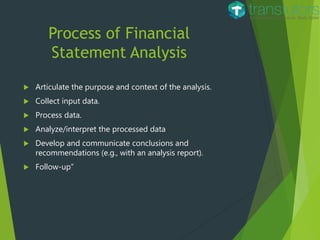

The document explains the concepts of common-size income statements and balance sheets, which present financial data as percentages for easier comparison. It outlines their advantages, such as facilitating cross-sectional and time-series analyses, while also noting disadvantages, including a lack of qualitative assessment and potential consistency issues in accounting policies. Additionally, the document covers the process and tools involved in financial statement analysis.