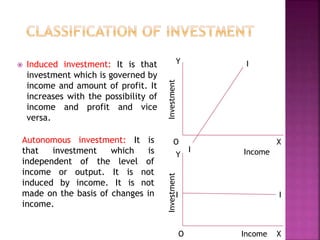

Investment can be defined and categorized in several ways. It includes the expenditure on real capital formation like new machines, buildings, and inventory. Investment can be autonomous or induced by income, private or public based on ownership, gross or net based on changes in capital stock, ex-ante or ex-post based on objectives, and categorized by propensity to invest. The marginal efficiency of capital and interest rate are key determinants of investment. Government policies aim to promote investment through measures like lowering interest rates, taxes, and increasing spending.