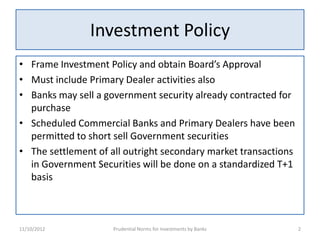

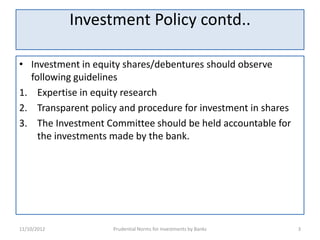

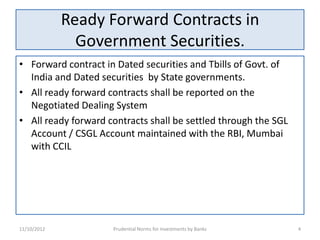

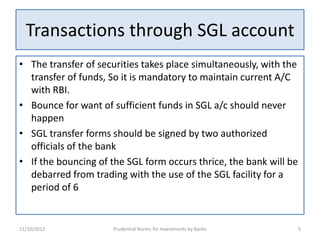

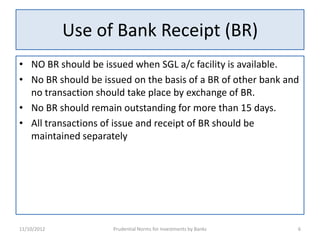

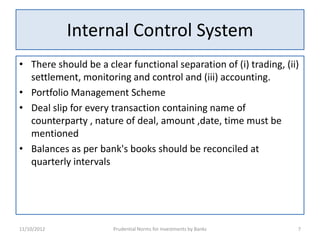

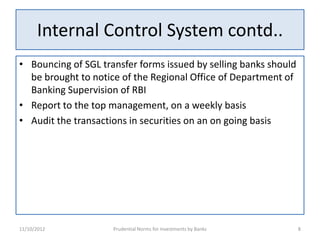

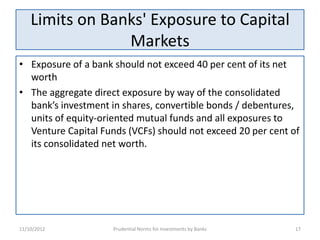

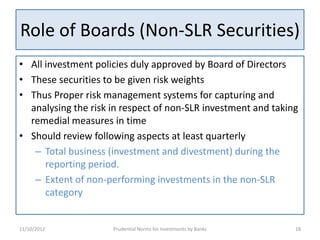

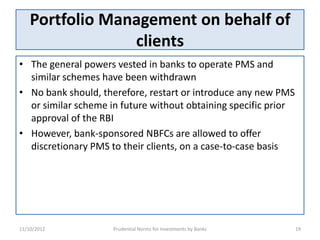

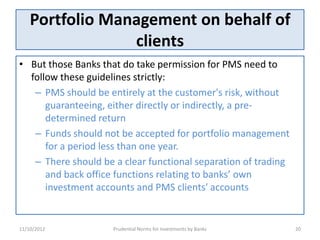

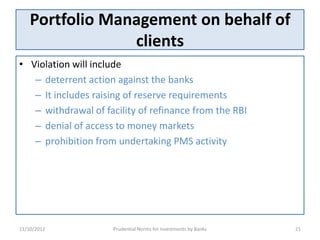

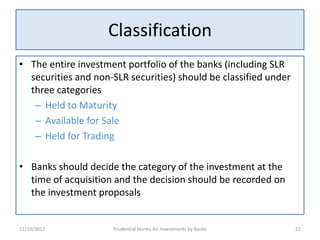

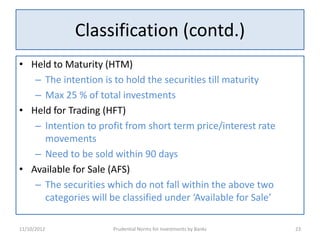

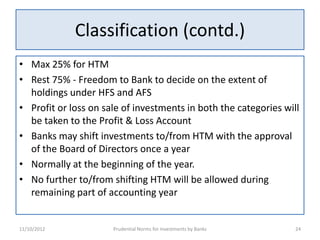

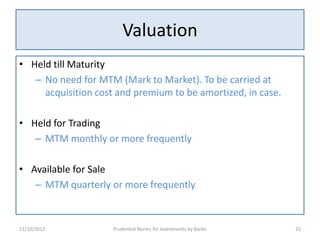

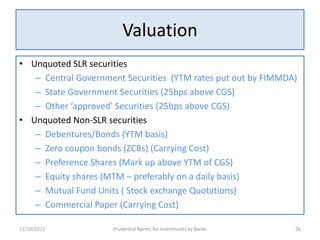

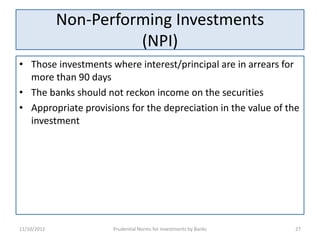

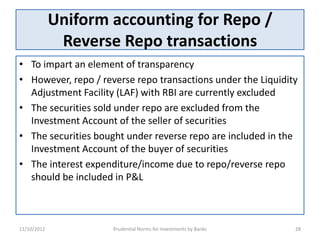

This document outlines prudential norms for classification, valuation, and operation of investment portfolios by banks in India. It discusses guidelines for banks' investment policies, ready forward contracts in government securities, transactions through SGL accounts, use of bank receipts, engagement of brokers, auditing of investments, and classification of investments as held-to-maturity, available-for-sale or held-for-trading. It also covers valuation of investments, non-performing investments, uniform accounting for repo/reverse repo transactions, and portfolio management on behalf of clients.