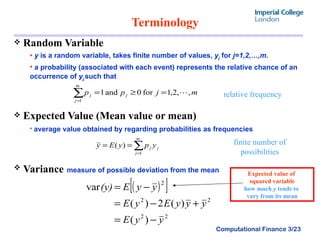

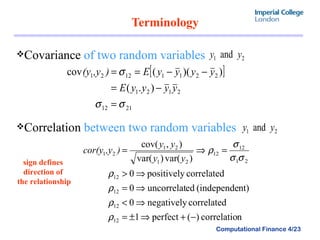

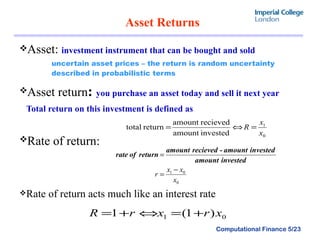

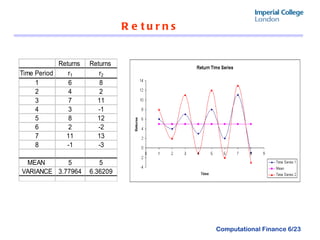

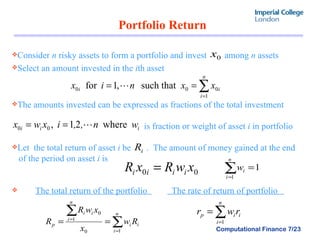

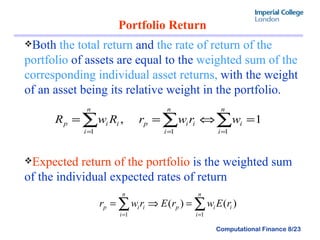

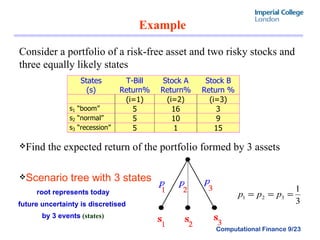

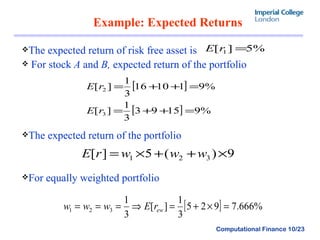

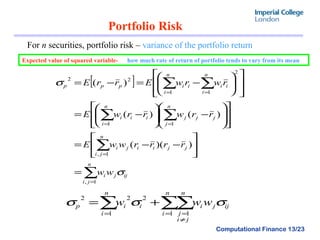

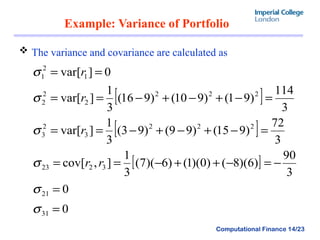

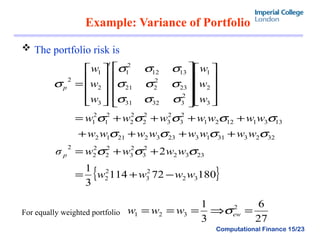

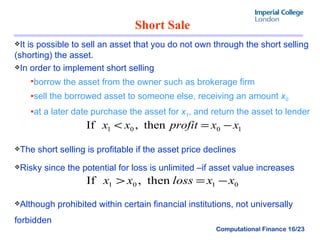

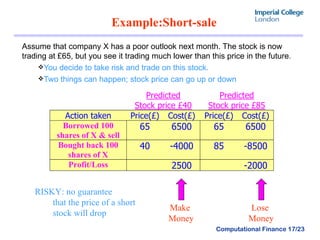

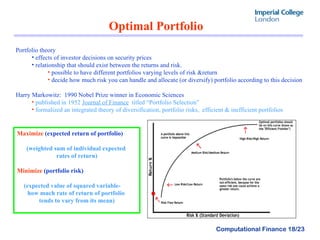

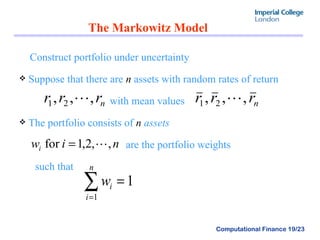

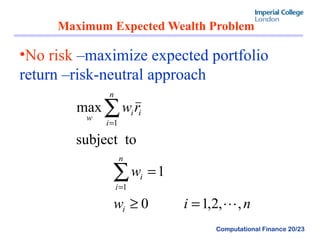

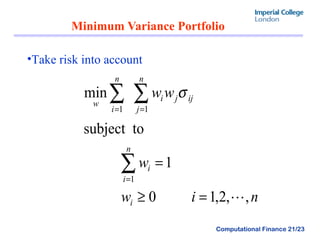

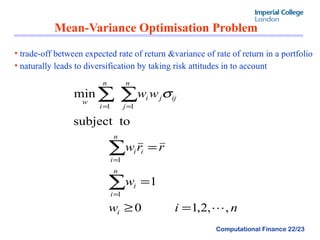

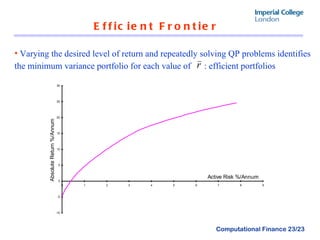

The document provides an overview of key concepts in portfolio optimization and the Markowitz model. It defines terms like random variables, mean, variance, correlation, asset returns, portfolio return, risk, and diversification. It then describes how the Markowitz model uses a mean-variance approach to optimize a portfolio by maximizing expected return for a given level of risk. The efficient frontier shows the minimum risk portfolio for each level of expected return.