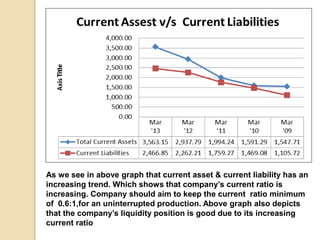

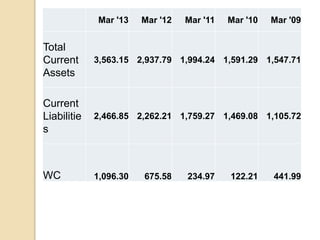

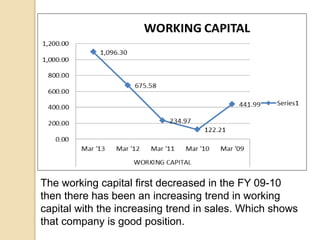

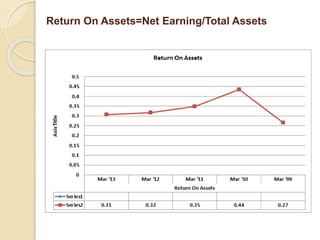

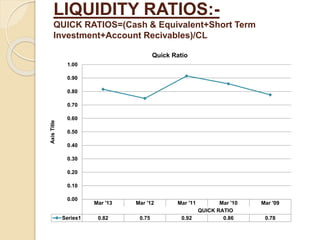

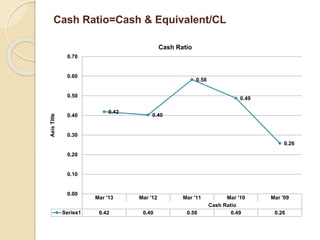

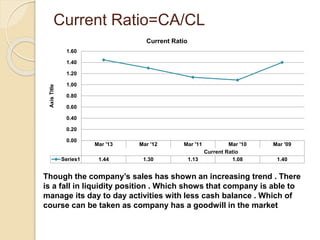

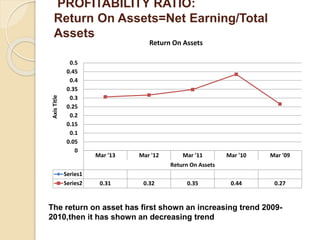

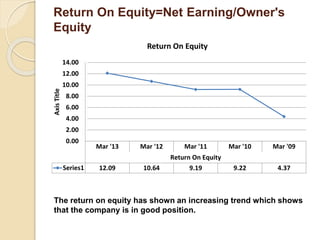

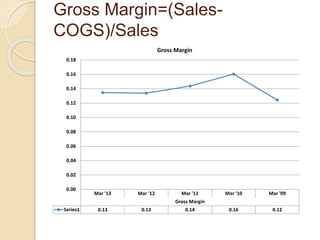

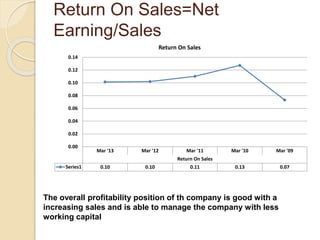

Asian Paints Limited is India's largest paint company based in Mumbai. The document analyzes Asian Paints' working capital management and profitability ratios from 2009 to 2013. It finds that while the company's sales have increased, it has been able to manage its daily operations with decreasing working capital. Asian Paints has maintained strong liquidity and profitability ratios over this period, demonstrating efficient working capital management despite sales growth.