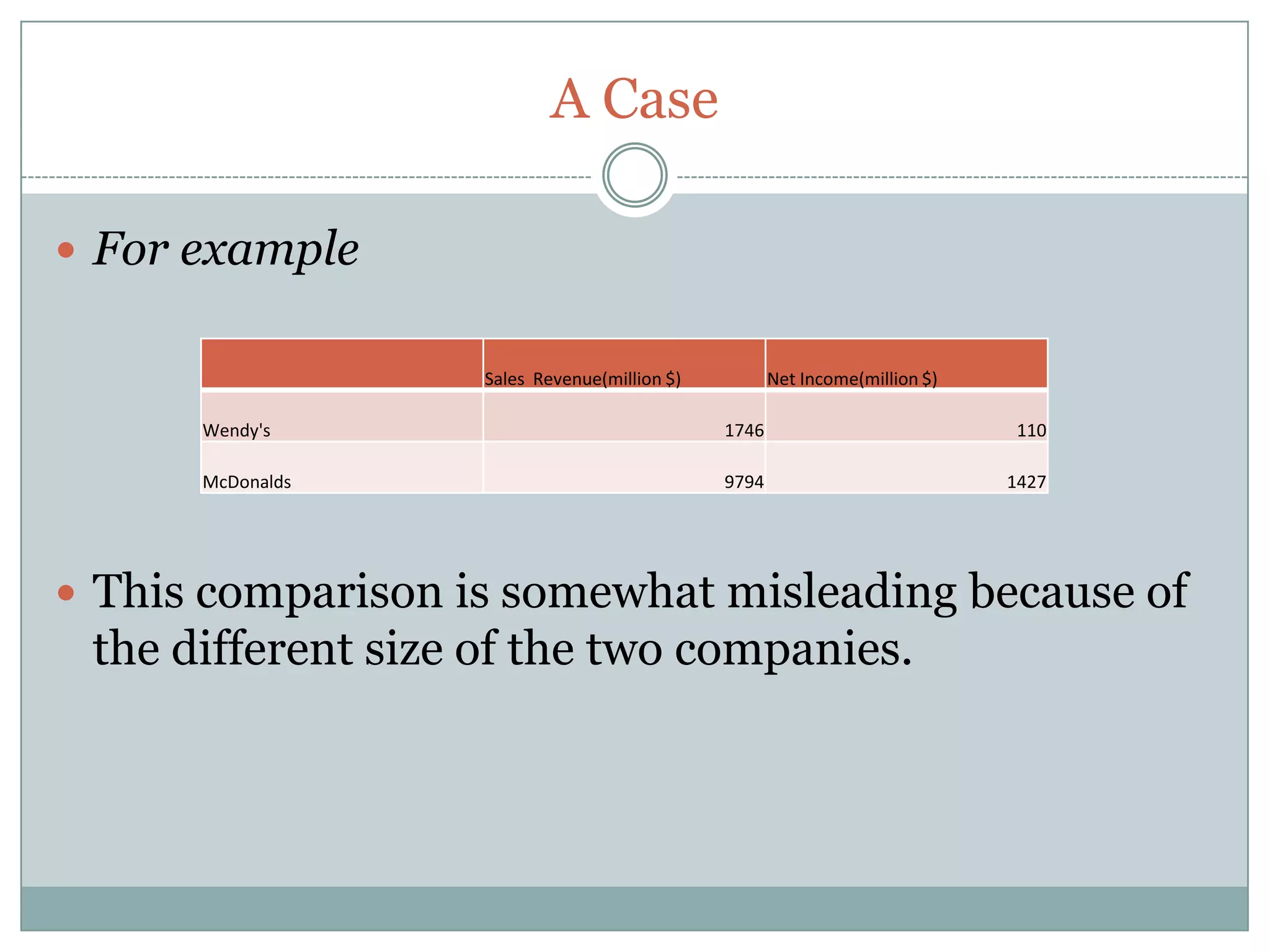

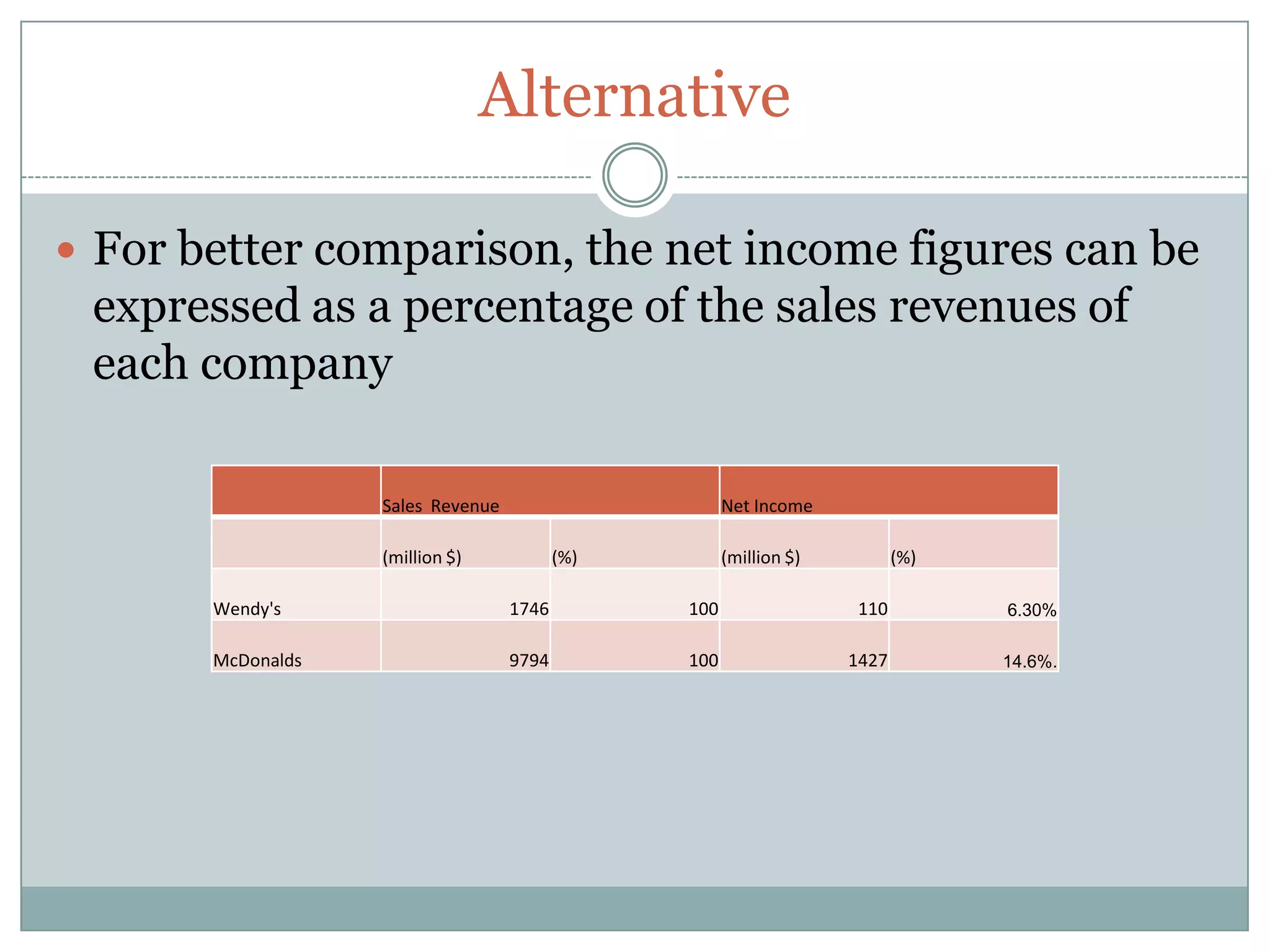

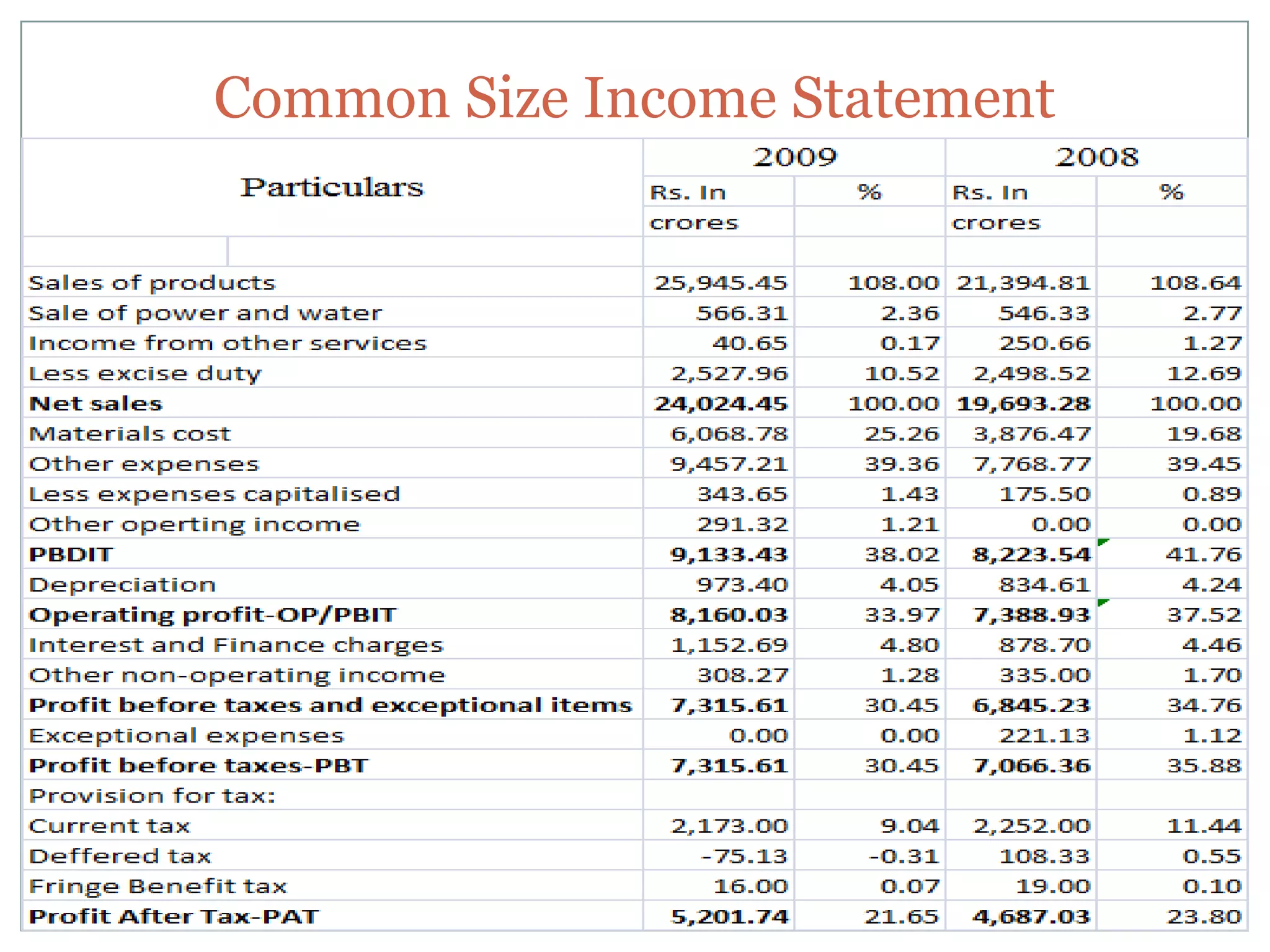

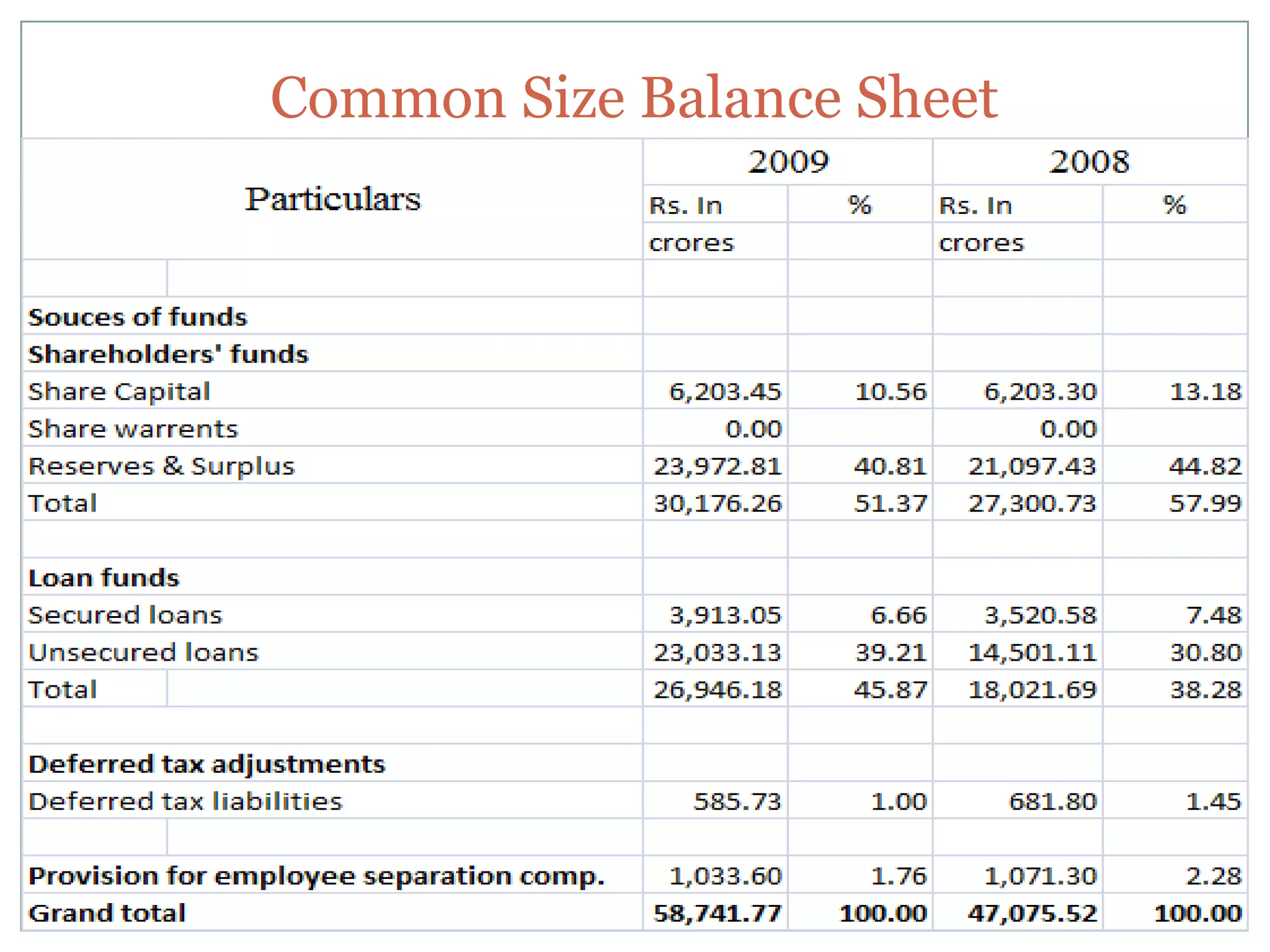

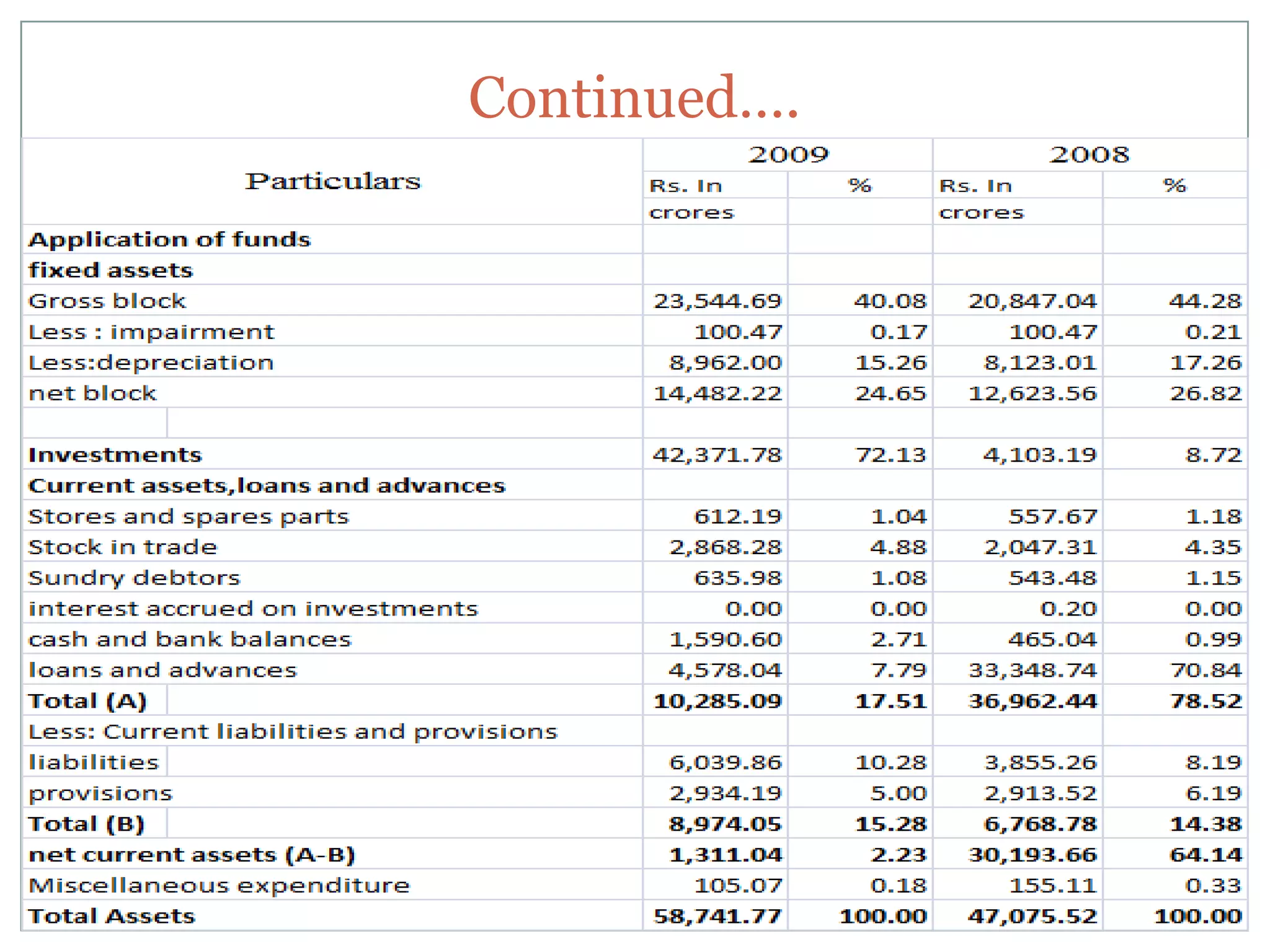

This document discusses common size analysis, which allows companies to be compared across time and against competitors by expressing financial statement items as percentages of a base figure. There are three types of common size analysis: vertical common size income statements, horizontal common size income statements, and common size balance sheets. An example is provided where net income figures for two companies of different sizes are expressed as a percentage of sales revenue for better comparison. The document outlines some limitations of common size analysis and provides an example analysis of common size income statements and balance sheets.