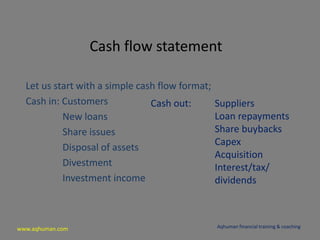

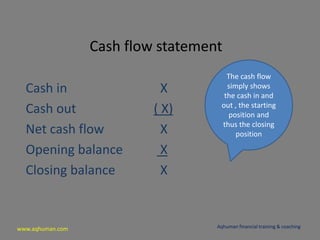

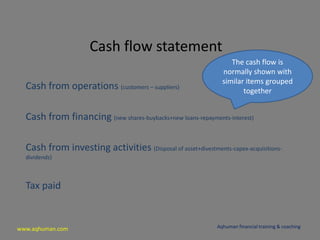

The document discusses the cash flow statement format and purpose. It begins by outlining the basic cash in and cash out categories including customers, loans, share issues, assets, suppliers, loan repayments, share buybacks, capital expenditures, and acquisitions. It then shows how net cash flow is calculated from beginning and ending balances. Key points made are that the cash flow statement simply shows actual cash movements, company survival depends on cash, and growth requires generating cash. The cash flow groups similar items like operations, financing, and investing activities and is popular because it shows real cash amounts without accounting rules.