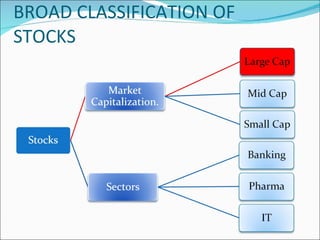

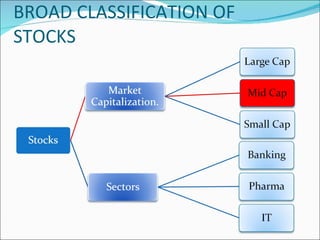

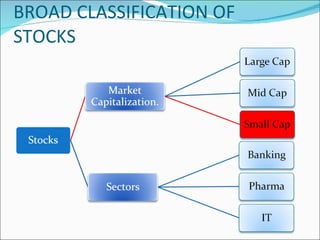

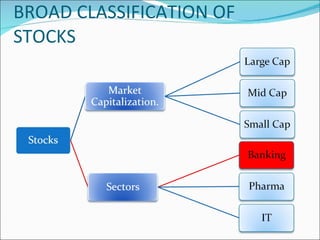

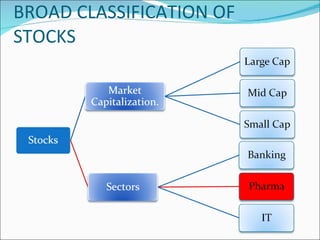

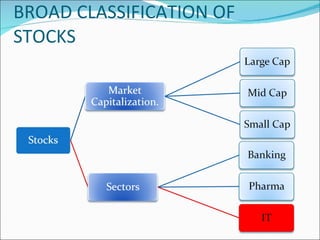

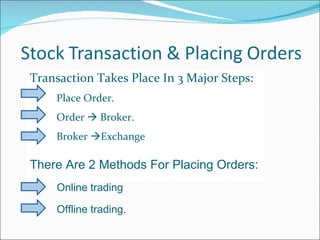

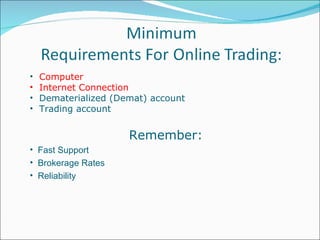

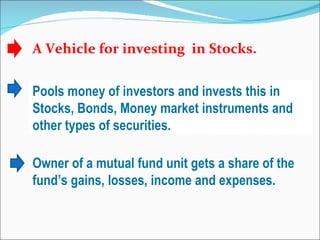

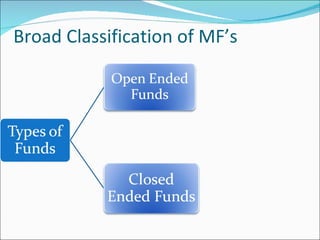

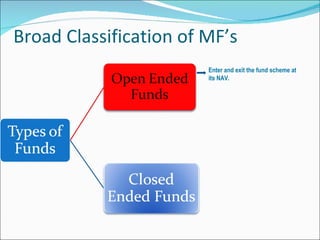

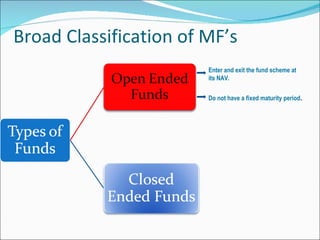

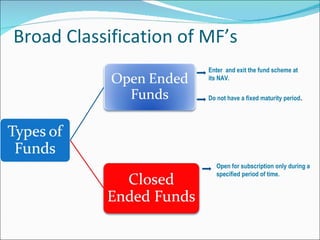

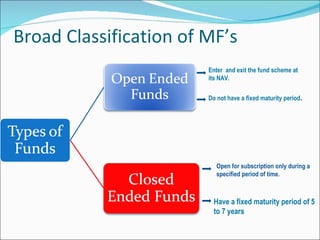

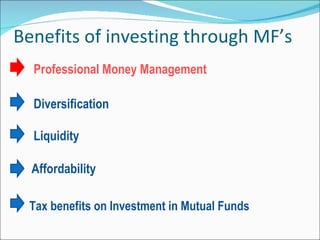

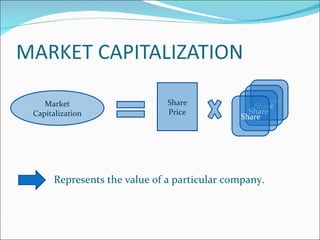

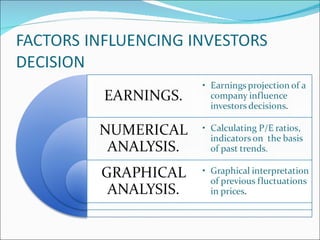

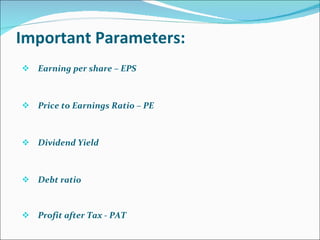

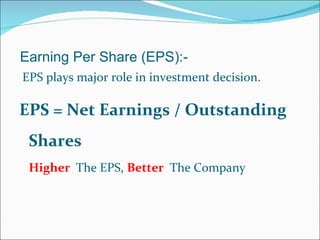

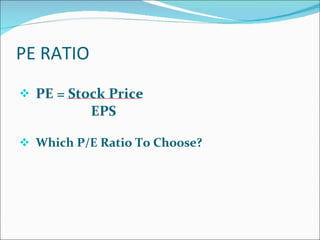

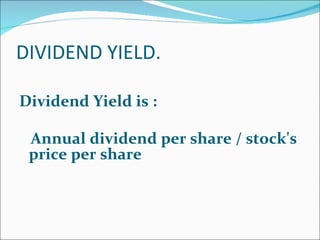

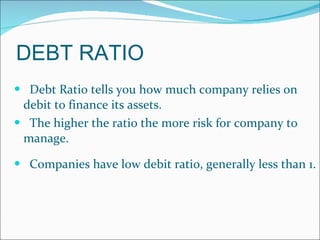

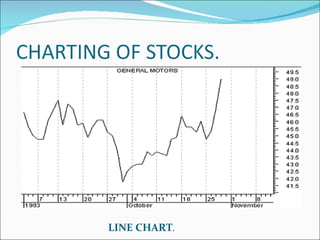

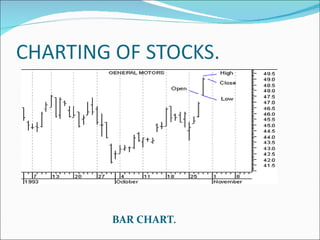

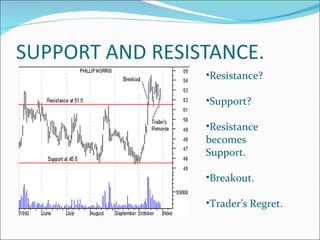

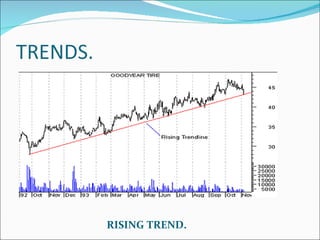

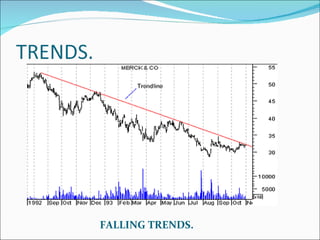

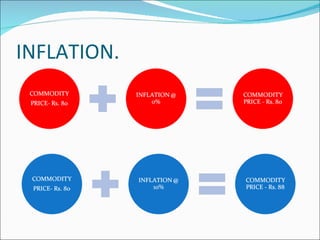

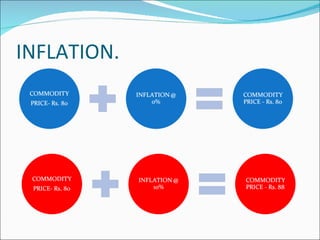

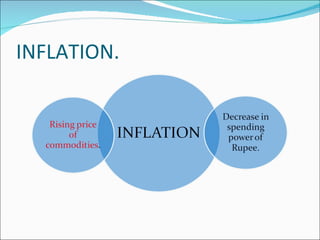

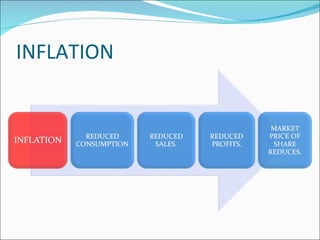

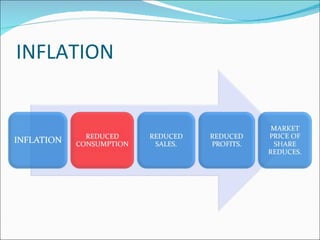

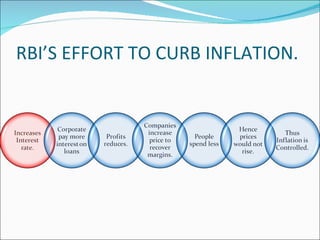

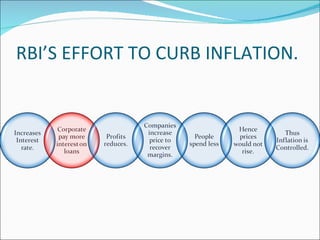

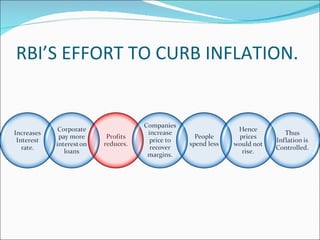

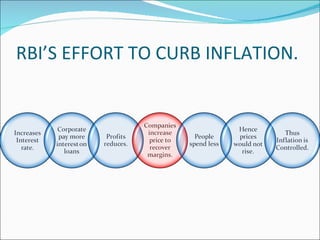

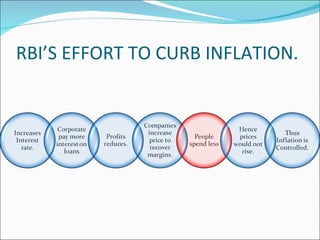

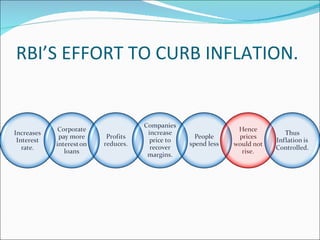

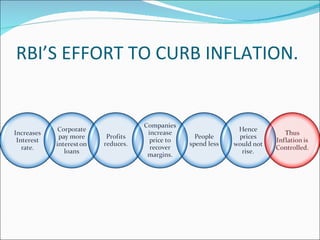

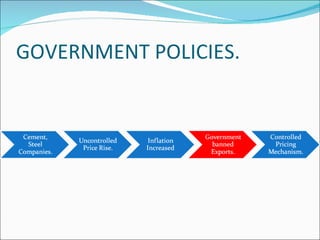

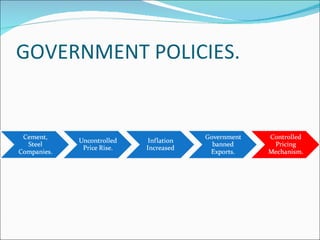

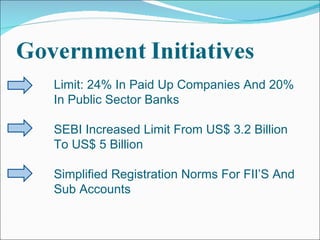

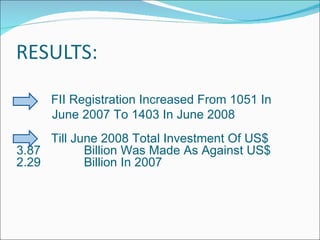

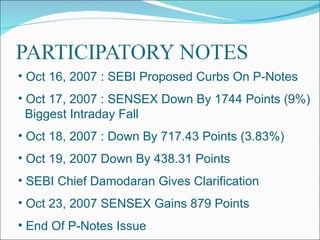

The document provides a comprehensive overview of the Indian stock market, including classifications of stocks, mutual funds, and the processes involved in trading. It outlines the characteristics of mutual funds, the roles of asset management companies, and the significance of net asset value. Additionally, it covers market terminology, analysis methods, and various investment strategies, as well as the impact of government and RBI policies on economic conditions.