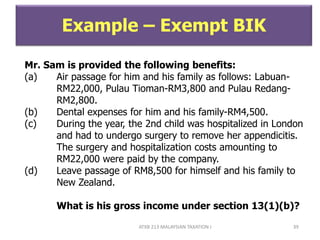

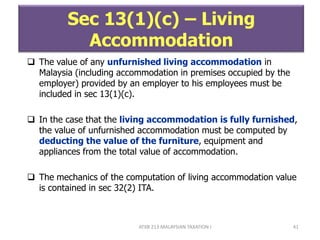

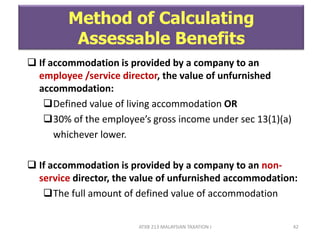

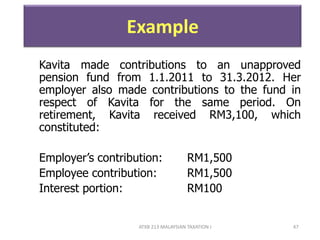

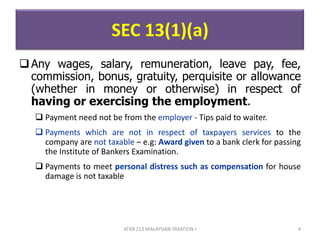

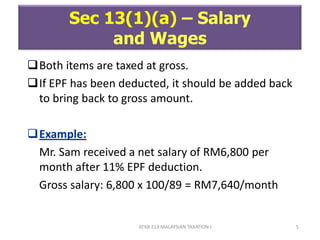

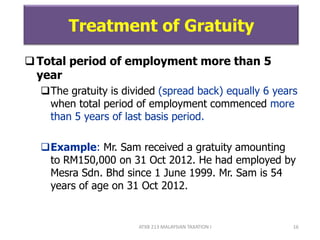

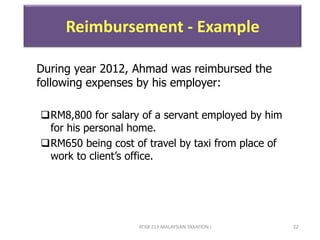

This document discusses types of gross employment income that are taxable under Malaysian tax law. It covers various types of monetary income like wages, salary, bonuses, and allowances. It also discusses benefits in kind such as company cars, mobile phones, interest subsidies, and furnished accommodation. Various examples are provided to illustrate how different types of income and benefits are treated, such as share options, reimbursements, leave pay, gratuity, and car benefits including the prescribed value method.

![ATXB 213 MALAYSIAN TAXATION I 37

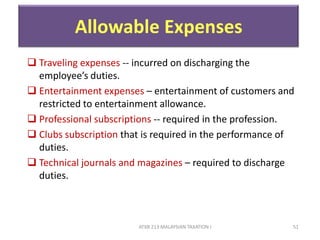

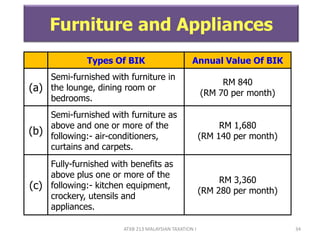

Other Benefit-in-kind

- Types Of BIK Annual Value Of BIK

(a)

Mobile telephone (rental &

charges)

RM 600

(b) Gardeners RM 3,600 [RM300/month]

(c) Domestic servants RM 4,800 [RM400/month]

(d)

Subsidized loan/interest below the

market value rate Subsidized loan interest paid by employer.

(e) Insurance premium Annual insurance premium paid by employer.

(f) School / Tuition fees Actual school / tuition fees paid by employer.

(g)

Corporate membership in

recreation clubs

Monthly/annual membership fees paid by

employer.](https://image.slidesharecdn.com/chapter4bemploymentincome-130616013518-phpapp02/85/Chapter-4-b-employment-income-37-320.jpg)

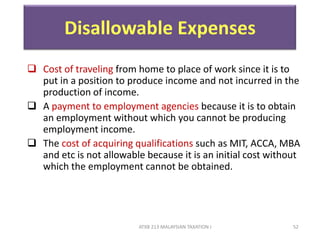

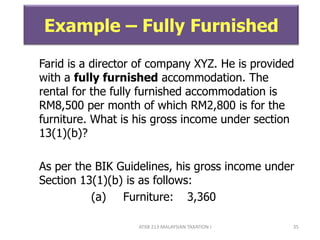

![ATXB 213 MALAYSIAN TAXATION I 38

Exempt Benefit-in-kind

Act Medical or dental treatment for employee and

immediate family

Benefit for child care

Leave passage [3 local + 1 overseas – max

RM3,000 per family] for travel of employee and

immediate family.

Benefits relating to official duties

IT(Exemption)(No. 56) Order 2000 1 PC per Employee (YA 2001 to YA 2003)

Income Tax Ruling 1997/2 Discounted goods and services

[Exclude houses sold to employees at discount]

Free food & drinks or subsidized

Free transportation

[Refers to transportation of workers to factory]](https://image.slidesharecdn.com/chapter4bemploymentincome-130616013518-phpapp02/85/Chapter-4-b-employment-income-38-320.jpg)