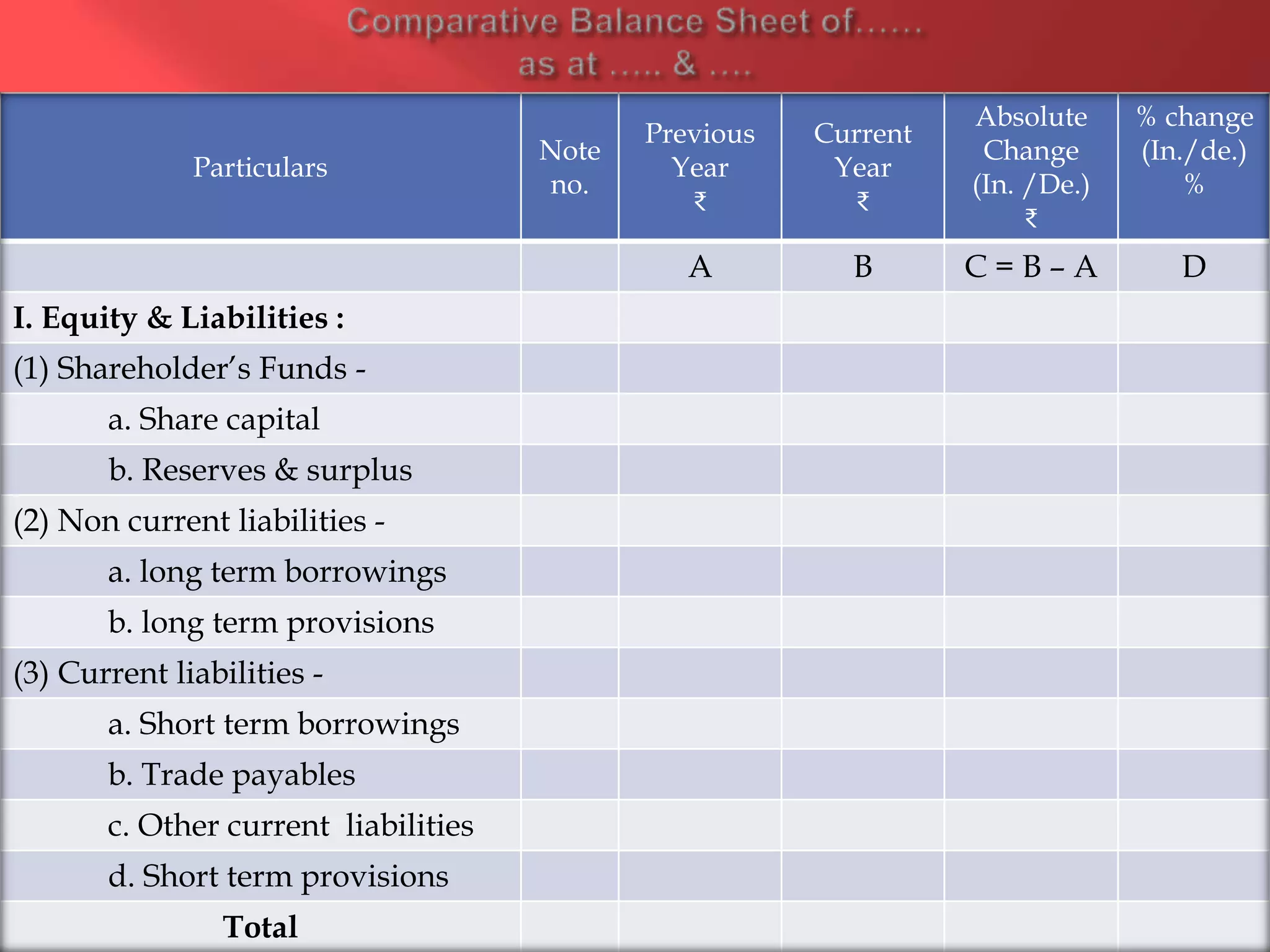

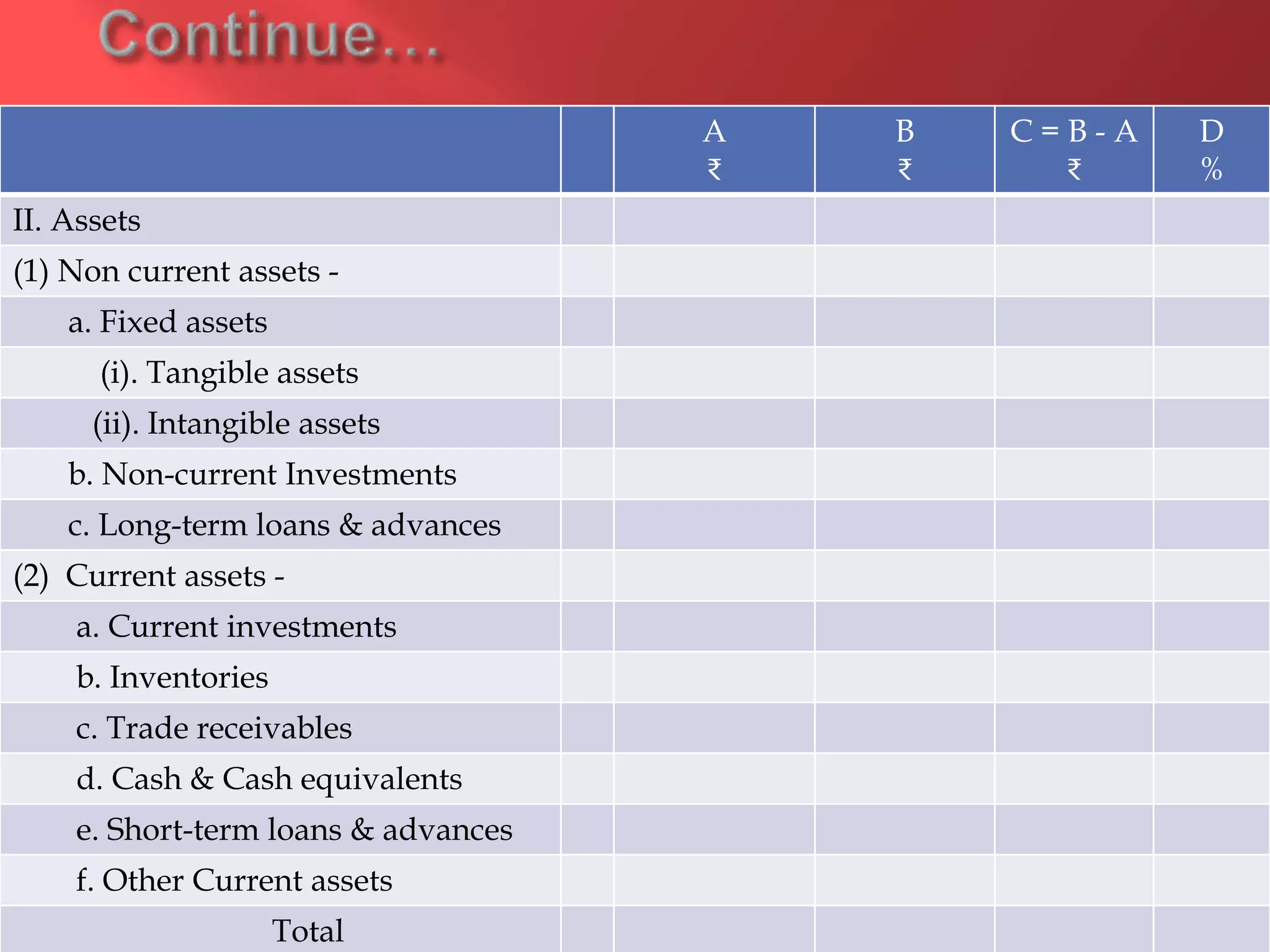

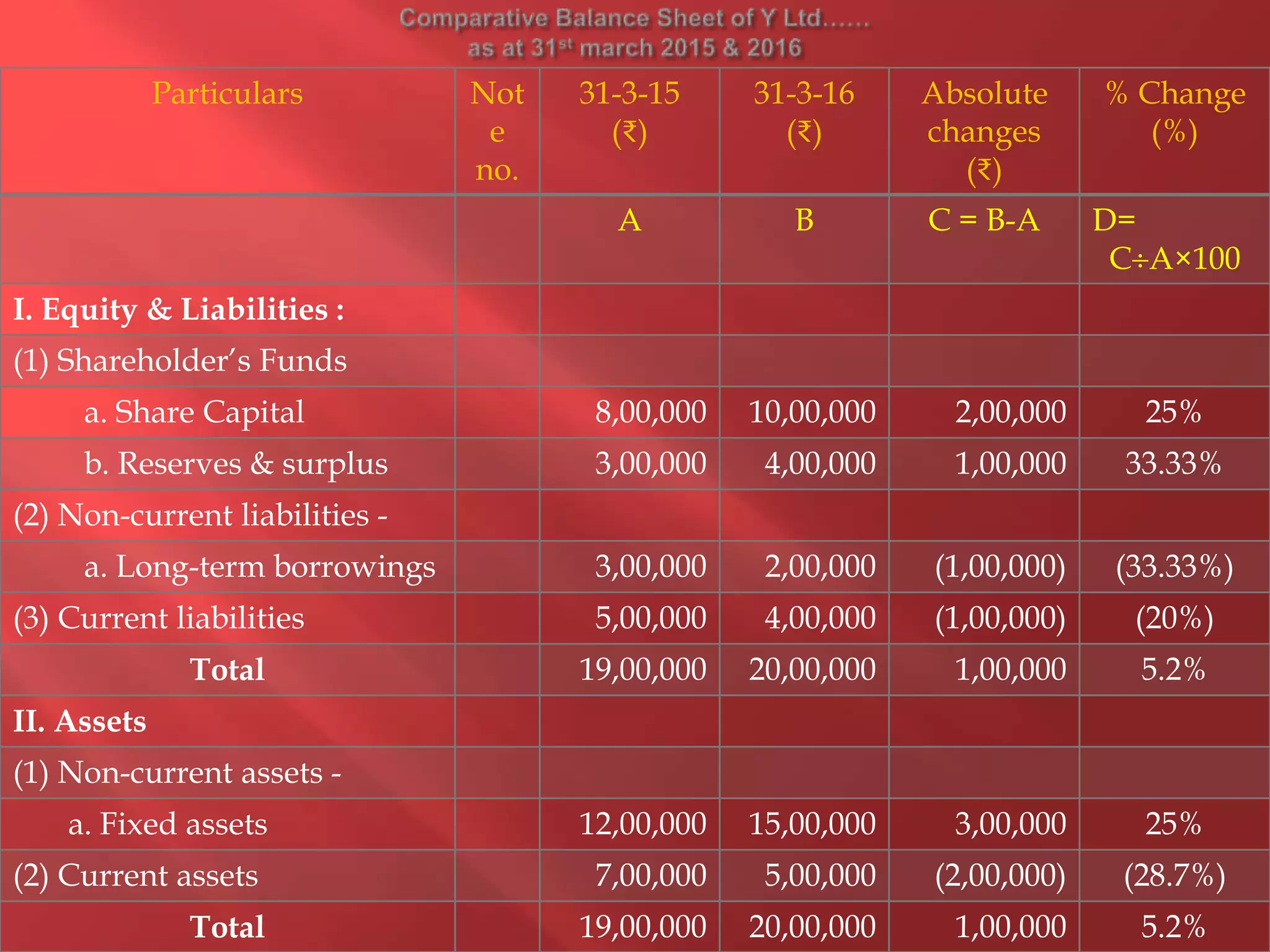

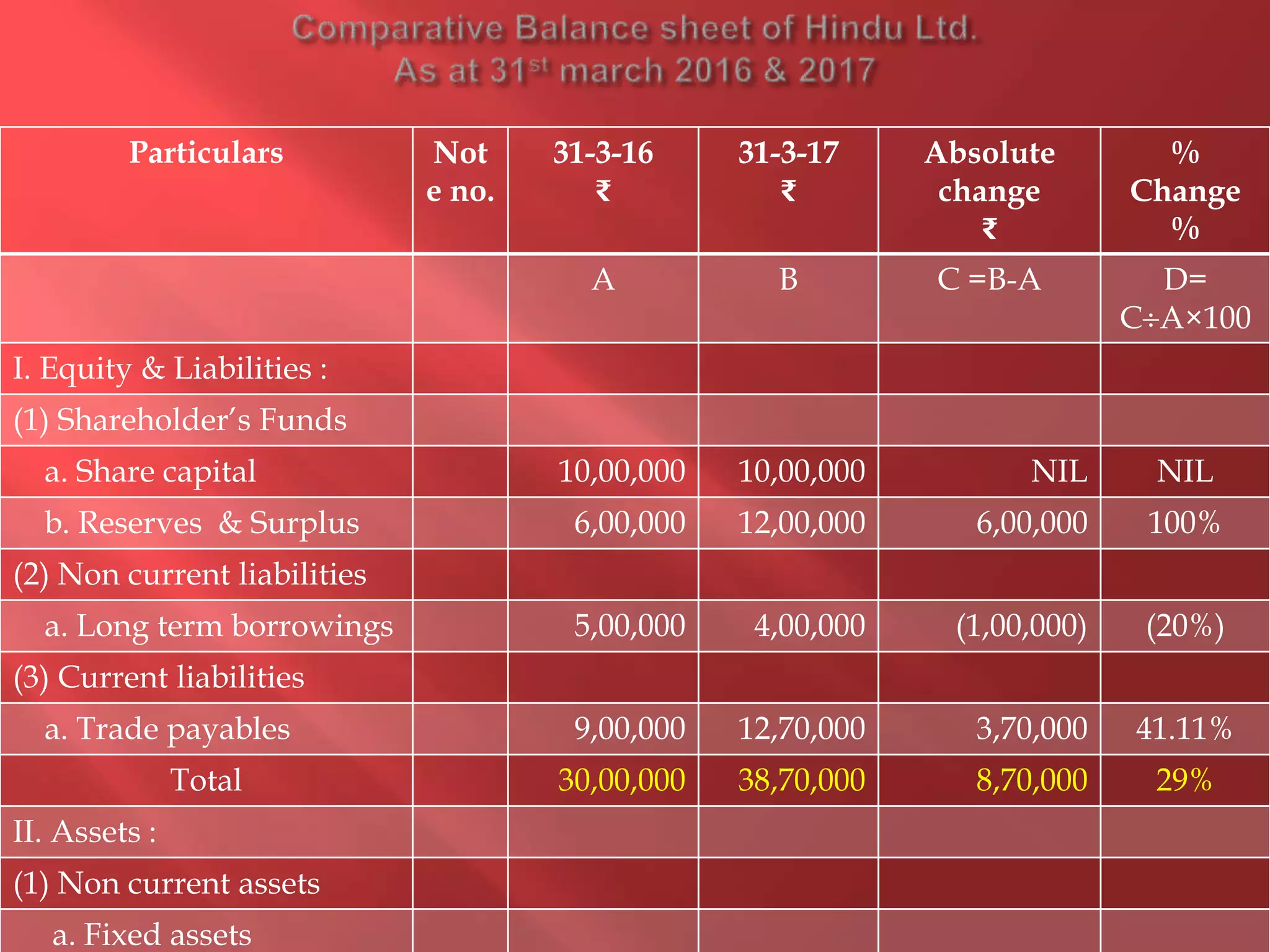

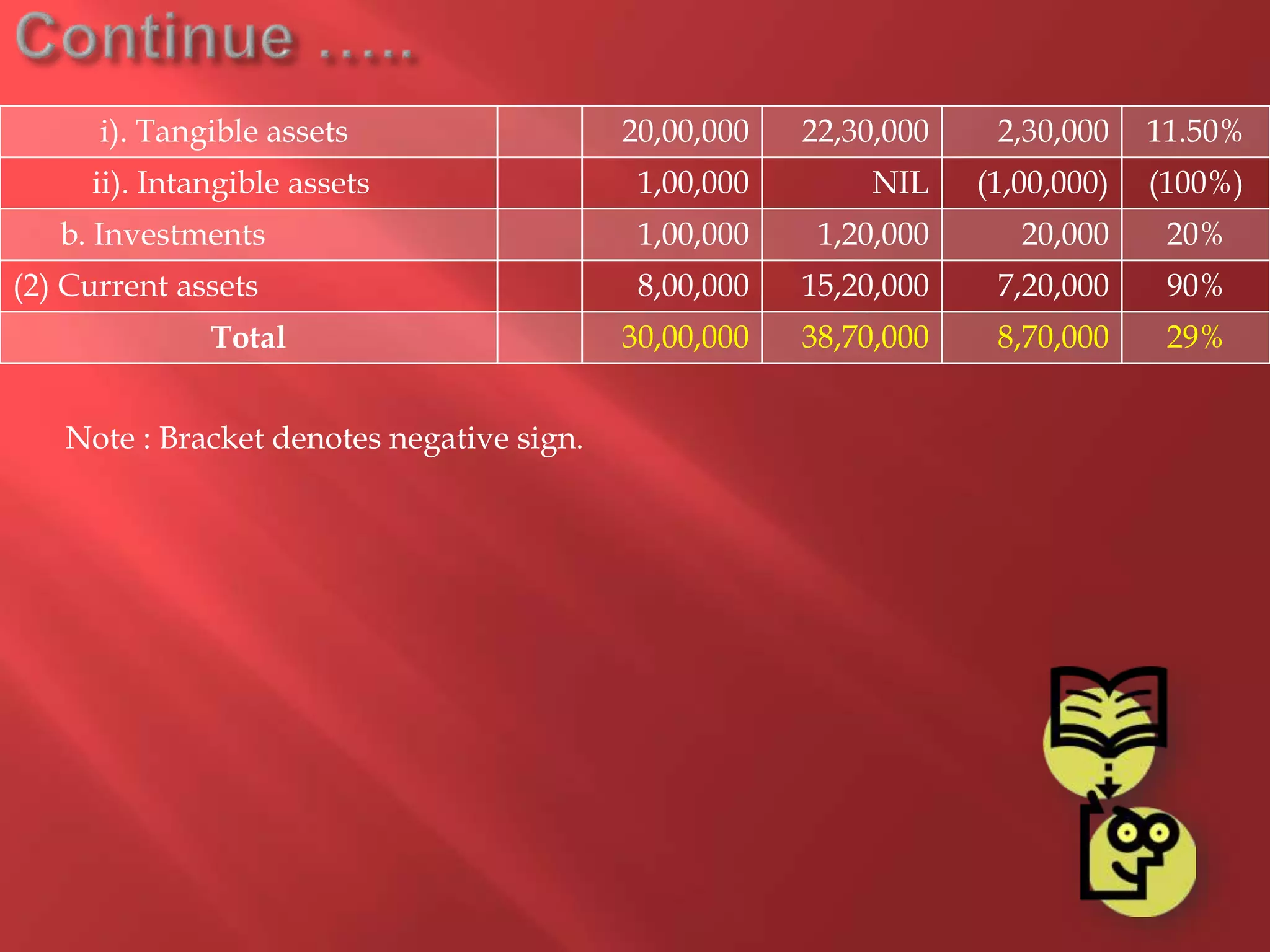

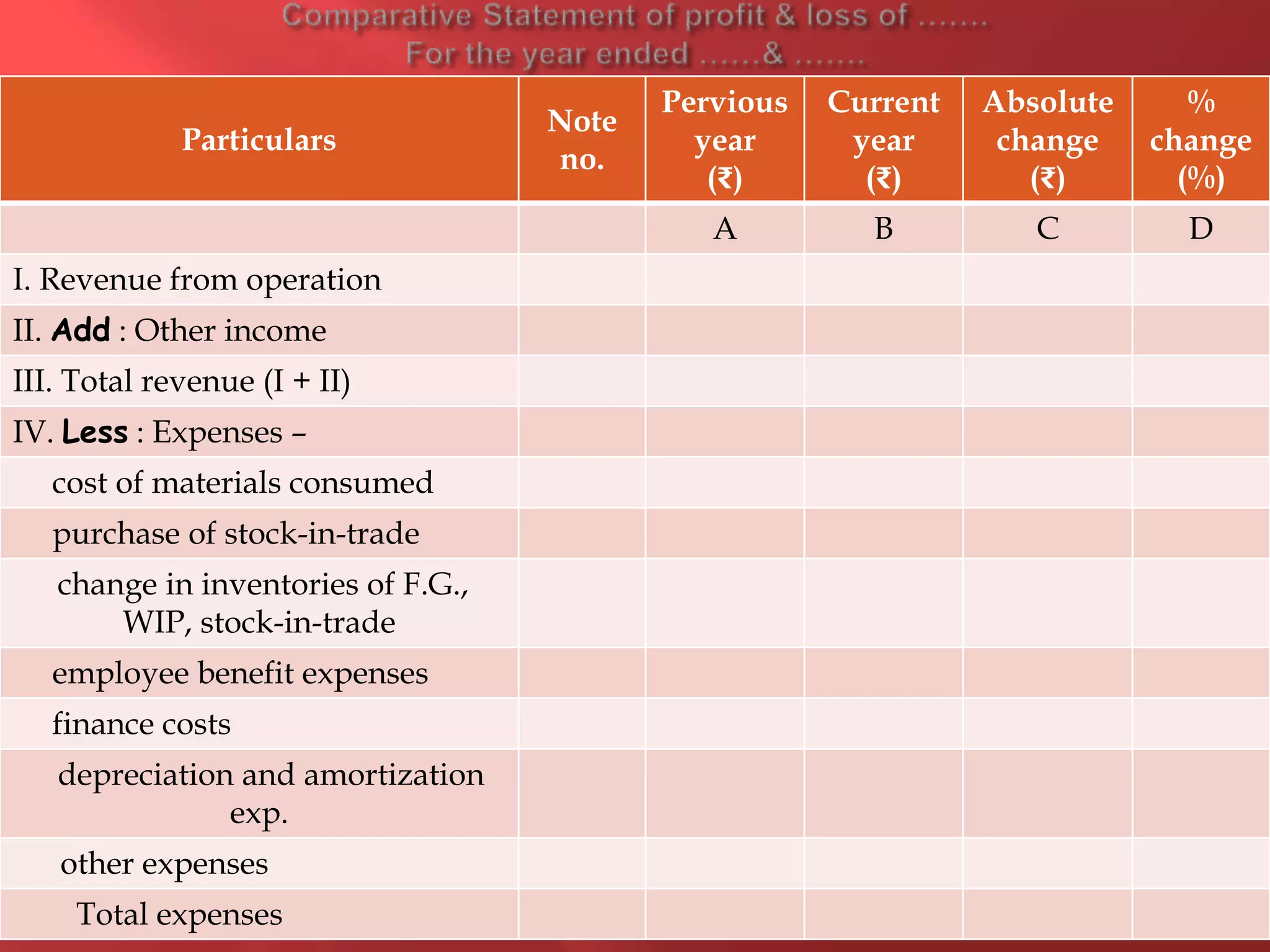

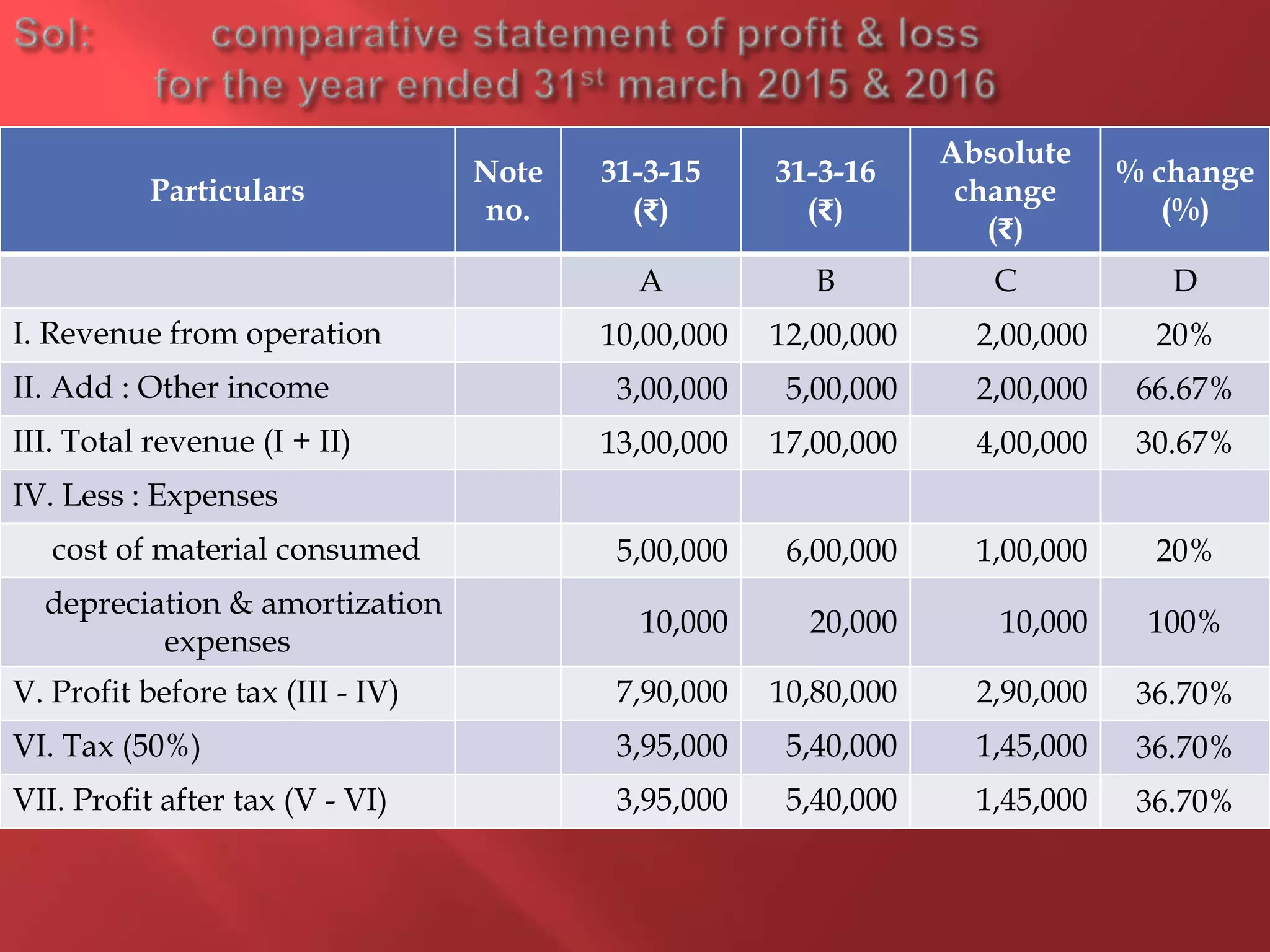

The document elaborates on comparative statements in financial analysis, focusing on comparative balance sheets and profit & loss statements. It discusses their purpose for comparing financial performance across multiple years, highlighting trends, increases or decreases in figures, and facilitating easier data interpretation. Illustrations and exercises are provided to guide the preparation of these statements, emphasizing the derivation of absolute changes and percentage variations in financial data.