The document initiates coverage of Sun TV Network with a "Buy" recommendation and target price of Rs497. Key points include:

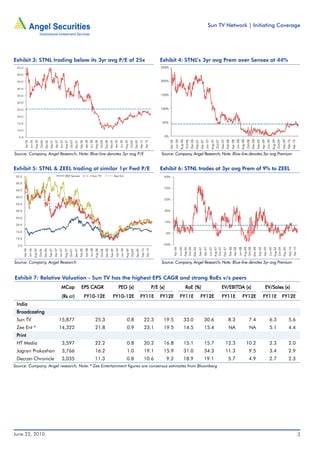

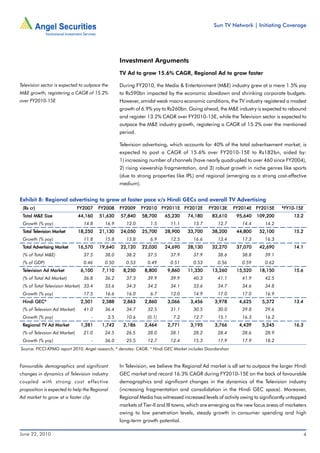

- Sun TV Network is a leader in 3 of 4 lucrative southern TV markets in India.

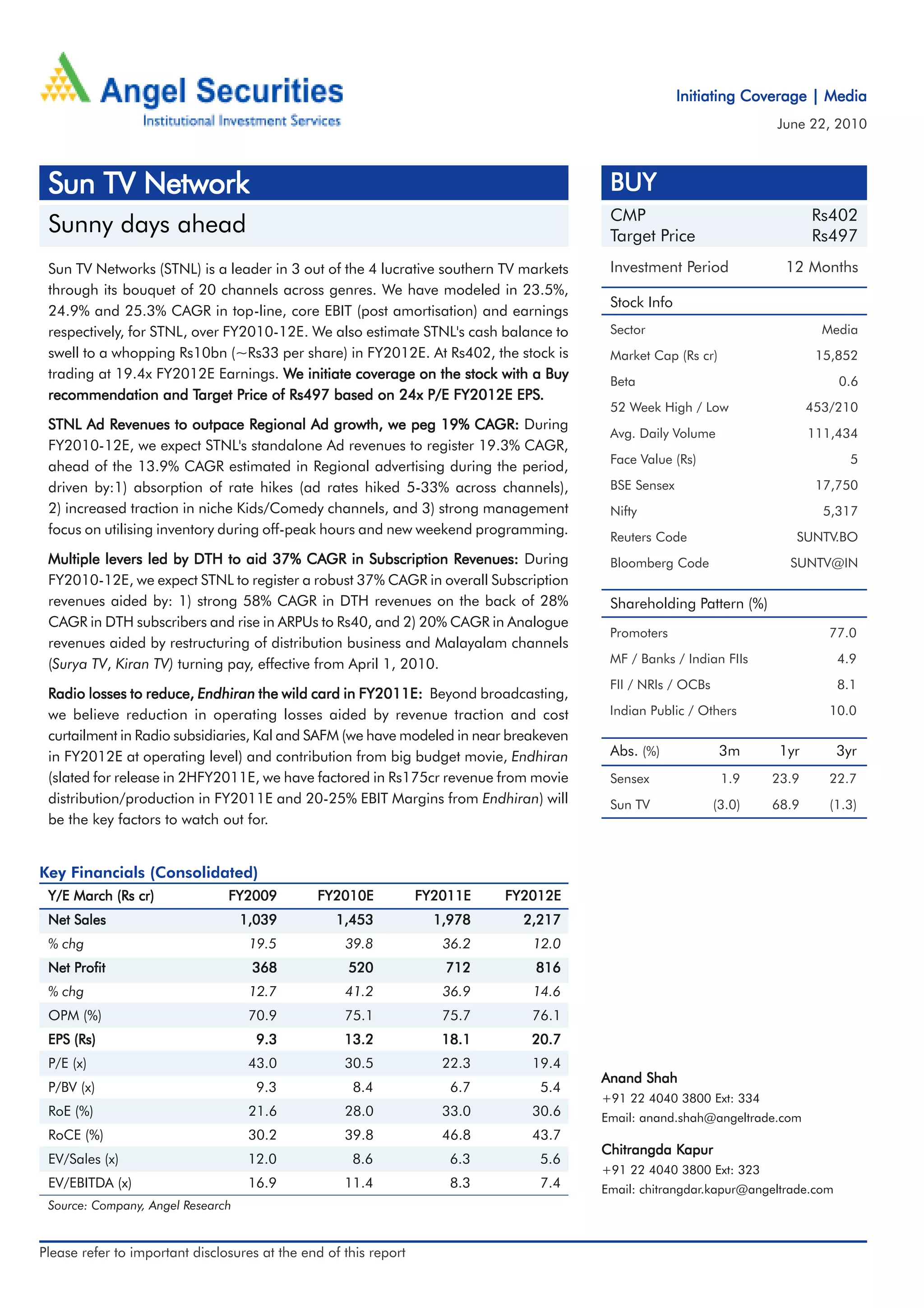

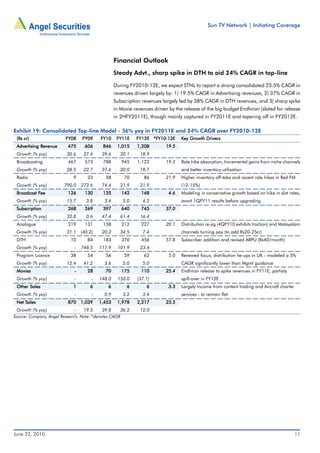

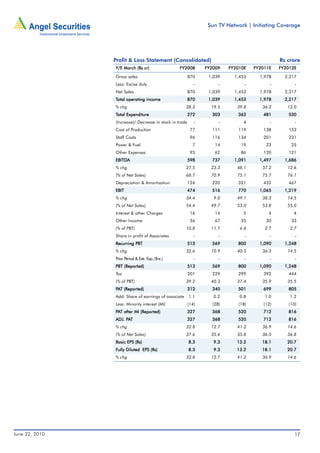

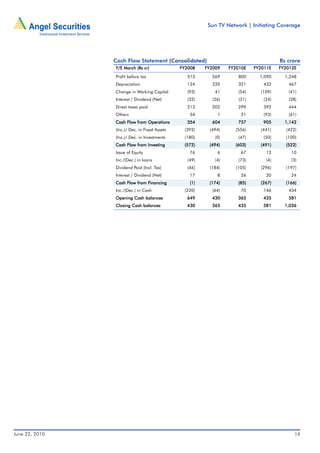

- The analyst models 23.5-25.3% CAGR in revenues, core profits, and earnings for Sun TV over FY2010-12, and cash balances swelling to Rs10 billion by FY2012.

- Factors like rate hikes, growth in niche channels and DTH subscriptions, and the movie Endhiran are expected to drive strong revenue growth.

- The target price of Rs497 represents a 24% upside and is based on a