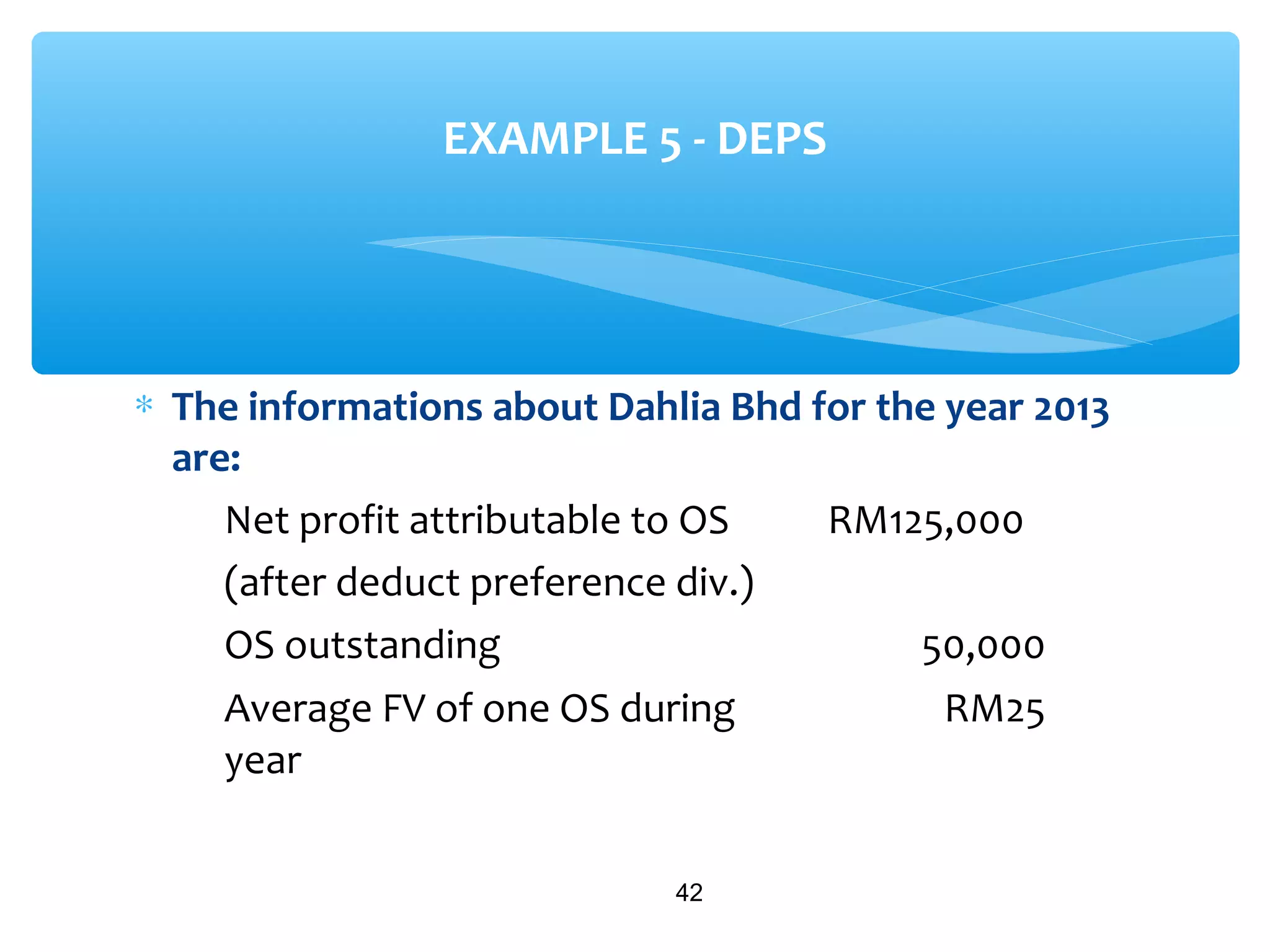

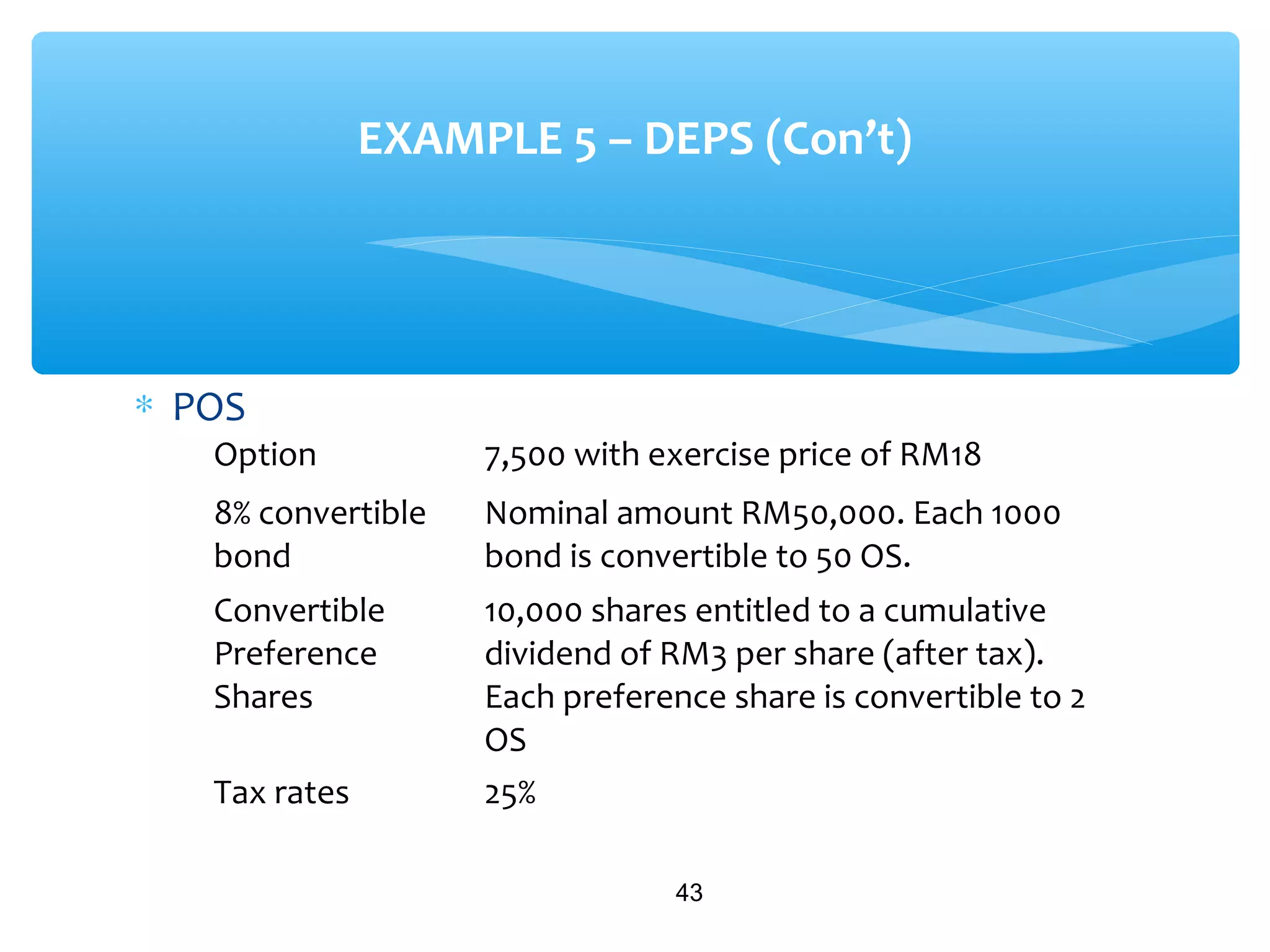

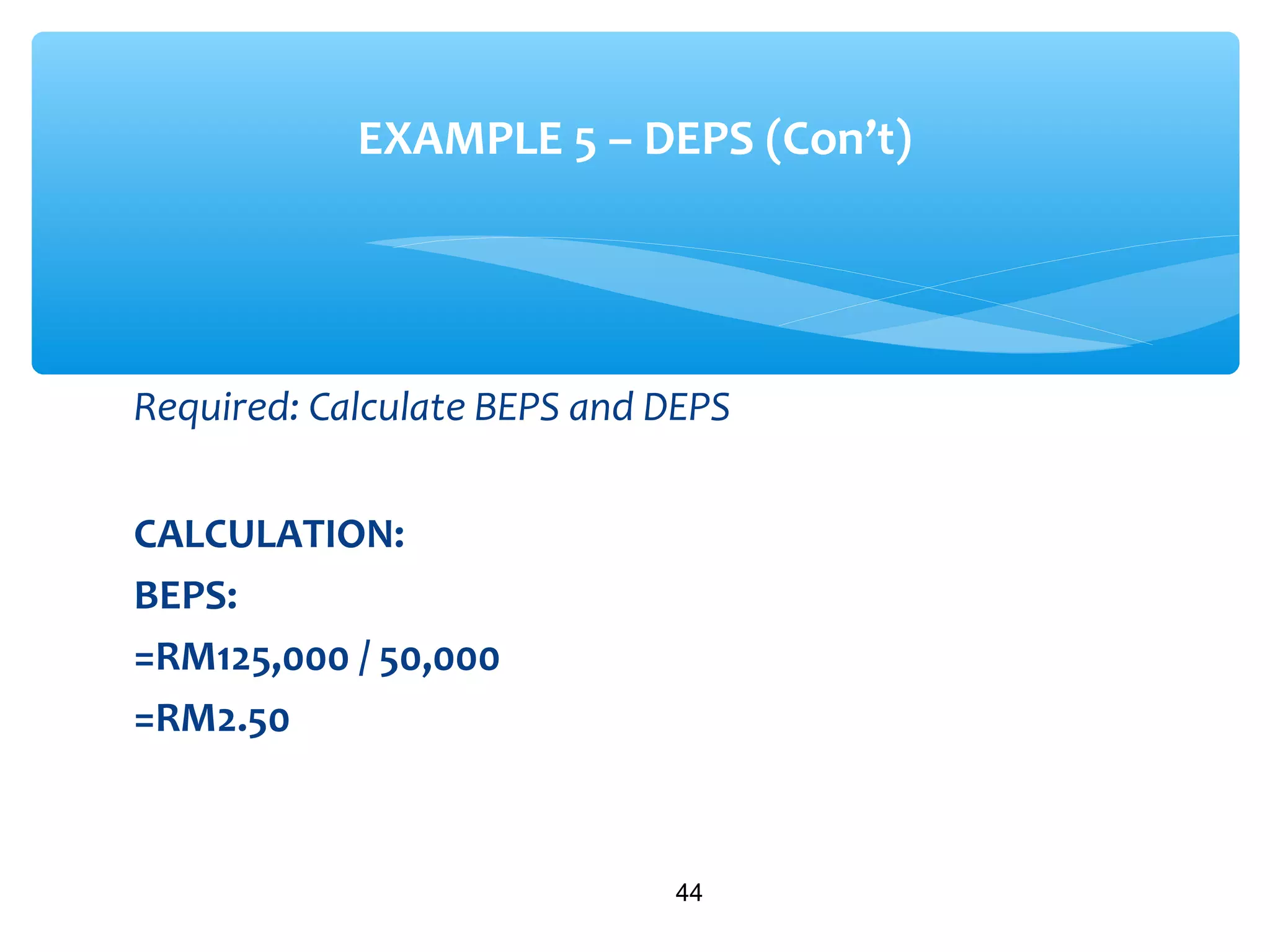

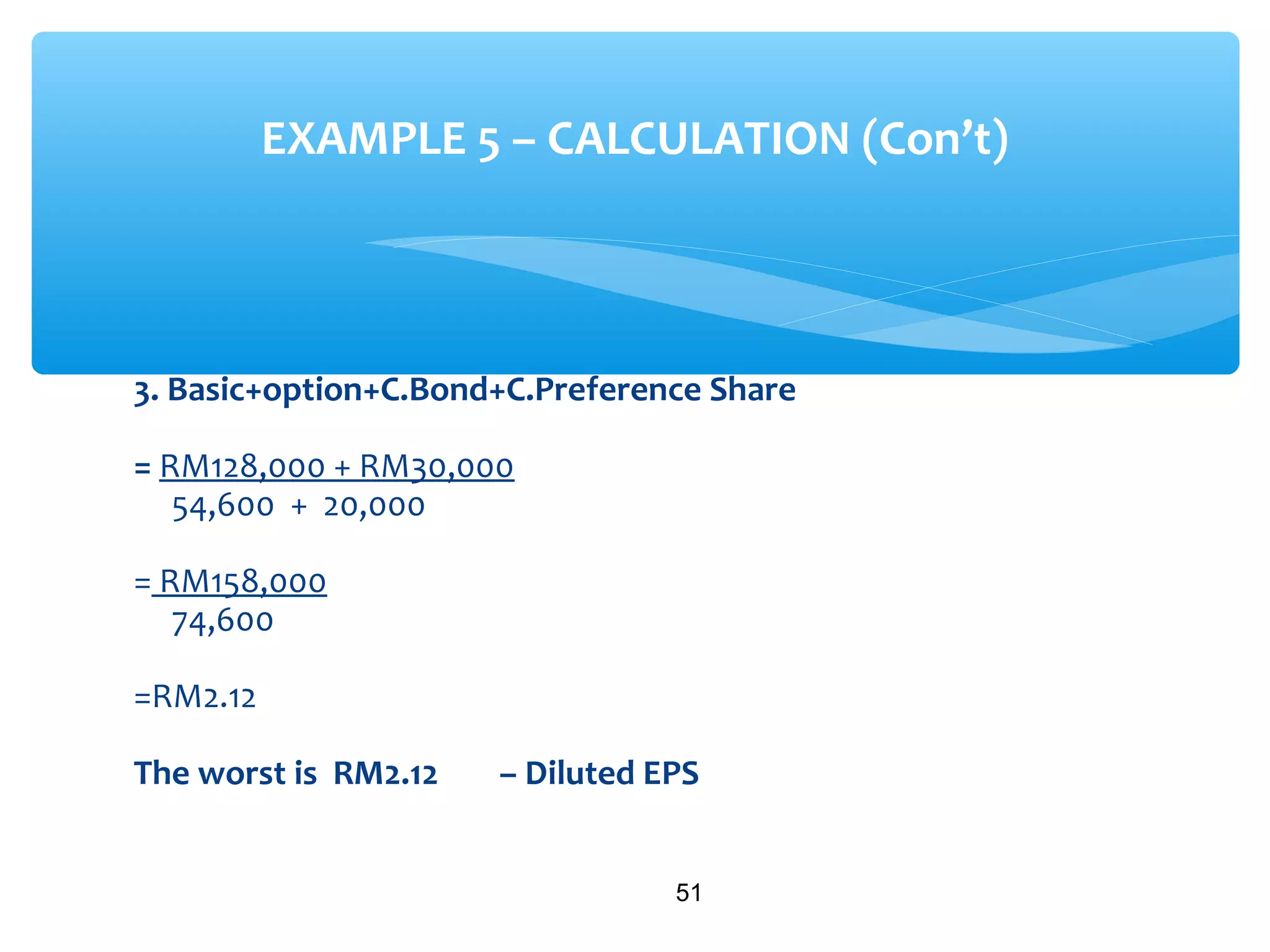

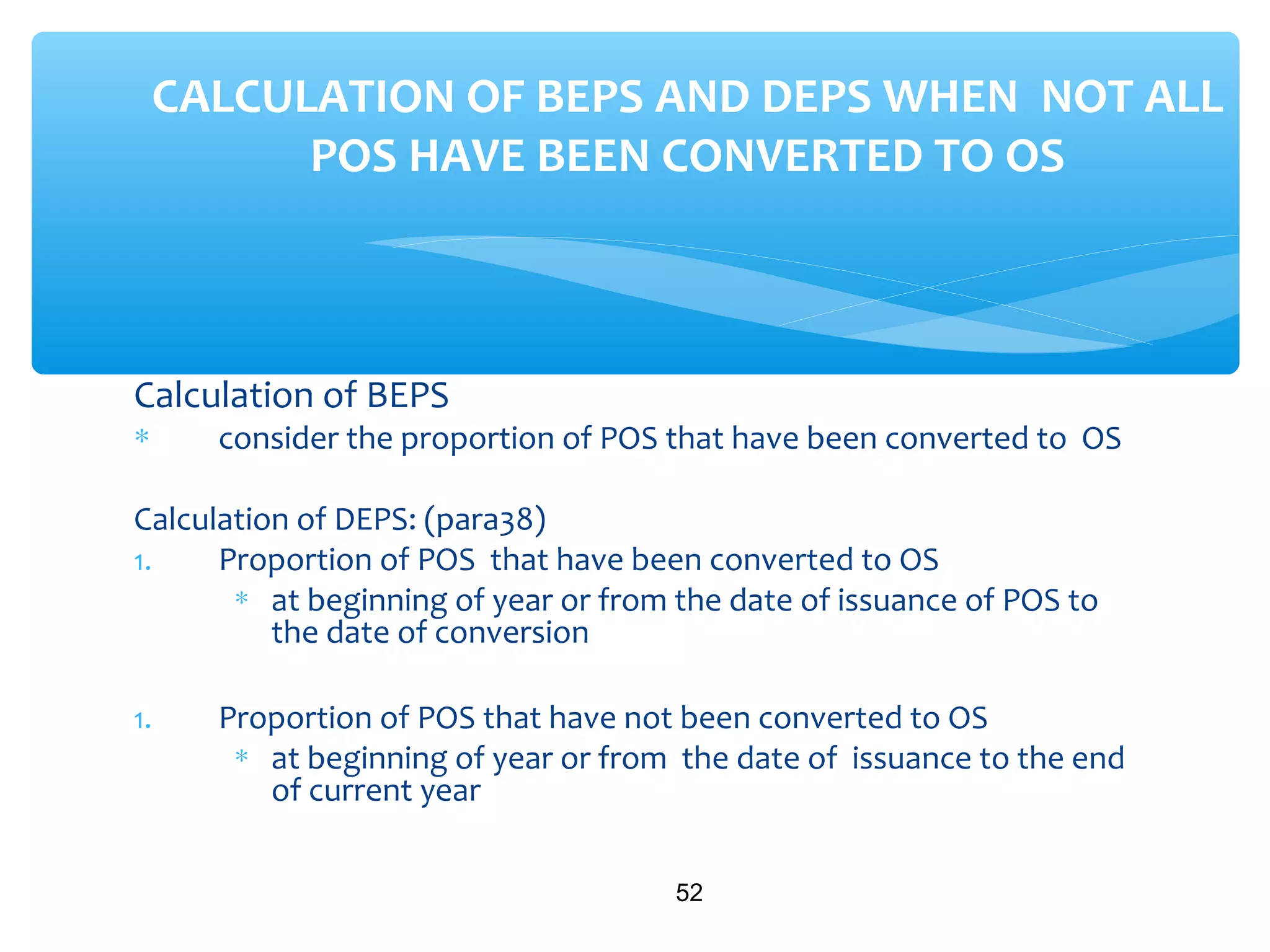

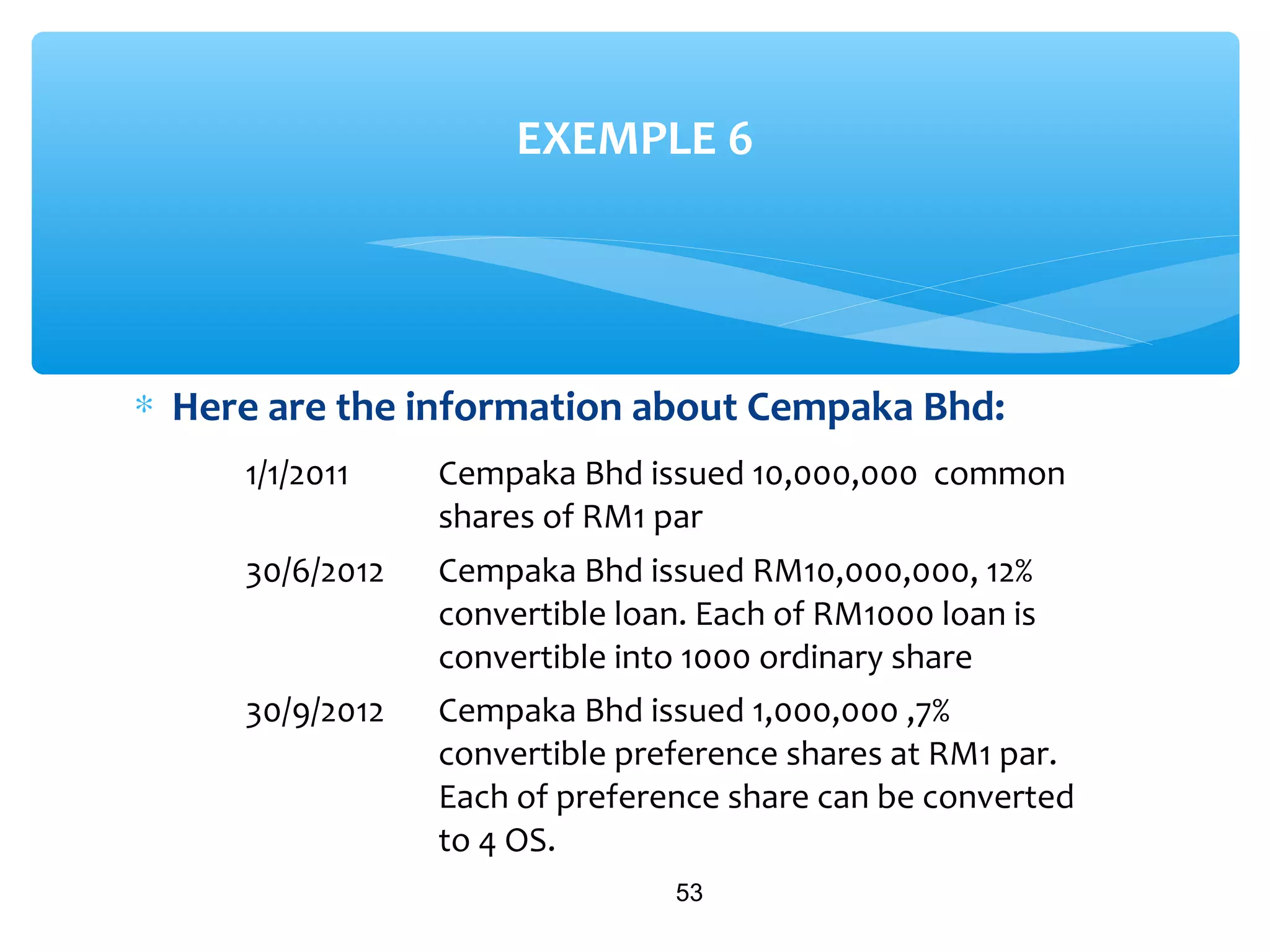

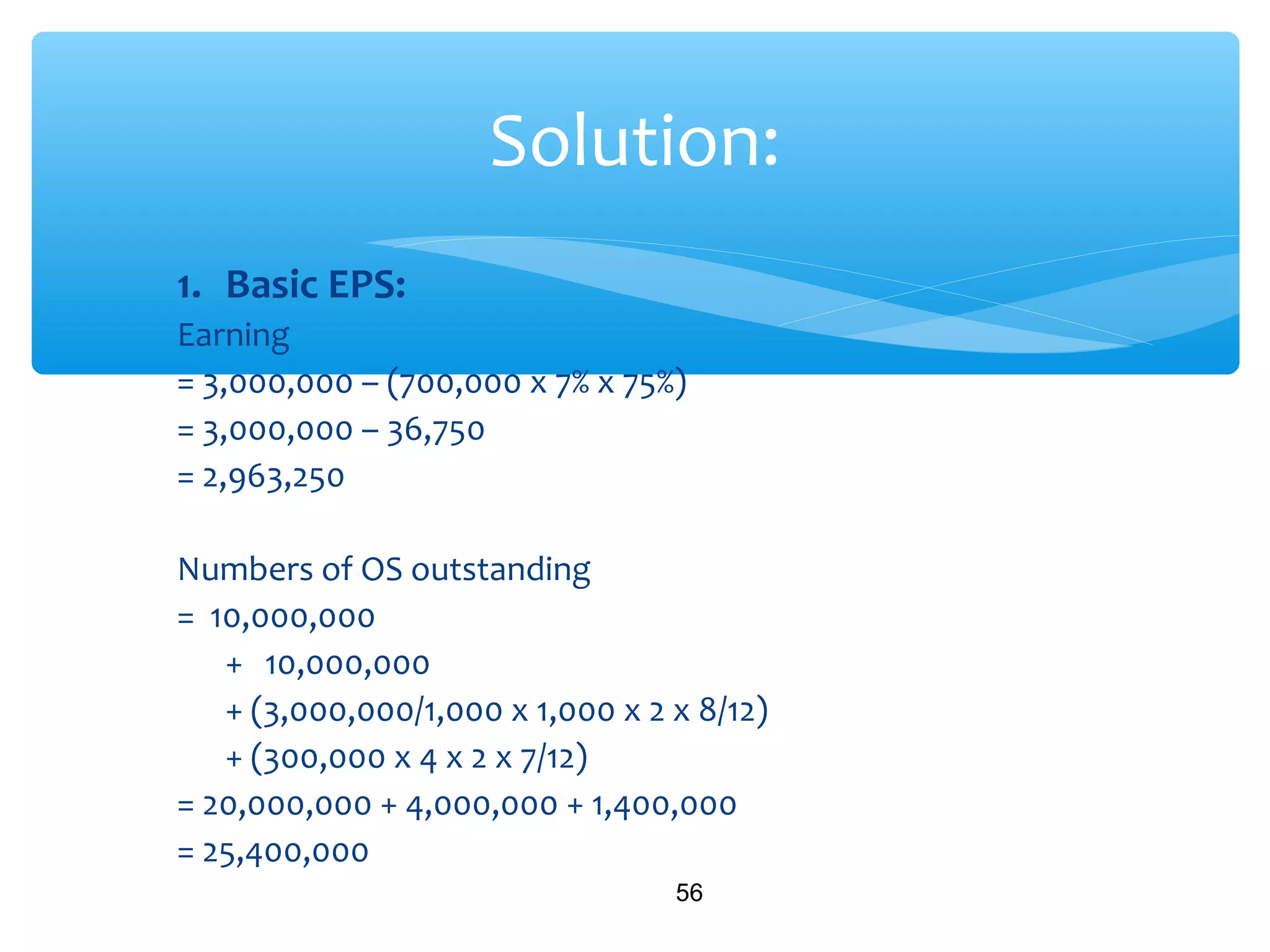

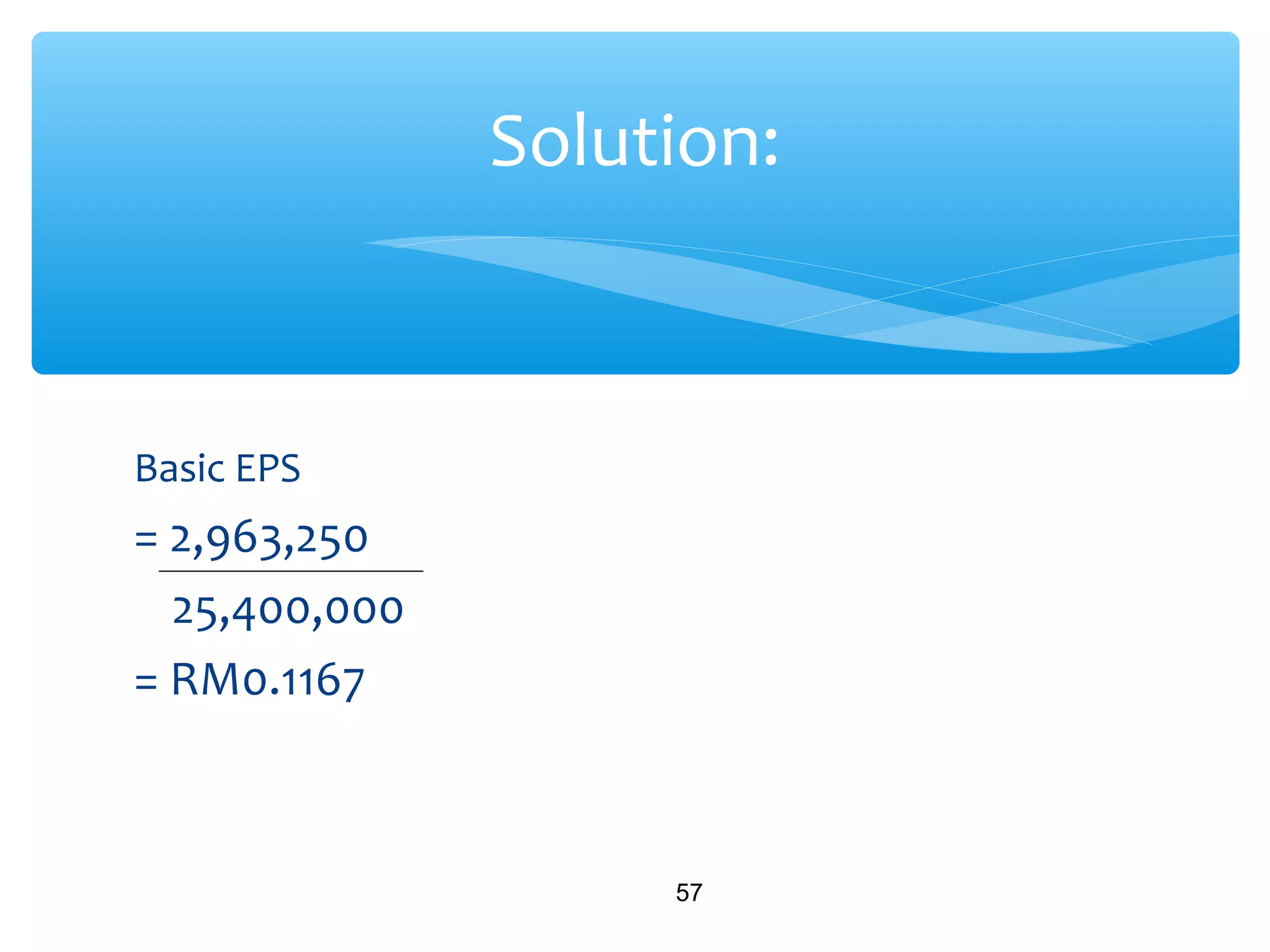

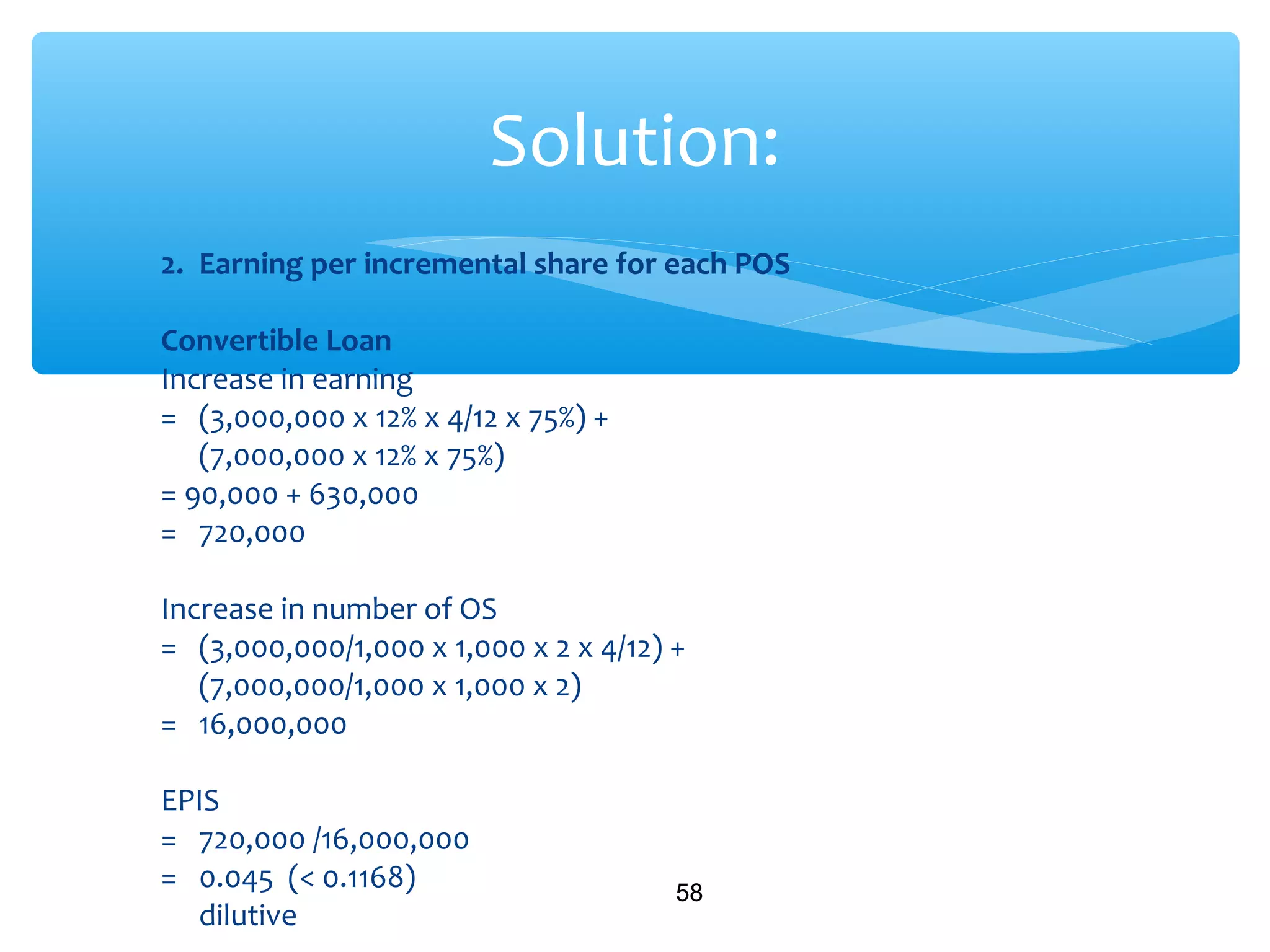

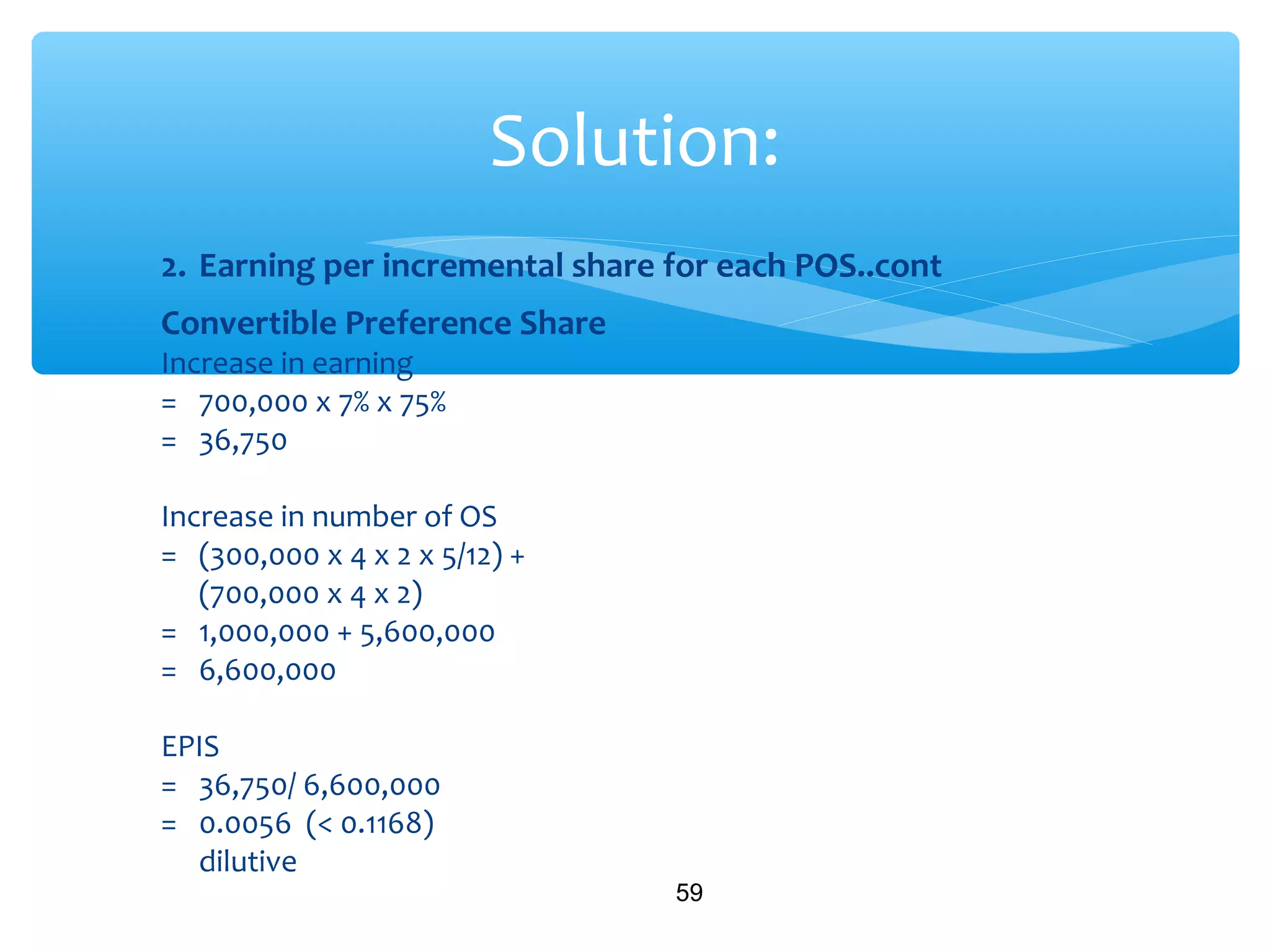

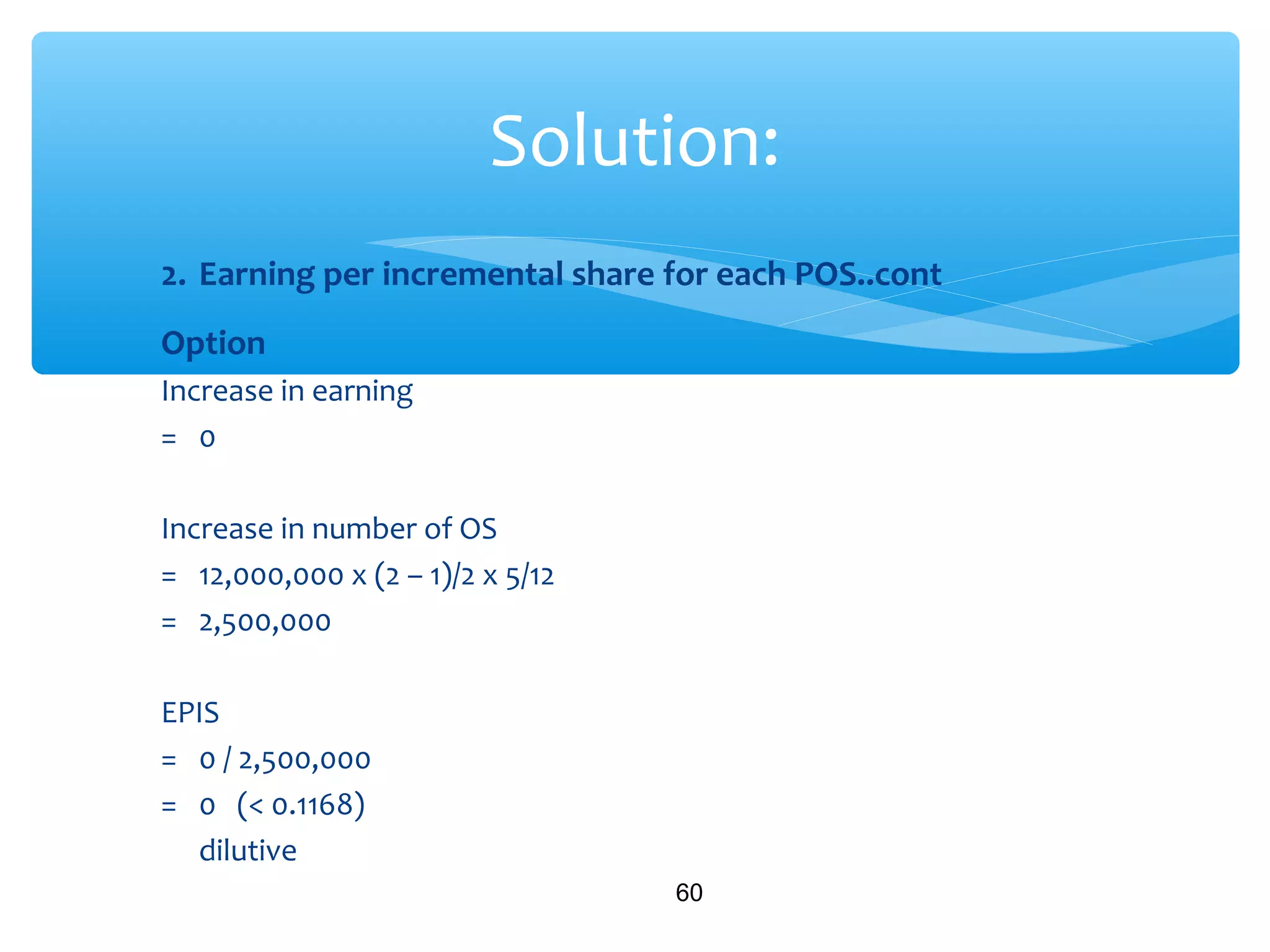

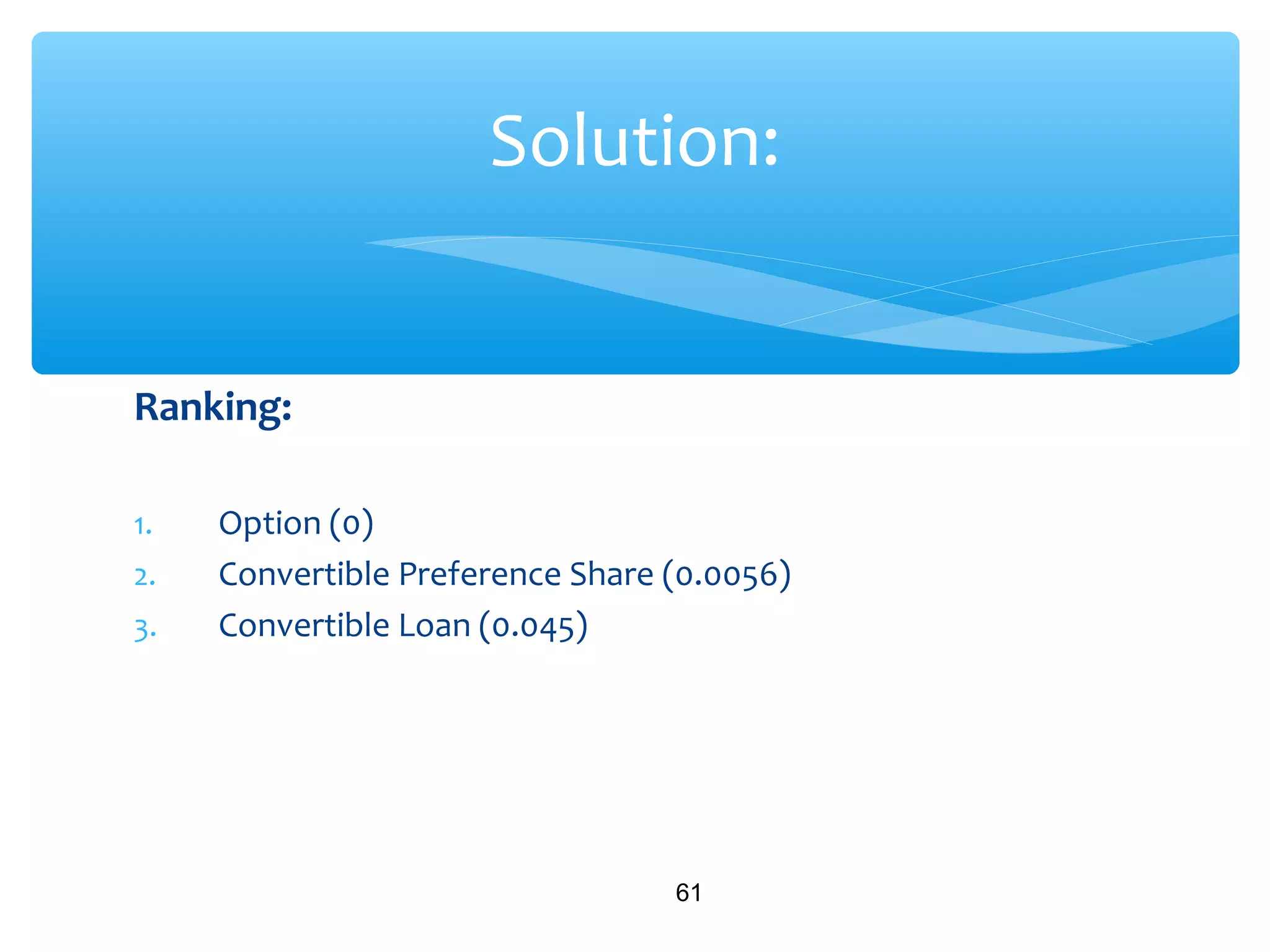

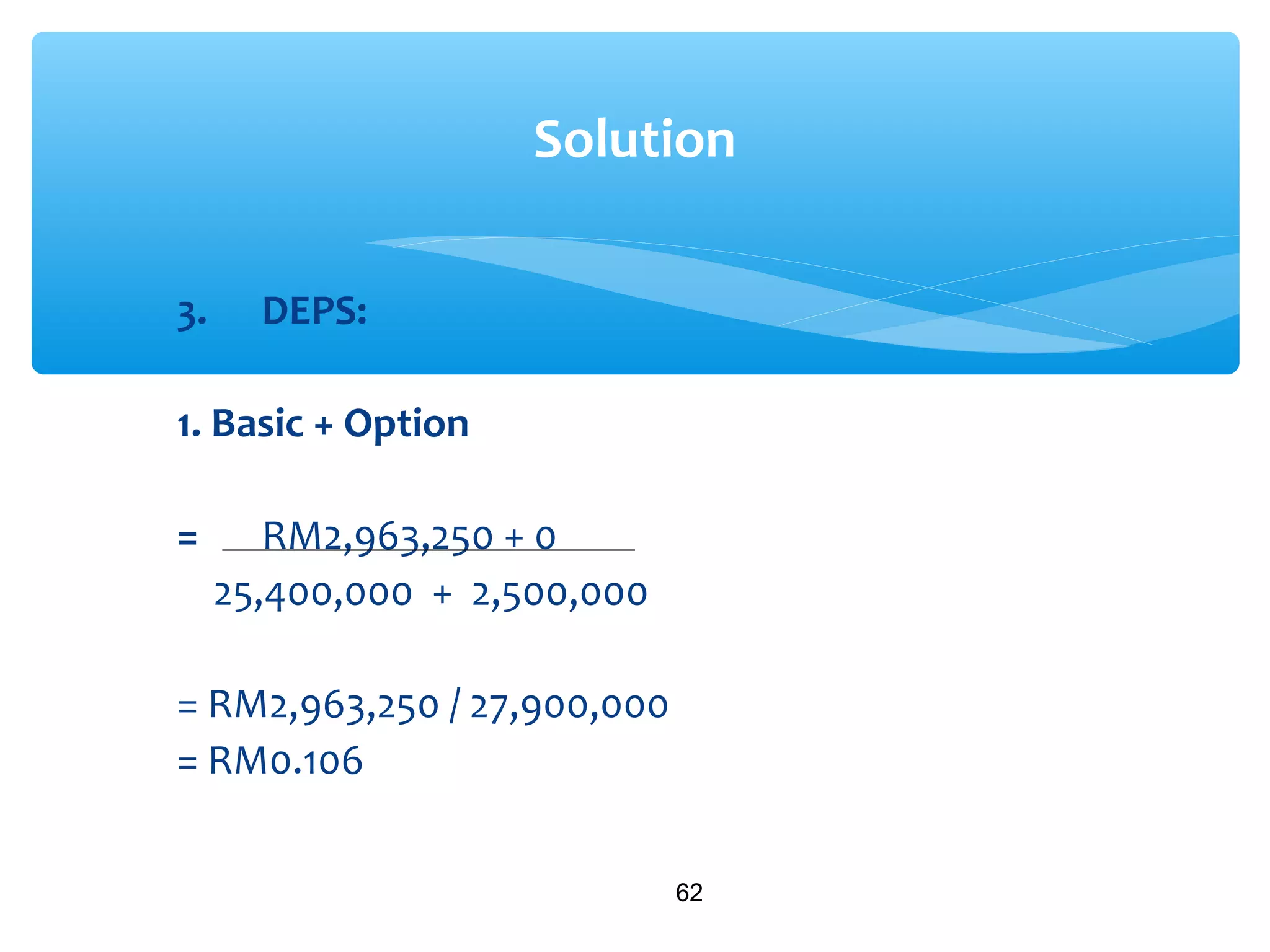

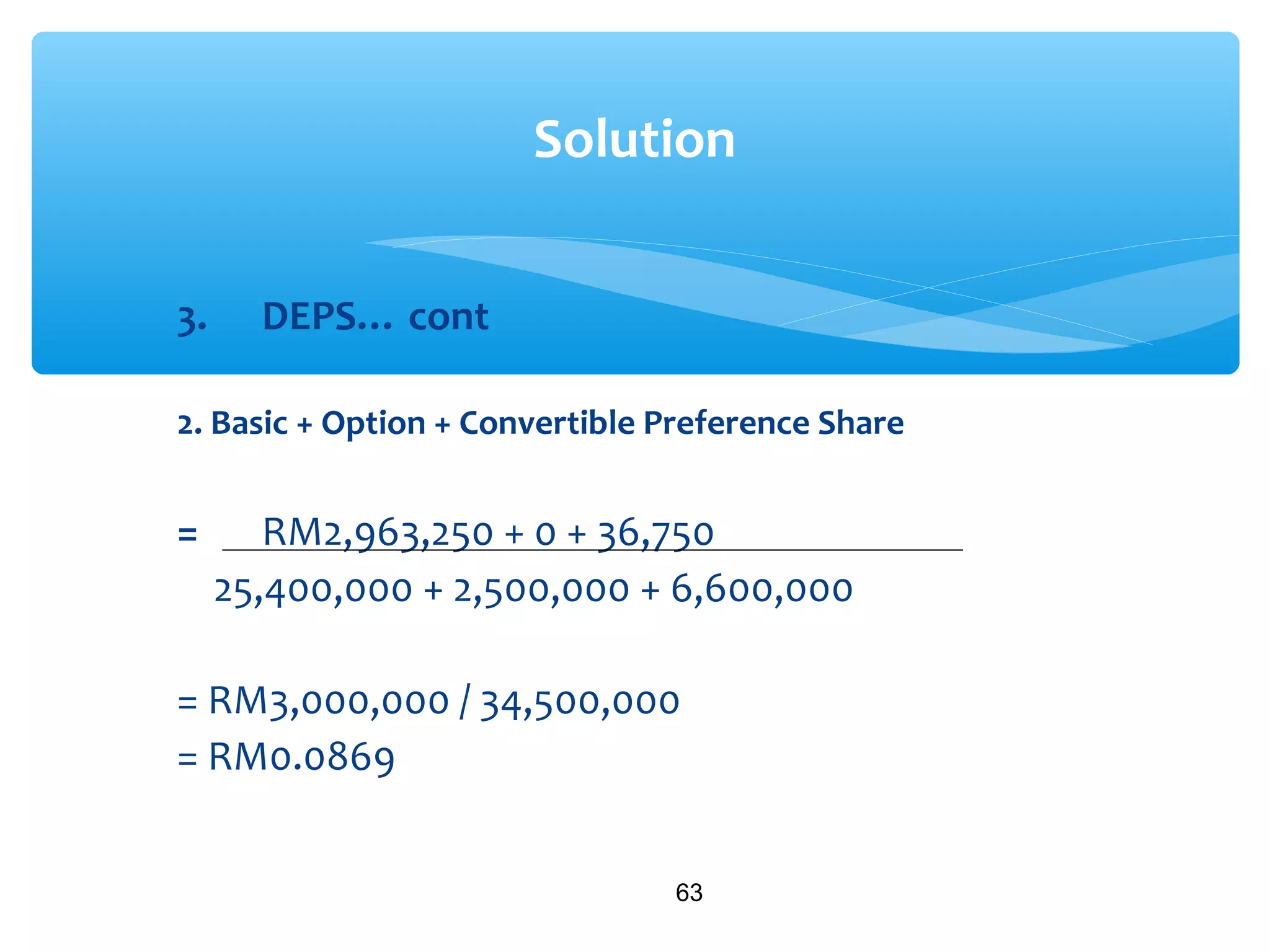

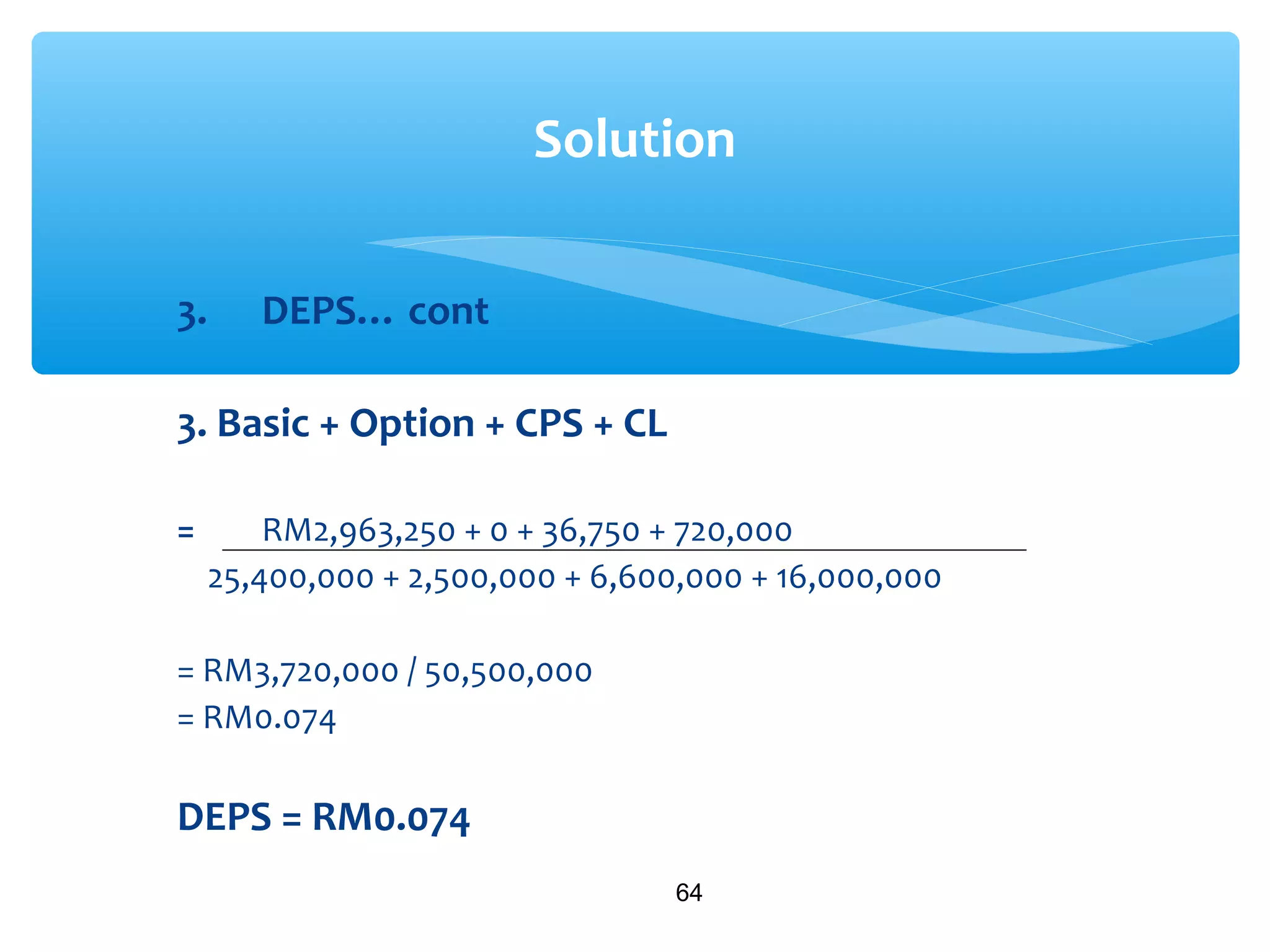

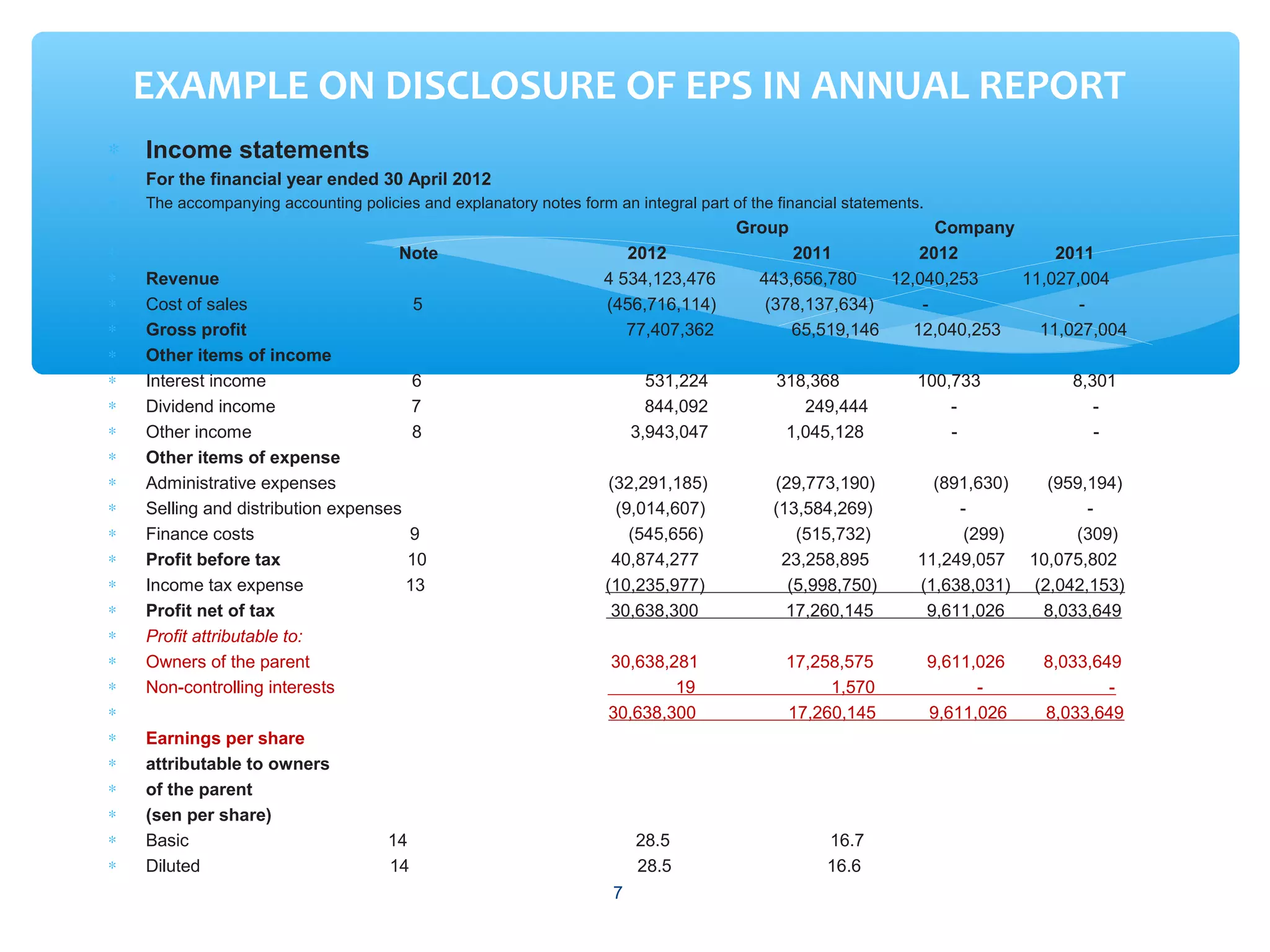

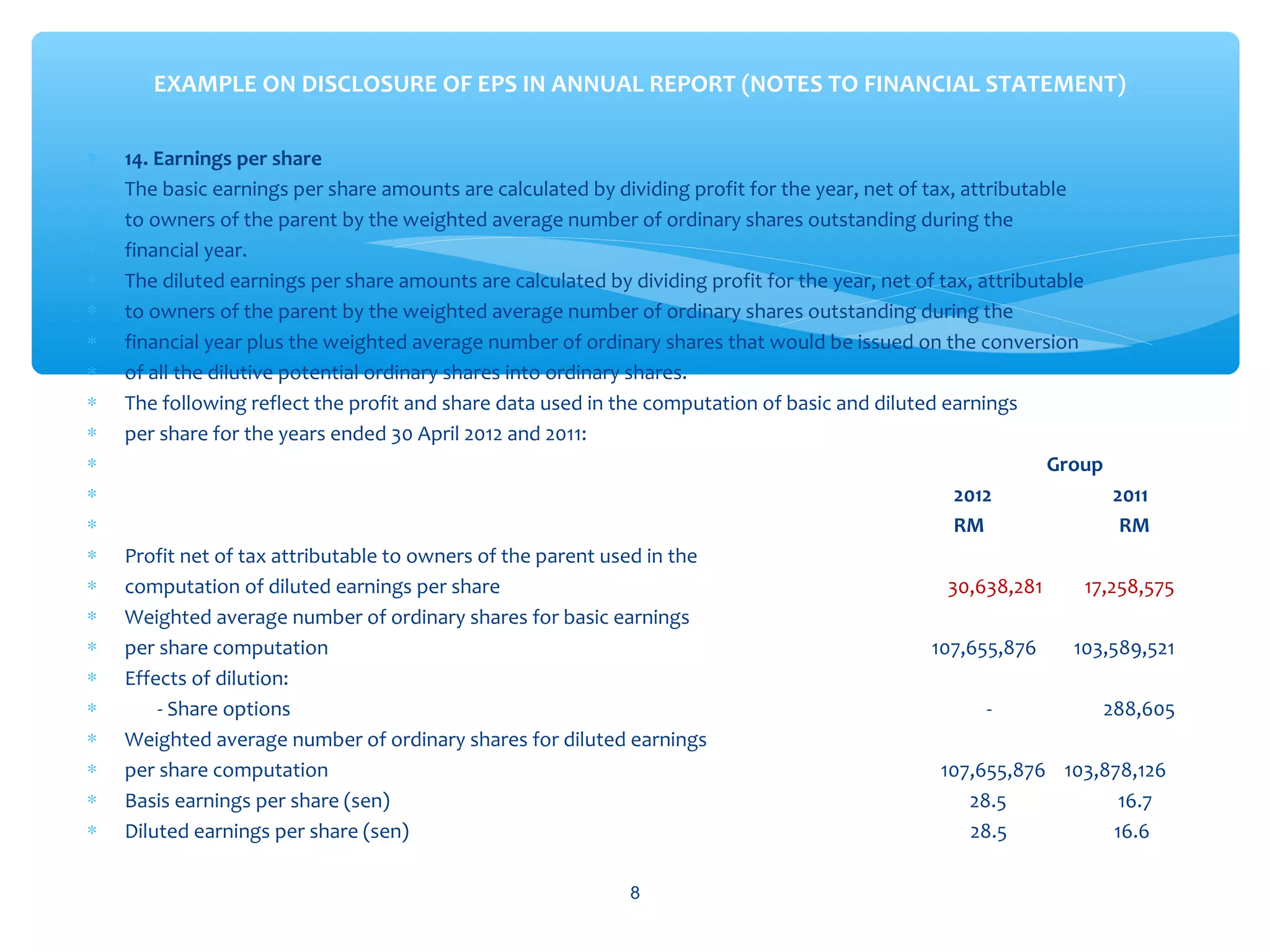

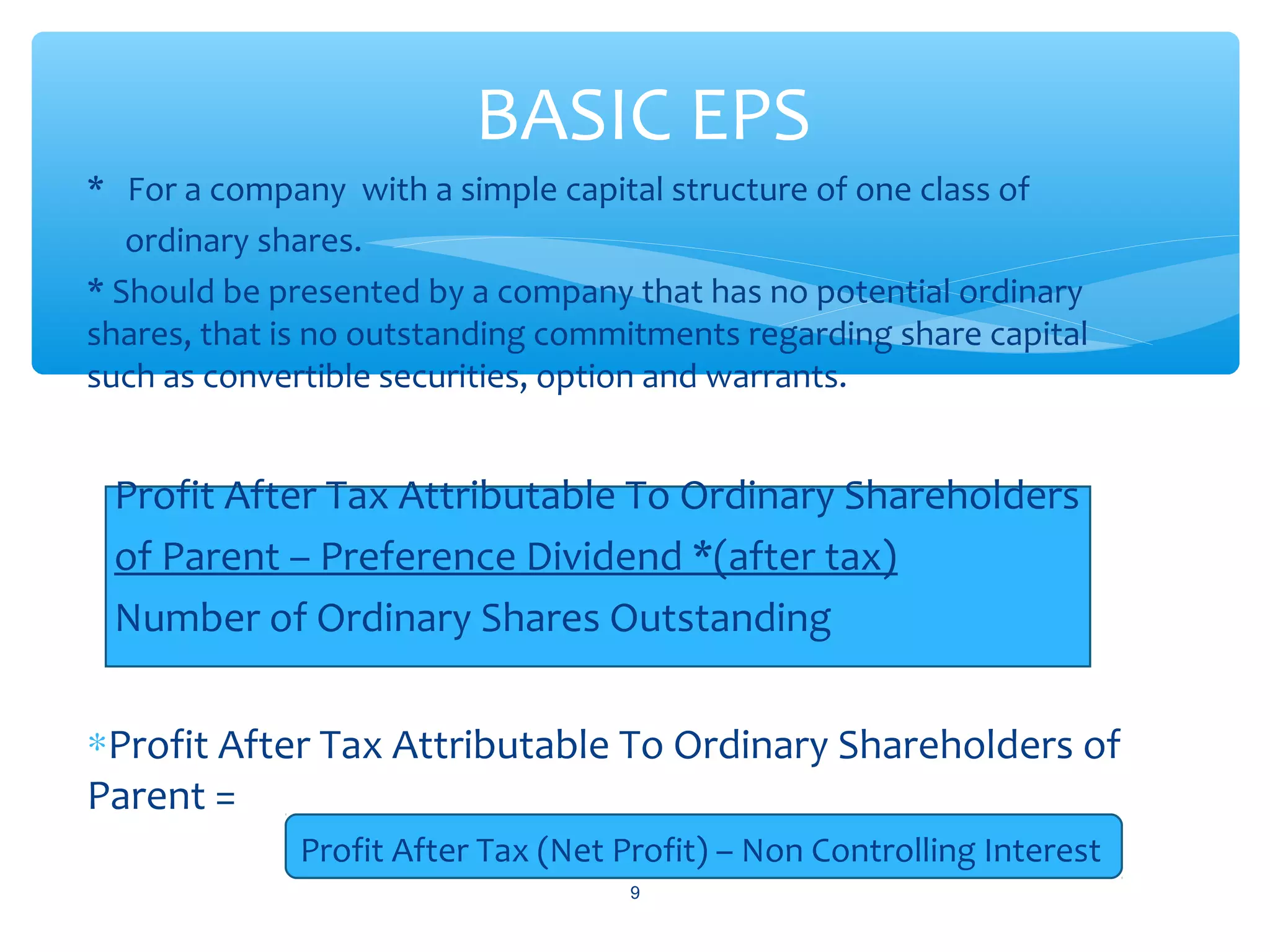

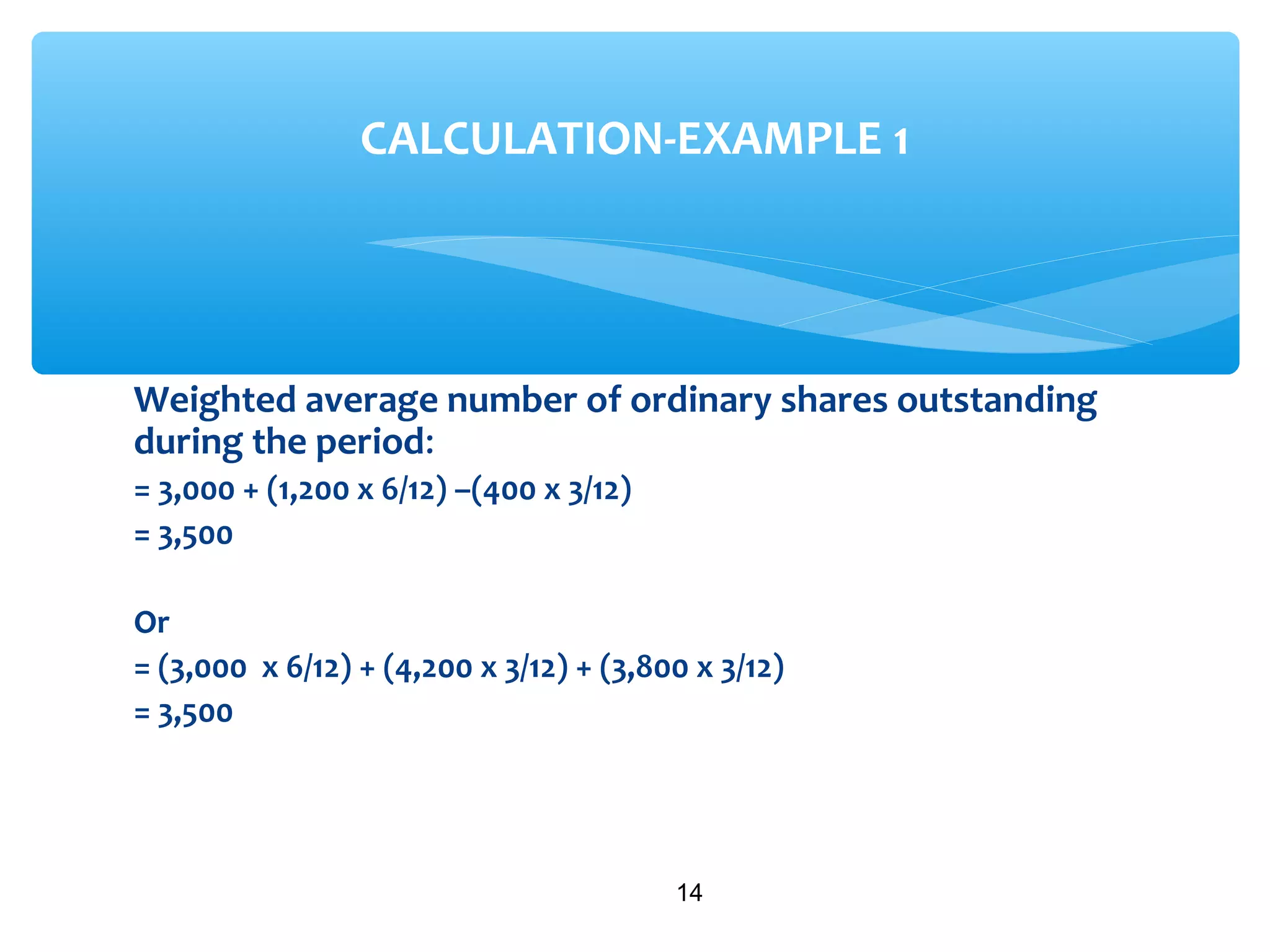

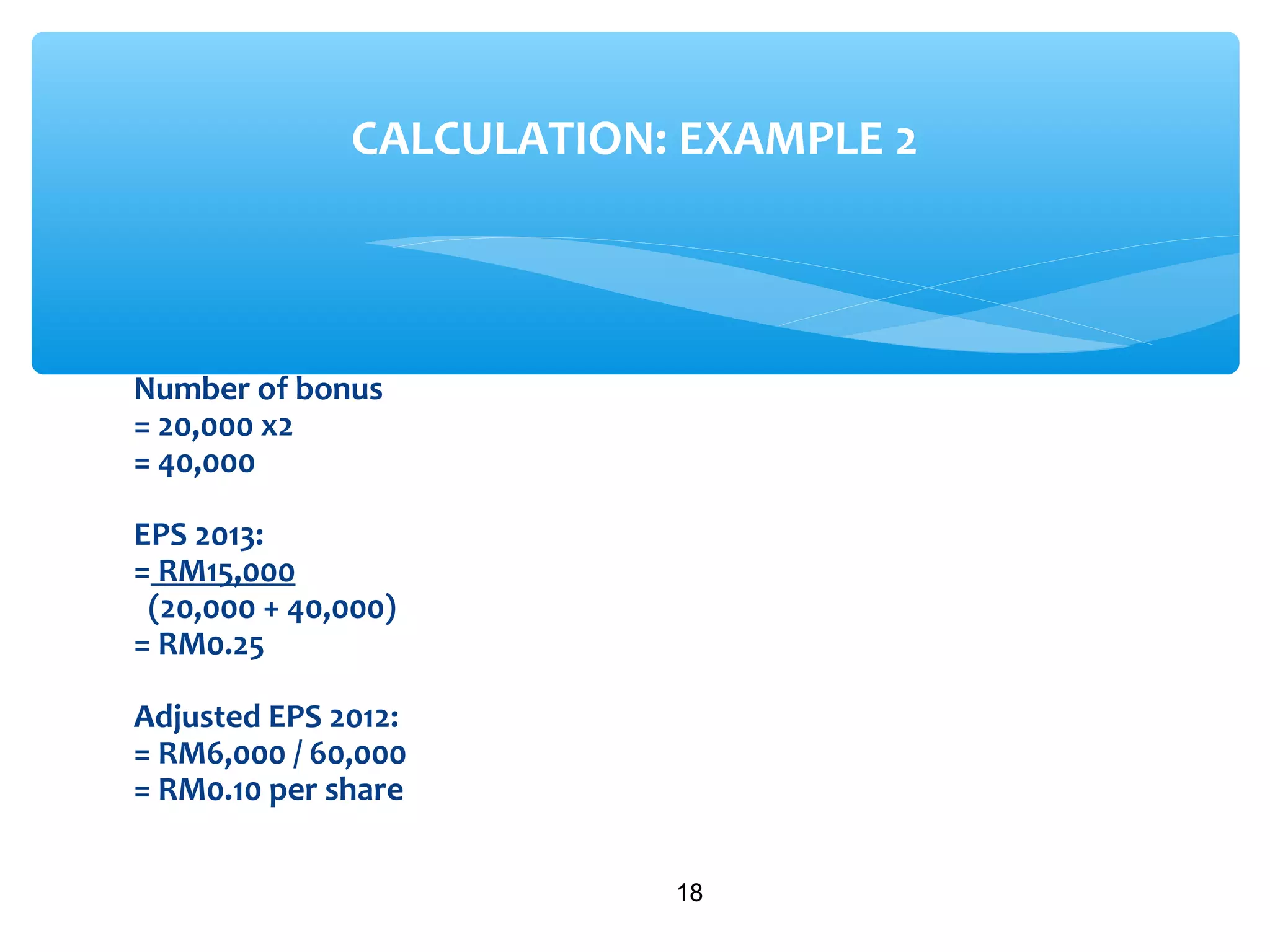

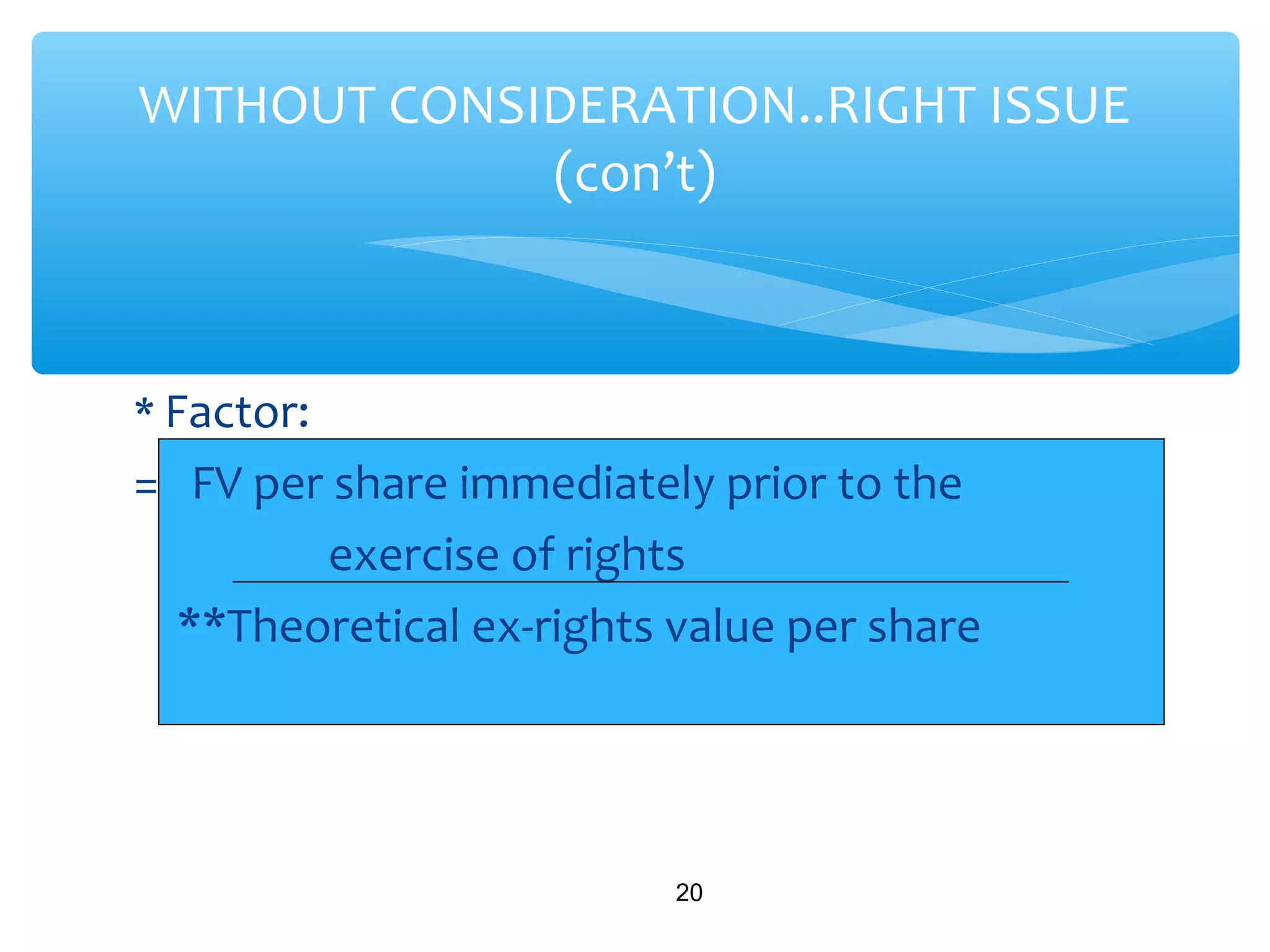

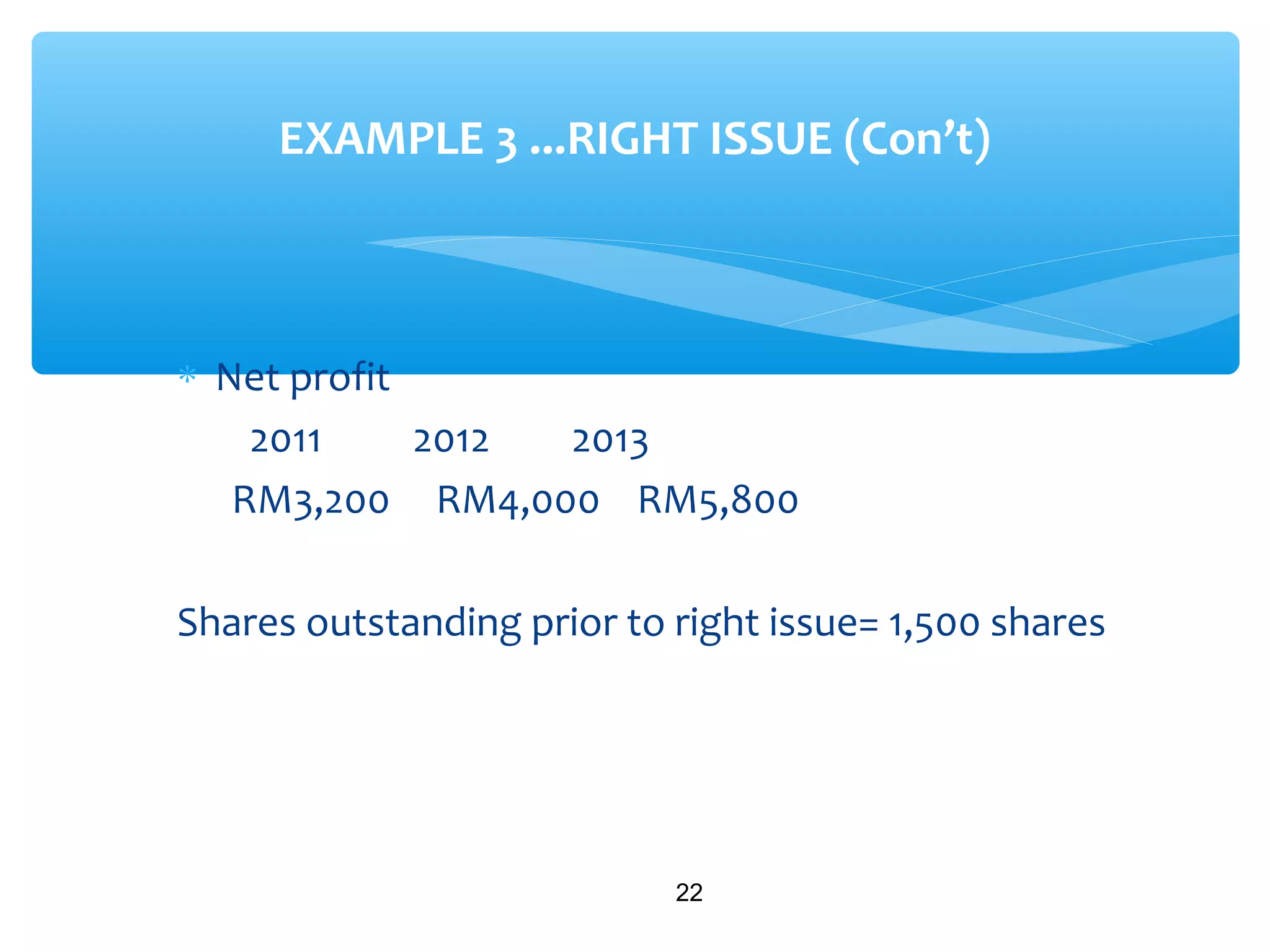

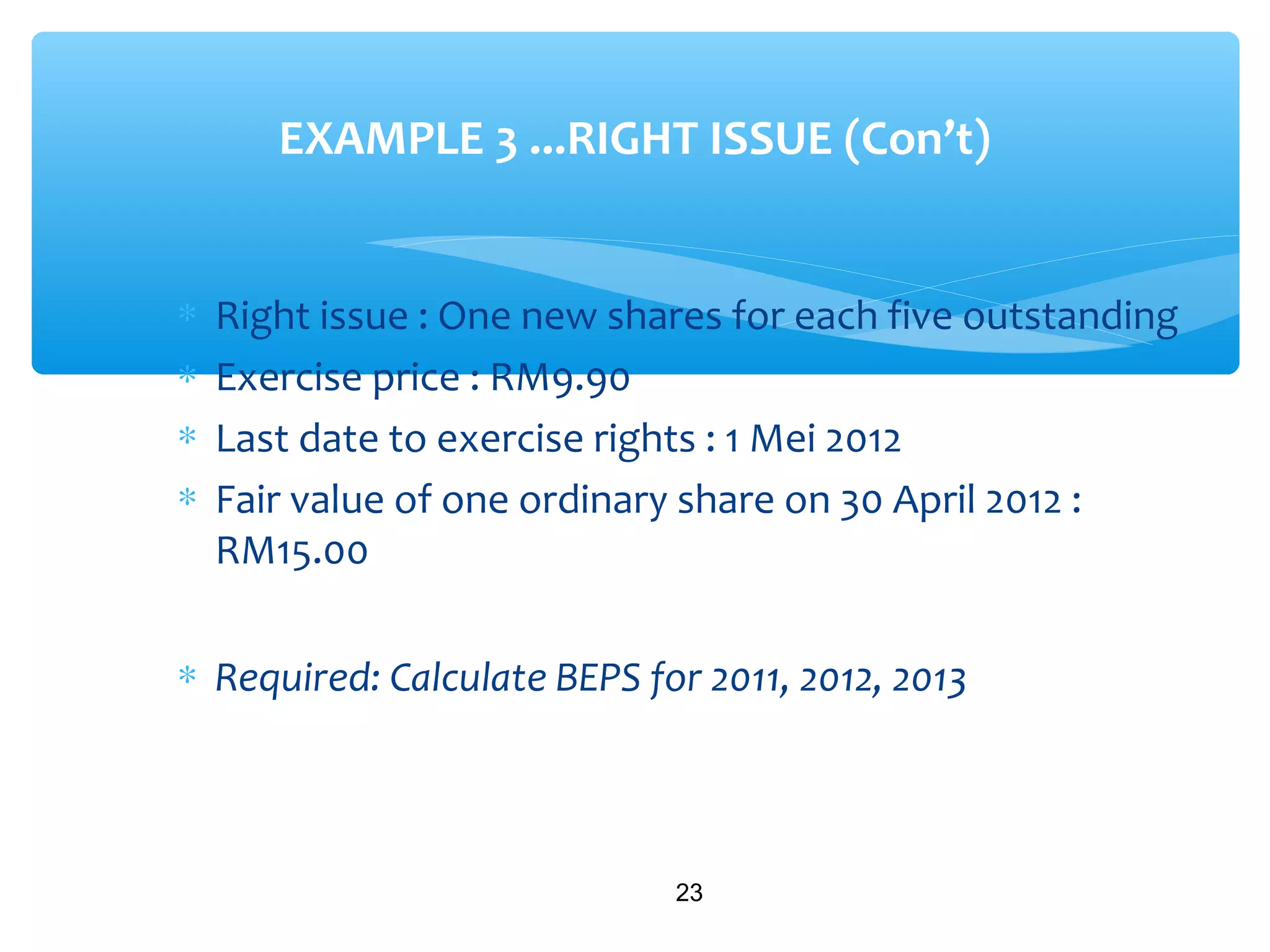

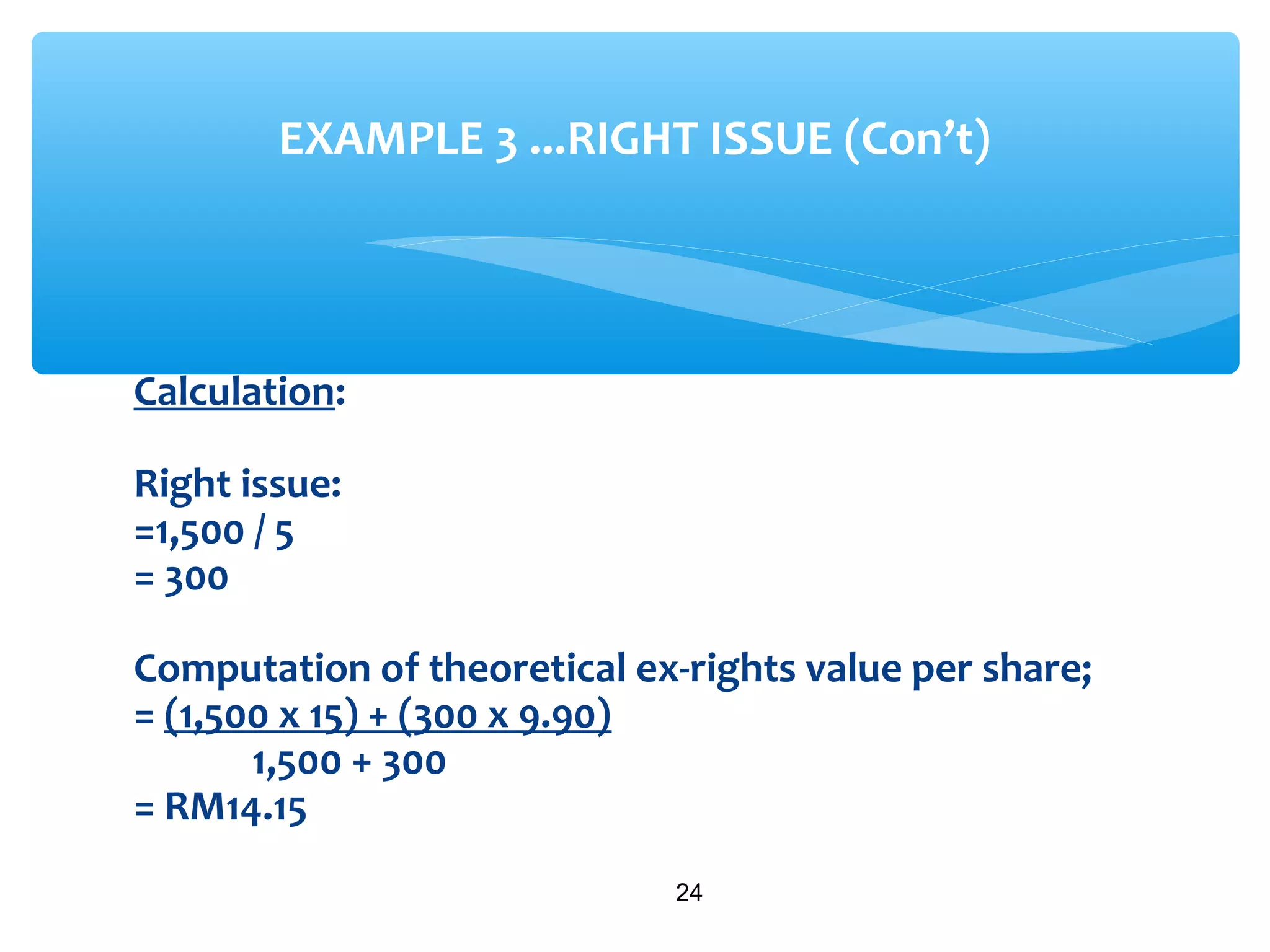

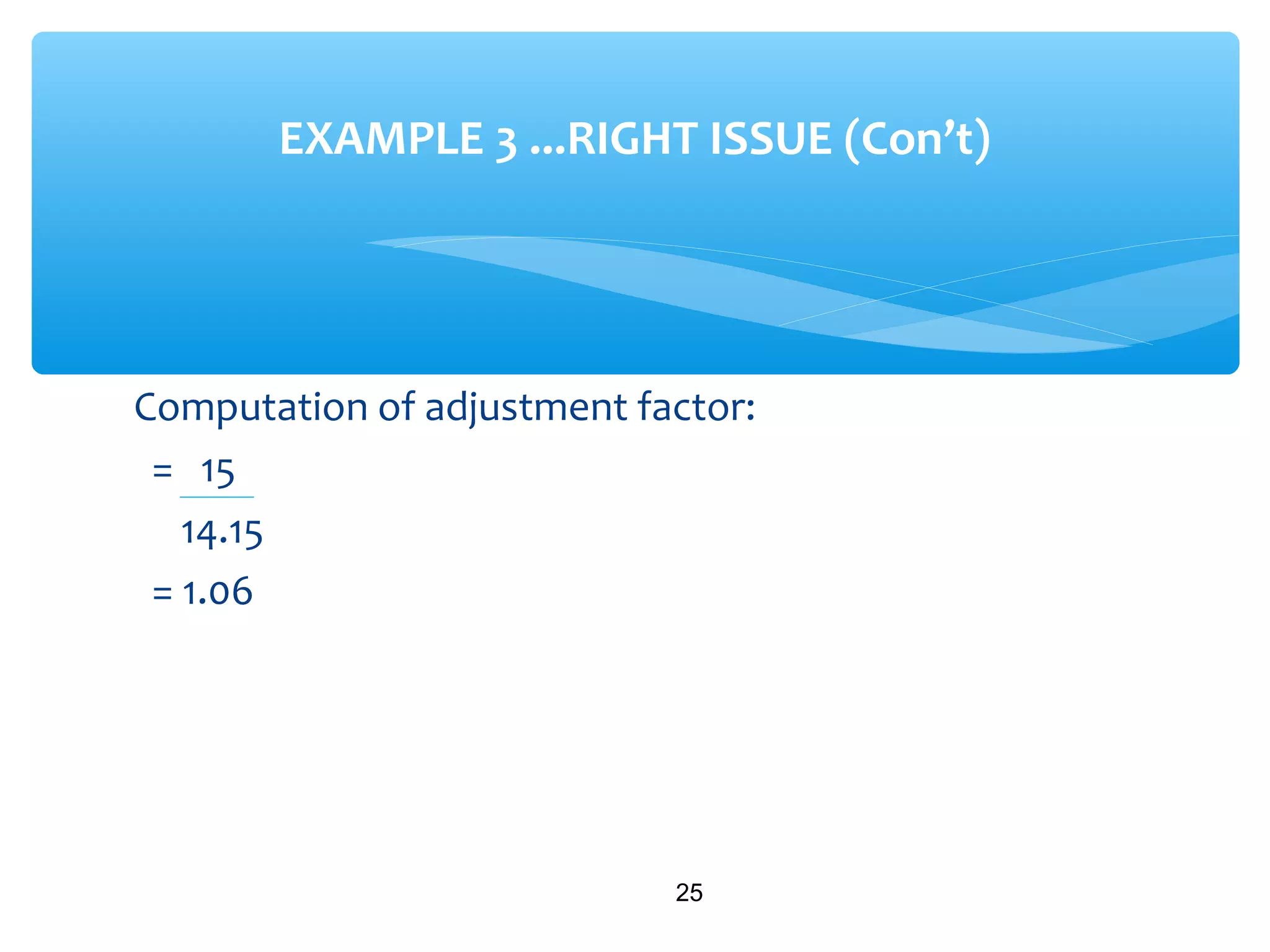

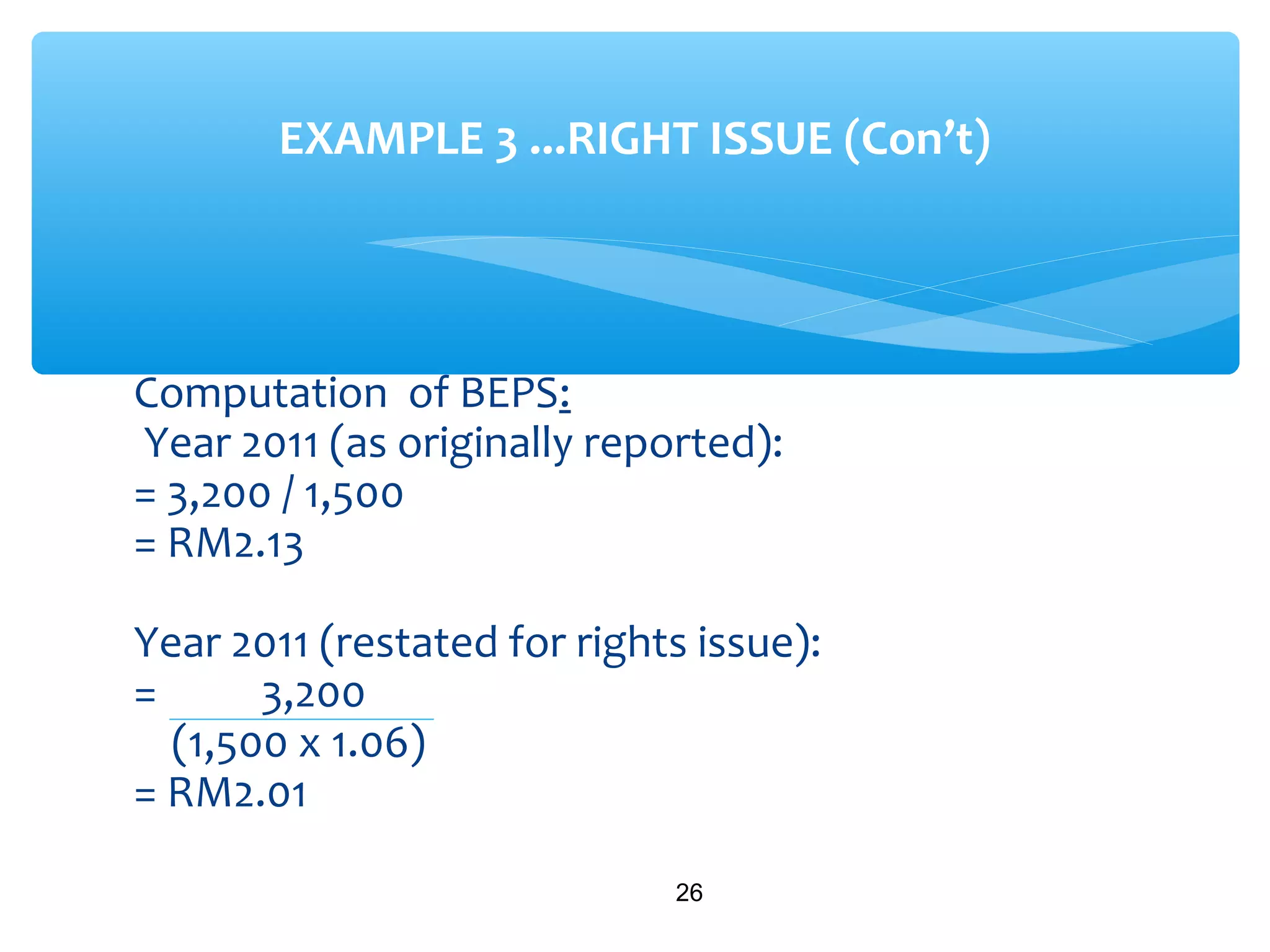

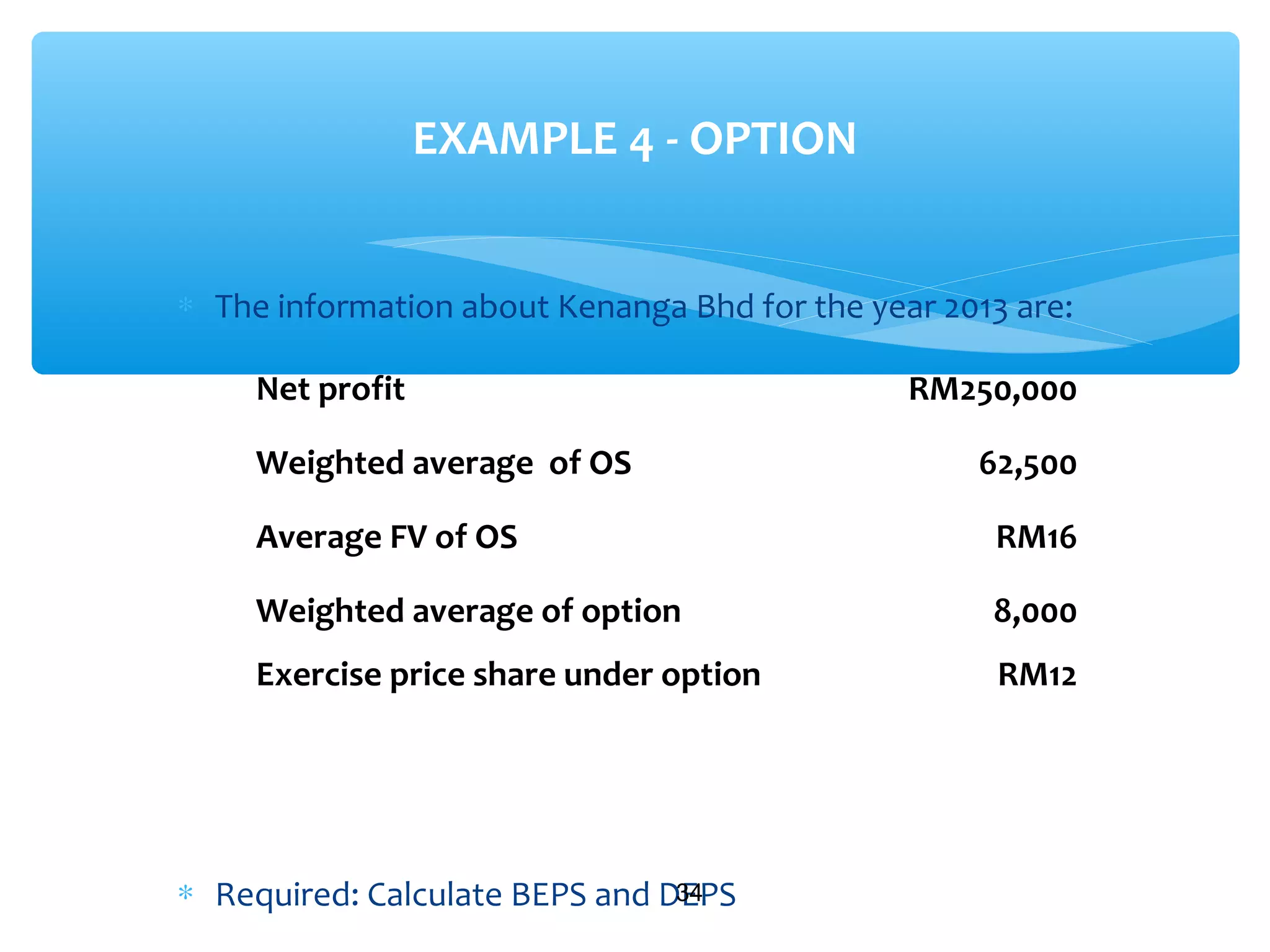

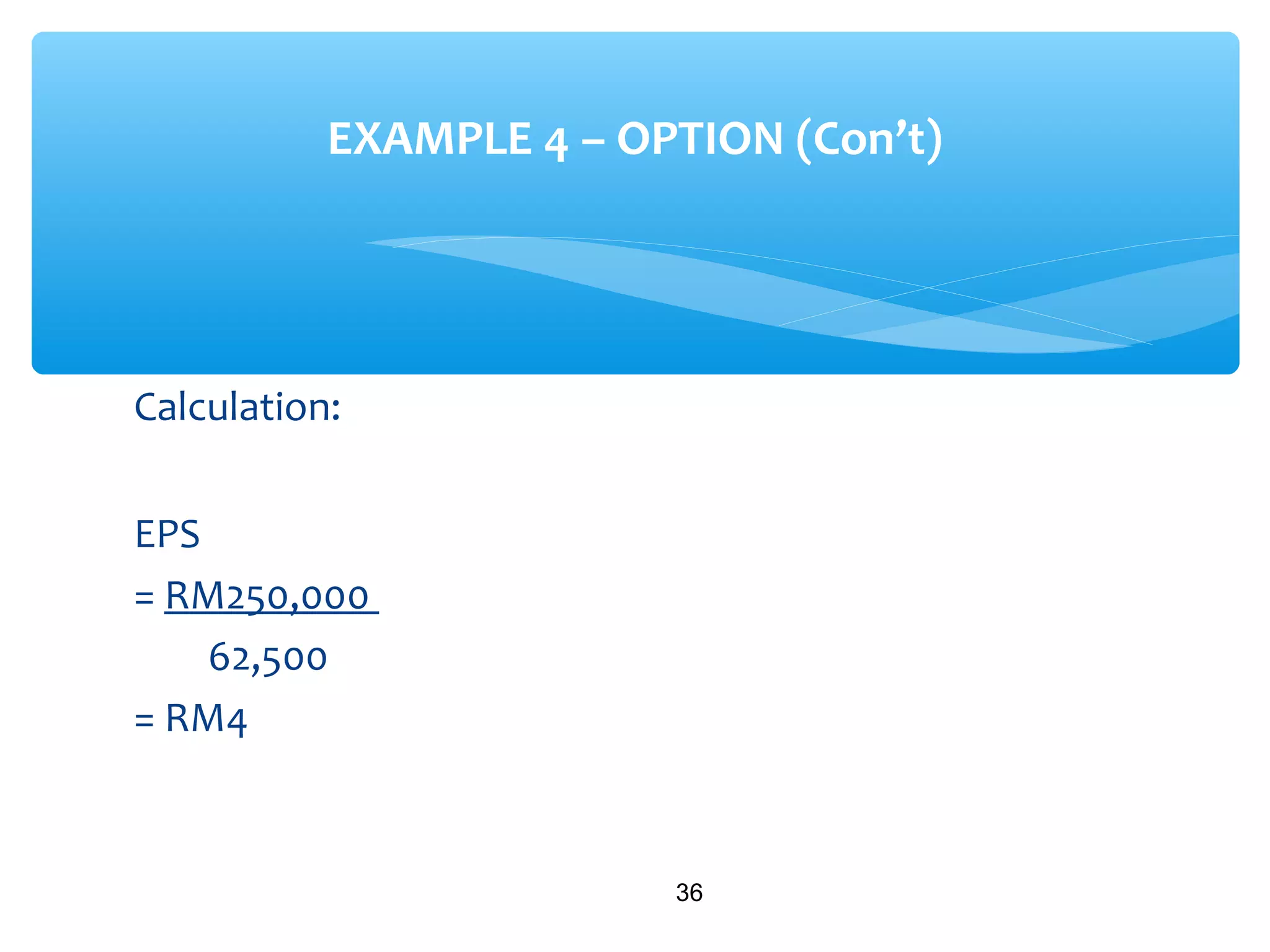

This document provides information on earnings per share (EPS) calculations. It defines EPS as the amount of profit attributable to each equity share. EPS is a useful metric for investors to evaluate and compare company performance and forms the basis for calculating the price-earnings ratio. The document outlines how to calculate basic EPS and diluted EPS, including adjustments that need to be made for changes in the number of ordinary shares, such as bonus issues or rights issues. It provides examples to demonstrate EPS calculations for companies with various capital structures.

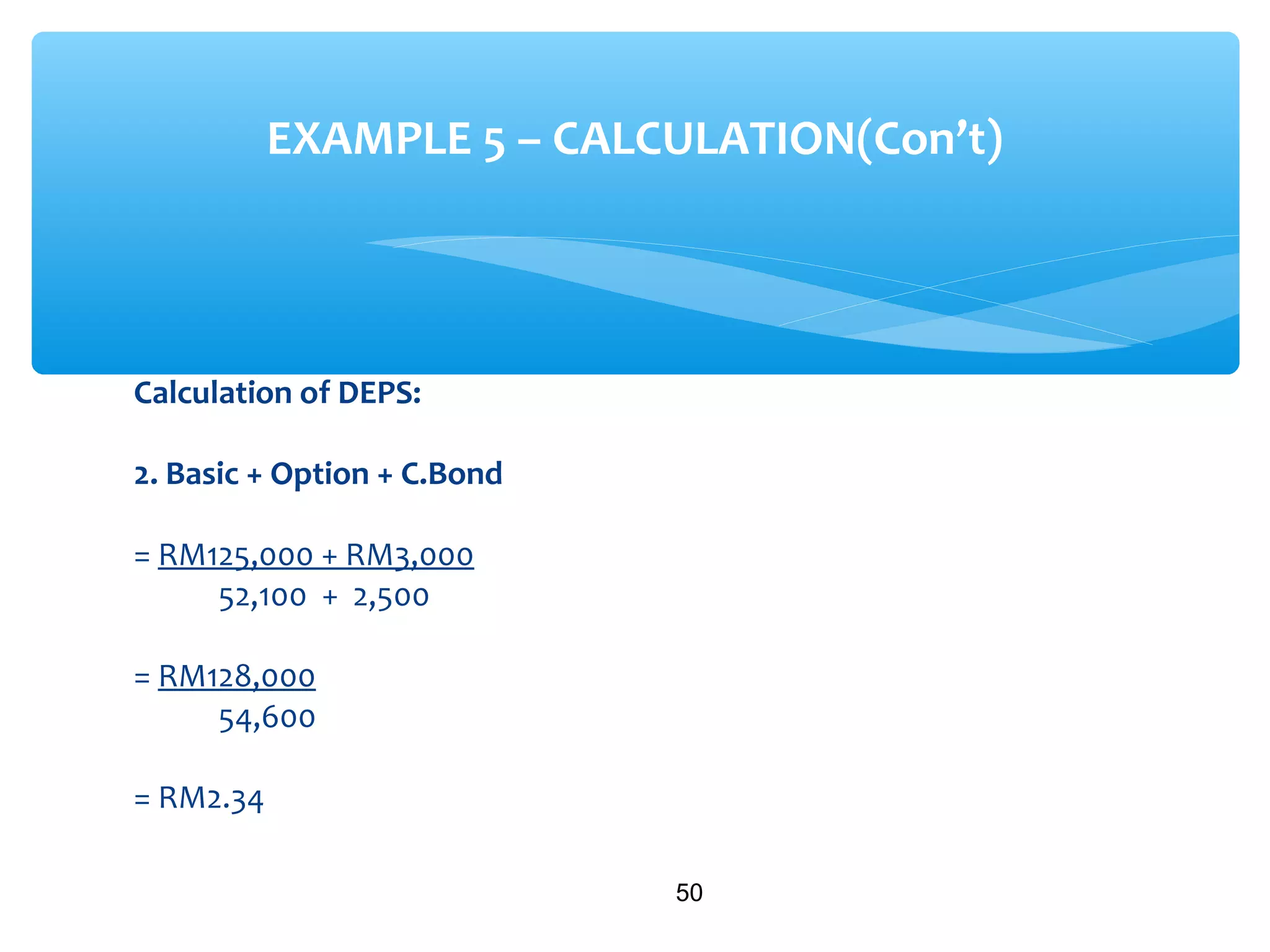

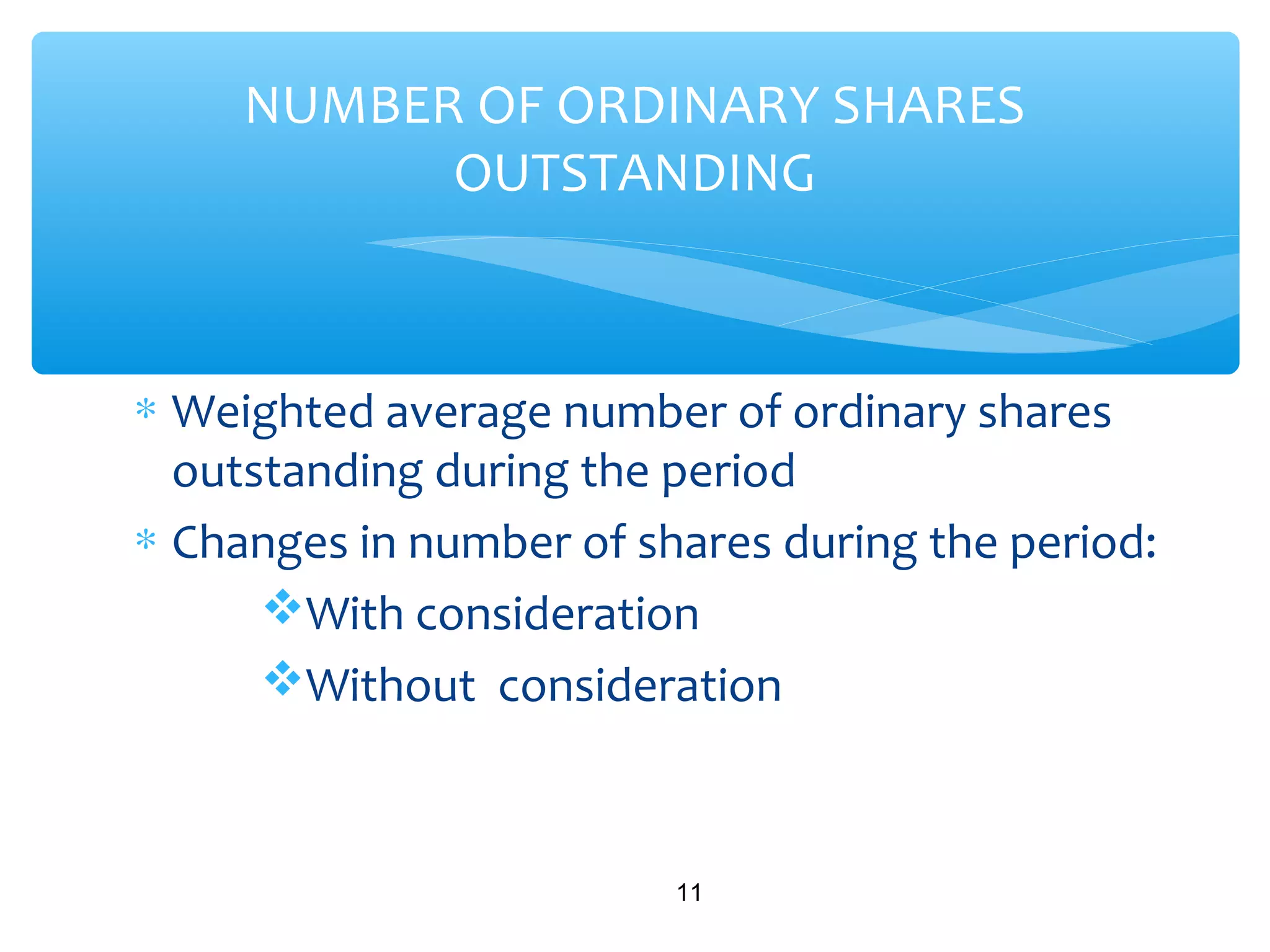

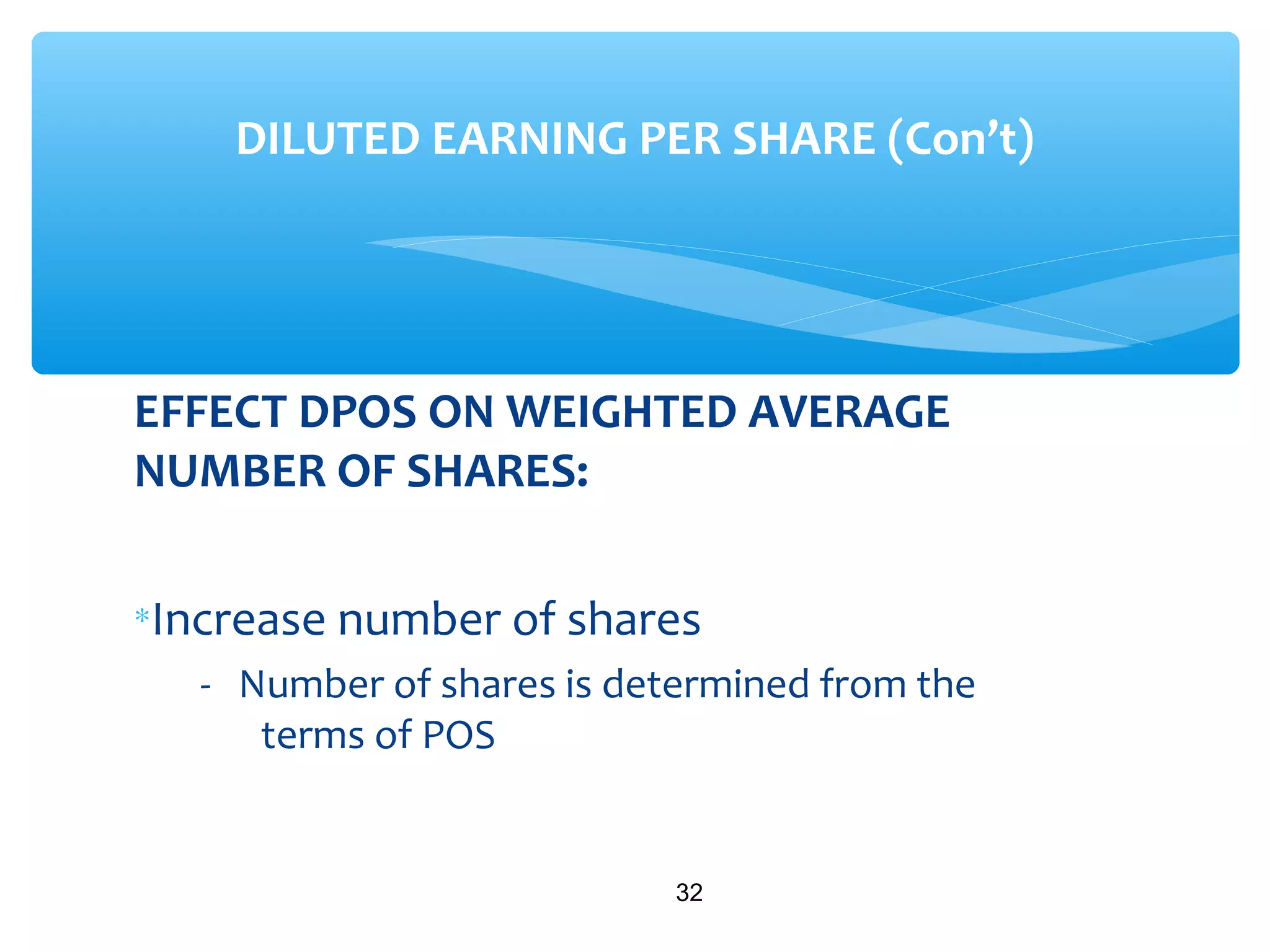

![DEPS:

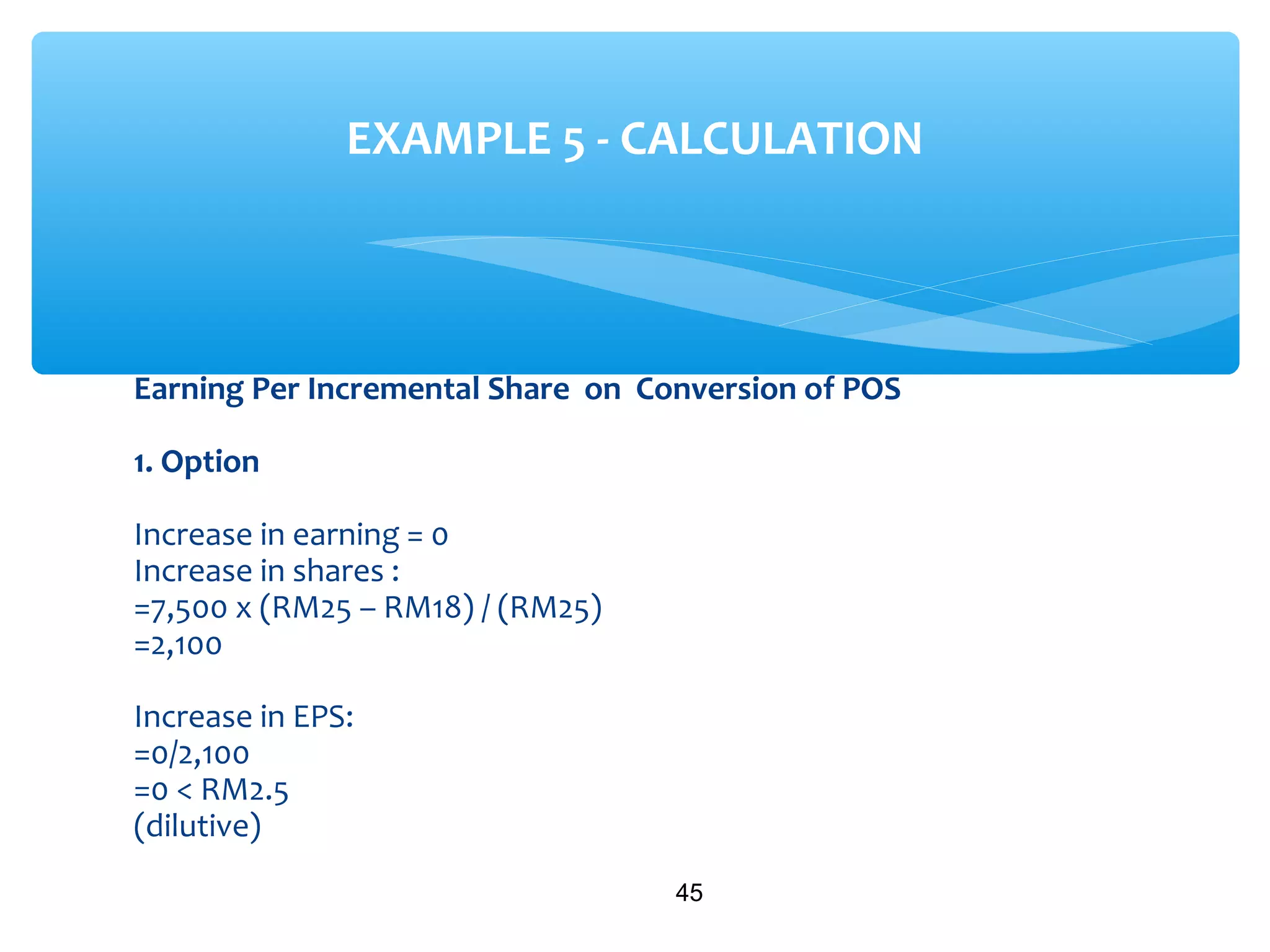

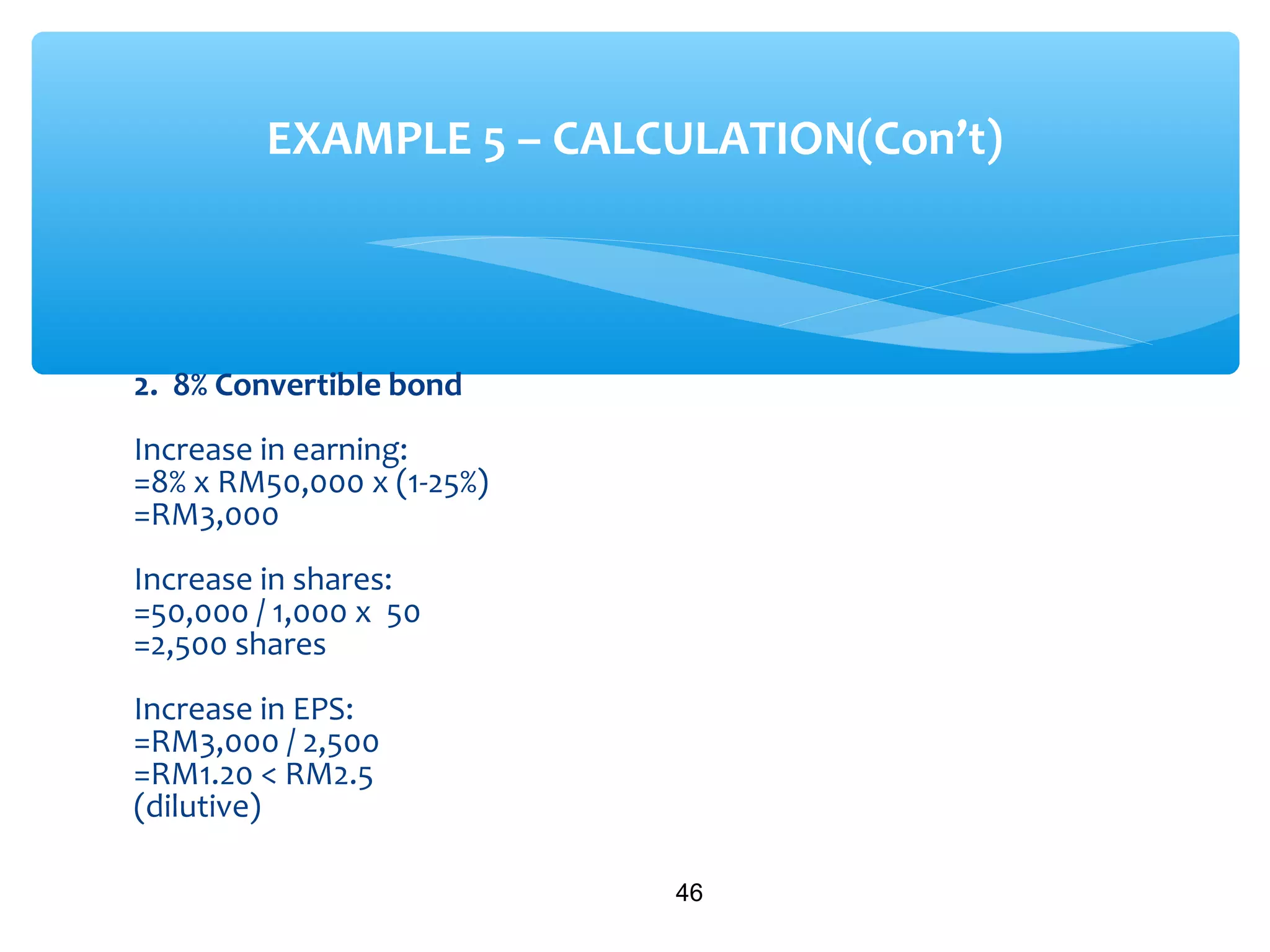

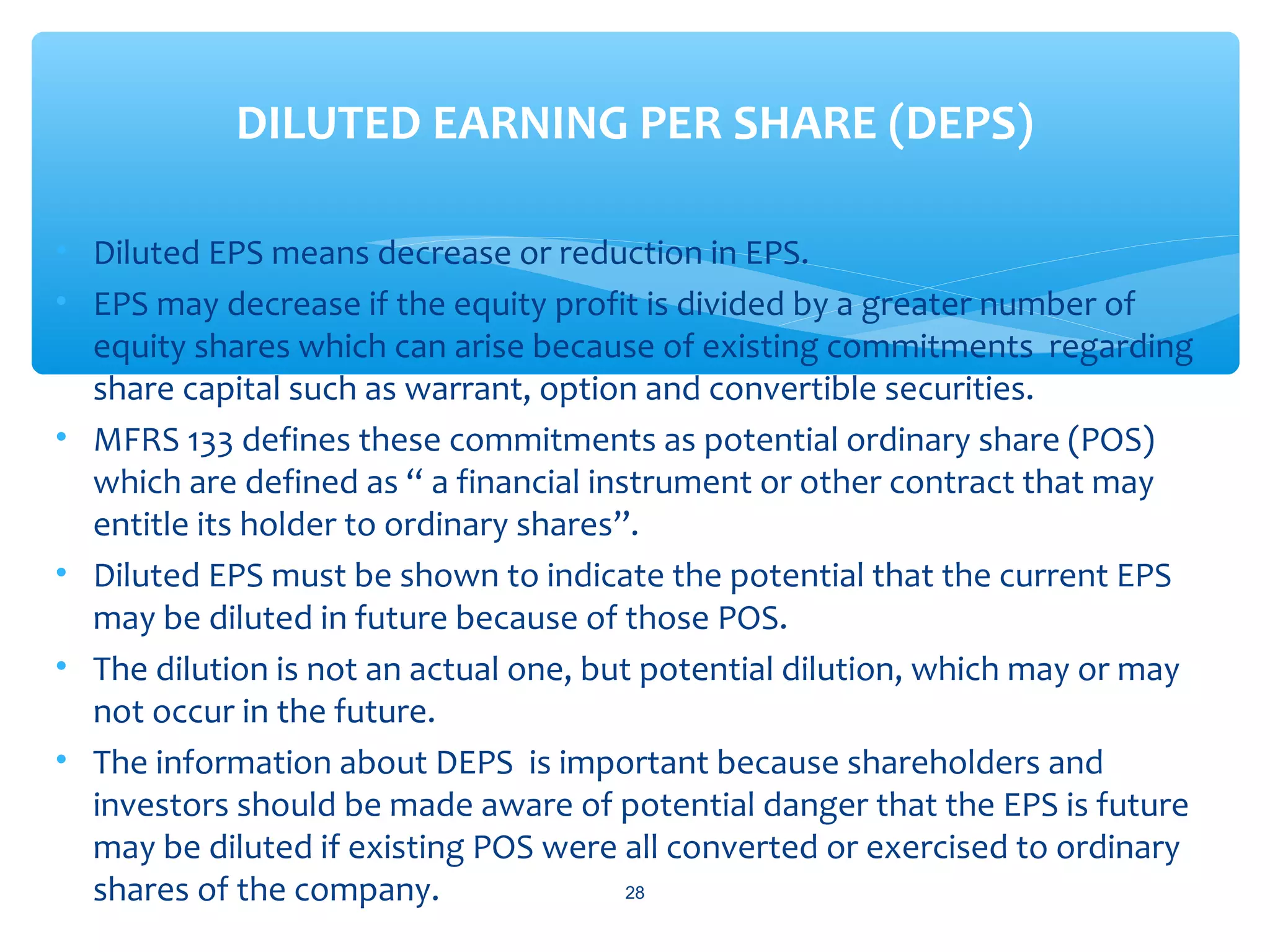

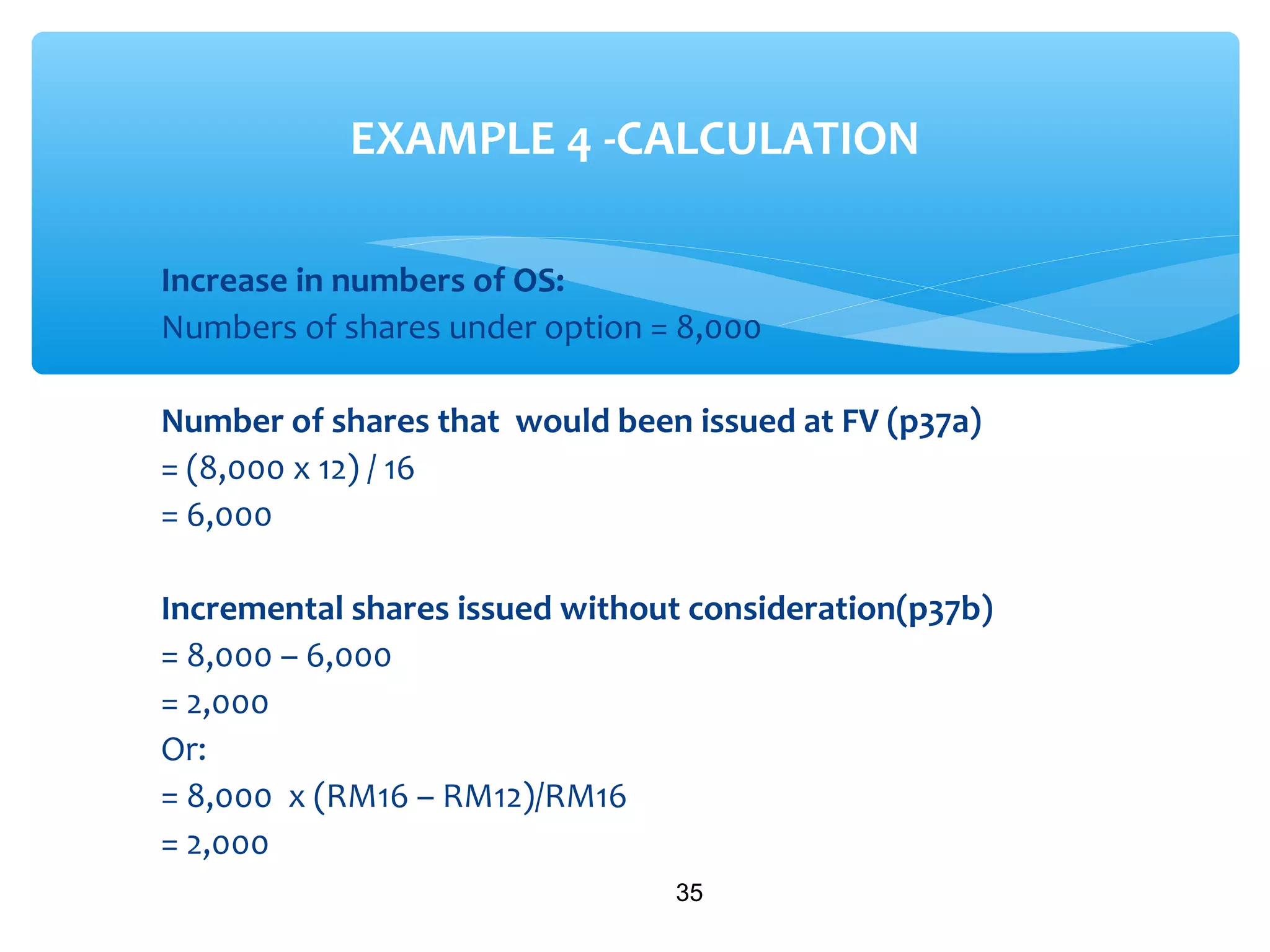

Increase in earning =0

Increase in numbers of OS:

37

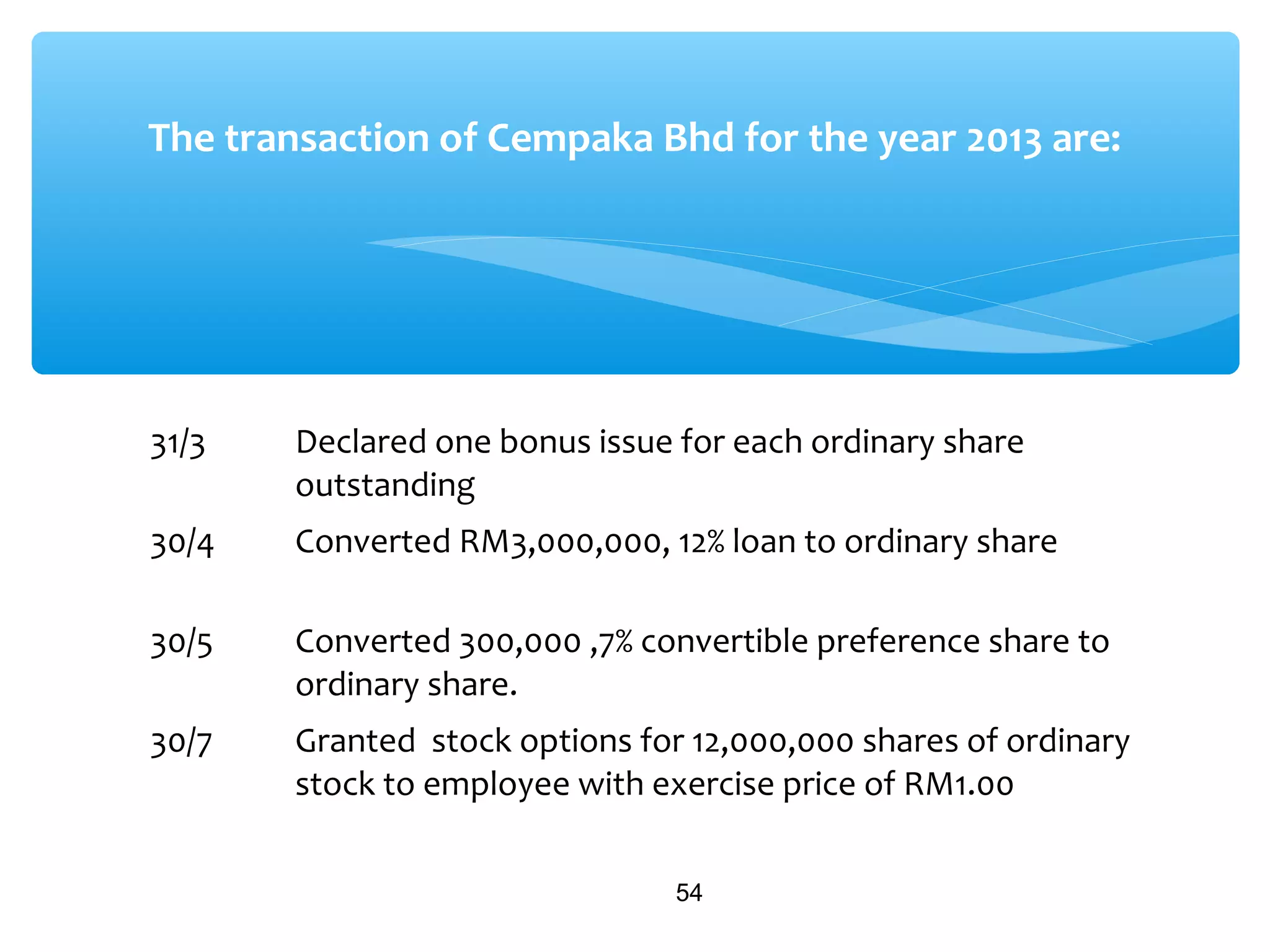

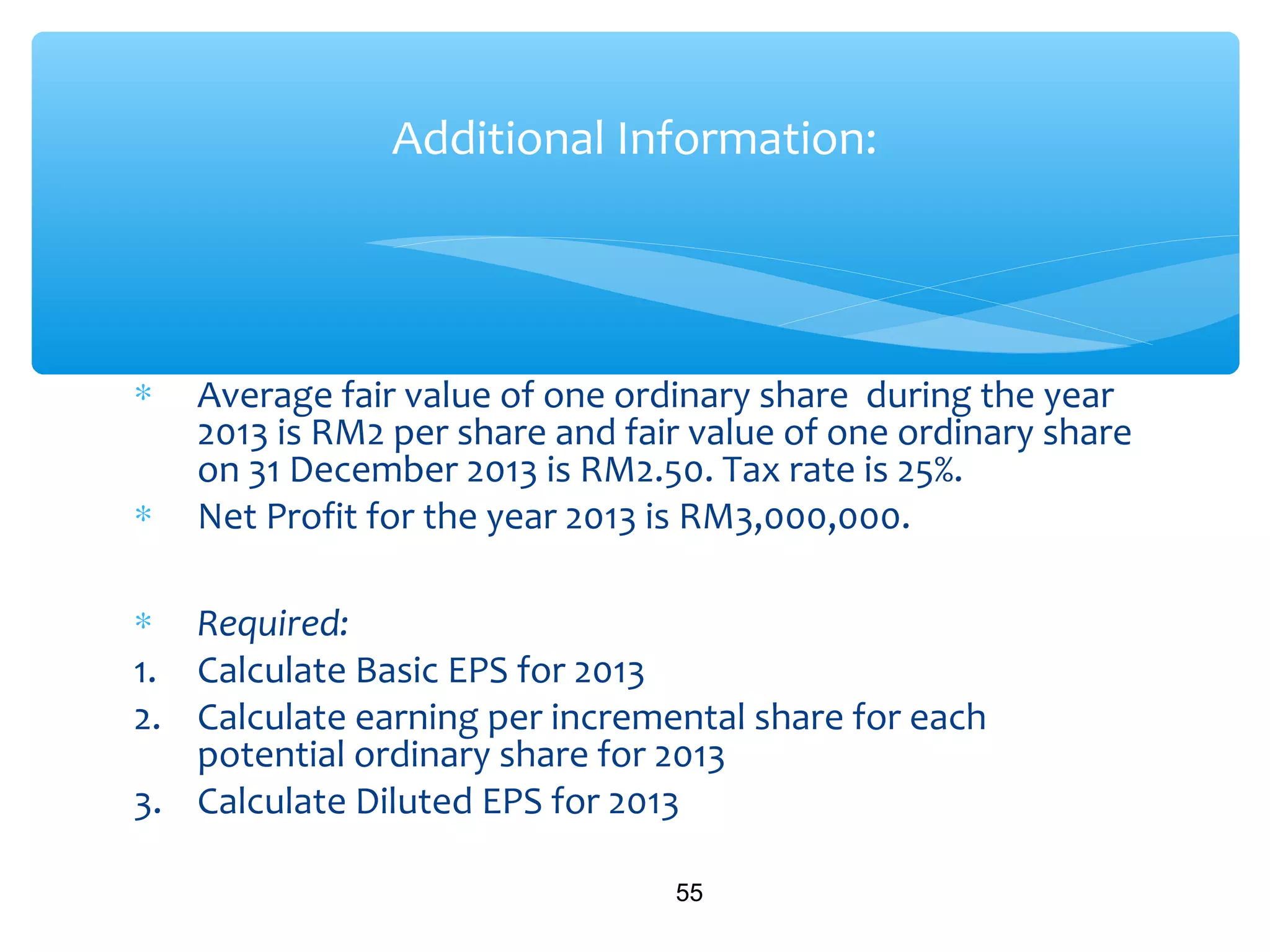

EXAMPLE 4 -CALCULATION

Numbers of shares under option 8,000

(-) Number of shares that would been

issued at FV

[(8,000 x 12) / 16]

6,000

Incremental shares issued without

consideration 2,000](https://image.slidesharecdn.com/topic7earningspershare-150119130016-conversion-gate02/75/Topic-7-earnings_per_share-37-2048.jpg)