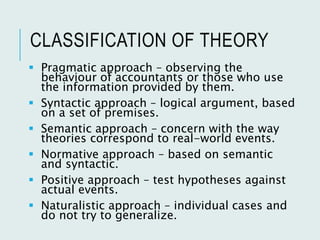

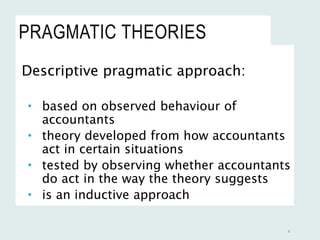

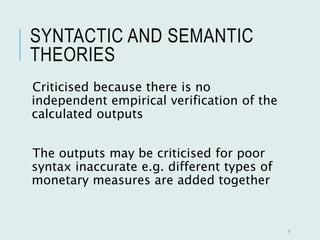

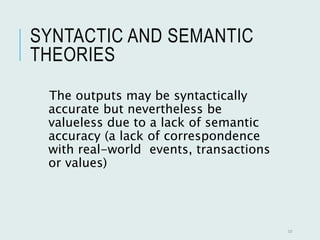

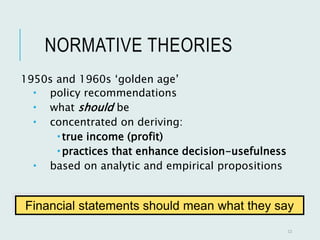

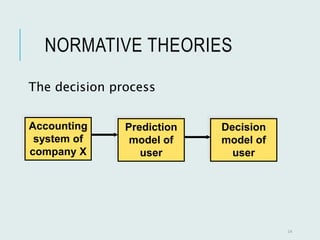

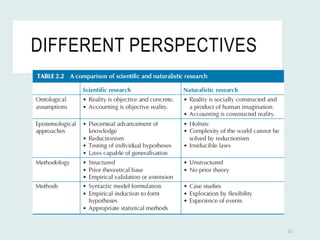

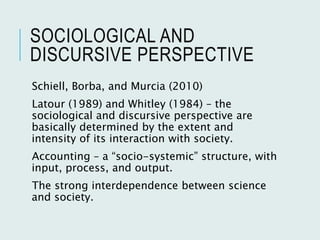

This document discusses various approaches to constructing accounting theories, including pragmatic, syntactic, semantic, normative, and positive approaches. It also addresses differences between scientific and naturalistic perspectives. Accounting theory has evolved from a normative approach focused on deriving true income and decision usefulness to a more positive descriptive approach based on real-world experiences. Developing auditing theory mirrors this evolution and the document discusses early normative auditing theories as well as more recent positive experimental research on auditing judgments and decision making.