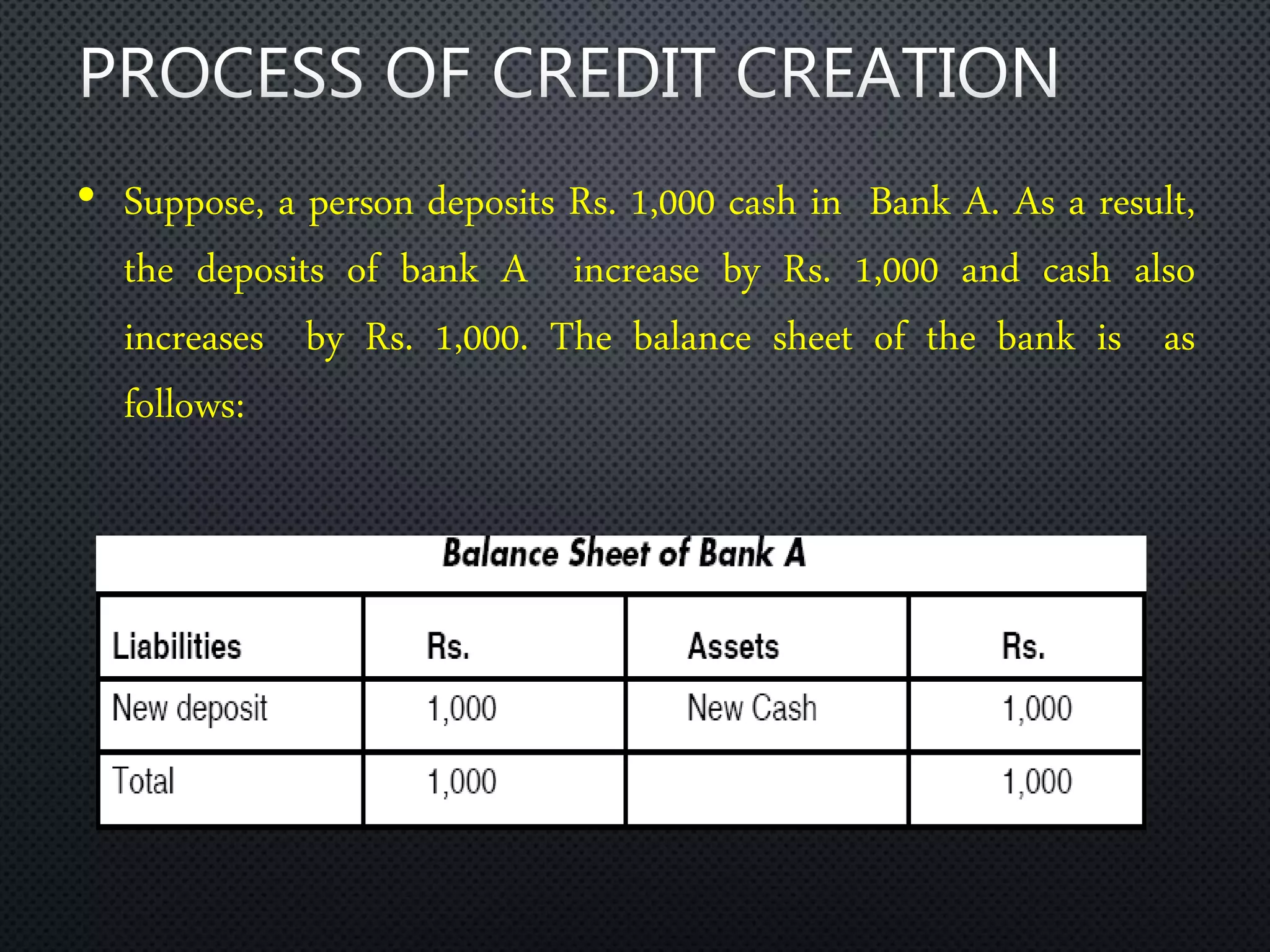

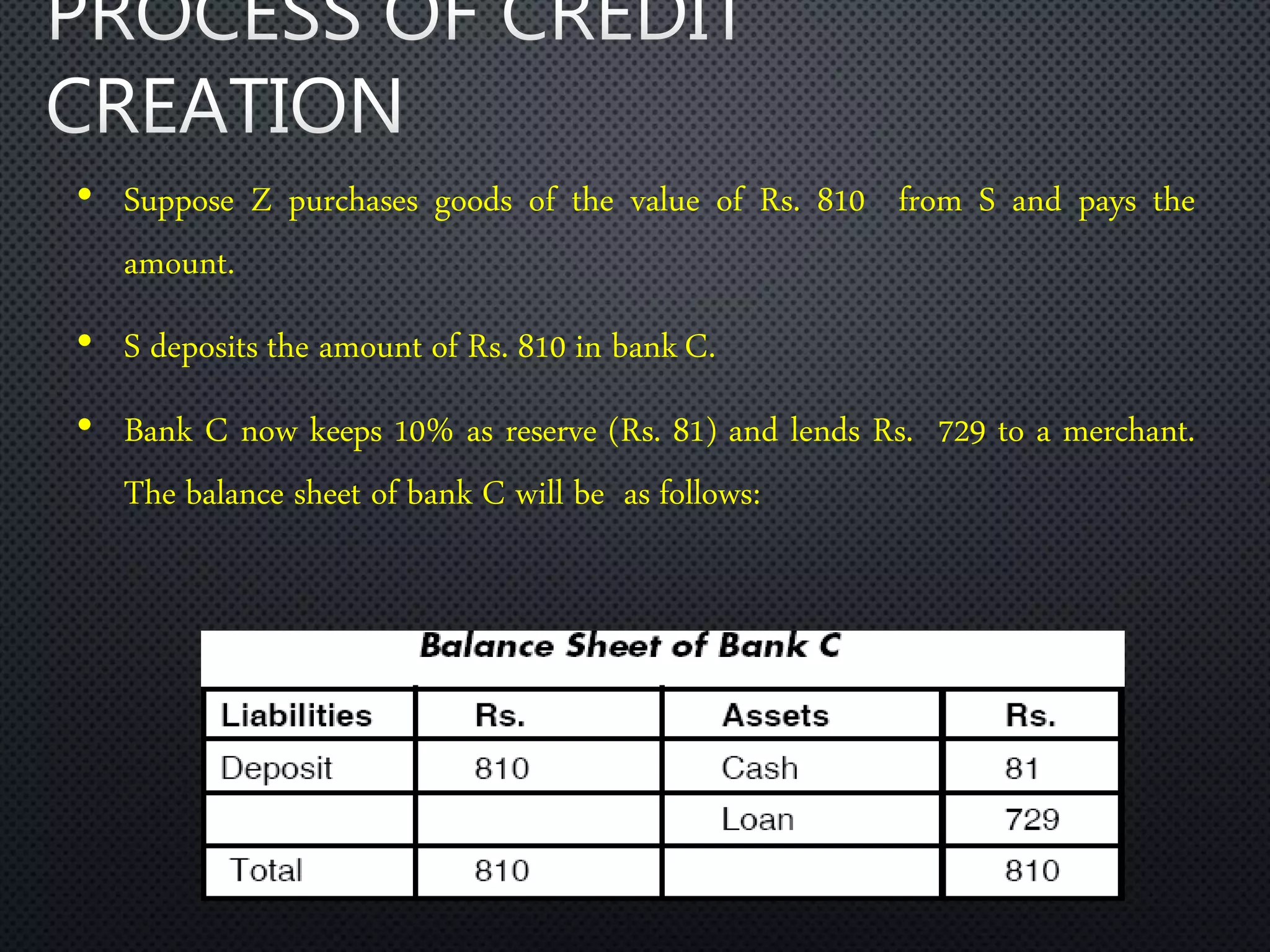

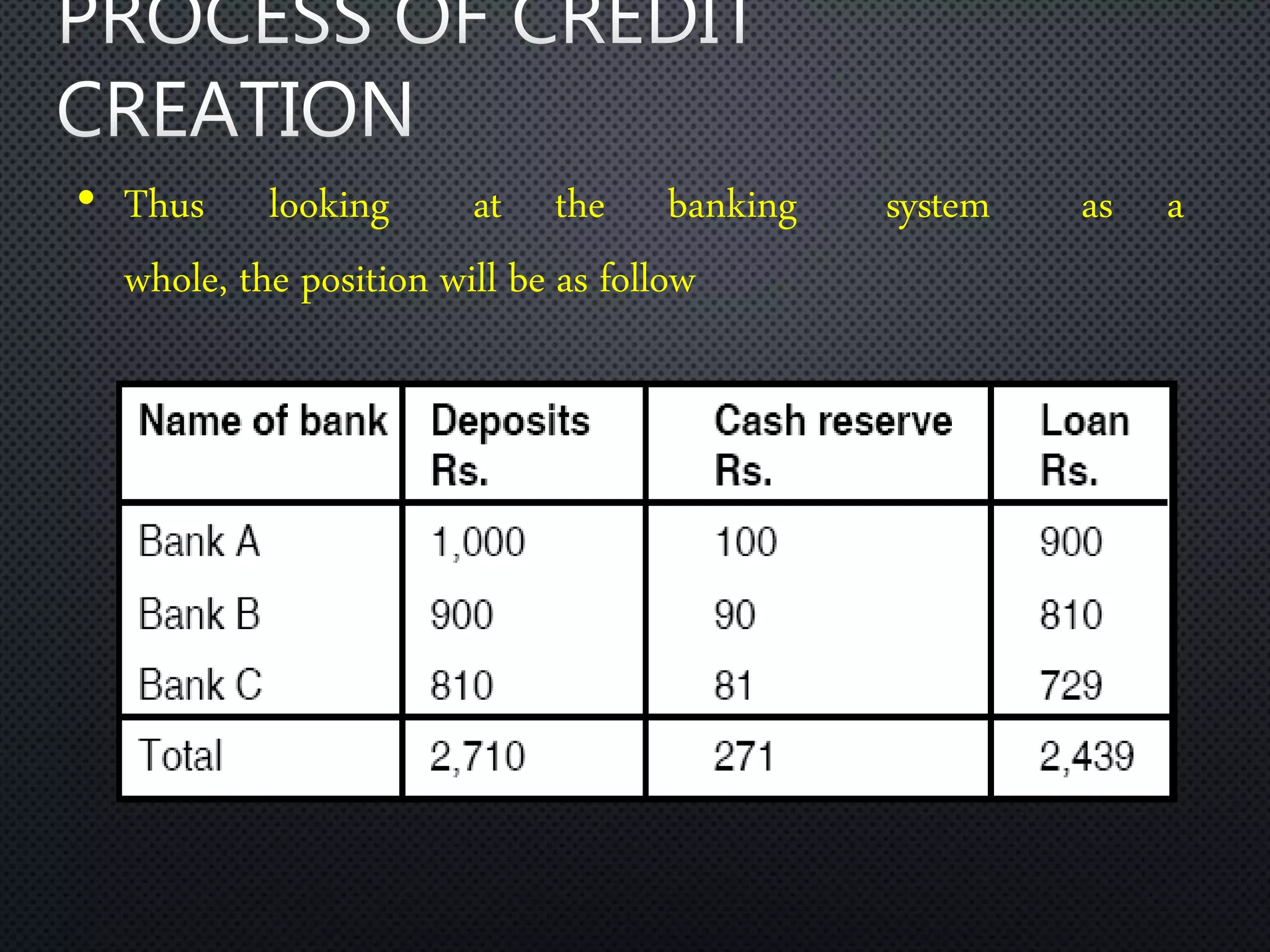

Commercial banks are able to create credit through a process of accepting deposits and lending out amounts in excess of the deposits received. They do this by keeping only a portion of deposits, like 10%, in reserve while lending out the rest. This allows the total credit created in the banking system to multiply based on the reserve ratio, like creating 10 times the initial deposit under a 10% reserve ratio. An example shows a $1000 deposit multiplying to $10,000 in total credit created across several banks each lending out most of the new deposits received.