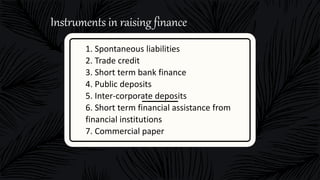

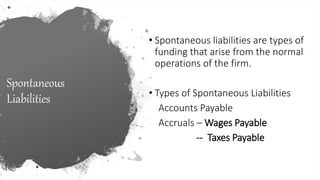

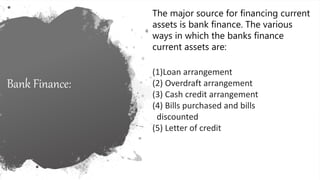

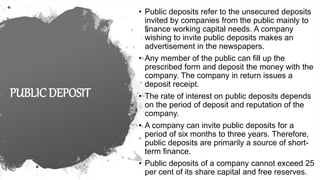

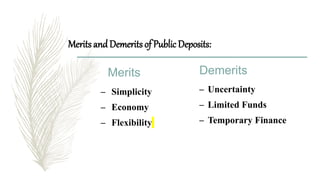

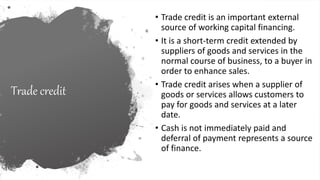

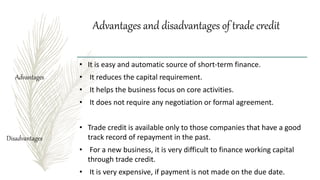

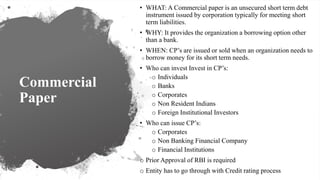

The document discusses the financing of current assets, categorizing them into cash or assets convertible to cash within a year, and describes various approaches to financing such assets including matching, conservative, and aggressive strategies. It elaborates on different financing sources like spontaneous liabilities, trade credit, public deposits, commercial paper, and inter-corporate deposits, outlining their advantages and disadvantages. Key insights on fund-based assistance by commercial banks for exporters are also provided, covering pre-shipment and post-shipment finance.