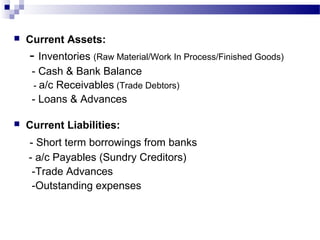

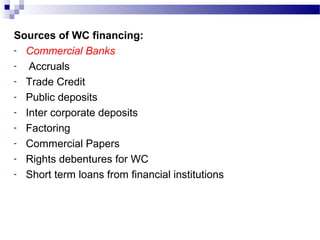

The document discusses working capital management. It defines working capital as the difference between current assets and current liabilities. Current assets include inventories, cash, accounts receivable, and loans/advances, while current liabilities include short term borrowings, accounts payable, and outstanding expenses. The operating cycle is defined as the time between purchase of raw materials and collection from sales. Key sources of working capital financing discussed include bank financing like overdrafts and loans, trade credit, accruals, public deposits, commercial papers, and debentures. Factors that determine working capital requirements include the nature of business, market conditions, technology, and credit policies.