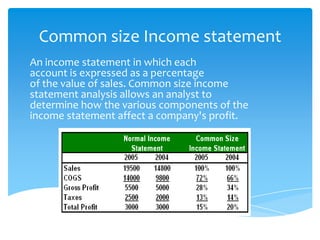

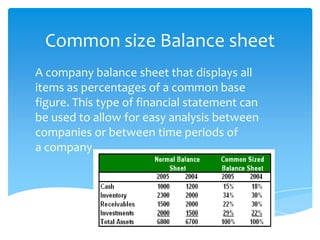

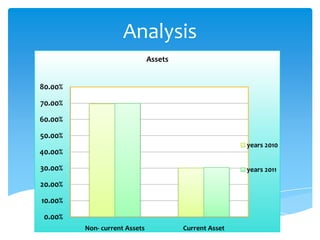

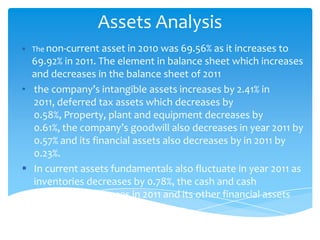

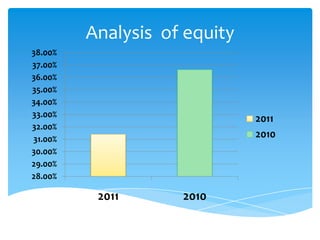

This document analyzes Unilever Pakistan's common size balance sheet and income statement for 2010 and 2011. It finds that non-current assets increased slightly from 2010 to 2011, while current assets fluctuated. Non-current liabilities increased and current liabilities increased substantially due to higher financial debts. Equity decreased by over 5% from 2010 to 2011 due to lower shareholder equity. The common size statements help analyze the company's performance and profit areas relative to shareholders over time.