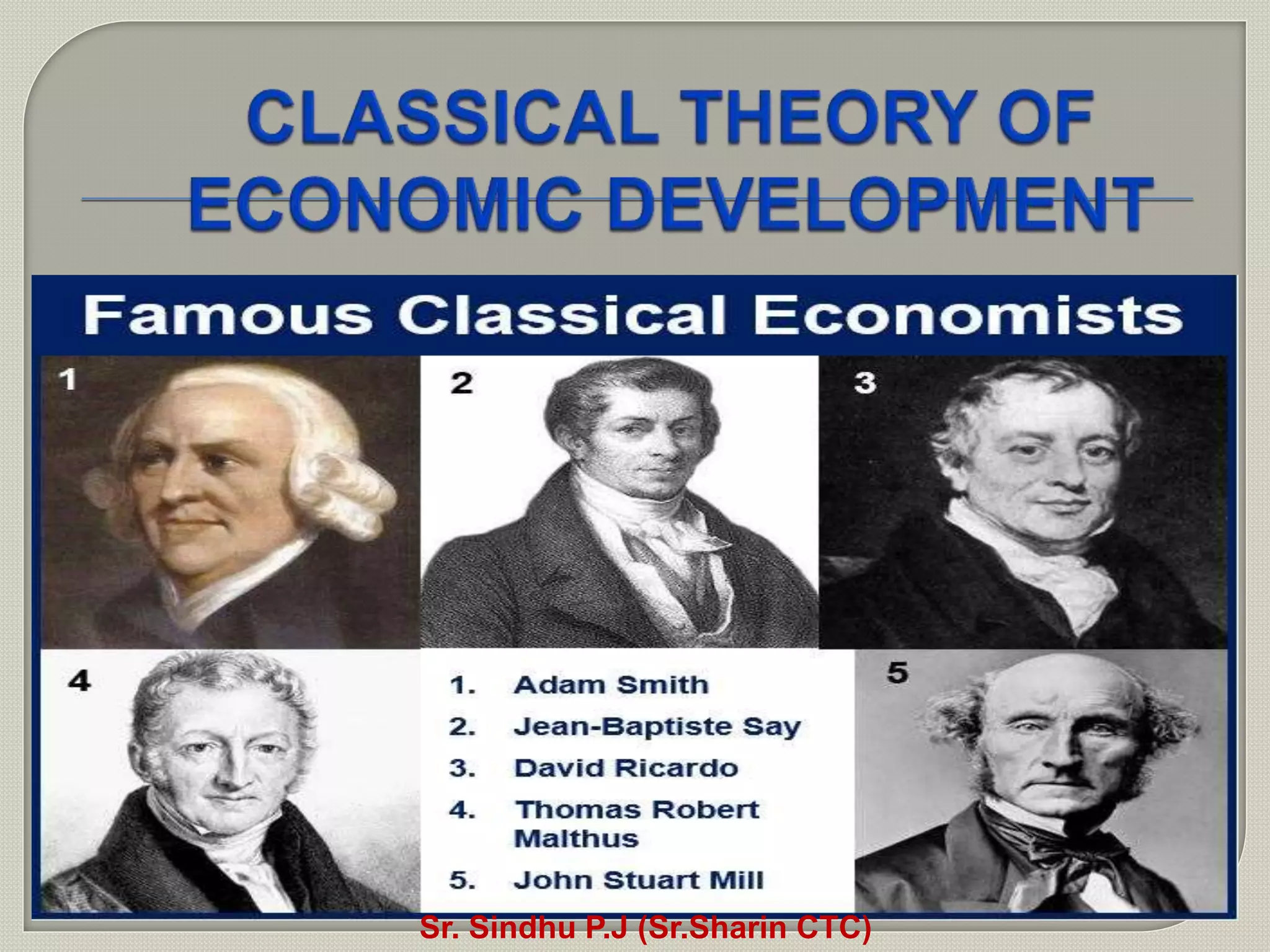

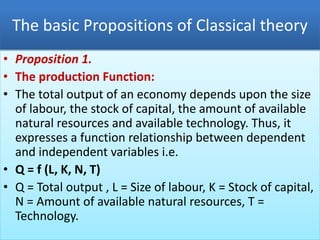

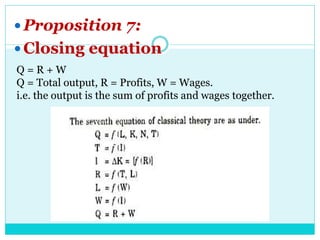

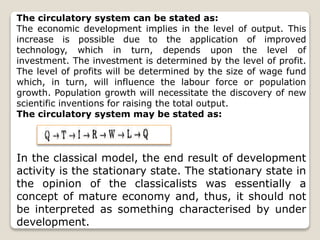

The document outlines the classical theory of economic development, emphasizing the foundational views of economists like Adam Smith, Malthus, and Mill. It presents key propositions regarding the relationships between output, technological progress, investment, and profits, alongside the influence of labor and wage funds. Ultimately, it describes how these interacting factors lead to economic development and the concept of a 'stationary state' in mature economies.