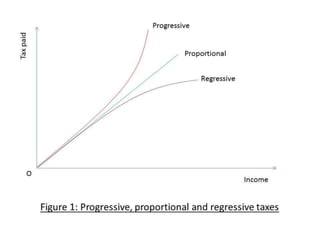

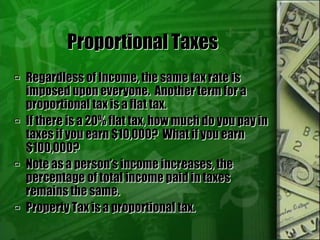

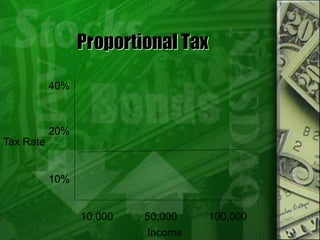

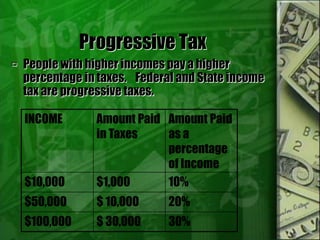

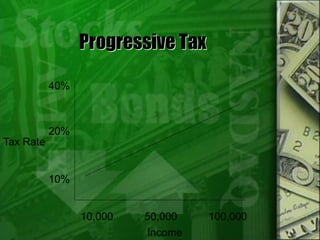

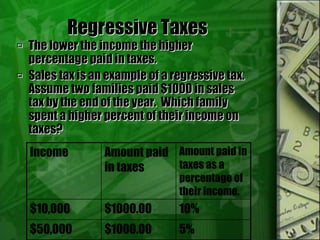

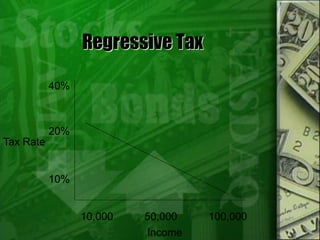

This document discusses different types of taxes. It defines tax as a compulsory contribution to the state to fund common services. Taxes can be proportional, progressive, or regressive depending on how the tax rate changes with income. Direct taxes are paid by the taxpayer, while indirect taxes are paid but the burden falls on consumers. Federal taxes include income tax, FICA, corporate tax, excise tax, estate tax, and customs duties. State and local taxes include sales tax, property tax, and intergovernmental transfers of funds.