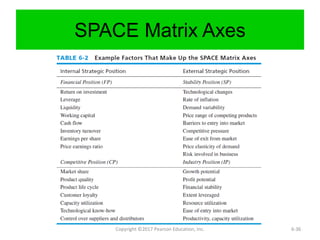

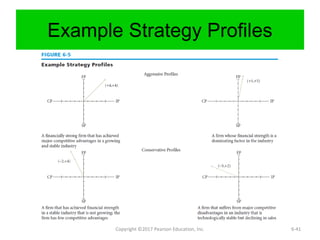

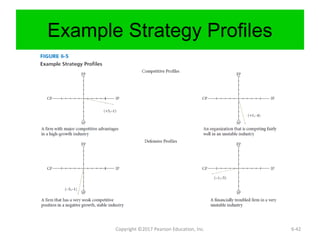

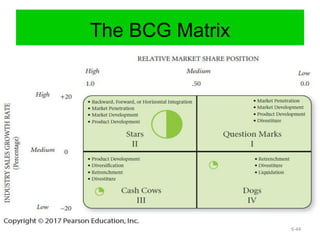

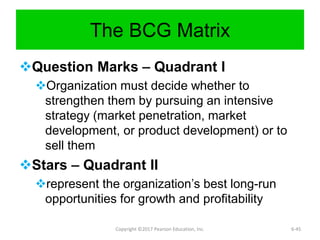

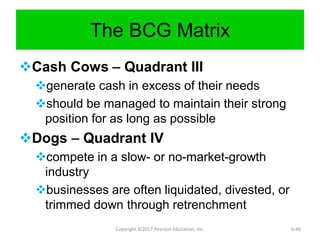

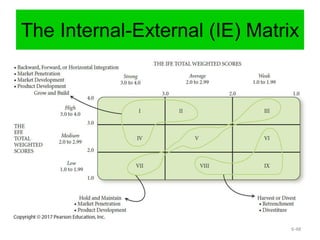

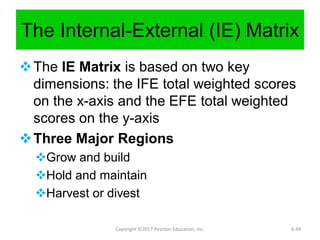

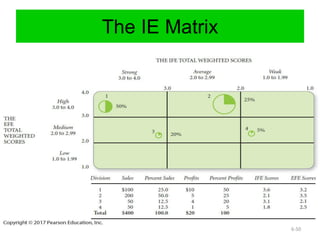

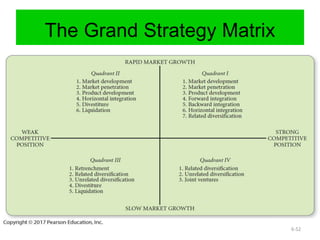

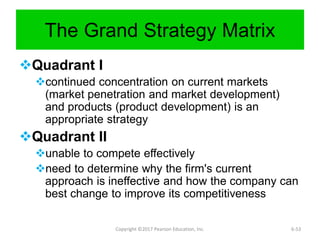

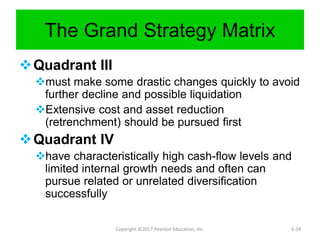

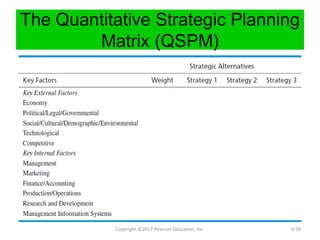

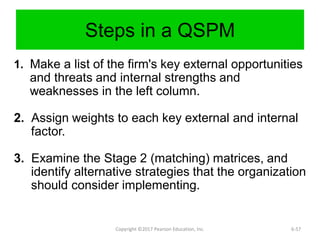

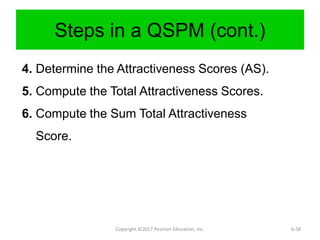

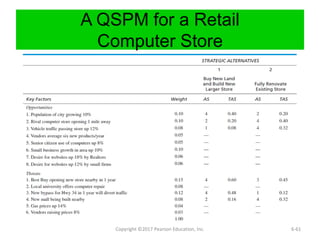

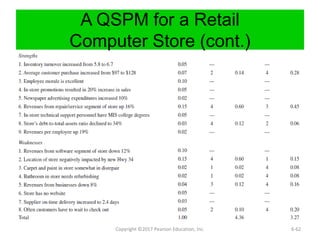

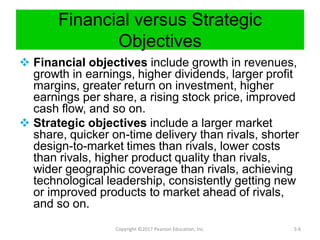

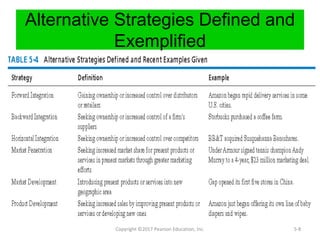

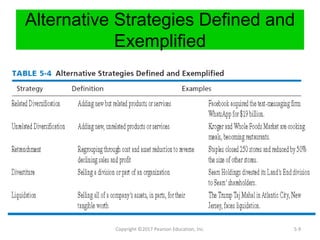

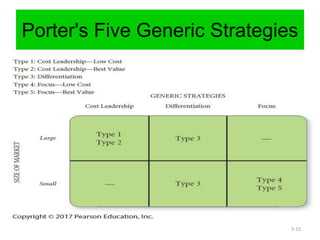

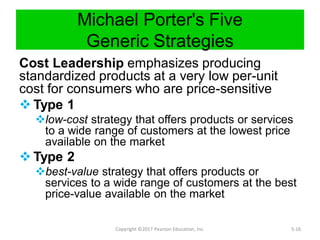

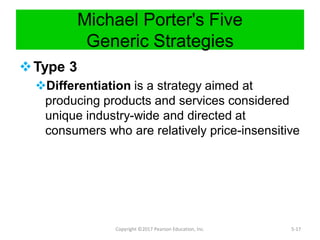

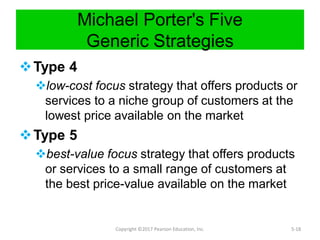

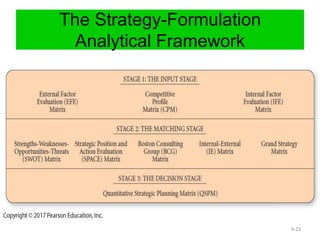

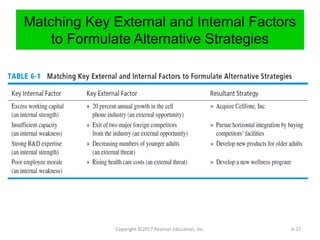

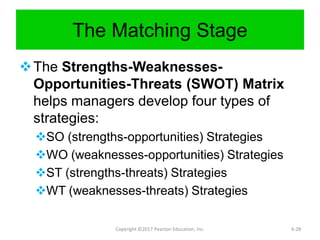

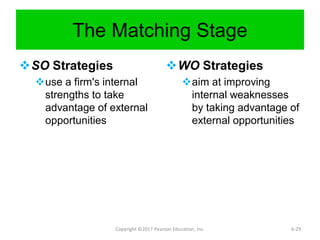

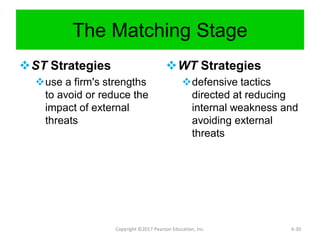

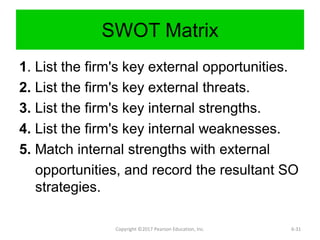

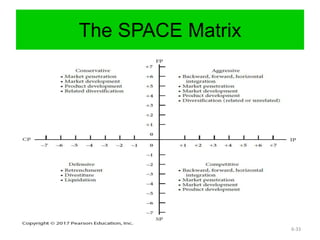

The document discusses various long-term strategic objectives and strategies that organizations can pursue, including financial objectives, strategic objectives, integration strategies, intensive strategies, diversification strategies, defensive strategies, and Porter's five generic strategies. It provides examples and definitions of different types of strategies, such as market penetration strategy, market development strategy, and product development strategy. It also outlines frameworks for developing strategies, including the SWOT matrix, SPACE matrix, and quantitative strategic planning matrix.

![The SPACE Matrix

Two internal dimensions (financial position

[FP] and competitive position [CP])

Two external dimensions (stability position

[SP] and industry position [IP])

Most important determinants of an

organization's overall strategic position

Copyright ©2017 Pearson Education, Inc. 6-35](https://image.slidesharecdn.com/unspecified2-170724052510/85/Strategic-management-Chapter-2-35-320.jpg)