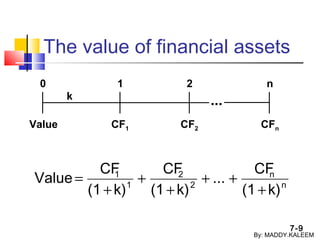

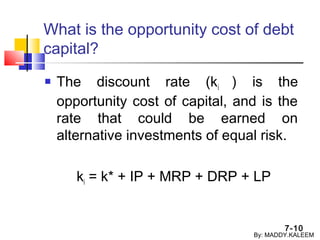

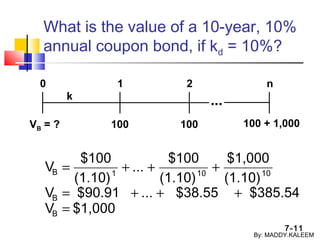

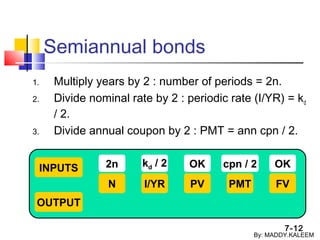

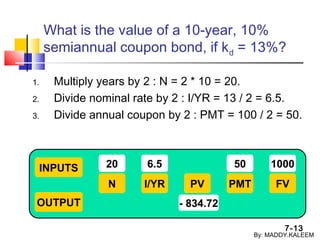

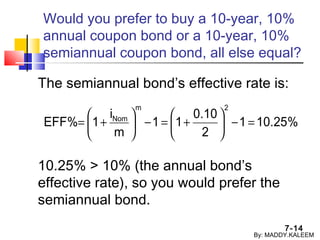

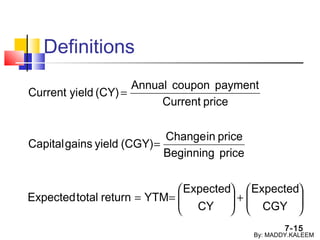

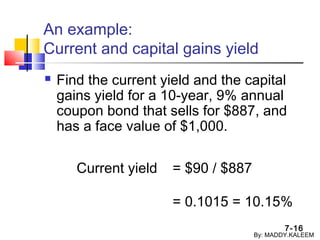

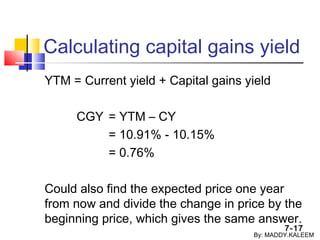

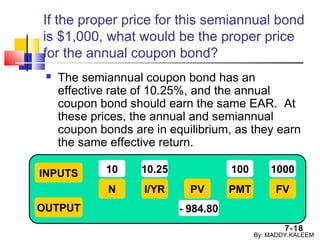

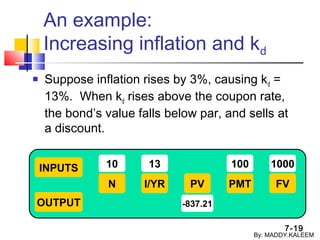

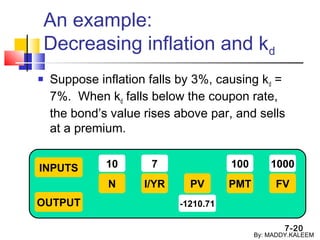

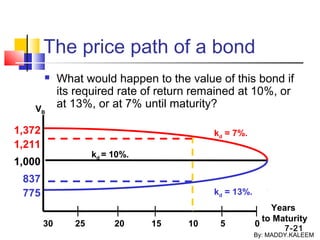

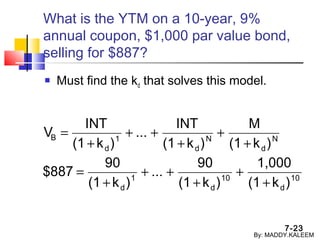

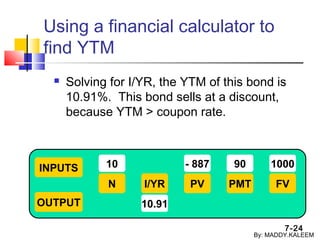

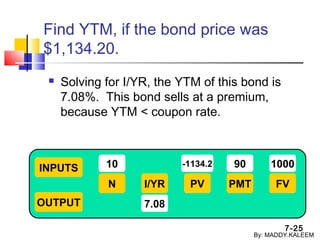

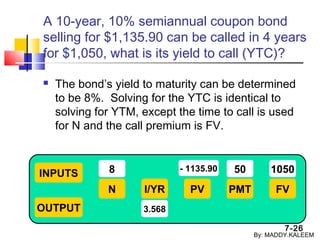

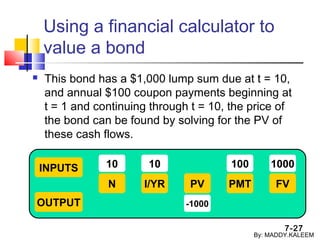

The document discusses key concepts related to bond valuation including features of bonds like par value, coupon rate, maturity date, and yield to maturity. It also defines different types of bonds such as coupon bonds, discount bonds, callable bonds, and convertible bonds. Examples are provided to illustrate how to calculate current yield, capital gains yield, and yield to maturity for bonds using a financial calculator. The valuation of bonds is demonstrated using the present value of future cash flows approach.