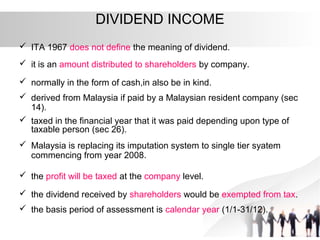

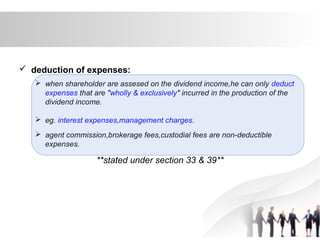

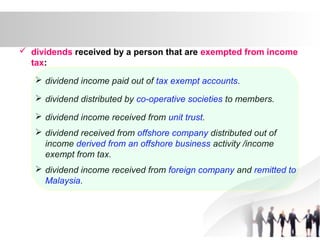

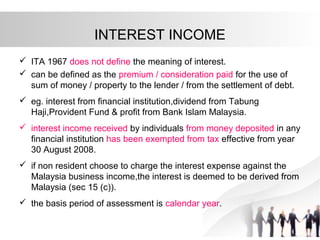

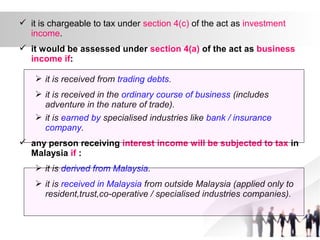

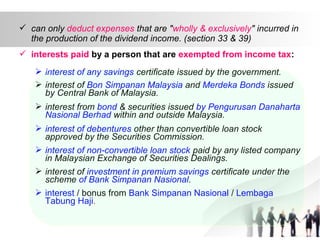

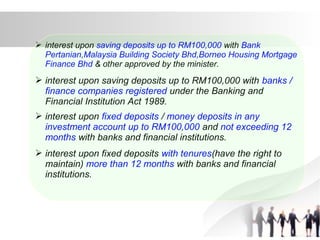

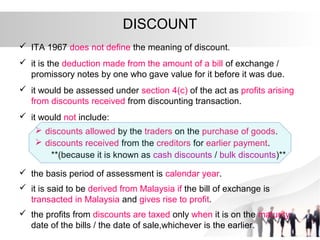

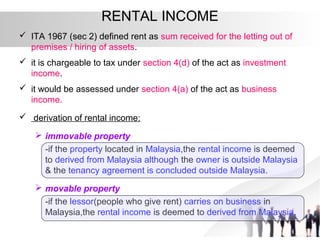

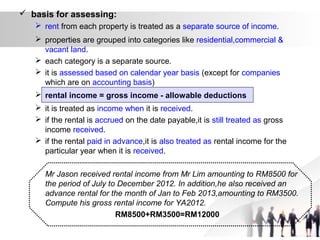

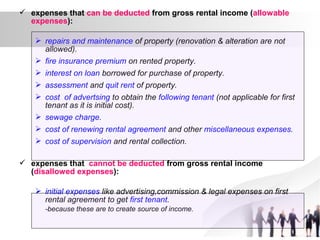

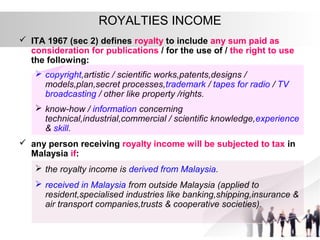

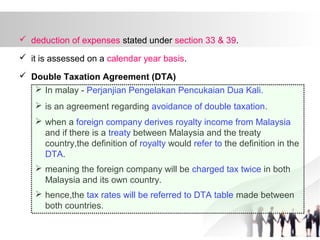

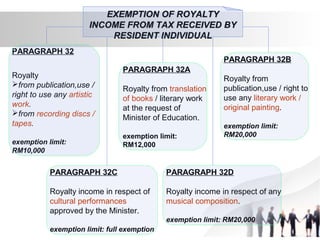

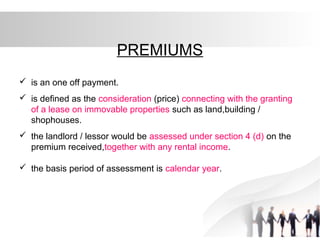

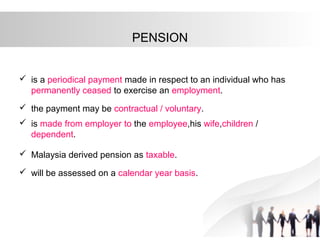

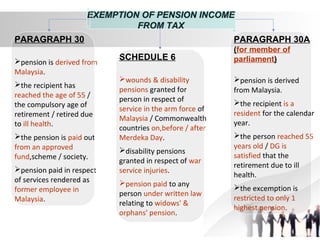

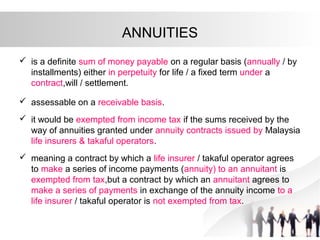

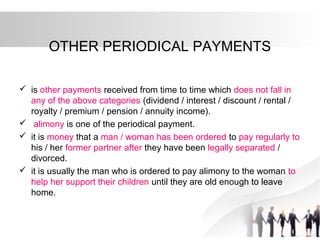

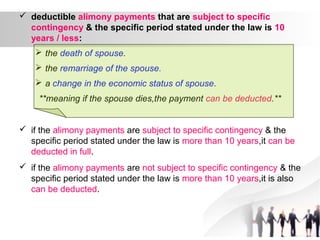

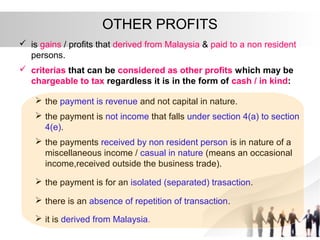

1. The document discusses various types of income that are taxable under Section 4 of the Malaysian Income Tax Act 1967, including dividend income, interest income, rental income, royalty income, pension income, and other periodic payments.

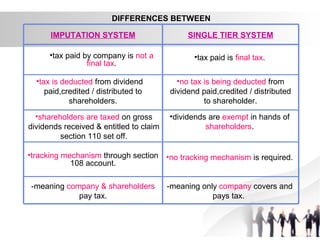

2. It provides details on how each type of income is defined, taxed, exempted, and the applicable basis periods. Key changes discussed include Malaysia replacing its imputation system for taxing dividends with a single-tier system from 2008.

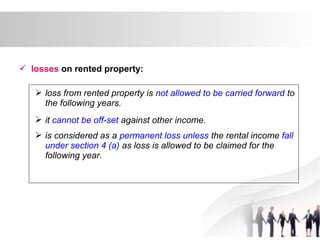

3. The document also examines deductions that can be claimed against income and losses from rented property, as well as differences in how income derived in Malaysia is taxed for residents versus non-residents.