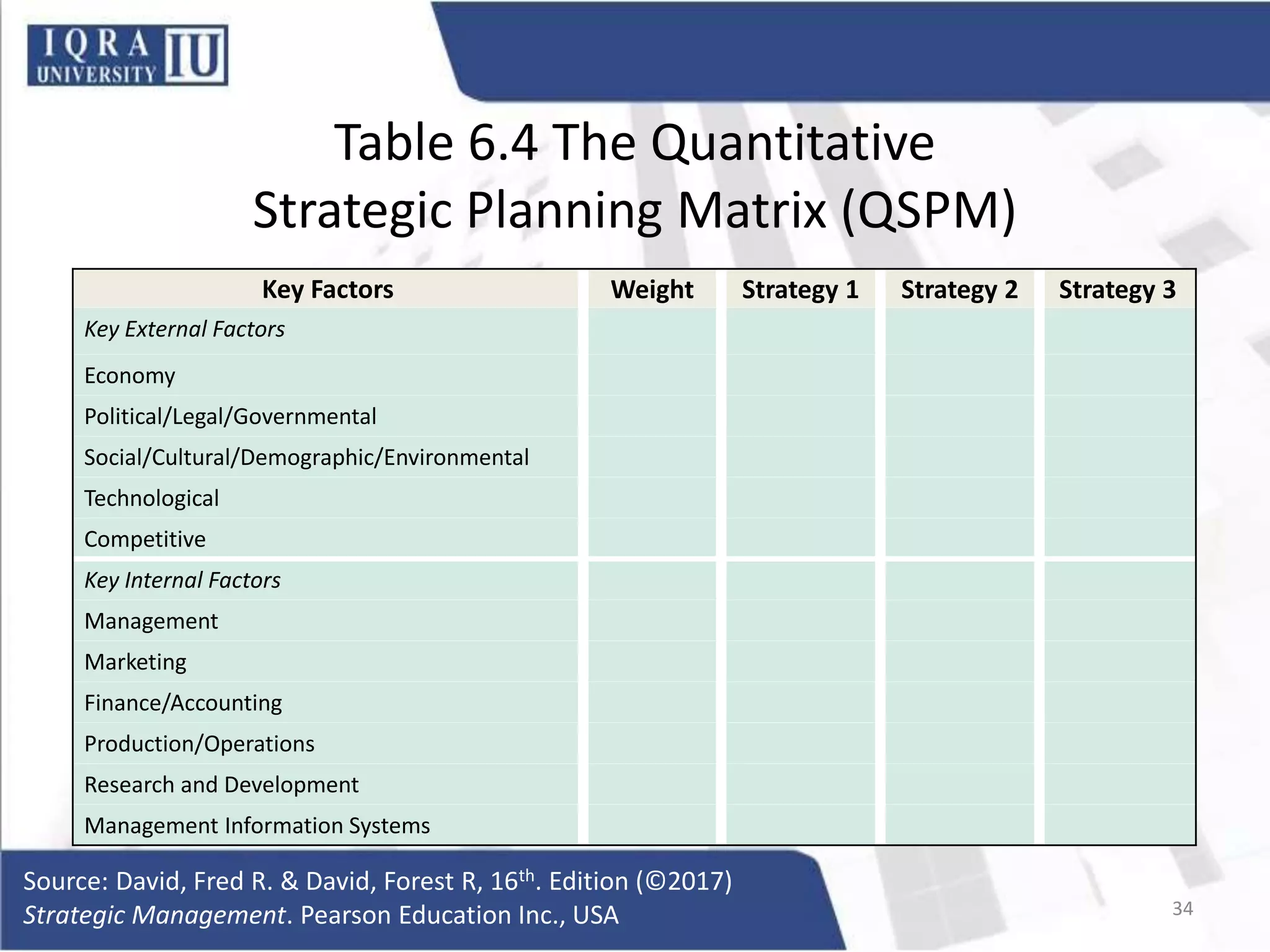

This document outlines learning objectives and content from a textbook on strategic management. It describes various analytical frameworks used in strategic analysis and choice, including the SWOT matrix, BCG matrix, IE matrix, and Grand Strategy matrix. These frameworks help analyze internal/external factors, generate alternative strategies, and select strategies by evaluating advantages/disadvantages and attractiveness. The goal is to develop a manageable set of attractive strategies using these strategic formulation and selection tools.