The document discusses different theories and principles related to taxation. It begins by defining taxation and describing the key aspects of a taxation system, including the purposes of taxation. It then discusses several theories of taxation, including:

1) The expediency theory, which states that the main consideration in taxation should be practicality and administrability.

2) The socio-political theory, which argues that social and political objectives, rather than individual interests, should guide taxation policy.

3) The benefits-received theory and cost-of-service theory, which propose tax liability should be linked to the benefits and services received from the state.

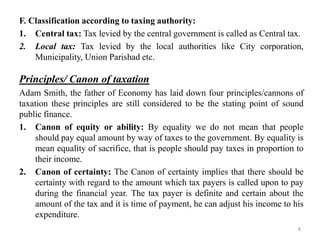

It also covers principles of taxation like equity, certainty, and convenience