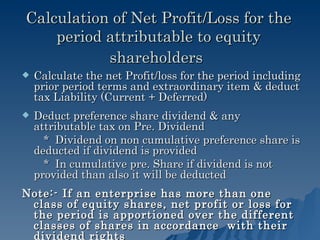

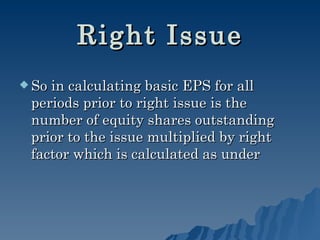

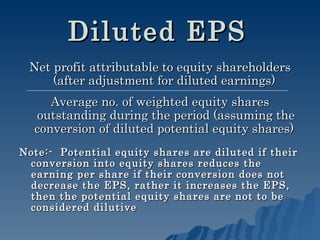

This document discusses the calculation and presentation of earnings per share (EPS) according to Accounting Standard 20. It defines EPS as a financial ratio that shows earnings available to each equity shareholder. It discusses the applicability of EPS reporting and the types of EPS - basic and diluted. The key steps for calculating basic EPS are determining net profit attributable to equity shareholders and calculating the weighted average number of outstanding shares. Right shares must be adjusted for in the weighted average calculation. Diluted EPS factors in additional shares that could be issued from convertible instruments.