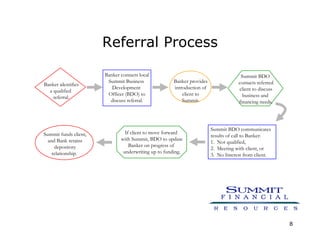

- Summit Financial Resources is a commercial finance company that partners with banks to provide working capital financing to small businesses when the bank cannot.

- They typically provide credit facilities between $100,000 and $3.5 million to companies with annual sales between $1-30 million in a variety of industries.

- Companies need their financing when they are not qualified for bank financing due to risk factors like a weak balance sheet, lack of operating history, or poor financial reporting.

![Contact Information Liz Castillo Vice President Southwest Region 1200 Smith Street, Suite 1600 Houston, TX 77002 713.353.3911 Phone 713.385.1789 Cell [email_address]](https://image.slidesharecdn.com/sfrbankpresentation-12529862372809-phpapp03/85/SFR-Bank-Presentation-9-320.jpg)