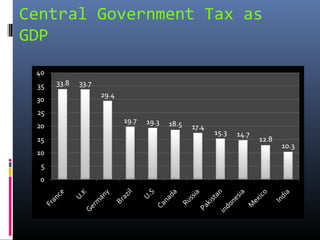

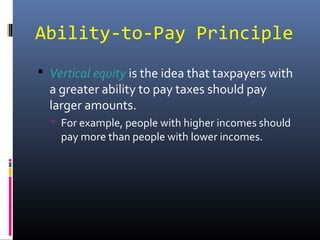

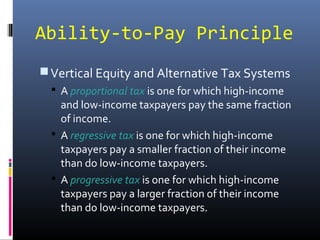

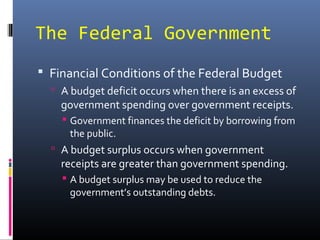

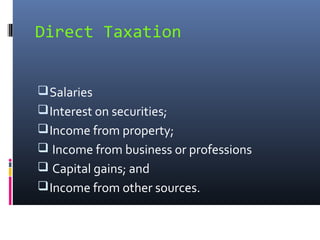

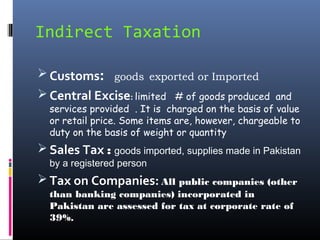

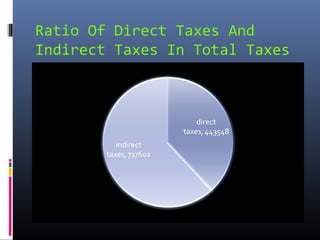

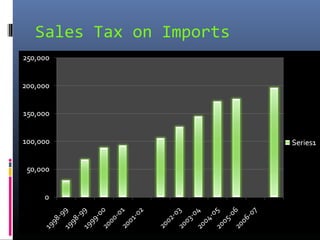

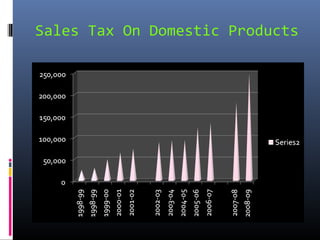

The document discusses taxation systems. It begins by introducing the group members and topic, which is the tax system. It then defines what a tax system is and discusses the key principles of taxation, including efficiency, equity, benefits received, and ability to pay. It also outlines different tax types like direct and indirect taxes. The document then focuses on Pakistan's tax system, describing direct taxes like income tax and indirect taxes like customs, central excise, and sales tax. It provides figures on the ratio of direct to indirect taxes in Pakistan's total tax revenues.