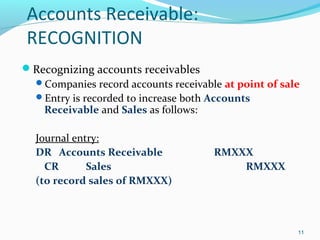

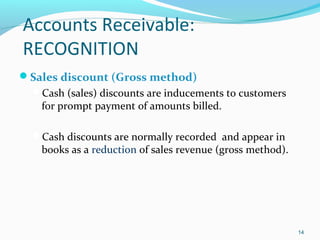

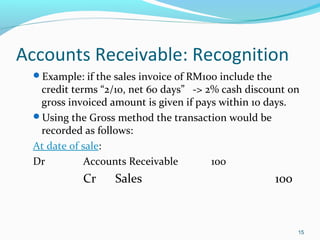

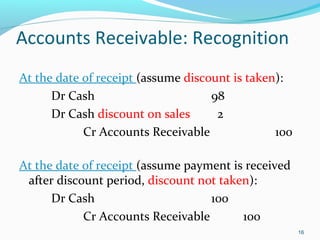

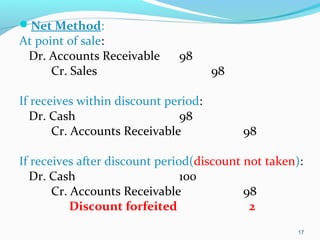

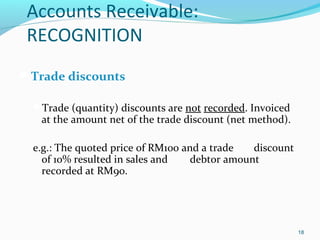

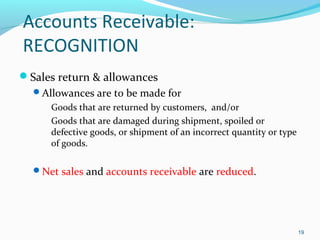

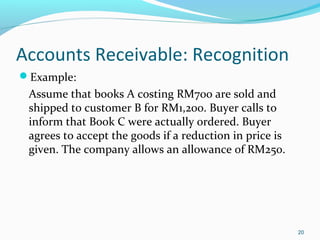

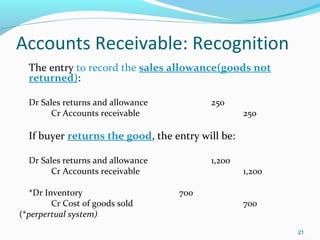

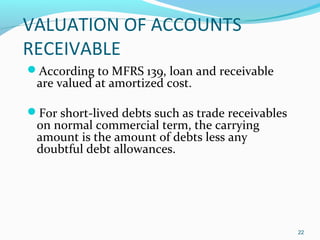

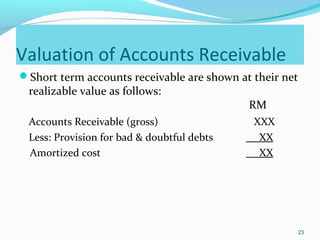

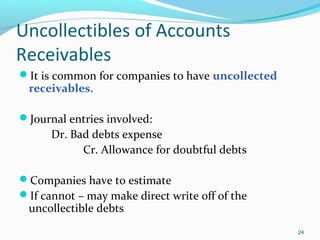

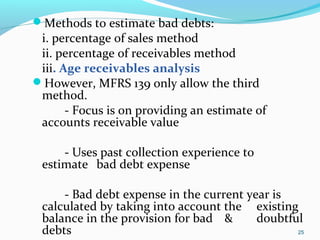

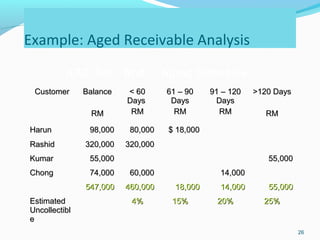

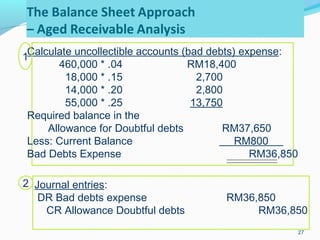

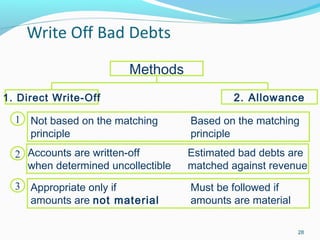

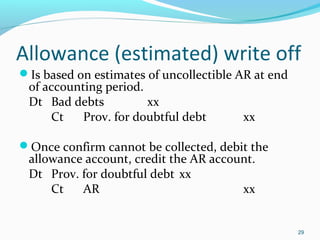

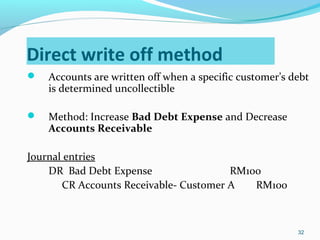

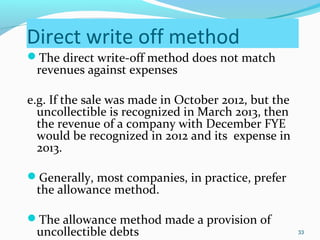

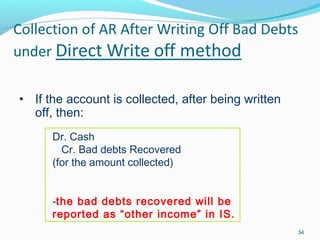

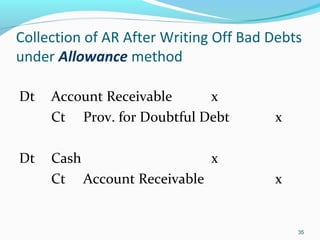

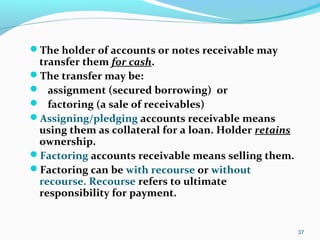

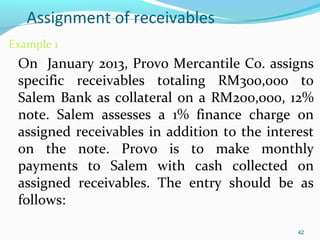

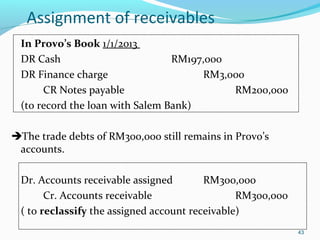

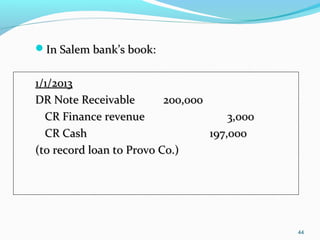

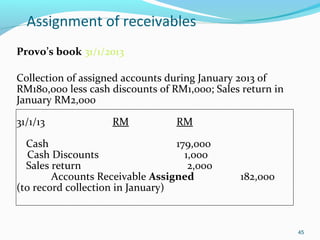

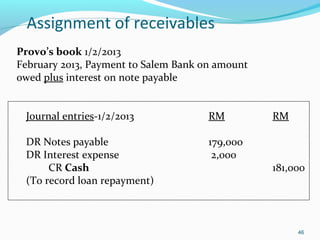

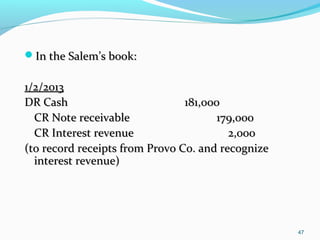

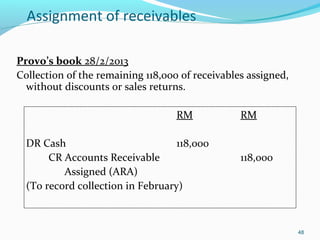

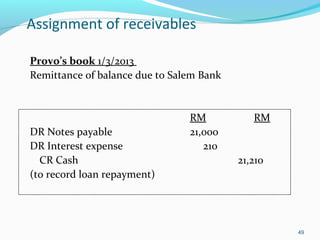

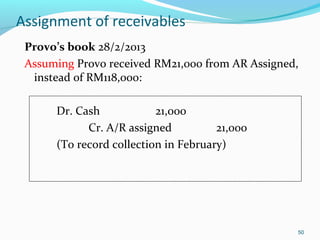

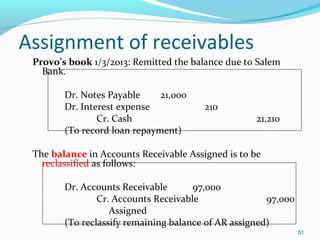

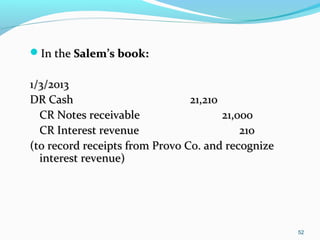

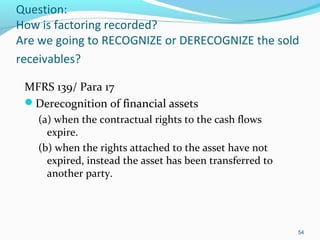

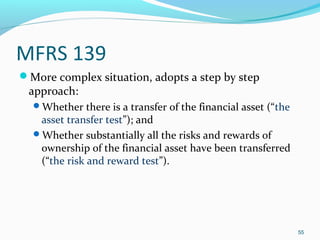

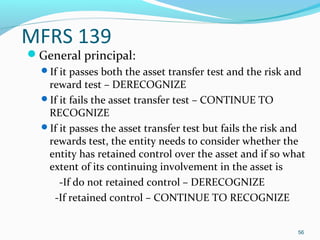

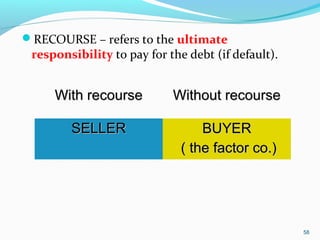

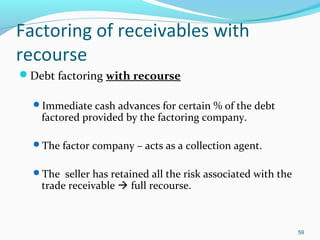

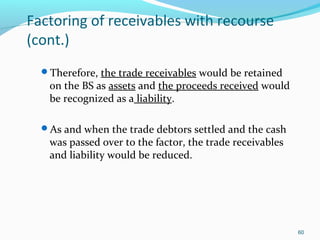

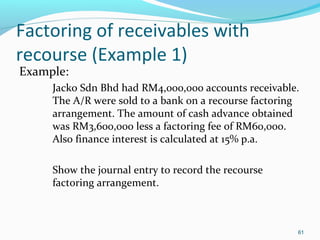

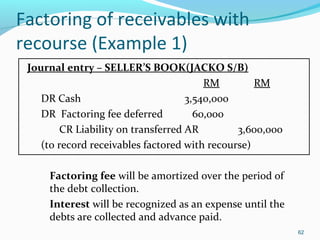

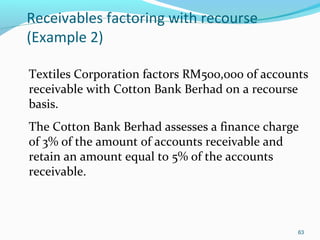

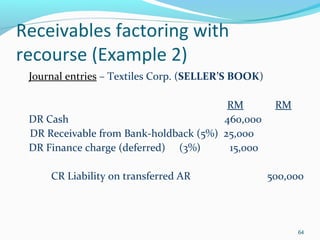

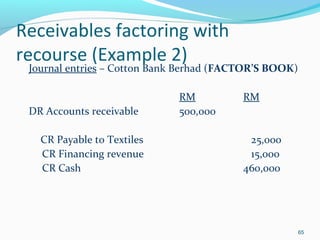

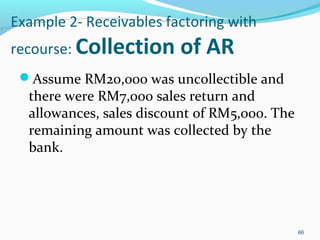

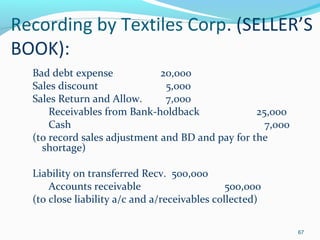

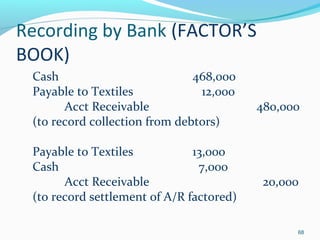

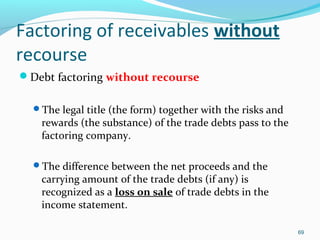

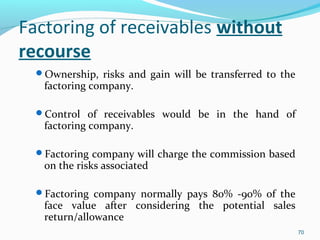

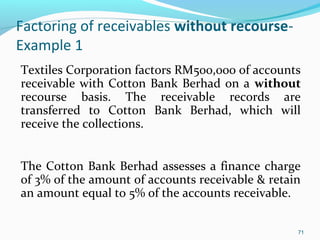

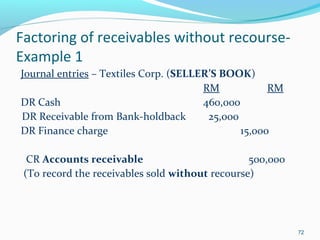

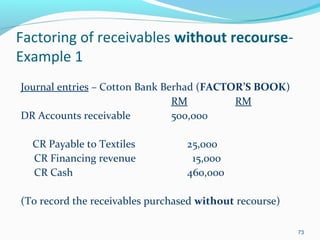

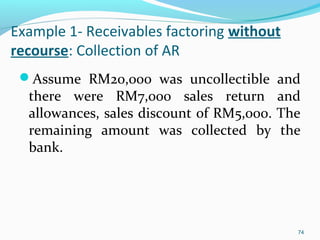

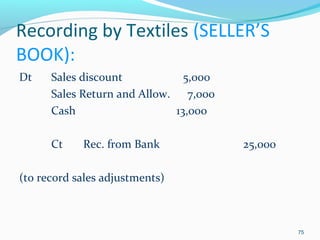

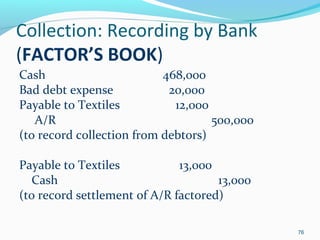

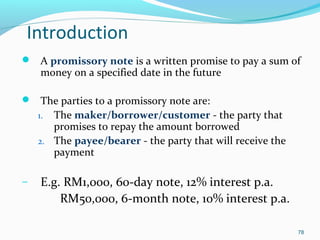

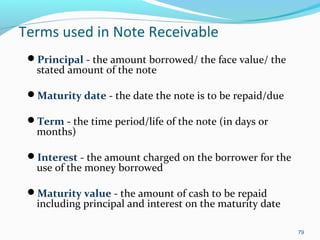

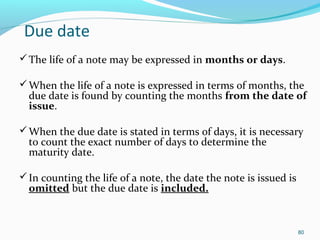

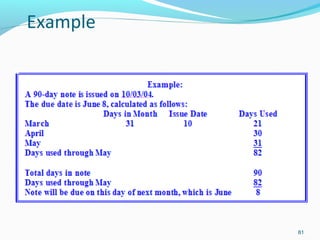

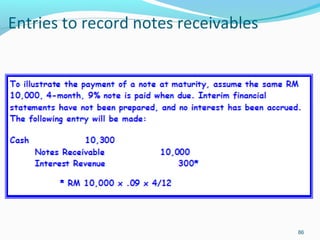

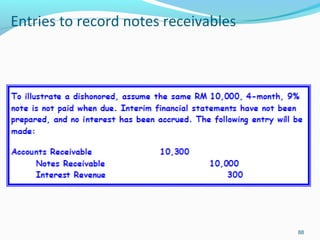

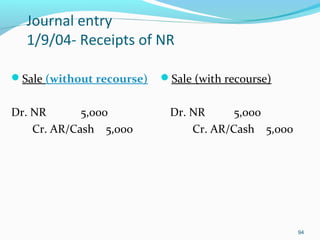

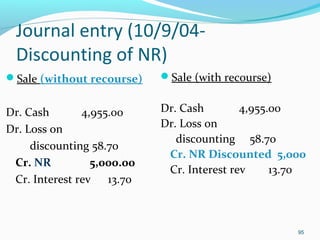

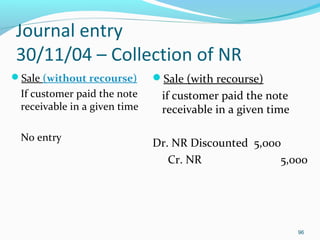

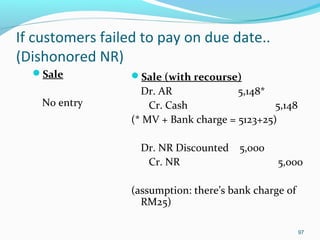

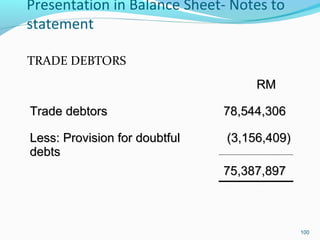

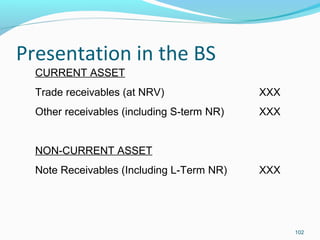

The document discusses accounts receivable and notes receivable. It defines receivables as amounts due from individuals and companies. It identifies the main types of receivables as accounts receivable, notes receivable, and other receivables. It then covers accounting issues related to recognition, valuation, and estimation of uncollectibles for accounts receivable. Finally, it discusses the processes of assigning or factoring accounts receivable, including examples of journal entries for assigning receivables as collateral for a loan.