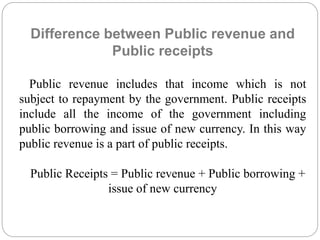

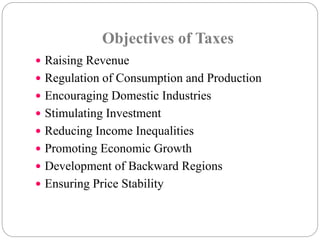

This document provides an overview of taxation in India. It defines taxation and its objectives, such as raising revenue. It describes different types of taxes like direct and indirect taxes. It outlines principles of a good tax system according to Adam Smith's canons of taxation. It also details India's individual income tax rates, exemptions, and deductions from taxable income. The document concludes that taxation helps increase economic activity and promote growth through mobilizing funds.