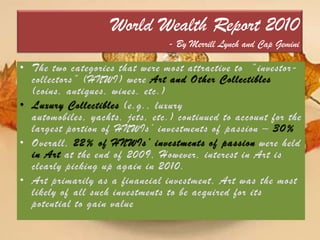

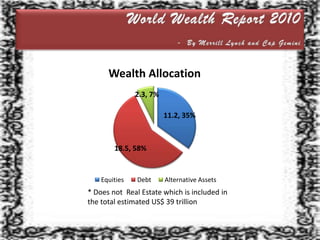

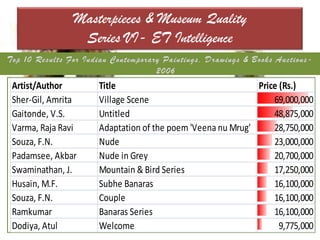

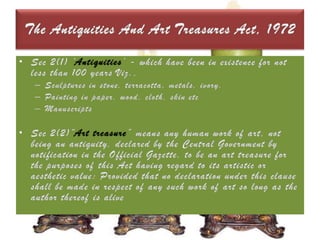

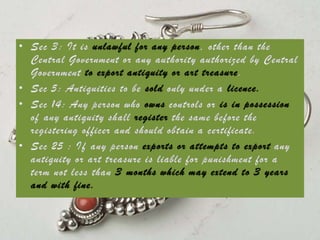

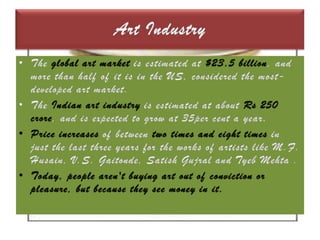

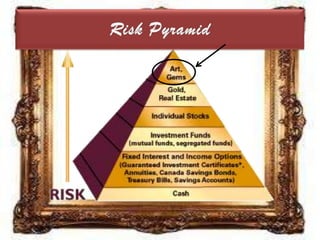

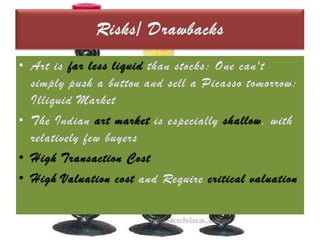

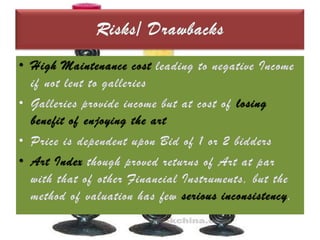

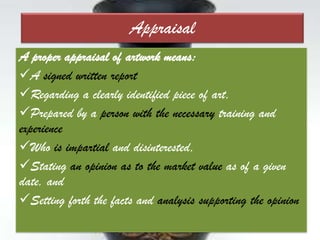

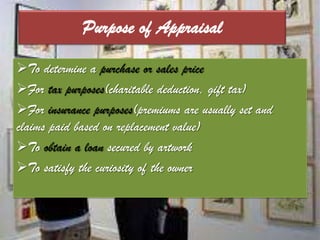

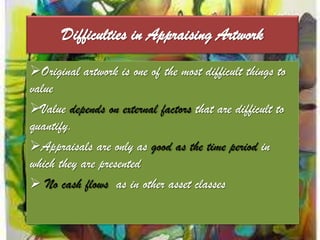

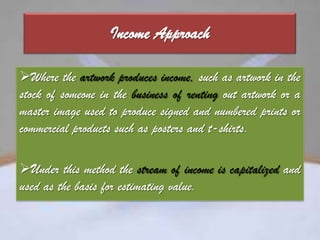

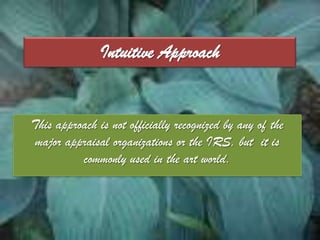

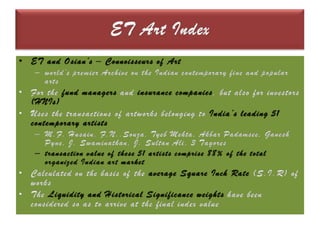

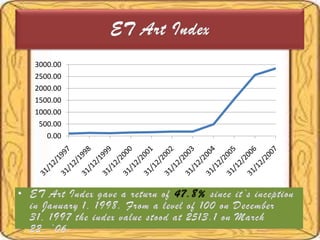

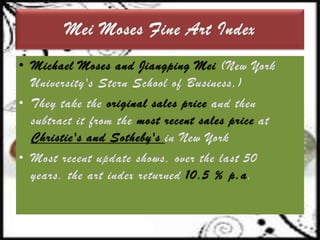

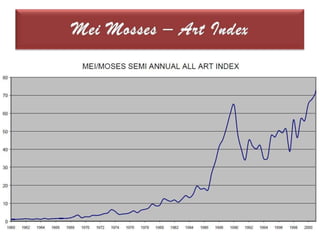

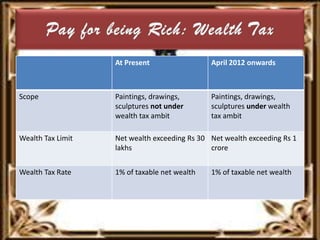

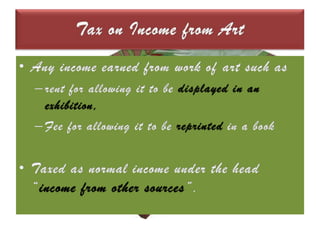

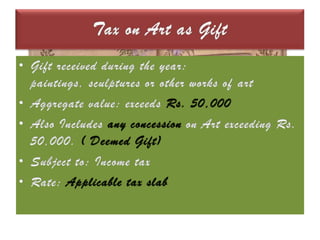

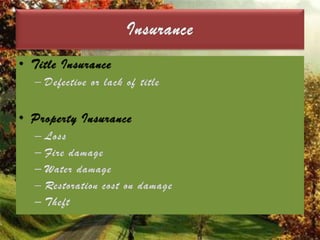

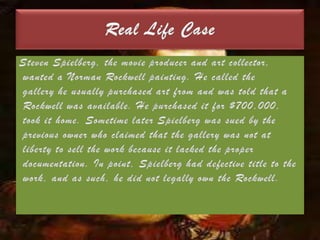

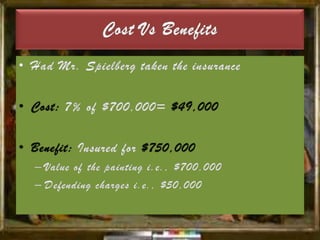

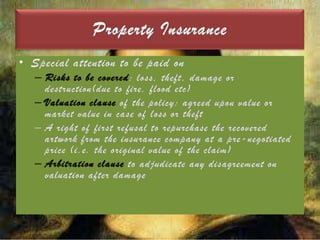

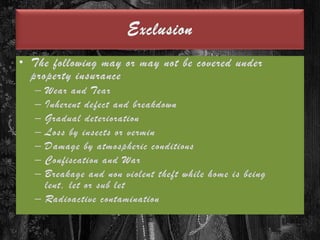

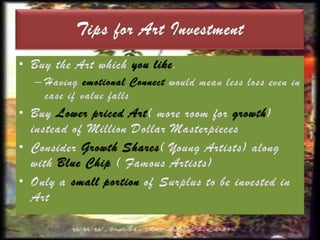

The document discusses the art market, emphasizing that collectors are increasingly motivated by potential financial gain rather than passion for art. It highlights the growth of the Indian art industry, the complexities of art valuation, and the risks associated with art investment compared to other asset classes. Additionally, it addresses art insurance, taxation, and tips for investing in art to mitigate financial risks.