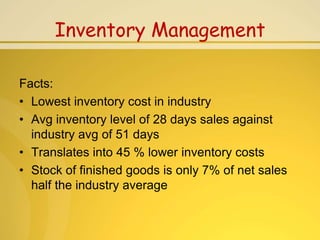

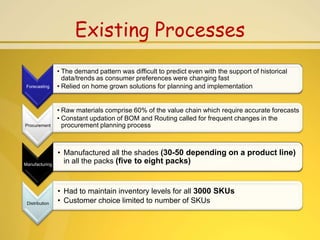

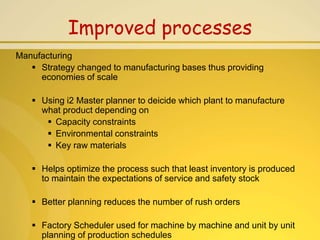

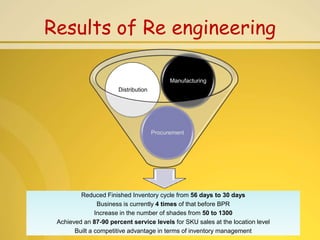

Asian Paints has implemented supply chain improvements through IT systems to better forecast demand, optimize manufacturing, and improve inventory management. Key changes include producing paint bases instead of individual shades, using color tinting machines to mix shades on demand, and implementing planning software. This has reduced inventory levels while increasing the number of available shades. Asian Paints' supply chain is now able to support 4 times the business volume with lower inventory carrying costs and higher service levels.