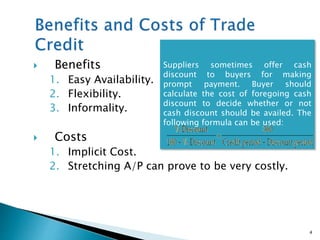

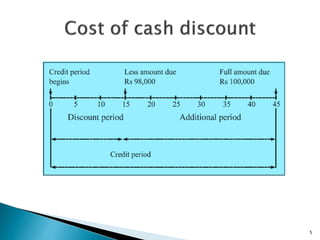

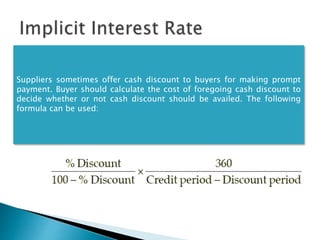

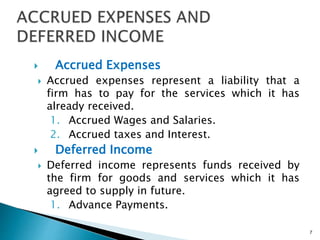

The document discusses various sources of working capital finance including trade credit, accrued expenses, deferred income, bank borrowings, factoring of receivables, commercial paper, and cash credit. It explains key concepts such as trade credit terms, costs and benefits of trade credit, accrued expenses and deferred income, cash credit facilities that allow borrowing against a sanctioned limit, and methods of securing bank loans such as hypothecation, pledge, mortgage, and lien. The document provides formulas for calculating costs of foregoing cash discounts and outlines different sources of working capital available to firms from banks.