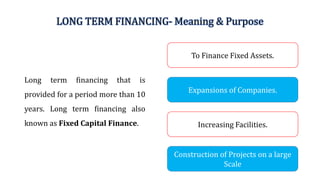

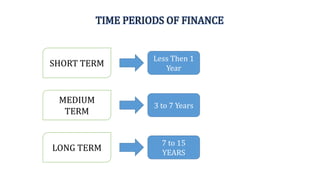

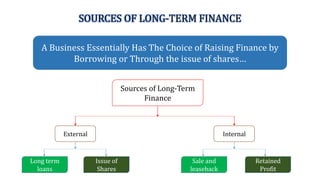

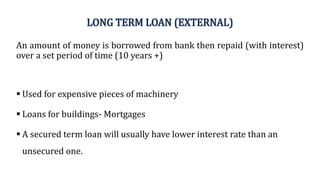

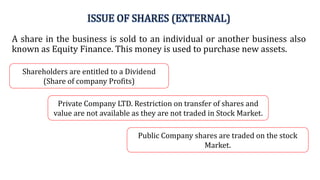

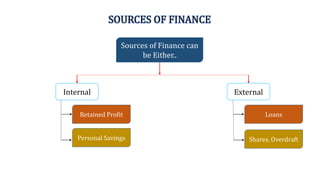

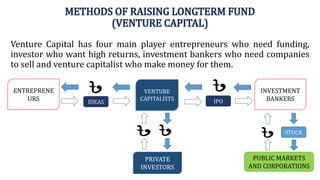

Mr. X owns a textile company worth 100cr that wants to expand. He needs 25cr but cannot afford the high interest rates from banks. He considers selling 25% ownership as shares on the stock market to raise funds without high interest. Long-term financing provides money for over 10 years and is used for expansions, fixed assets, and large construction projects. Businesses can raise long-term funds internally through retained profits or externally through loans, bonds, or issuing shares.