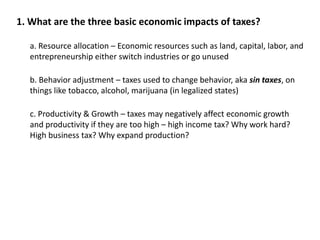

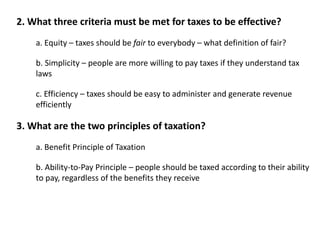

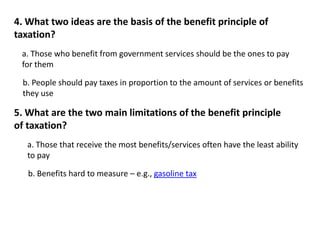

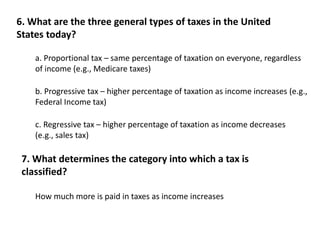

The document discusses the economic impacts and principles of taxation. It identifies three basic economic impacts as resource allocation, behavior adjustment, and productivity and growth. It also outlines two principles of taxation: the benefit principle and ability-to-pay principle. Finally, it describes the three general types of taxes in the US as proportional, progressive, and regressive taxes.