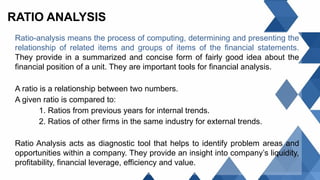

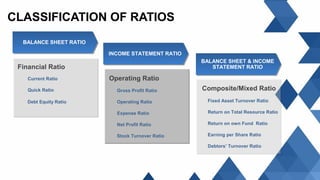

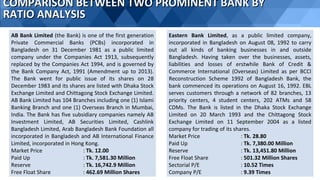

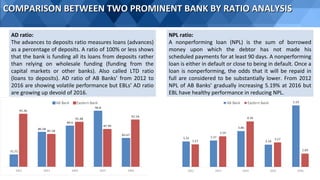

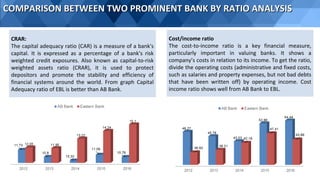

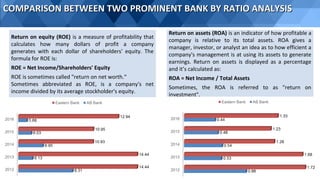

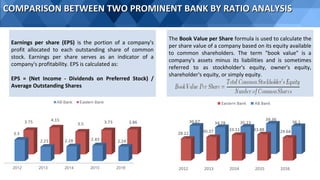

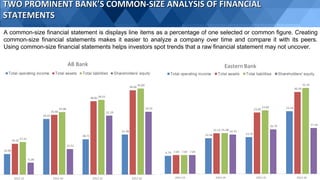

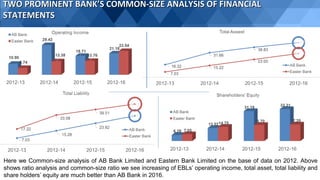

This document discusses ratio analysis and provides a comparison of ratio analyses between two prominent Bangladeshi banks, AB Bank Limited and Eastern Bank Limited, from 2012 to 2016. Ratio analysis involves calculating and presenting relationships between financial statement items to analyze a company's financial position and performance over time and compared to other companies. The document analyzes several key ratios for the two banks, including the advances to deposits ratio, non-performing loan ratio, capital adequacy ratio, cost to income ratio, return on equity, return on assets, earnings per share, and book value per share. It finds that Eastern Bank Limited generally demonstrated better performance and financial stability based on these ratios over the period analyzed.