This document provides an overview of derivatives, including:

- Definitions of financial derivatives and how their value is derived from underlying assets like stocks, commodities, etc.

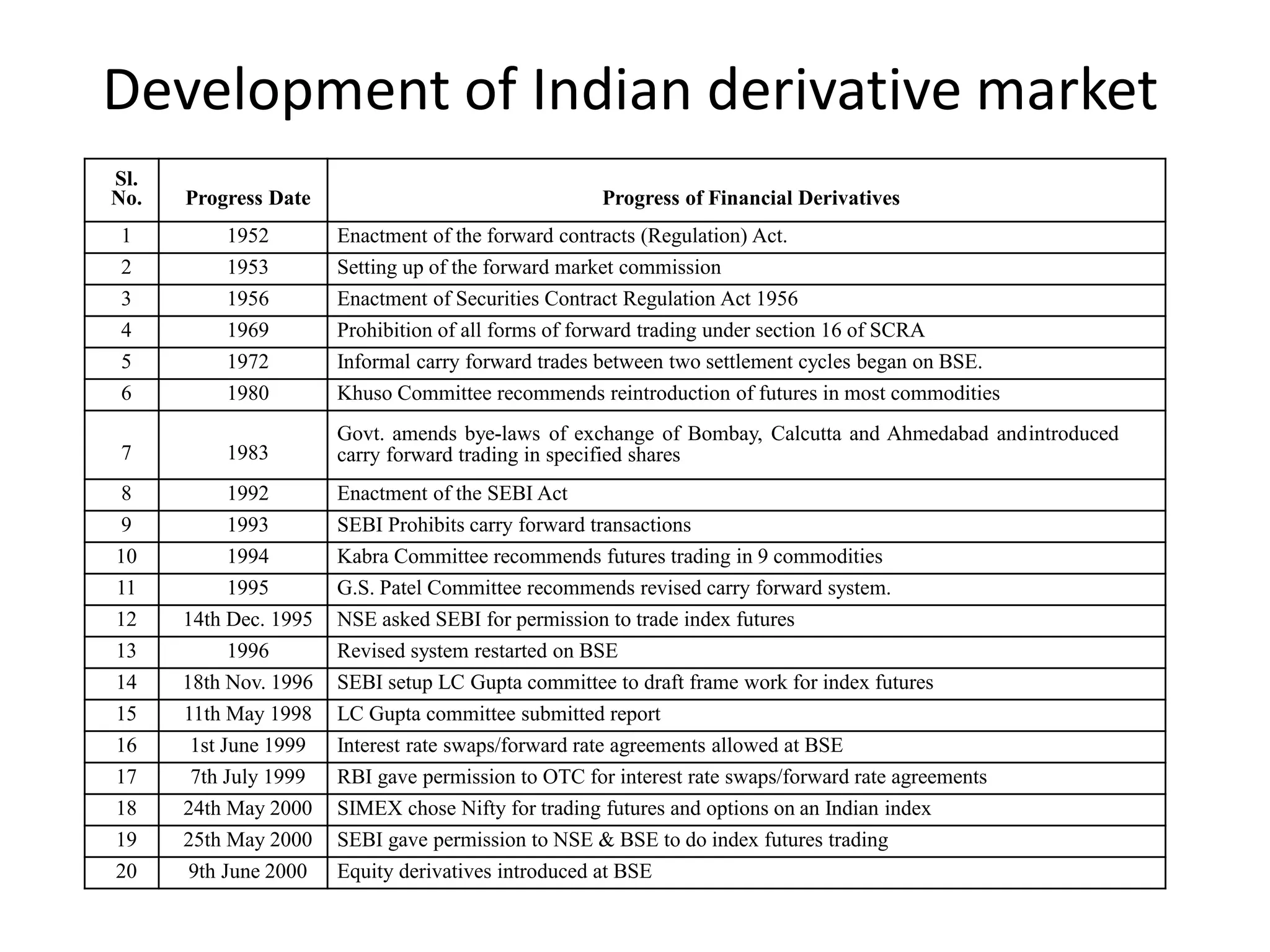

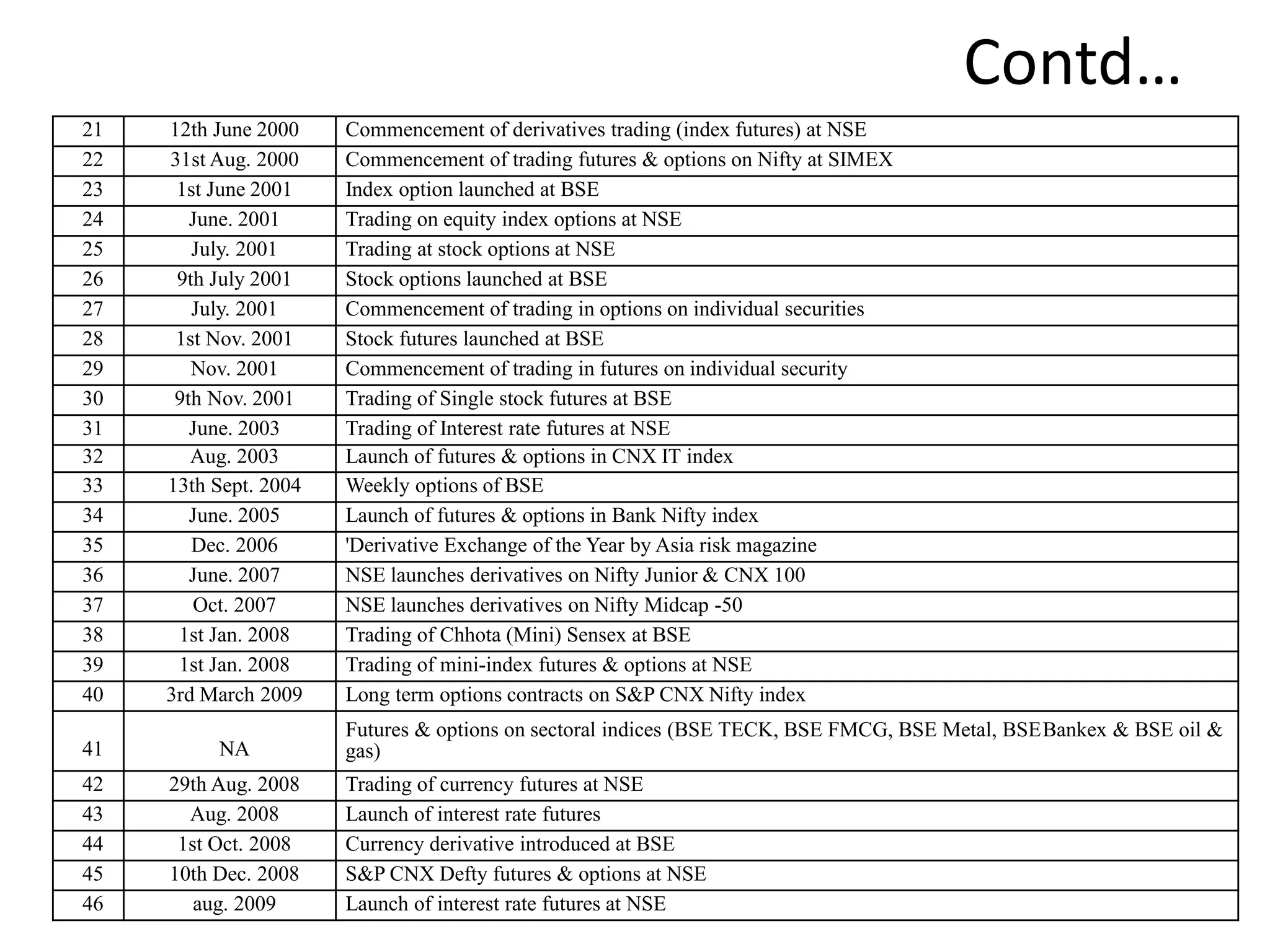

- The evolution of derivatives markets in India since the 19th century and key milestones in developing exchange-traded derivatives.

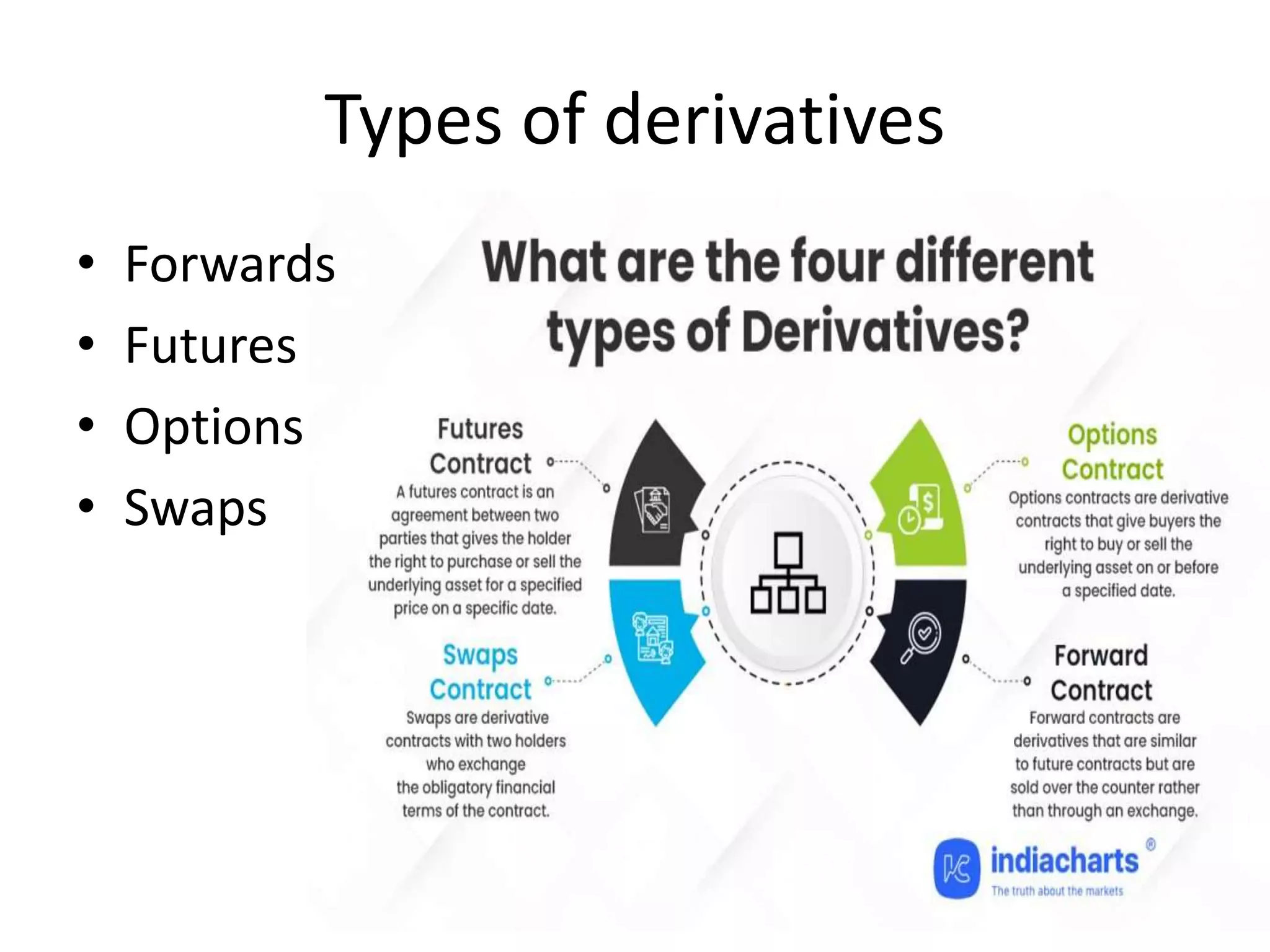

- Features and types of common derivative instruments like futures, options, swaps, and forwards.

- Participants in derivatives markets like speculators, hedgers, arbitrageurs, and margin traders.

- Uses of derivatives like risk management, hedging, speculation, and arbitrage between markets.

- The fundamental linkage between the spot and derivatives markets through arbitrage and the law of one price.