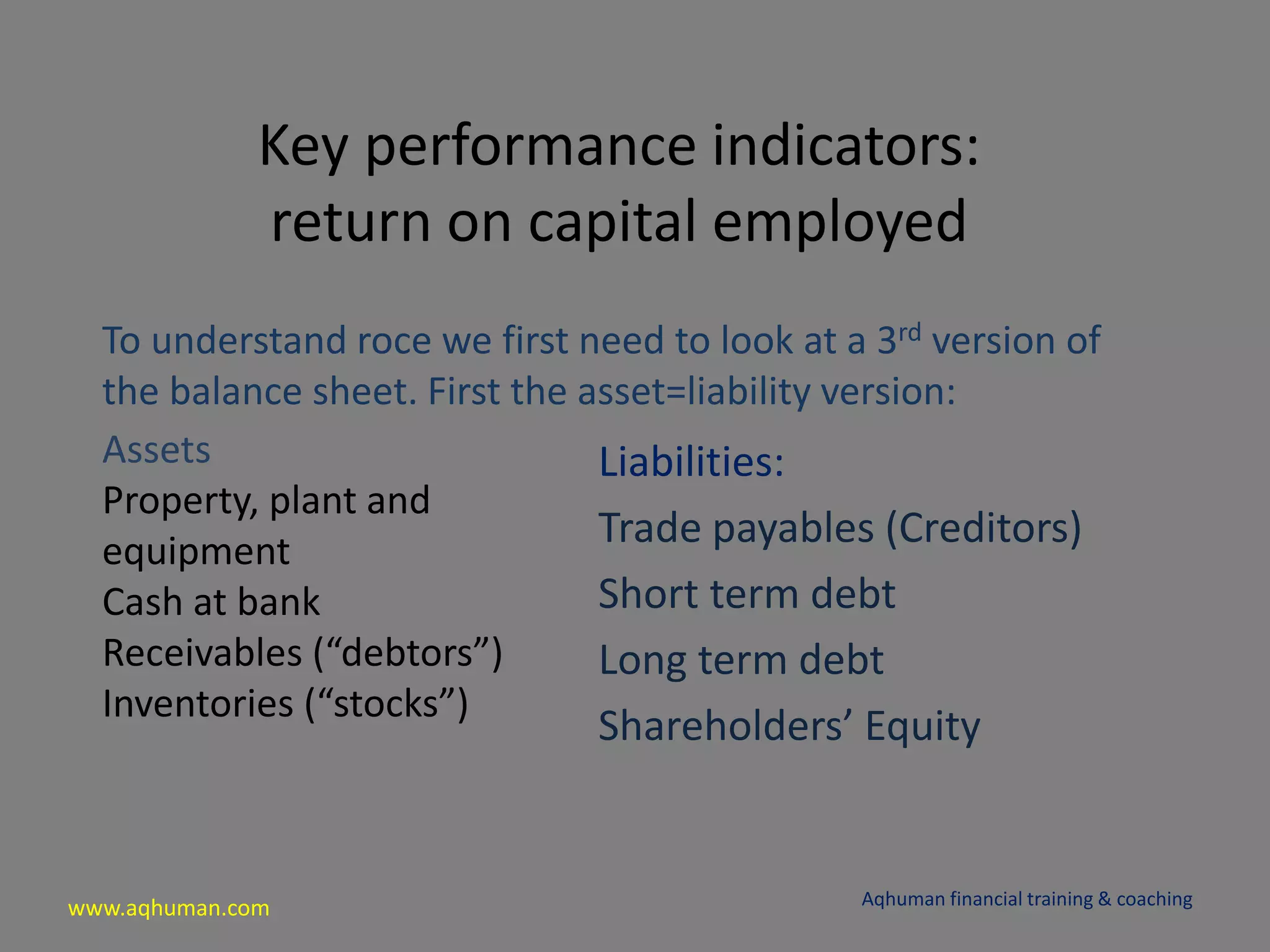

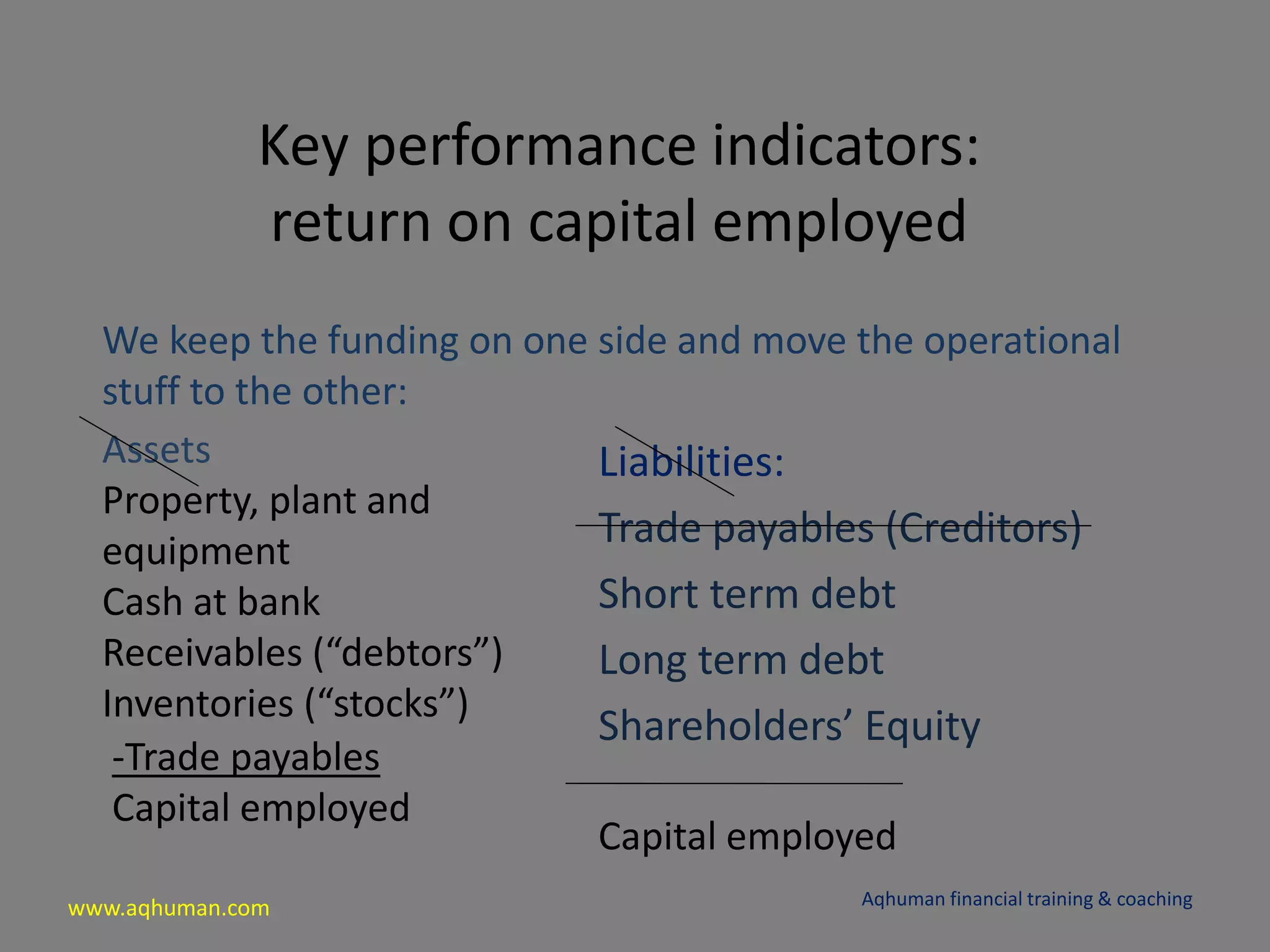

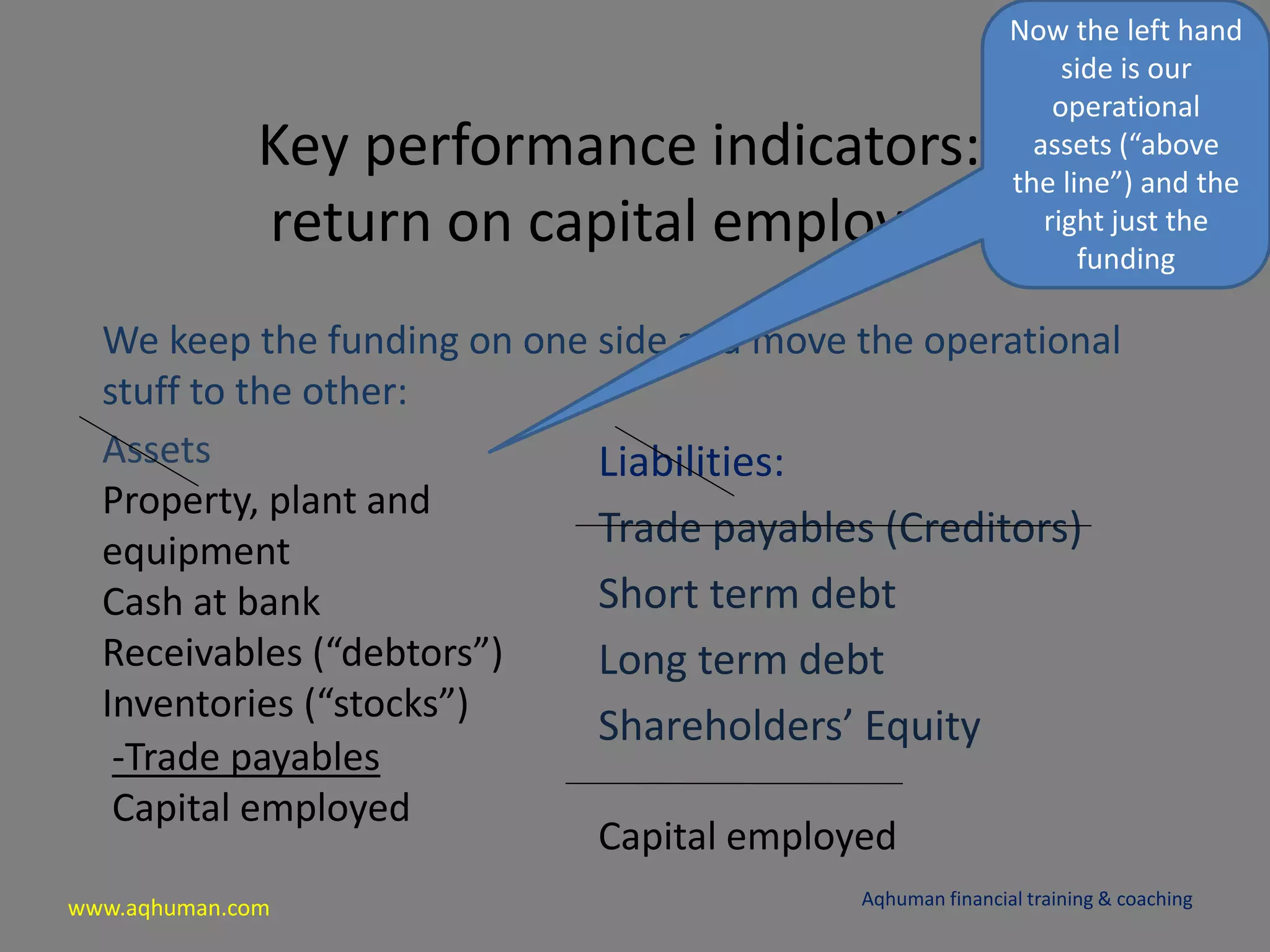

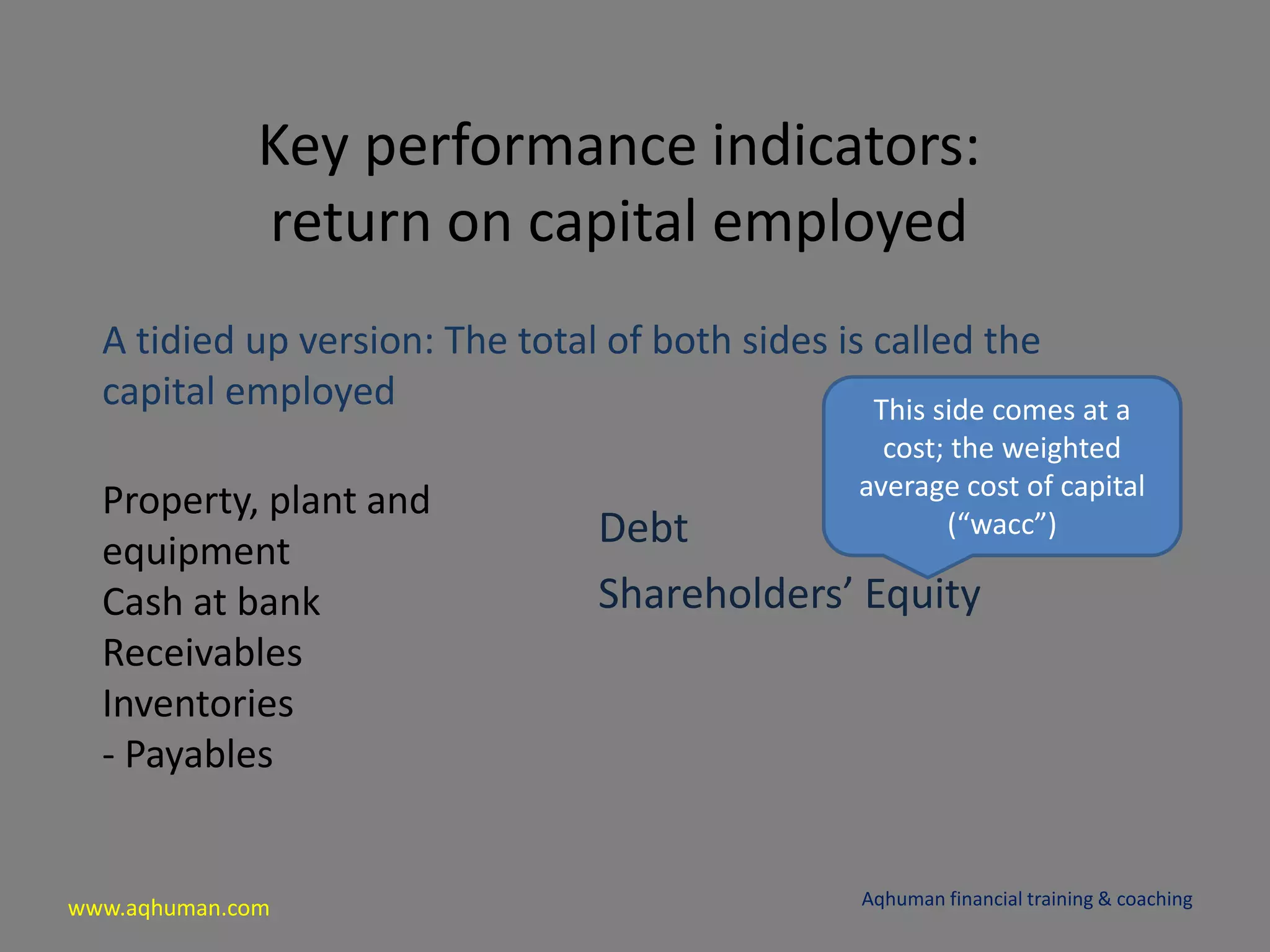

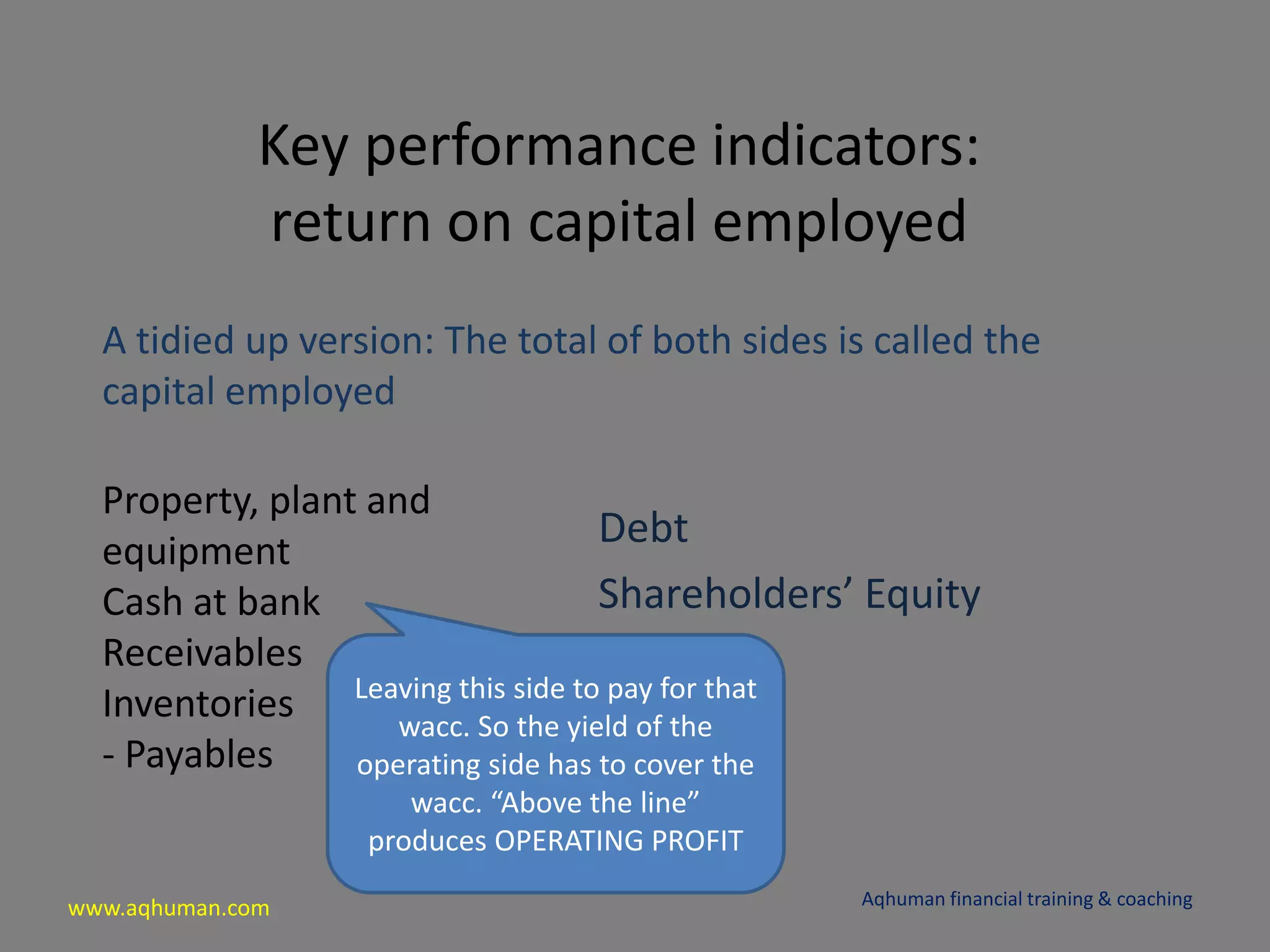

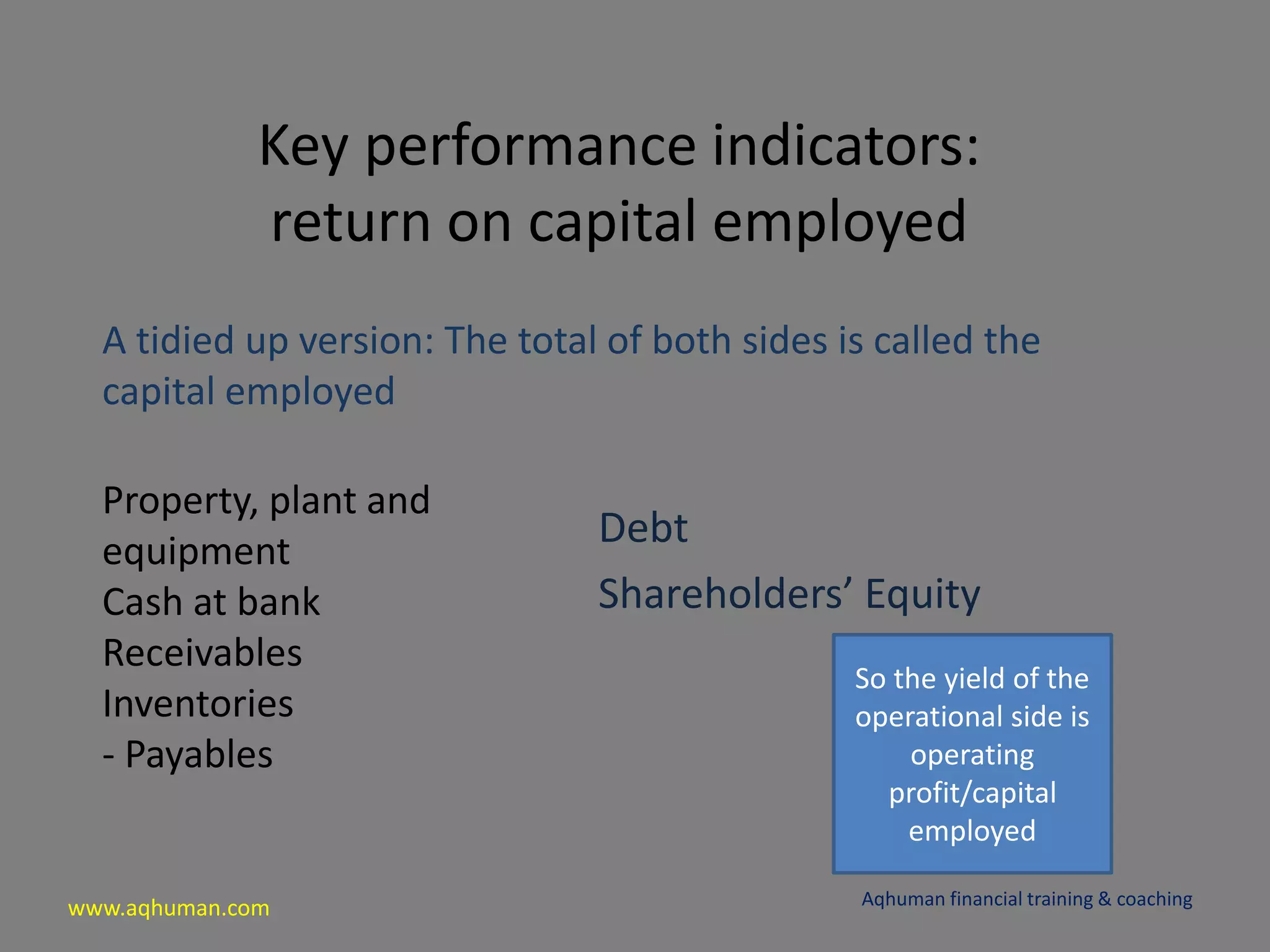

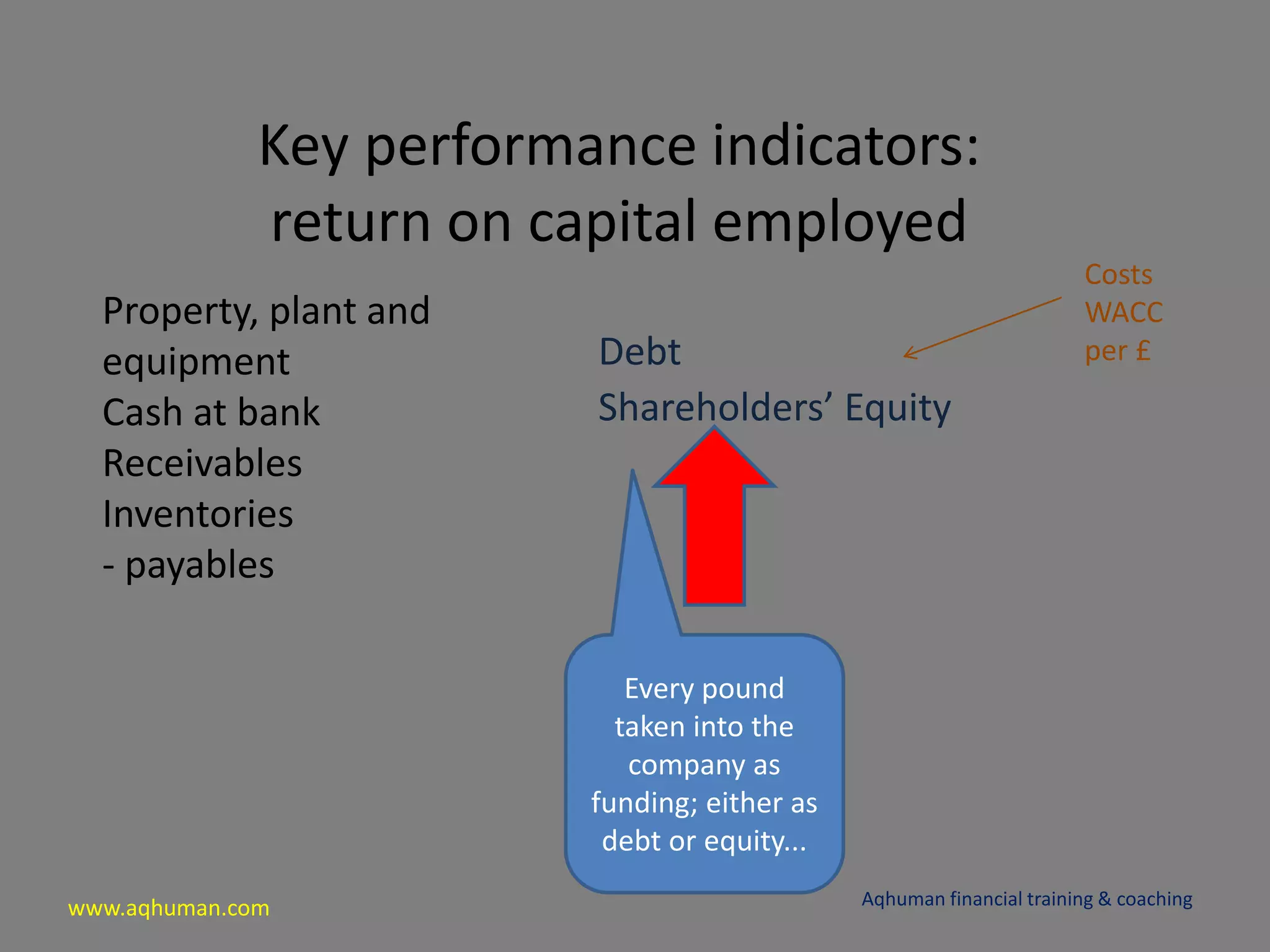

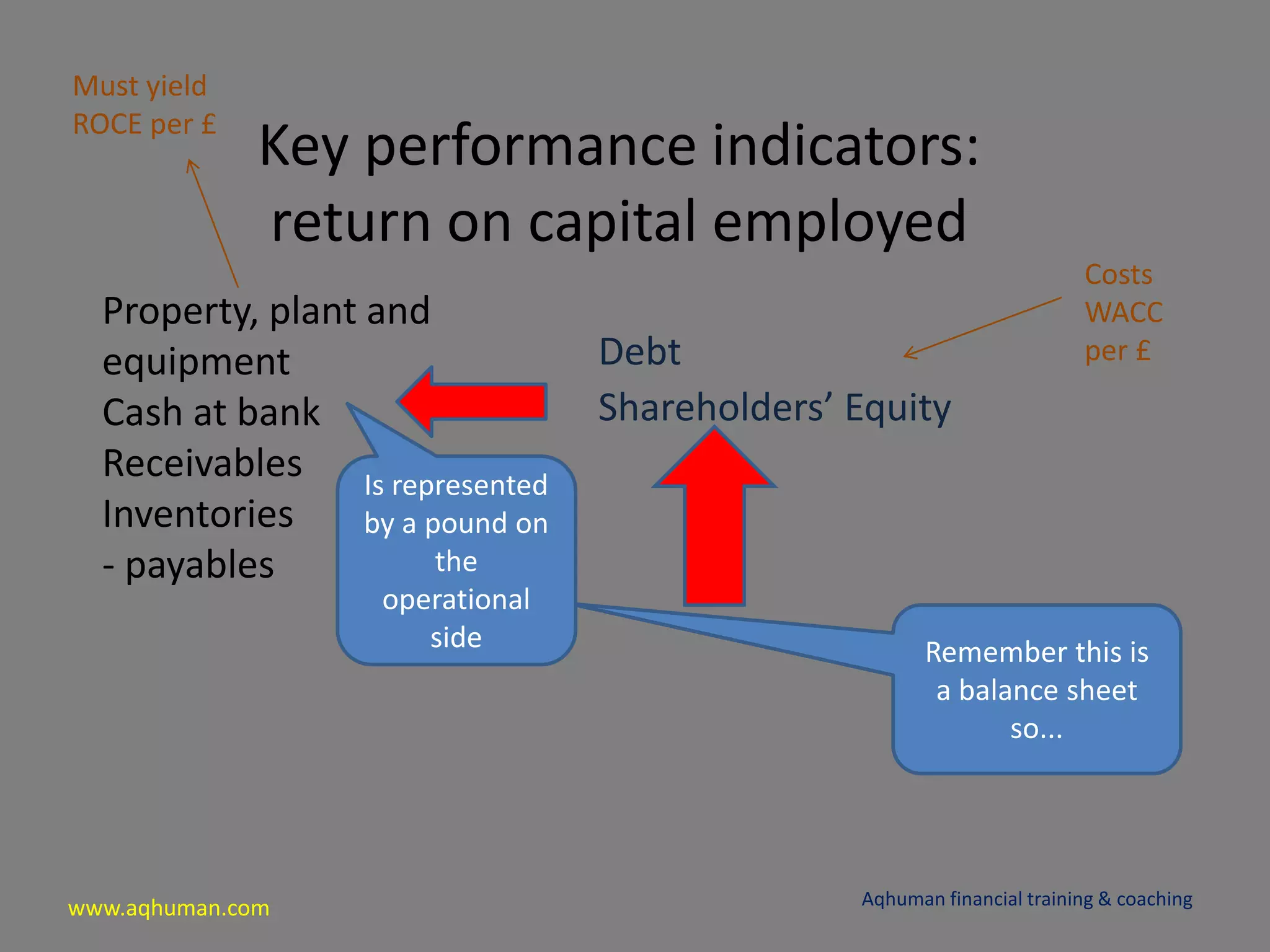

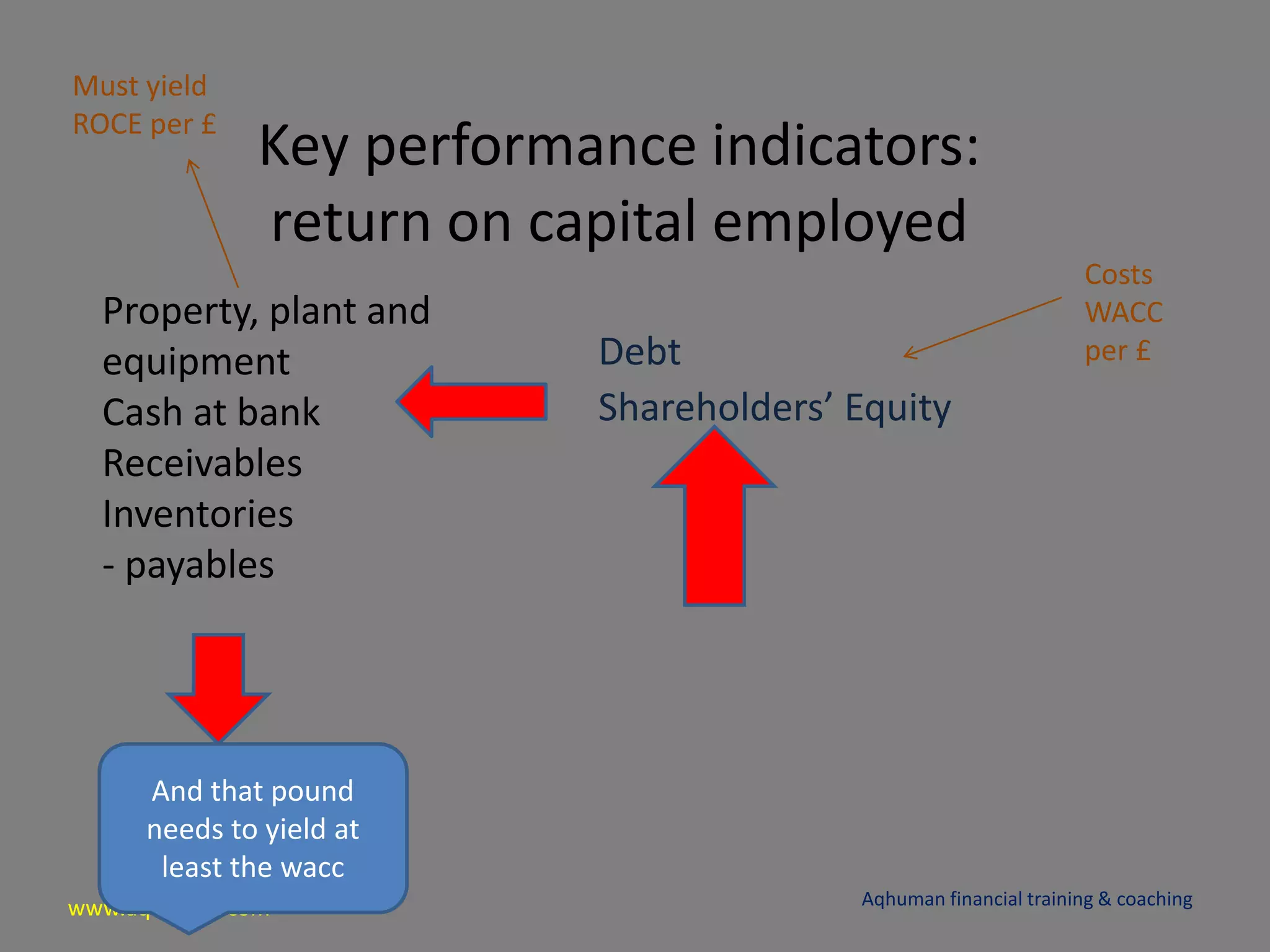

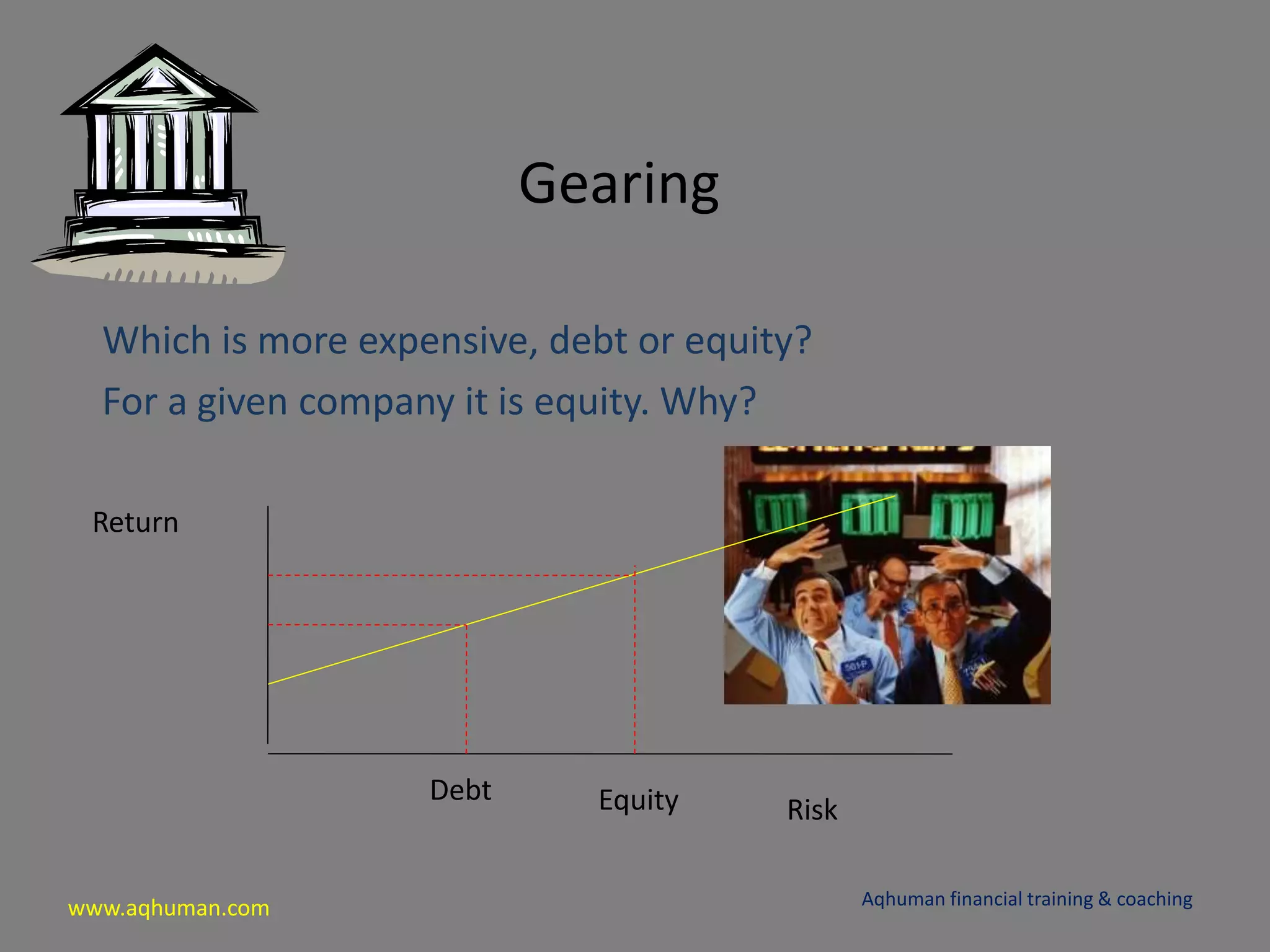

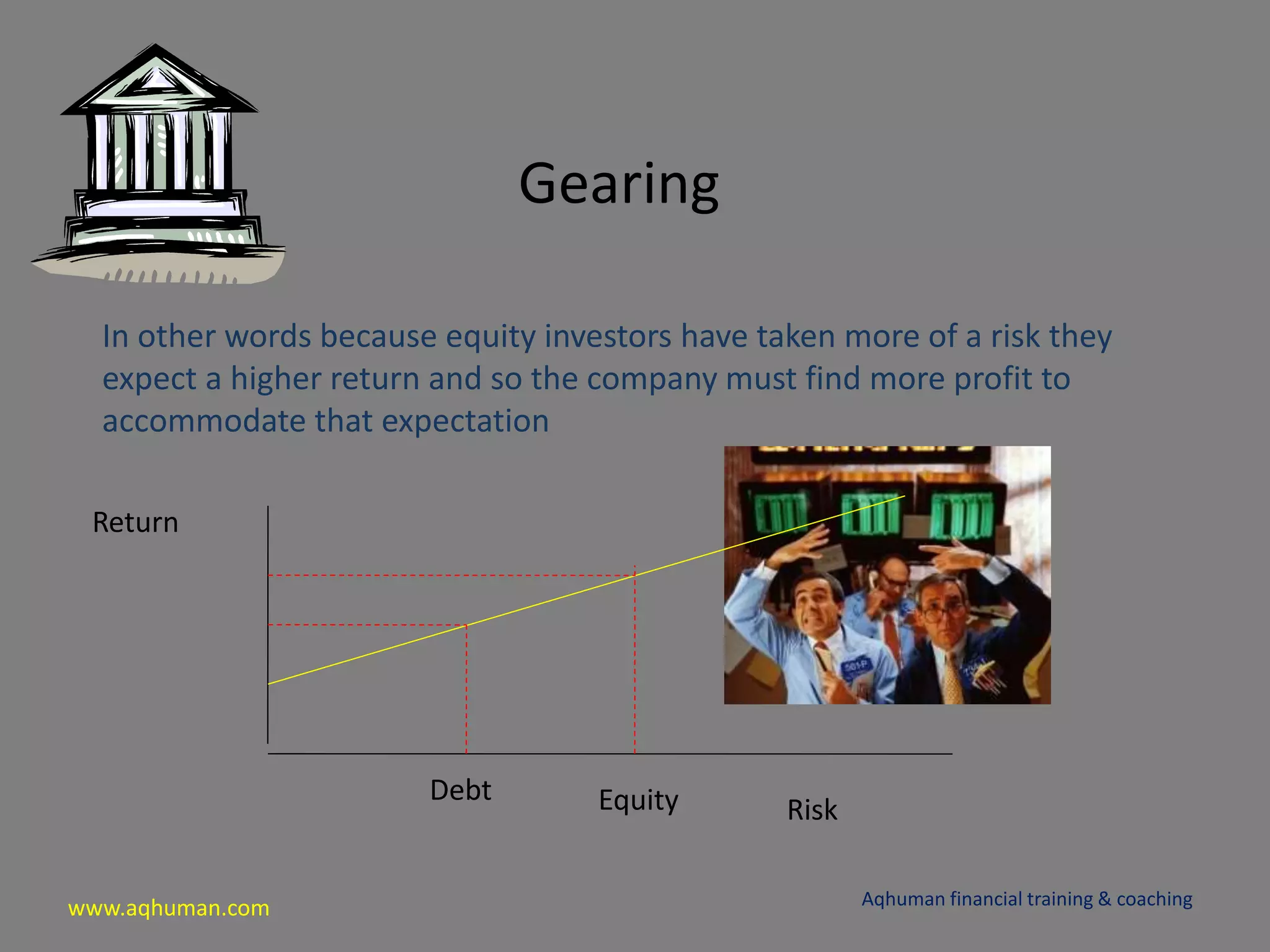

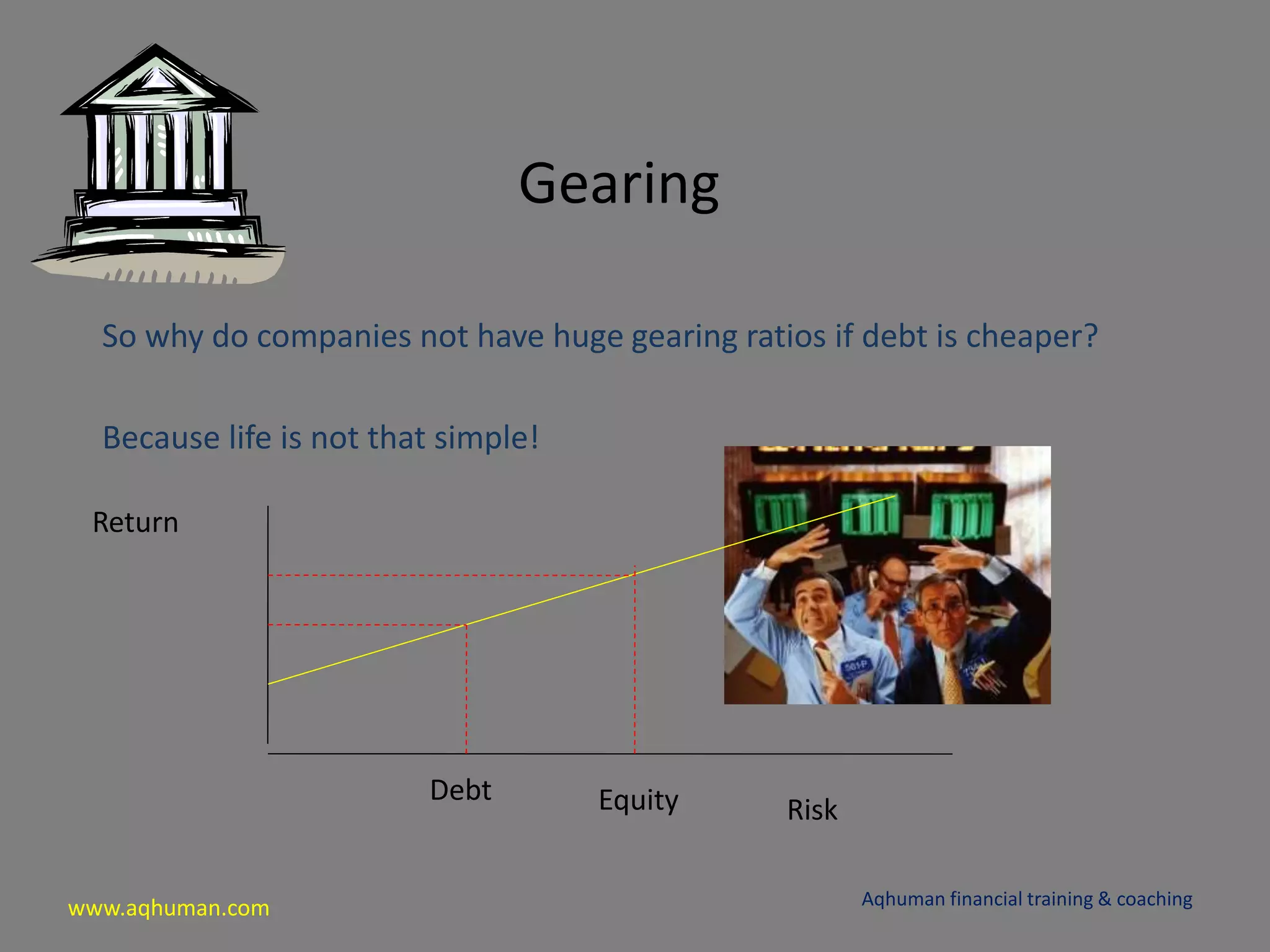

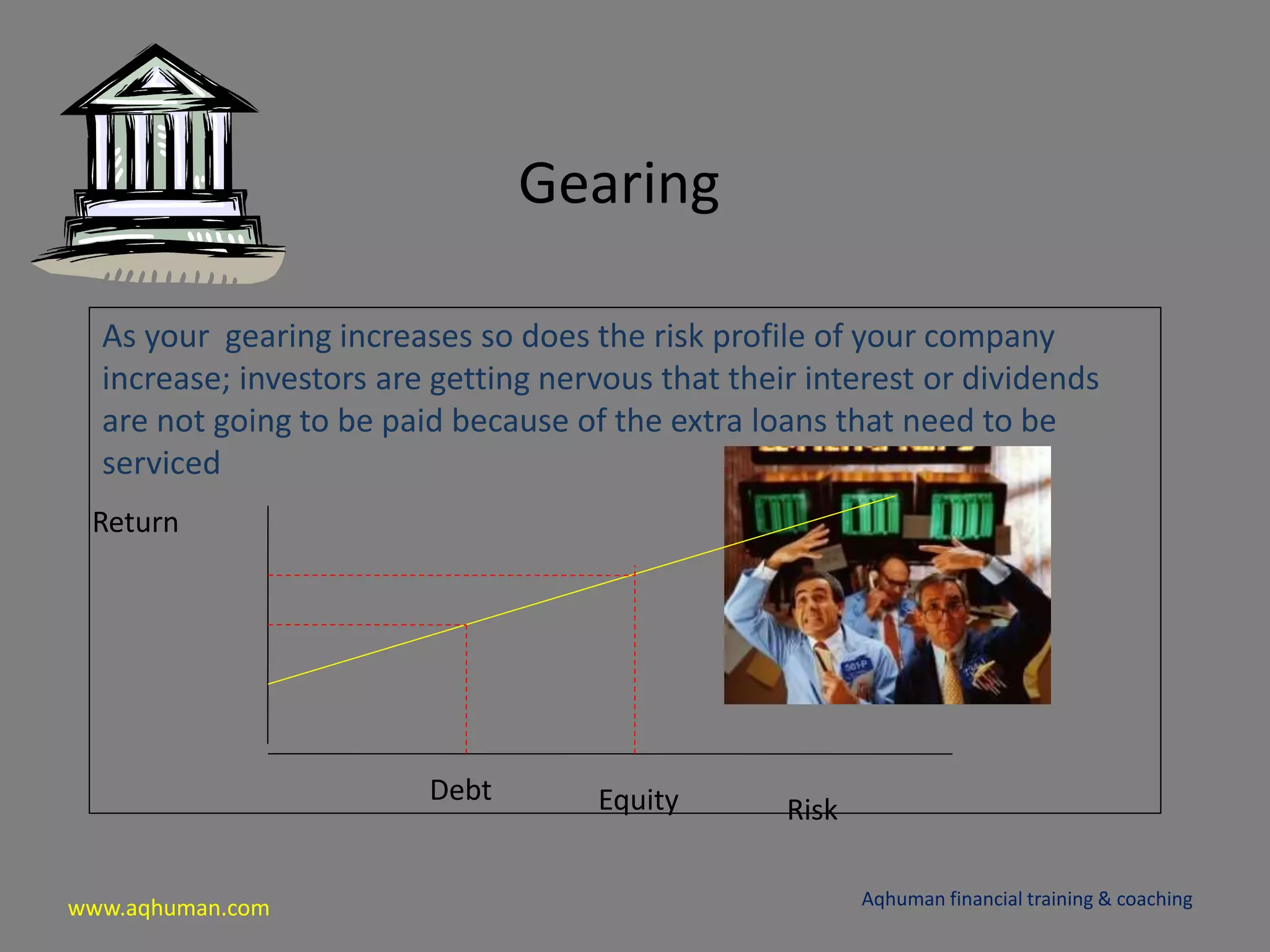

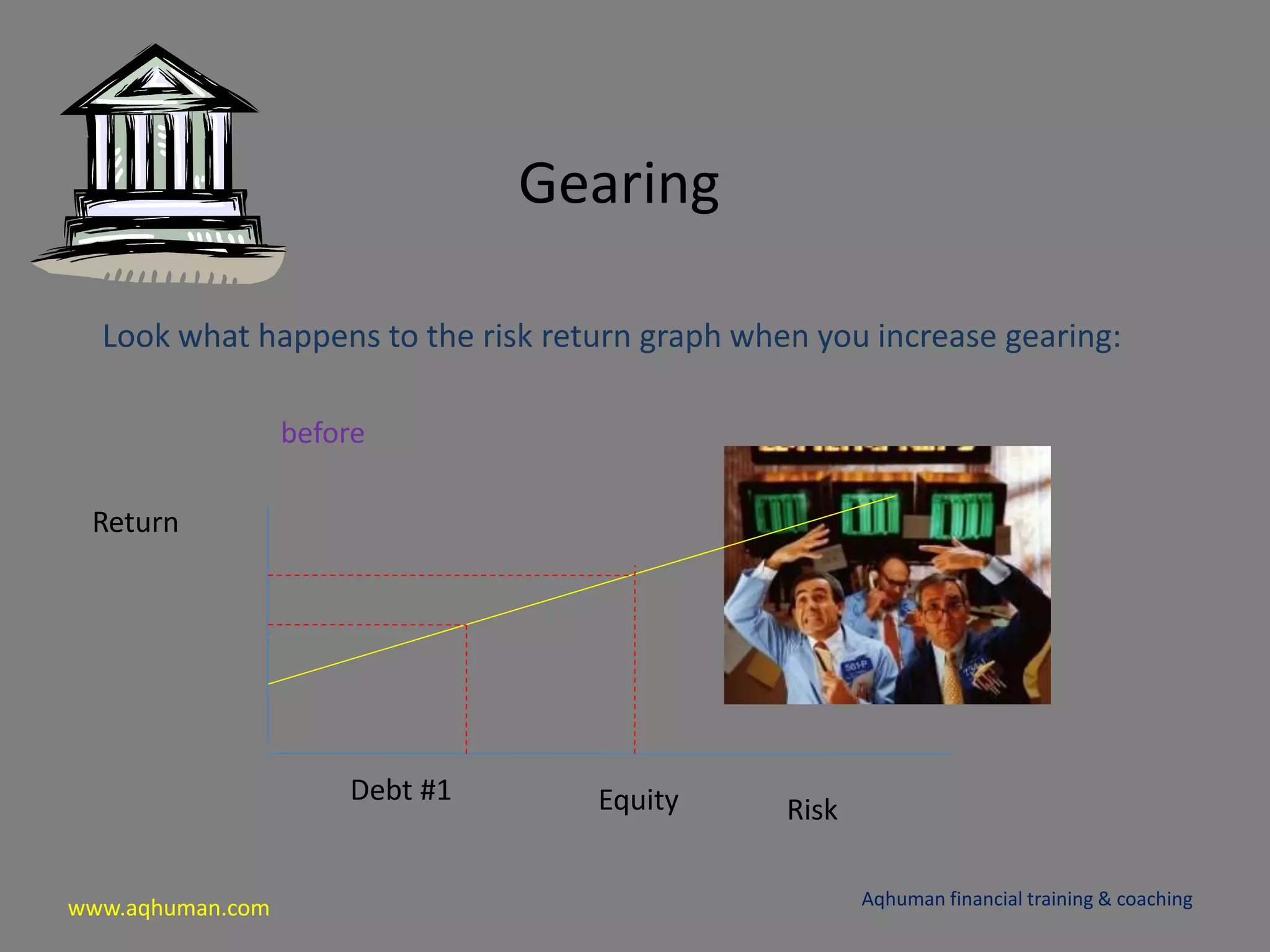

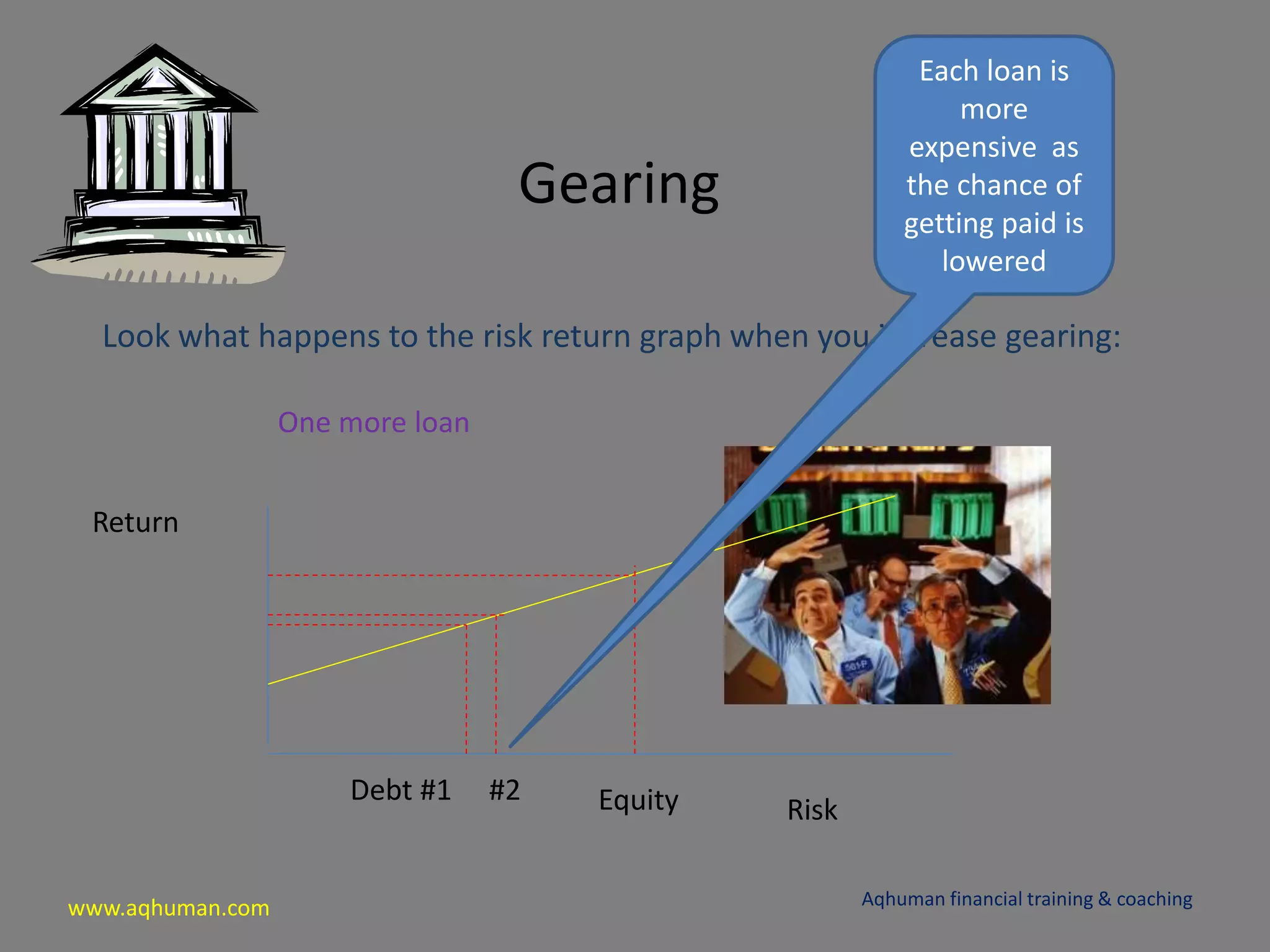

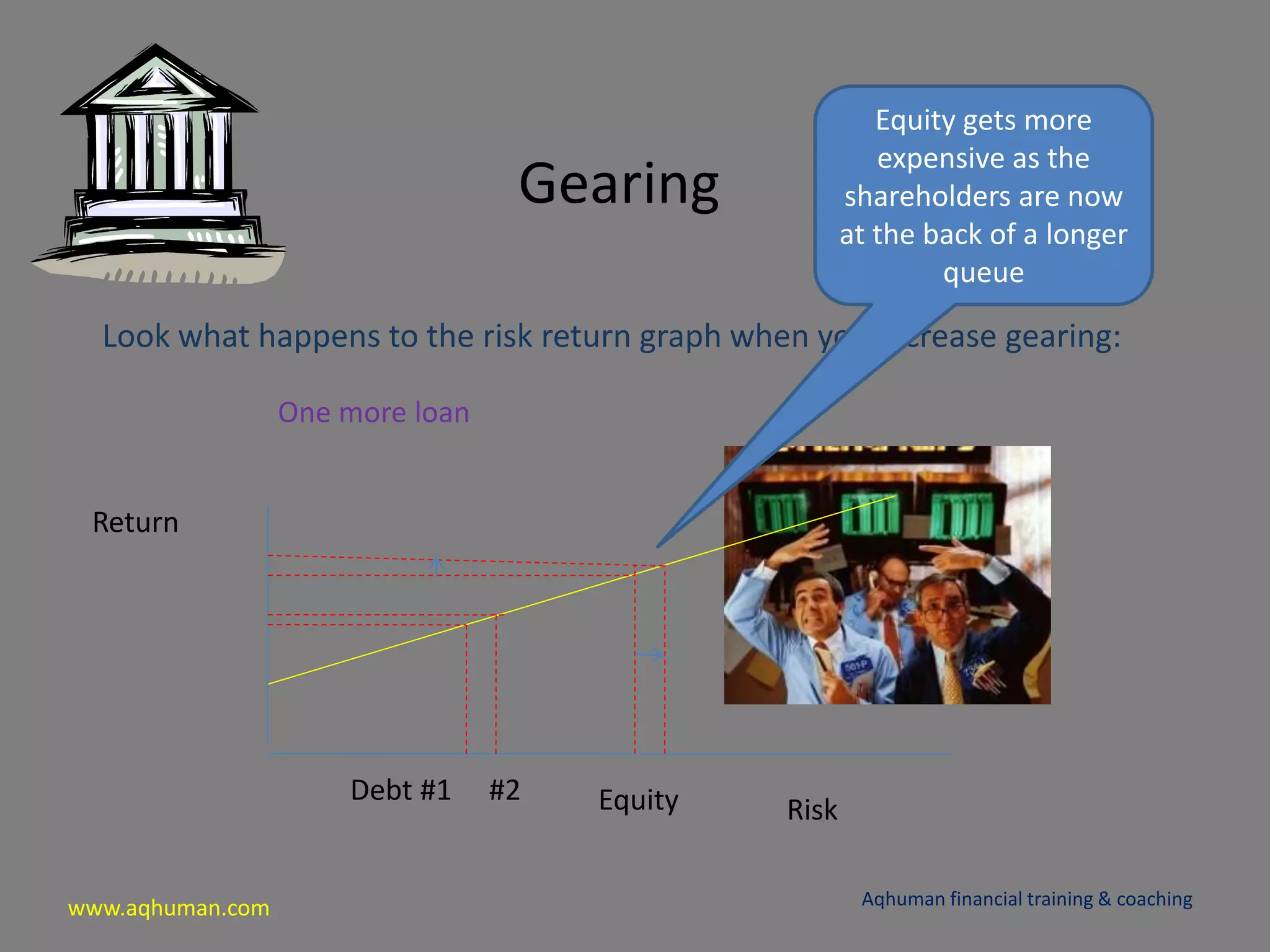

The document discusses key performance indicators such as operating margin, return on capital employed, and gearing. It defines operating margin as operating profit divided by revenue. Return on capital employed is defined as operating profit divided by capital employed, where capital employed equals debt plus equity. Gearing is the amount of debt financing a company uses, and is measured as debt divided by debt plus equity. Higher gearing increases risk but lowers the cost of capital due to tax deductibility of interest payments. Free cash flow is defined as cash from operations minus interest, tax, depreciation, and represents cash available to reinvest in the business or return to shareholders.