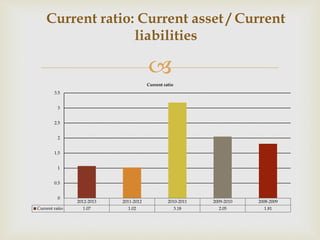

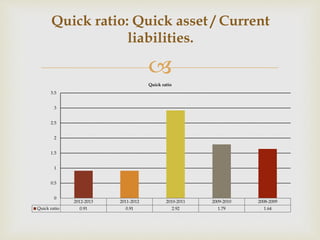

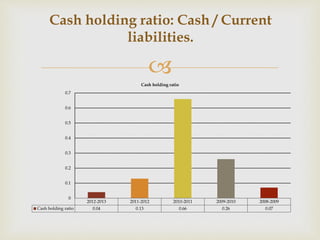

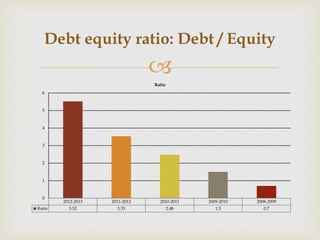

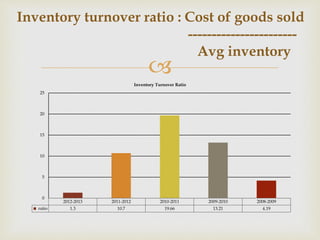

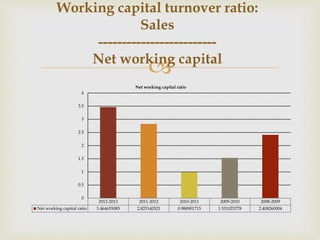

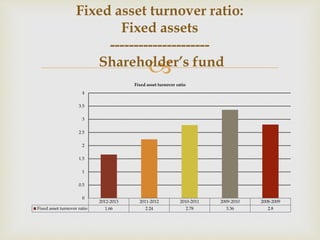

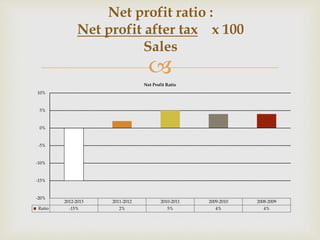

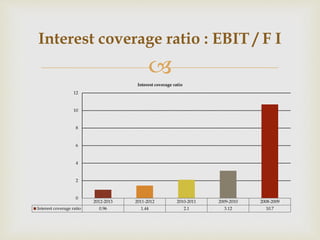

This document analyzes the working capital management of a company that manufactures wind turbines and cooling towers. It provides background on the company and examines various financial ratios to assess the company's liquidity, asset efficiency, debt levels, and profitability over multiple years. The analysis finds that the company has some liquidity issues, high debt levels, and low cash holdings. Inventory turnover and interest coverage ratios have also declined in recent years.