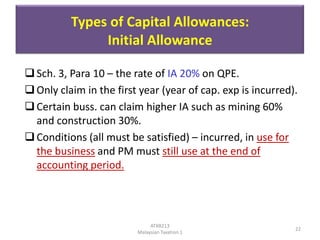

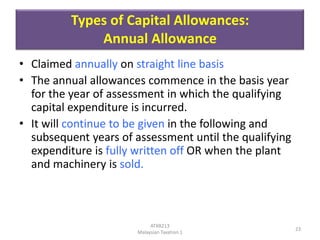

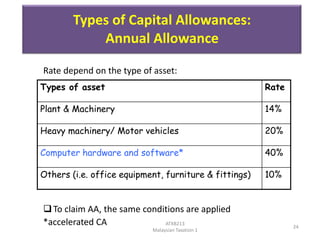

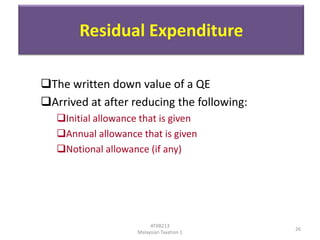

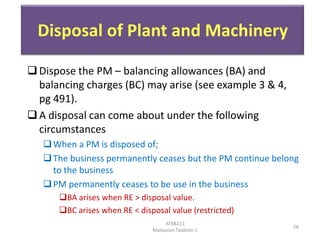

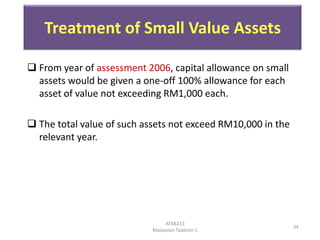

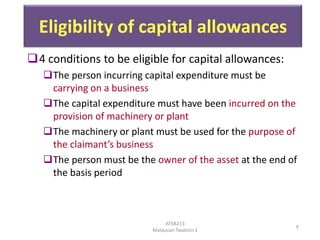

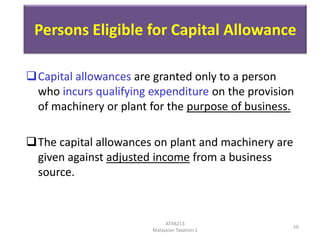

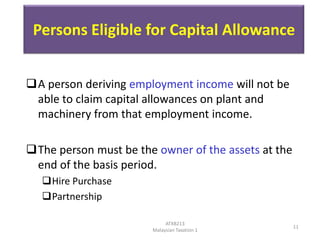

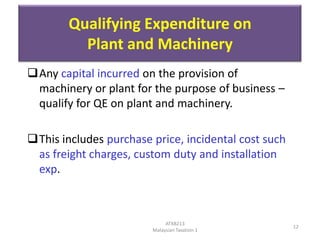

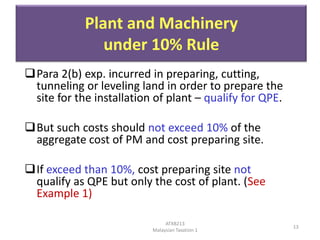

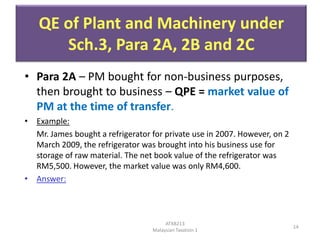

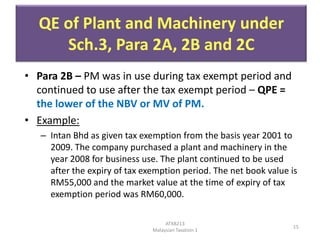

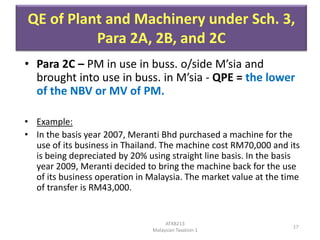

This document provides an overview of capital allowances under Malaysian tax law. It discusses that while accounting depreciation is not tax deductible, taxpayers are granted tax depreciation or "capital allowances" on qualifying capital expenditures to determine taxable income. Capital allowances are only given for business sources and only to the person who incurs the qualifying expenditure. The document outlines the types of capital allowances (initial allowance, annual allowance, notional allowance), eligibility requirements, qualifying expenditures, treatment of plant and machinery purchases and disposals, and other related topics.

![Other Qualifying Capital Expenditure

Fish pond, animal pens etc. [Para. 2(1)( c )]

Machinery or plant used for research (approved by

the minister)

ATXB213

Malaysian Taxation 1

20](https://image.slidesharecdn.com/chapter7capitalallowancesstudents-131206235250-phpapp02/85/Chapter-7-capital-allowances-students-20-320.jpg)