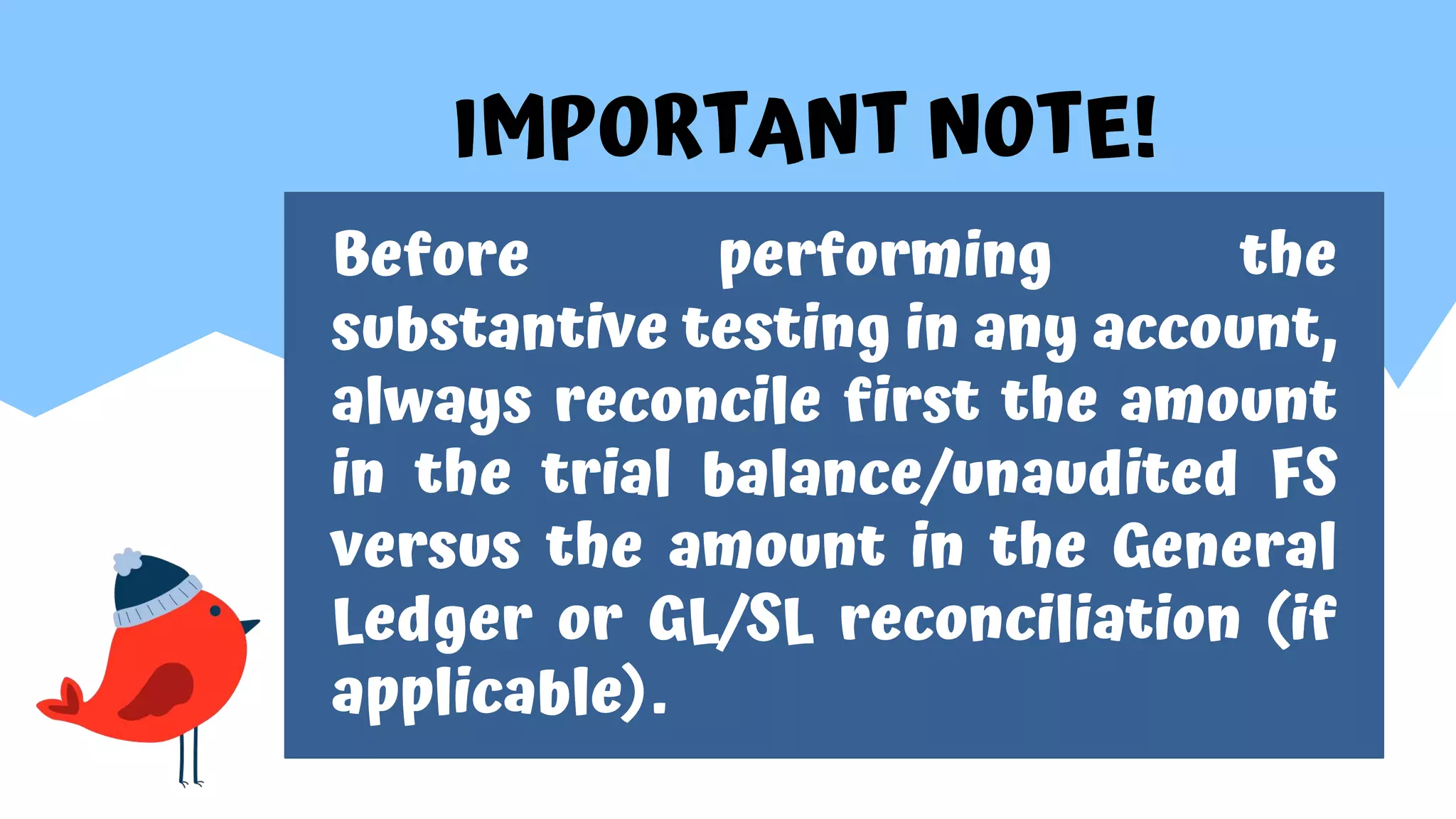

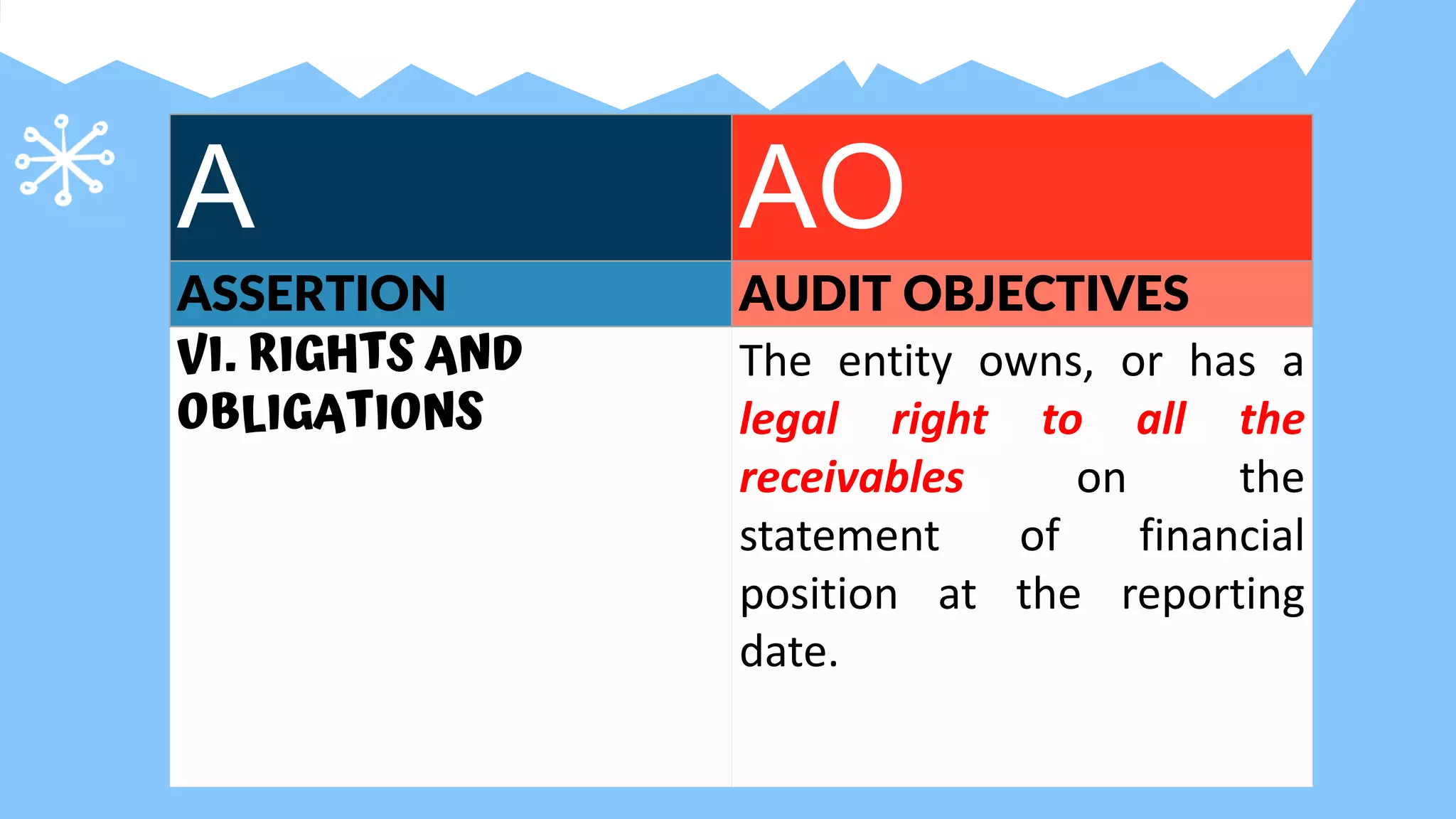

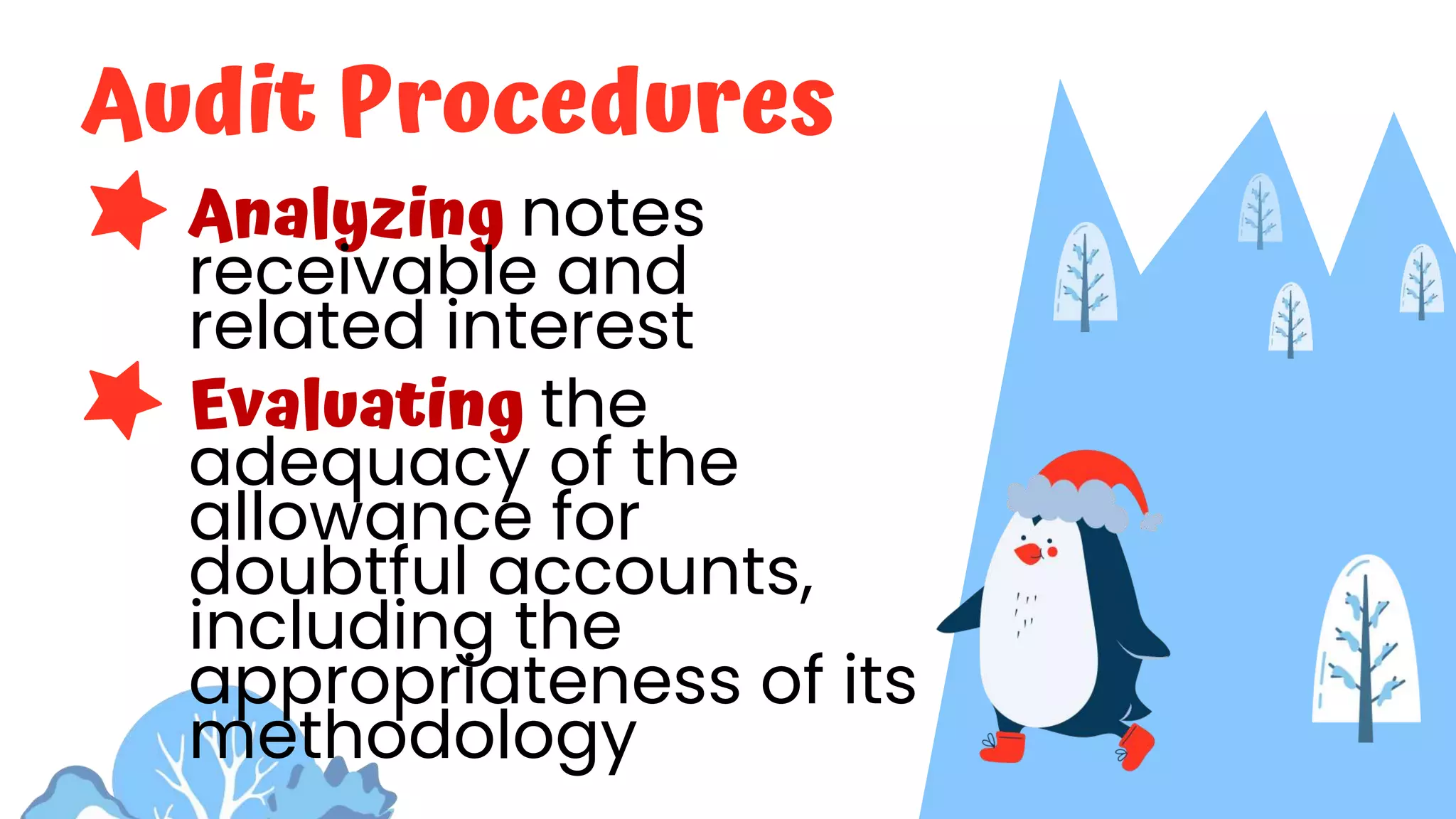

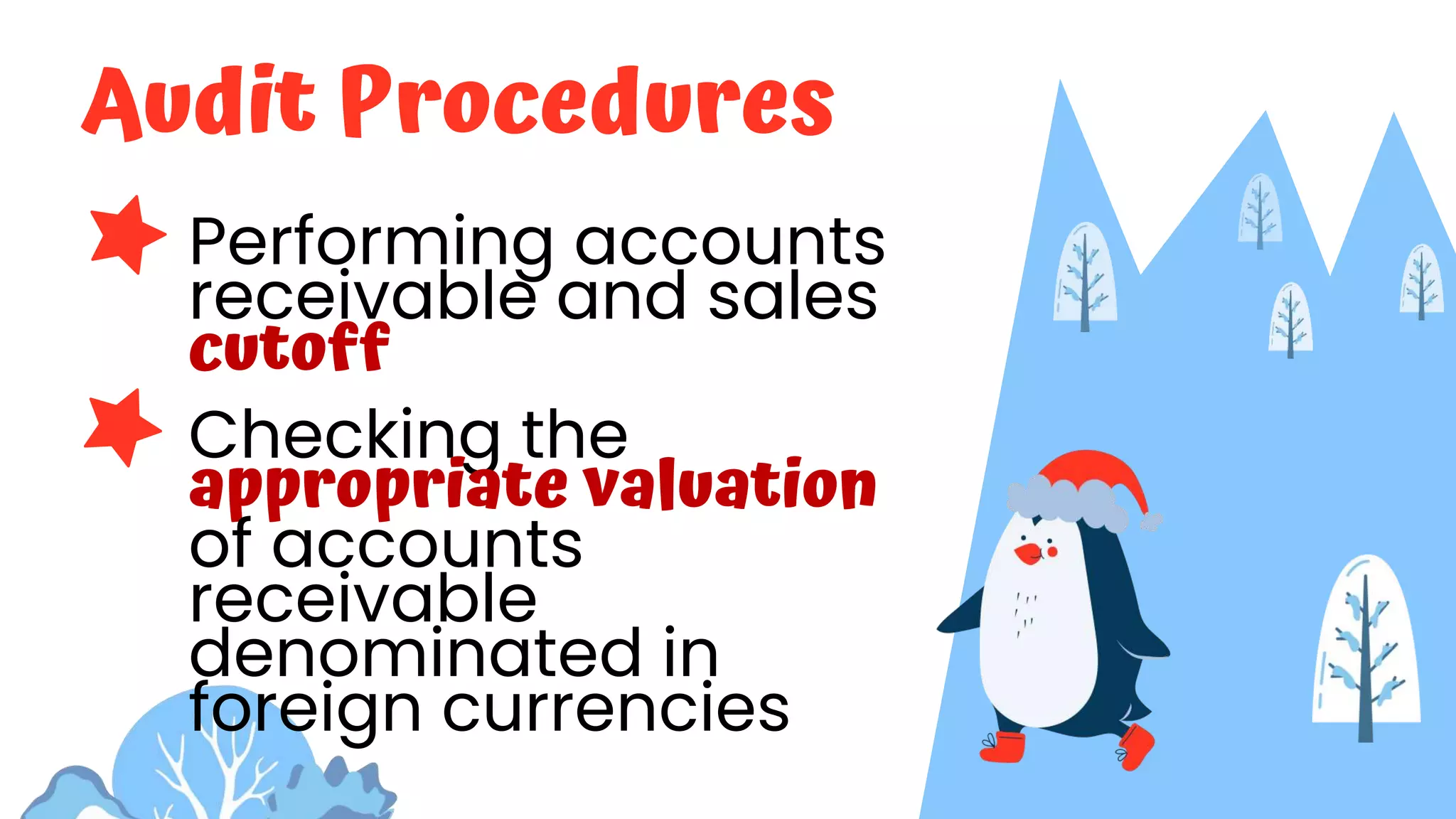

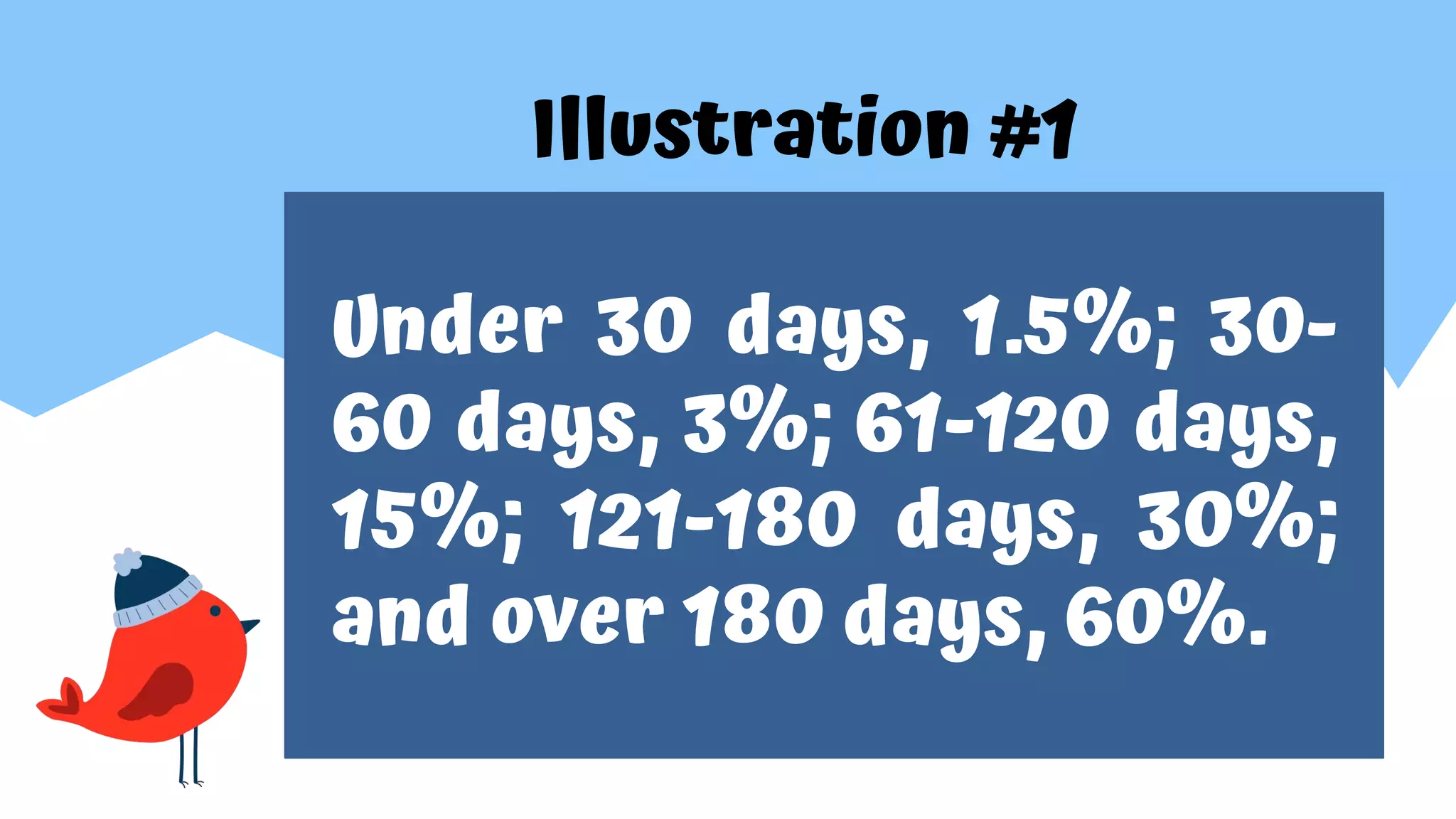

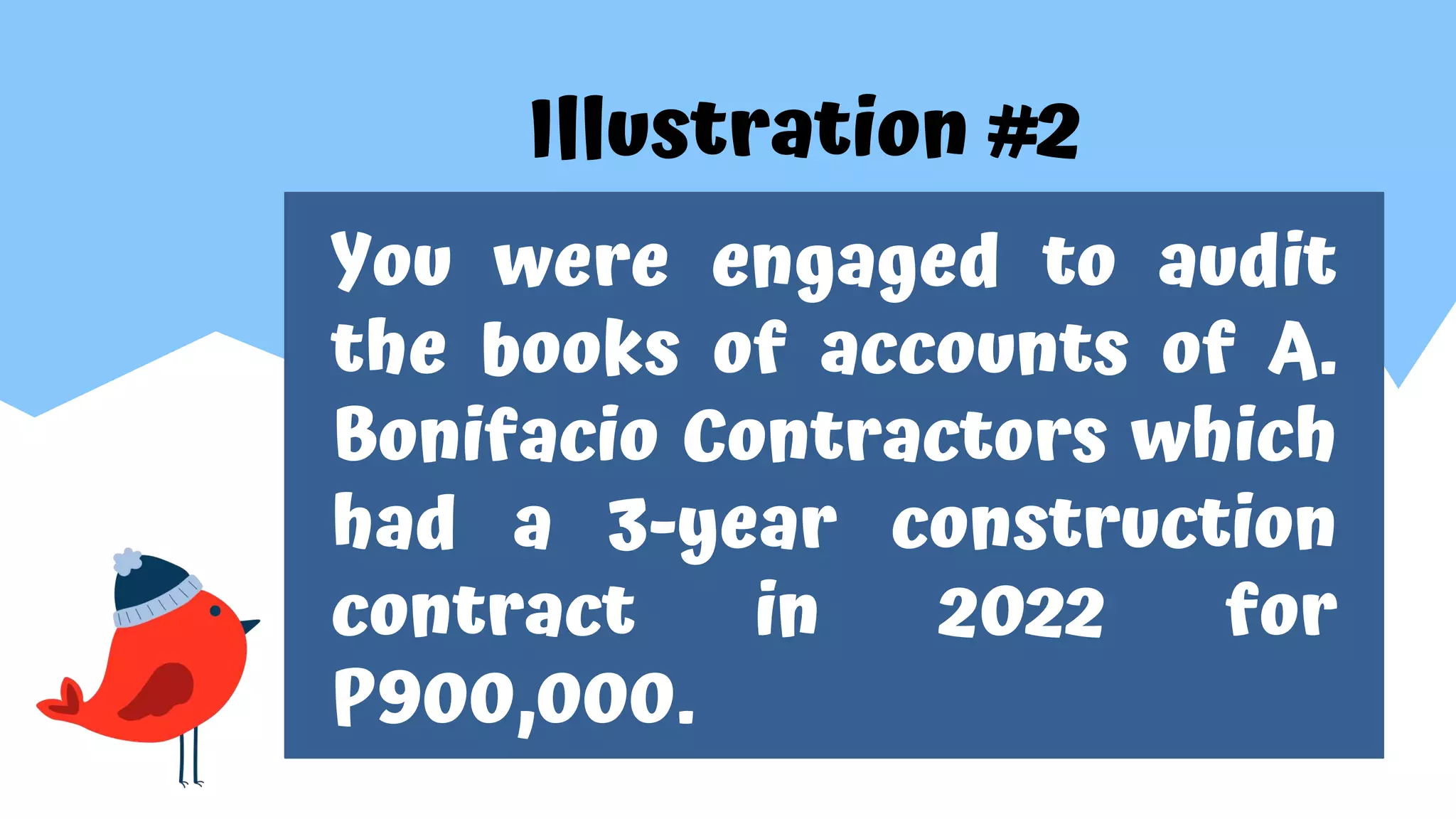

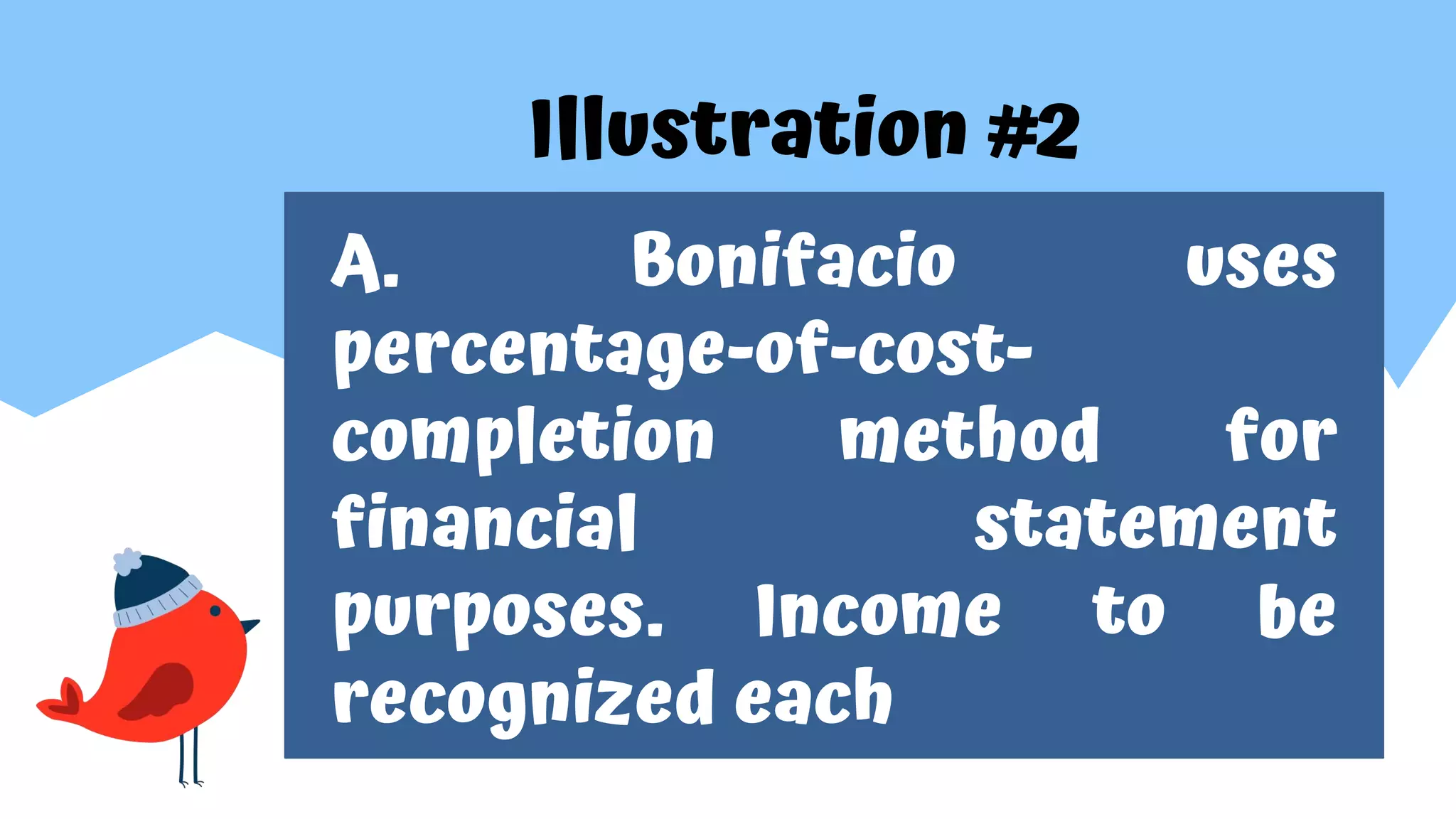

This document outlines an audit presentation on receivables. It discusses why receivables and revenue represent significant audit risk due to financial fraud risks and complex accounting rules. It then lists the audit objectives for receivables and sales across various assertions like existence, completeness, and valuation. Finally, it outlines the primary substantive audit procedures that would be used, such as reconciling subsidiary ledgers to the general ledger, confirming receivables, and analyzing allowance accounts. It includes two illustrations, one calculating a bad debt expense adjustment and another discussing a percentage-of-completion construction contract.