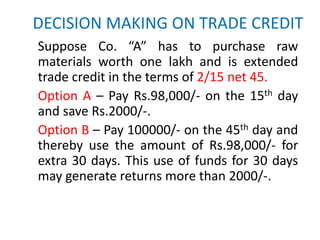

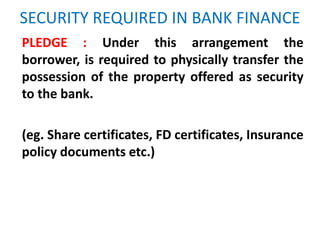

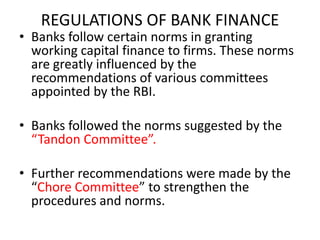

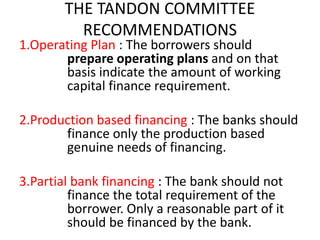

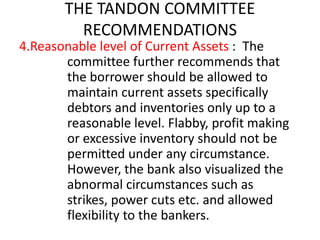

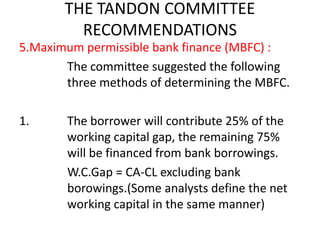

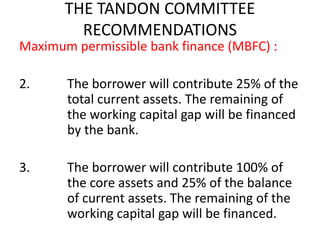

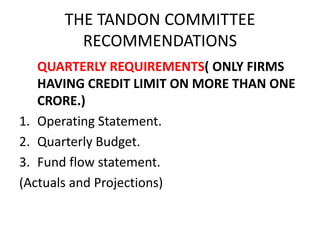

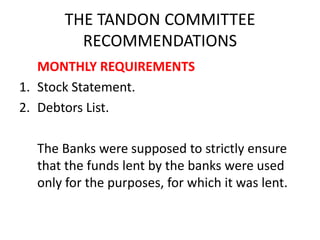

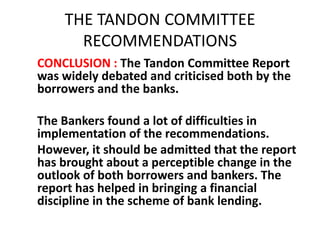

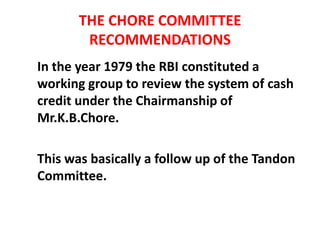

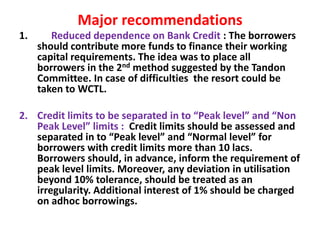

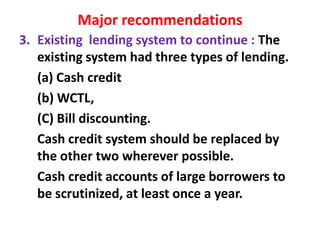

This document discusses sources of working capital finance in India, focusing on trade credit and bank borrowing. It provides details on trade credit terms, benefits, and factors to consider in deciding whether to take a discount or pay later. For bank borrowing, it outlines forms of financing like overdrafts and cash credits, as well as security requirements and regulations on financing based on recommendations from the Tandon and Chore Committees to the Reserve Bank of India.